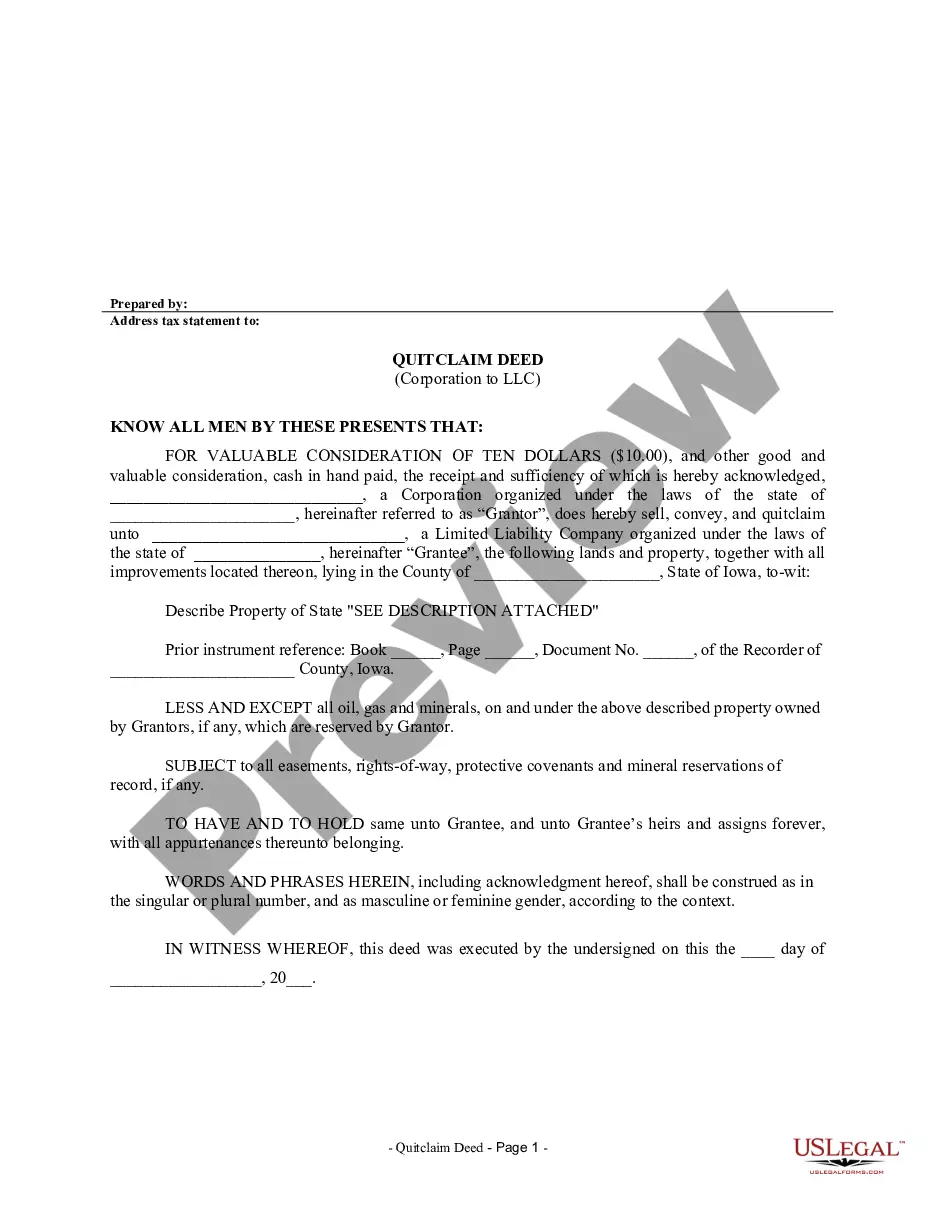

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Iowa Quitclaim Deed from Corporation to LLC

Description

How to fill out Iowa Quitclaim Deed From Corporation To LLC?

Acquire one of the most comprehensive collections of legal templates.

US Legal Forms is a service where you can locate any state-specific document in just a few clicks, including examples like the Iowa Quitclaim Deed from Corporation to LLC.

There’s no need to squander your time searching for a court-recognized template. Our certified professionals guarantee you receive current documents each time.

If everything’s correct, click the Buy Now button. After choosing a pricing plan, create your account. Pay via credit card or PayPal. Save the template to your computer by clicking Download. That's it! You should complete the Iowa Quitclaim Deed from Corporation to LLC form and verify it. To ensure accuracy, contact your local legal advisor for assistance. Register and simply browse through more than 85,000 useful forms.

- To benefit from the document library, choose a subscription and create your account.

- If you have set it up, simply Log In and click Download.

- The Iowa Quitclaim Deed from Corporation to LLC template will be swiftly saved in the My documents section (a section for all your saved forms on US Legal Forms).

- To establish a new account, follow the quick instructions outlined below.

- If you intend to use a state-specific document, make sure to specify the correct state.

- If feasible, examine the description to understand all the details of the form.

- Utilize the Preview option if it's available to inspect the document's information.

Form popularity

FAQ

To place your property into an LLC, begin by forming the LLC, which includes filing required documents with the state. Next, prepare an Iowa Quitclaim Deed from Corporation to LLC to transfer the property's title. This step not only formalizes the ownership change but also offers you valuable protection against personal liability.

To transfer personal assets to an LLC, you first need to create the LLC and make sure all documents are in order. Then, execute an Iowa Quitclaim Deed from Corporation to LLC to facilitate the transfer of specific assets. Ensure you maintain clear records of the asset transfer for accounting and legal purposes.

To file a quitclaim deed in Iowa, you need to obtain the appropriate form, fill in the details, and sign the document in the presence of a notary. Ensure you include the legal description of the property and the names of the transferring parties. After executing the quitclaim deed, file it with the county recorder’s office to officially transfer ownership.

Individuals often place their homes in an LLC to gain liability protection and manage property more effectively. By using an Iowa Quitclaim Deed from Corporation to LLC, homeowners can shield personal assets from risks associated with property ownership. Additionally, an LLC can offer tax benefits and streamline estate planning.

To place a property in an LLC, first establish the LLC by filing the necessary paperwork with the state. After creating the LLC, you will need to execute an Iowa Quitclaim Deed from Corporation to LLC to legally transfer ownership. This process simplifies property management while protecting your personal assets from potential liabilities.

While an LLC offers liability protection and can simplify property management, it may also bring some disadvantages. For instance, transferring property held by an LLC requires an Iowa Quitclaim Deed from Corporation to LLC, which can complicate the ownership structure. Additionally, some lenders may be hesitant to finance a property owned by an LLC, potentially making it challenging to secure loans.

Yes, title companies can assist in preparing quitclaim deeds. They can help ensure all necessary documentation is in order and that the deed is properly filed with the appropriate county office. If you're dealing with an Iowa Quitclaim Deed from Corporation to LLC, working with a title company can provide added peace of mind throughout the process.

To transfer your deed to your LLC, you will need to execute a quitclaim deed that names the LLC as the recipient. It's essential to properly fill out the deed to avoid any legal hurdles. Services like US Legal Forms offer the resources necessary to create an effective Iowa Quitclaim Deed from Corporation to LLC, ensuring a smooth transition.

Typically, the property owner initiates a quitclaim deed. The owner is the individual or entity transferring their interest in the property. For an Iowa Quitclaim Deed from Corporation to LLC, the corporation would initiate the transfer, streamlining the process of transferring property ownership.

In California, a quitclaim deed can be prepared by anyone, but it is advisable to seek help from a legal professional. A qualified attorney or a title company can ensure the document meets all legal standards. Using platforms like US Legal Forms can simplify the process, providing you with customizable templates specifically for an Iowa Quitclaim Deed from Corporation to LLC.