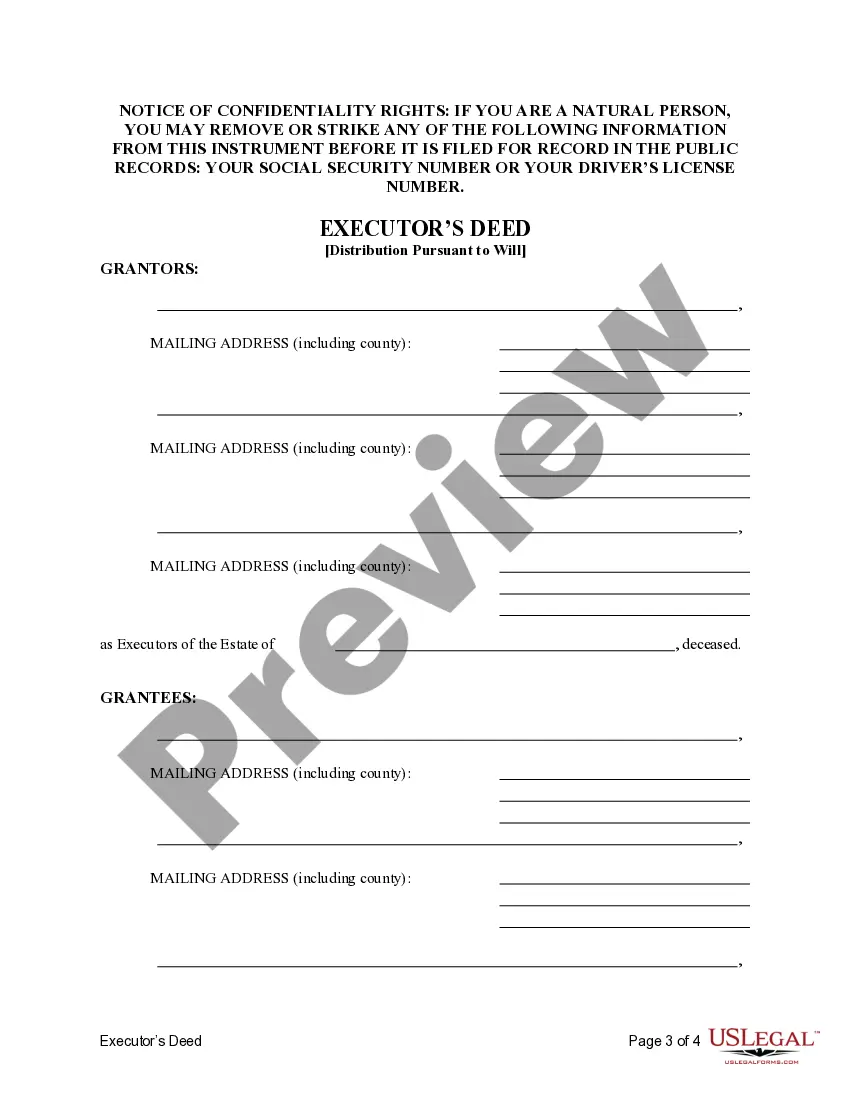

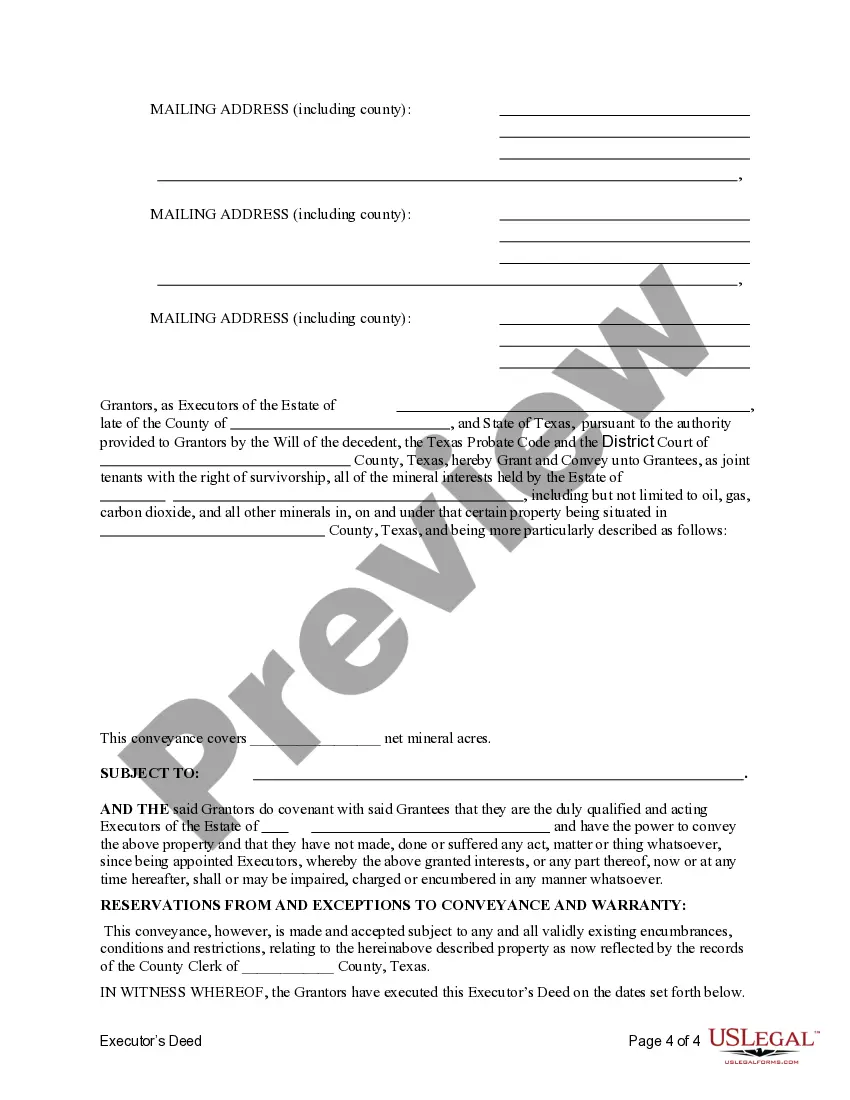

This form is an Executor's Deed where the Grantors are the executors of an estate and the Grantees are the beneficiaries of the estate. Grantors convey the described property to the Grantees. The Grantors warrants the title only as to events and acts while the property is held by the Executors. This deed complies with all state statutory laws.

Round Rock Texas Executor's Deed - Three Executors to Five Beneficiaries Pursuant to Terms of Will

Description

How to fill out Texas Executor's Deed - Three Executors To Five Beneficiaries Pursuant To Terms Of Will?

Utilize the US Legal Forms and gain instant access to any document you desire.

Our helpful platform with numerous document templates simplifies the process of locating and obtaining nearly any document example you require.

You can save, complete, and authorize the Round Rock Texas Executor's Deed - Three Executors to Five Beneficiaries Pursuant to Terms of Will in mere minutes, rather than spending hours searching online for a suitable template.

Leveraging our collection is an excellent method to enhance the security of your form submissions.

If you do not yet have an account, follow the steps below.

Locate the form you need. Verify that it is the required template: check its title and description, and utilize the Preview option when available. Otherwise, use the Search feature to find the necessary document.

- Our experienced attorneys routinely examine all documents to ensure that the forms are pertinent to a specific area and adhere to current regulations and legal standards.

- How can you acquire the Round Rock Texas Executor's Deed - Three Executors to Five Beneficiaries Pursuant to Terms of Will.

- If you already possess an account, simply Log In to your account.

- The Download option will be activated on all documents you review.

- Furthermore, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

A reasonable executor fee in Texas is typically 5% of the probate estate's value.

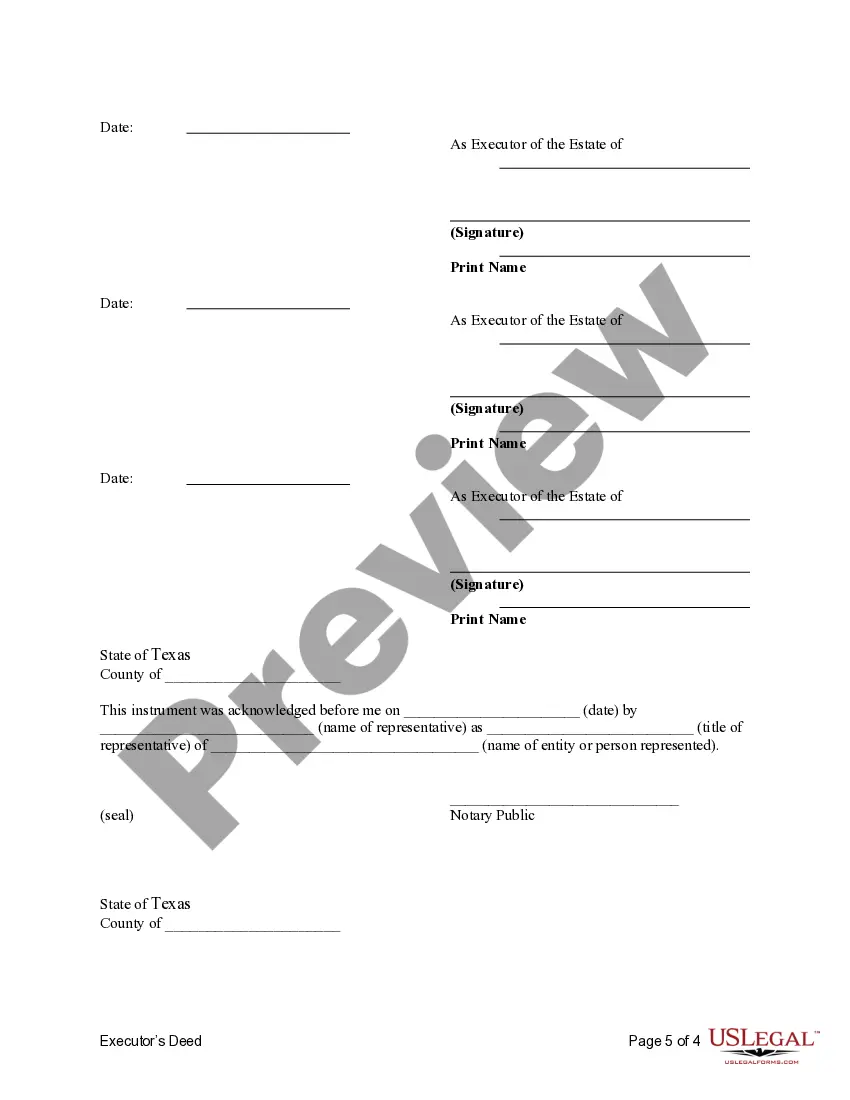

The Transfer on Death Deed must: Be in writing, signed by the owner, and notarized, Have a legal description of the property (The description is found on the deed to the property or in the deed records.Have the name and address of one or more beneficiaries, State that the transfer will happen at the owner's death,

What Are Executor Duties in Texas? Locate and notify all beneficiaries of the will; Give notice to the decedent's creditors; Identify and collect all the decedent's assets; Take steps to maintain and protect the assets; Pay all the decedent's debts; Bring a wrongful death suit, if appropriate, if family members do not;

It isn't legally possible for one of the co-executors to act without the knowledge or approval of the others. Co-executors will need to work together to deal with the estate of the person who has died. If one of the executors wishes to act alone, they must first get the consent of the other executors.

Can An Executor Sell Estate Property Without Getting Approval From All Beneficiaries? The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

The Will must give the executor the power to sell property; Letters Testamentary must be issued; and. The estate Inventory and Appraisal has been filed with the court.

The Will must give the executor the power to sell property; Letters Testamentary must be issued; and. The estate Inventory and Appraisal has been filed with the court.

The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

An Executor's Deed in Texas is used to transfer real property from the estate of a deceased property owner to the heir or heirs designated in their Will. It is signed by a court appointed Executor, who is the person named in a will to execute the terms of a Will.

The executor may also be a beneficiary of the Will, though he or she must treat all beneficiaries fairly and in accordance with the provisions of the Will. The duties of an independent executor are those of a trustee. He holds property interests, not his own, for the benefit of others.