Texas Quitclaim Deed from Individual to LLC

Overview of this form

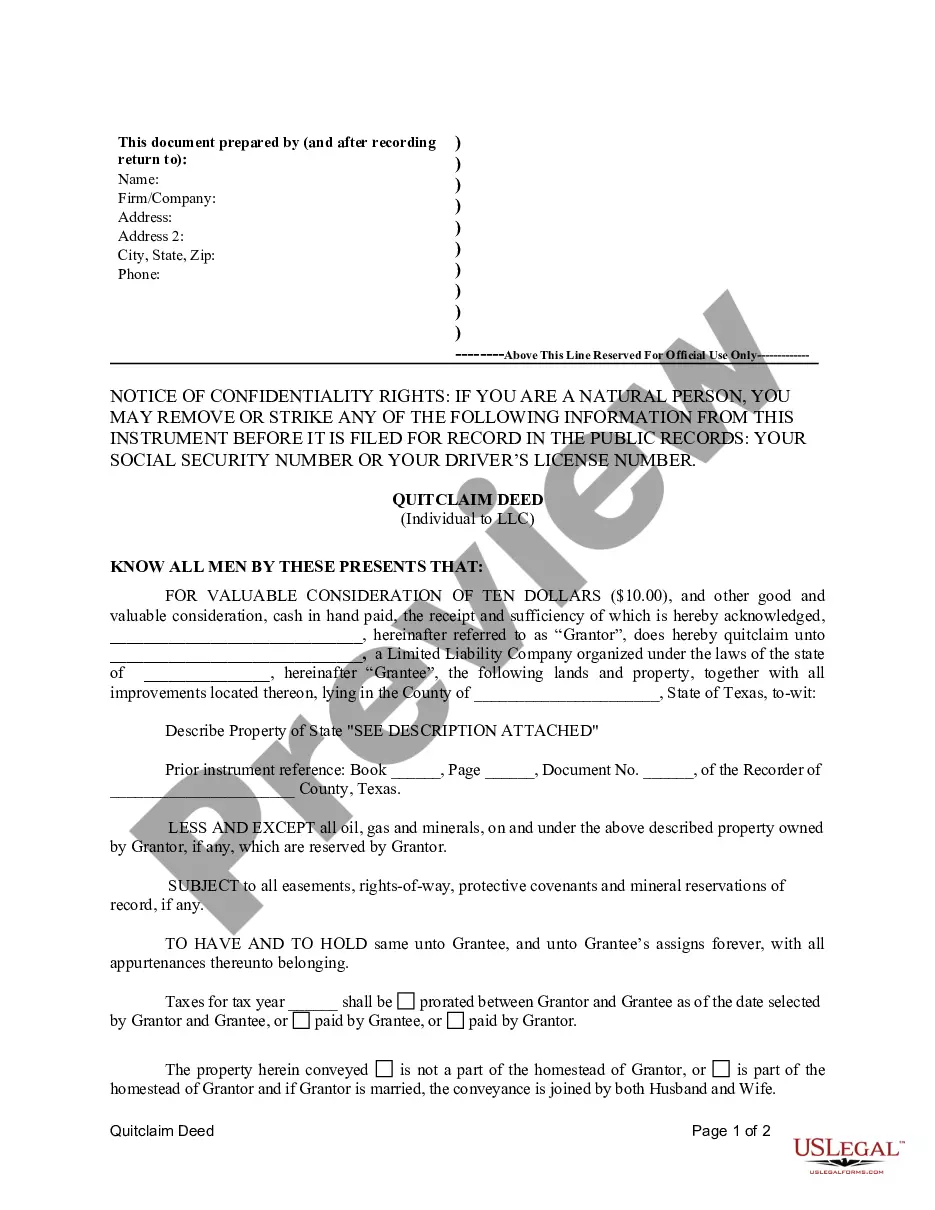

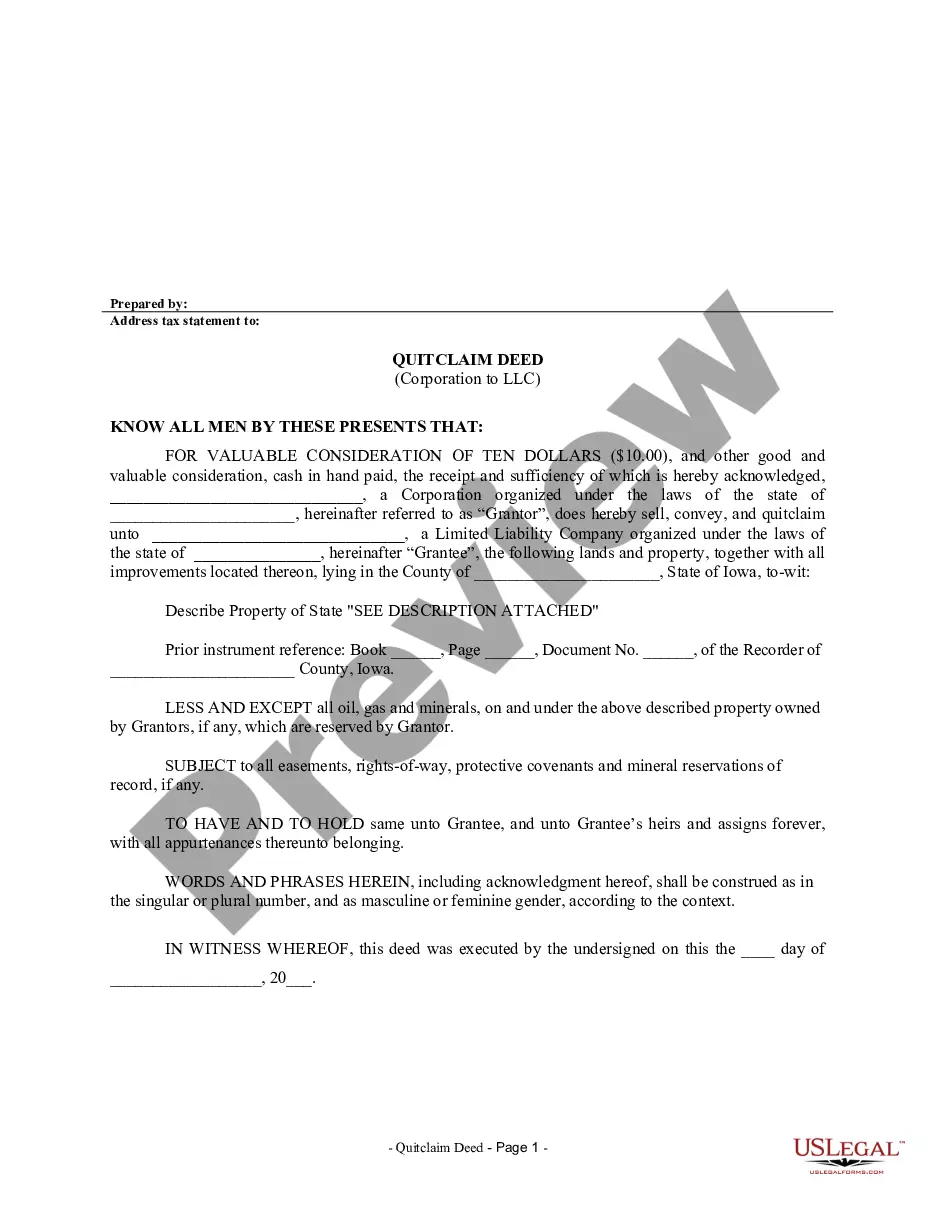

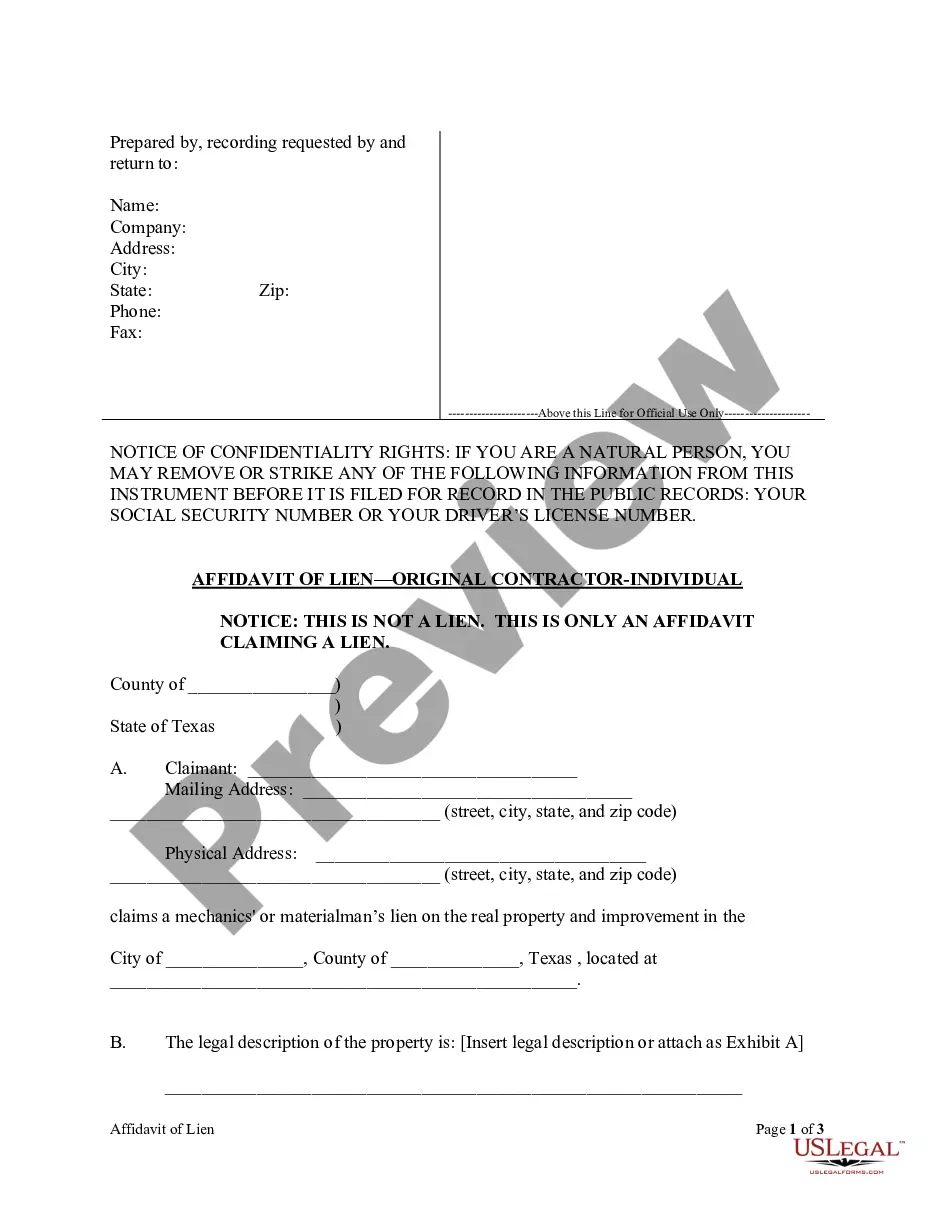

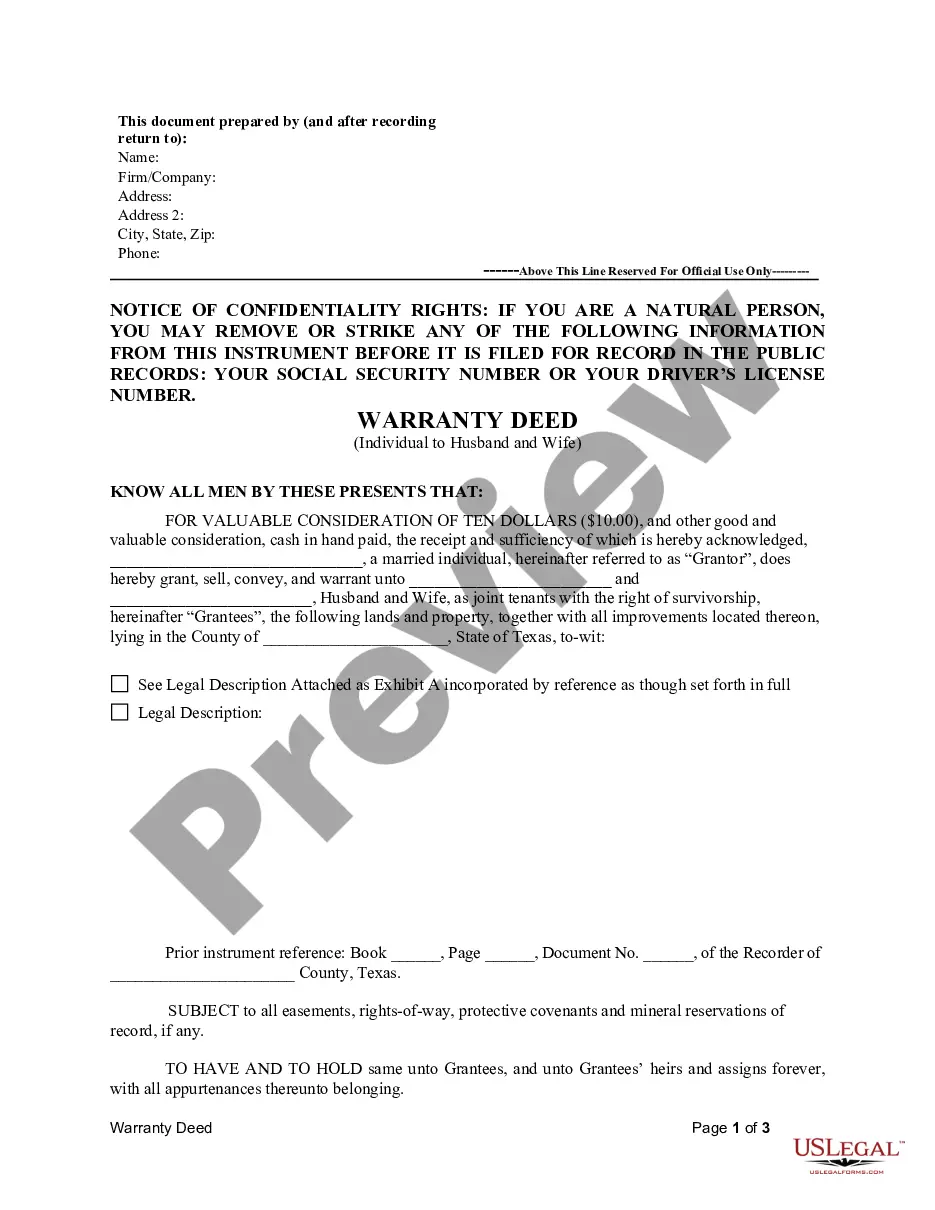

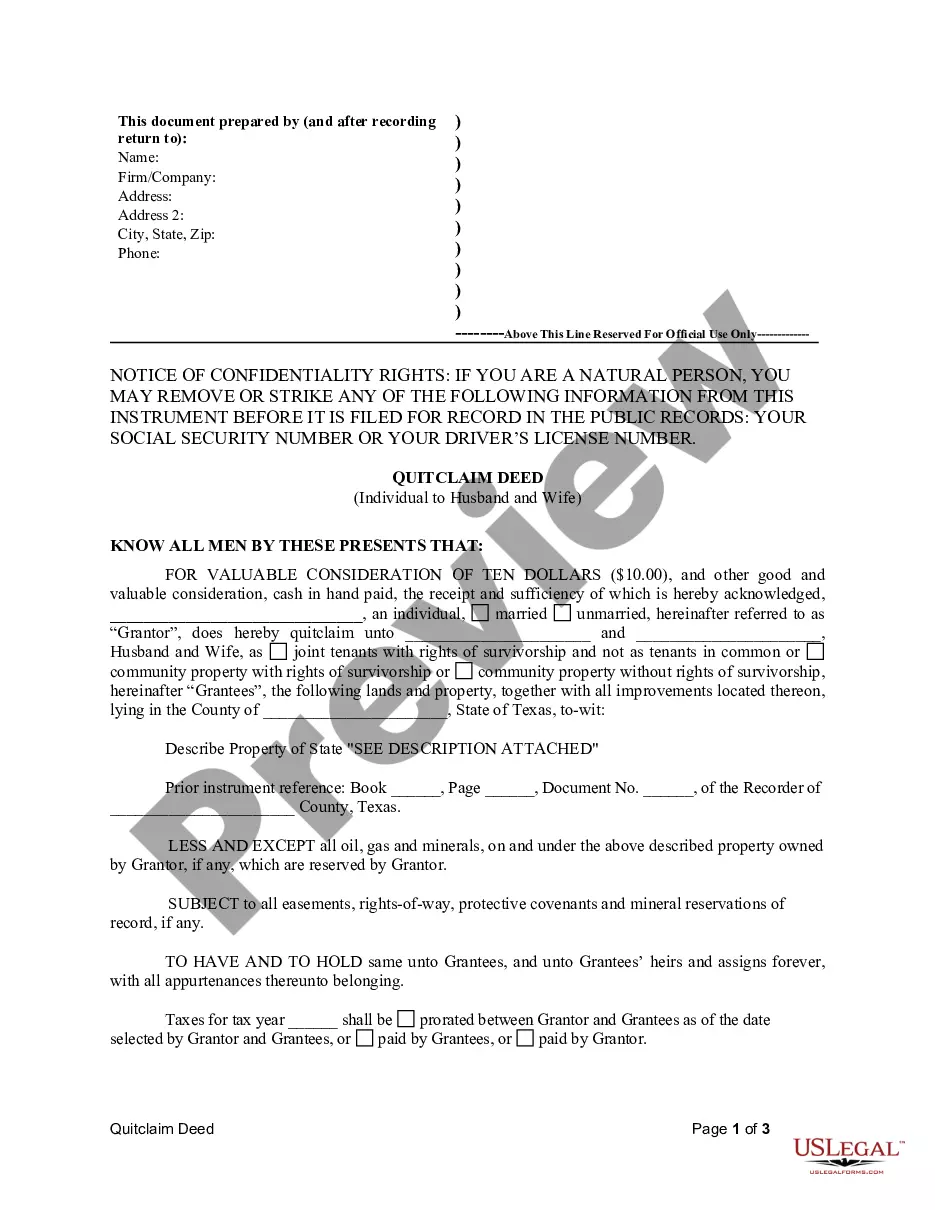

The Quitclaim Deed from Individual to LLC is a legal document in which an individual (the grantor) transfers their interest in a property to a limited liability company (the grantee). Unlike other types of deeds, a quitclaim deed does not guarantee that the grantor has clear title to the property. This form is typically used in real estate transactions where the owner wishes to transfer property without making warranties regarding the title, making it distinct from warranty deeds or grant deeds.

What’s included in this form

- Grantor and Grantee: Identifies the individual transferring the property and the LLC receiving it.

- Property Description: A detailed description of the property being conveyed, including legal references.

- Reservation clause: Specifies any reserved rights for the grantor, such as oil, gas, and mineral rights.

- Tax Proration: Provides instructions for how property taxes shall be handled between the parties.

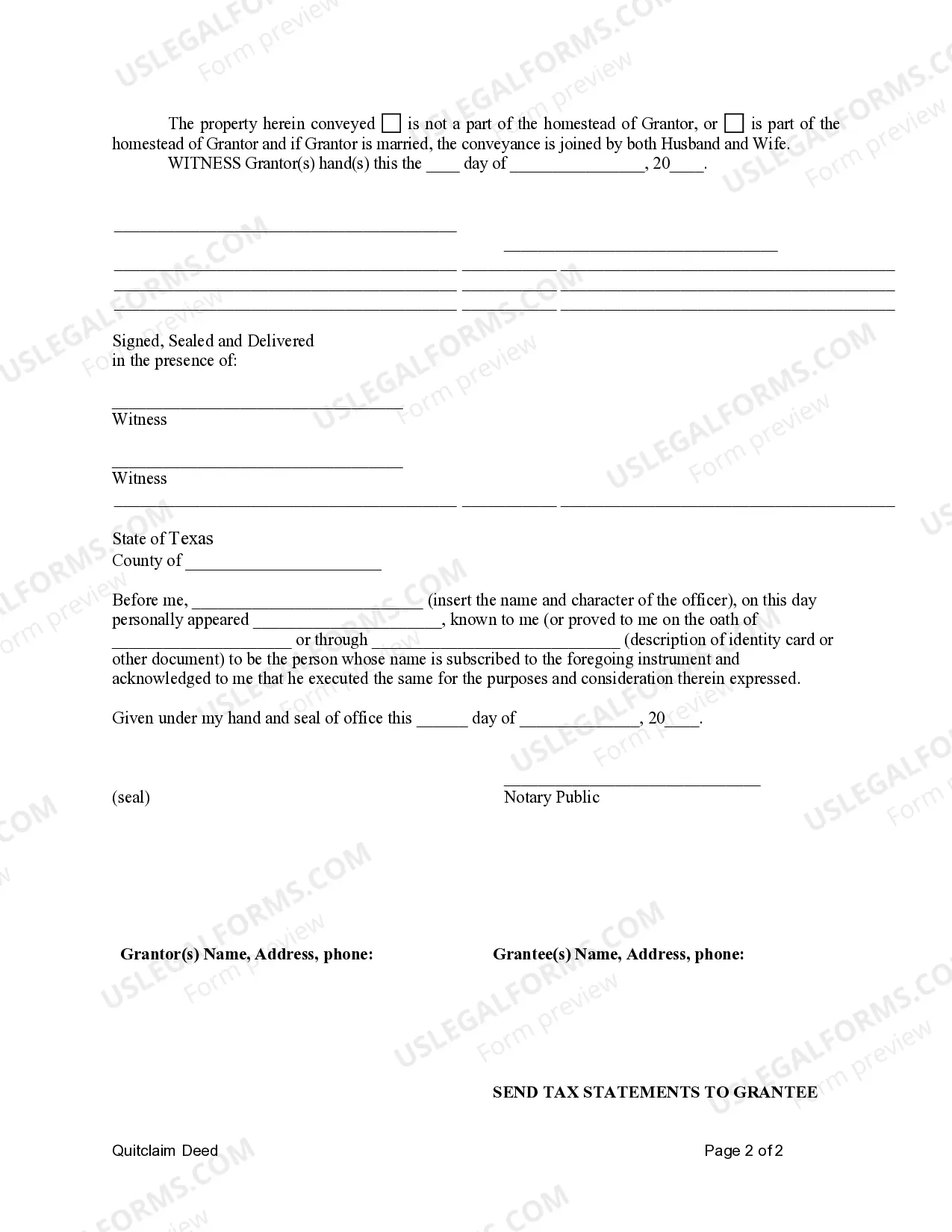

- Signature section: Where the grantor signs and dates the document, along with notarization if required.

Common use cases

Who needs this form

This form is intended for:

- Individuals looking to transfer real estate into an LLC.

- Business owners wanting to formalize ownership of property held by their LLC.

- Real estate investors seeking straightforward deed transfers without title warranties.

Completing this form step by step

- Identify the parties: Enter the names of the individual (grantor) and the LLC (grantee).

- Describe the property: Provide a complete legal description of the property being transferred.

- Specify the tax arrangement: Decide how property taxes will be handled between the parties.

- Sign and date: The grantor must sign the document, indicating the date of the transfer.

- Notarize: If required, have the signature notarized to validate the deed.

Notarization guidance

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include a complete legal description of the property.

- Not having the document notarized when required by state law.

- Omitting the reservation clause, which could lead to loss of mineral rights.

- Not ensuring all parties review the terms before signing.

Benefits of completing this form online

- Convenience: Access and complete the form anytime, saving you time.

- Editability: Make adjustments quickly to fit your specific needs.

- Reliability: Use templates drafted by licensed attorneys to ensure compliance with legal standards.

Looking for another form?

Form popularity

FAQ

Rates vary by state and law office but typically fall in the range of $200 to $400 per hour. Title companies routinely prepare quitclaim deeds in many states.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

It does not convey muniment of title. Instead, unlike a warranty deed, which conveys property, a quitclaim deed only conveys whatever interest the grantor has at the time of the transfer.Despite all of this, quitclaim deeds are still a valid, if unreliable, means of transferring title to real property in Texas.

You can use a simple form, called a quitclaim deed, to transfer your joint property ownership to either yourself, a family member, a former spouse, or even a trust. Many utilize this deed to make property title transfers without the time and expense of legal fees.

Fill out the quit claim deed form, which can be obtained online, or write your own using the form as a guide. The person giving up the interest in the property is the grantor, and the person receiving the interest is the grantee.

Laws Section 13.002. Recording This form must be filed at the Recorder's Office in the County Clerk's Office. Signing (Section 11.002(c)) The Grantor(s) has the choice of authorizing this form in the presence of Two (2) Witnesses or a Notary Public.

The Quit Claim Deed form uses the terms of Grantor (Seller or Owner of said property) and Grantee (Buyer of said property) for the two parties involved. First, the parties must fill in the date. Then, write in the name of the county and state in which the property is located.

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

Step 1: Download the TX quitclaim deed form. Step 2: In the upper left-hand corner, add the name and address of the person preparing the form. Under this, add the name and address of the person who will receive the form after the recorder's office is finished with it. Step 3: Write the county in the appropriate blank.