This form is a Oil, Gas and Mineral Deed reflecting the transfer of mineral interest from Trust by a single Trustee to an individual Beneficiary Grantee. Grantor conveys and grants the described property to the Grantee. This deed complies with all state statutory laws.

Houston Texas Oil, Gas, and Mineral deed from Trust to an Individual Beneficiary- Single Trustee

Description

How to fill out Texas Oil, Gas, And Mineral Deed From Trust To An Individual Beneficiary- Single Trustee?

If you've previously utilized our service, sign in to your account and download the Houston Texas Oil, Gas, and Mineral deed from Trust to an Individual Beneficiary - Single Trustee to your device by selecting the Download button. Ensure your subscription is active. Otherwise, renew it according to your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have perpetual access to every document you've purchased: you can find it in your profile under the My documents section anytime you need to use it again. Utilize the US Legal Forms service to effortlessly locate and save any template for your personal or professional endeavors!

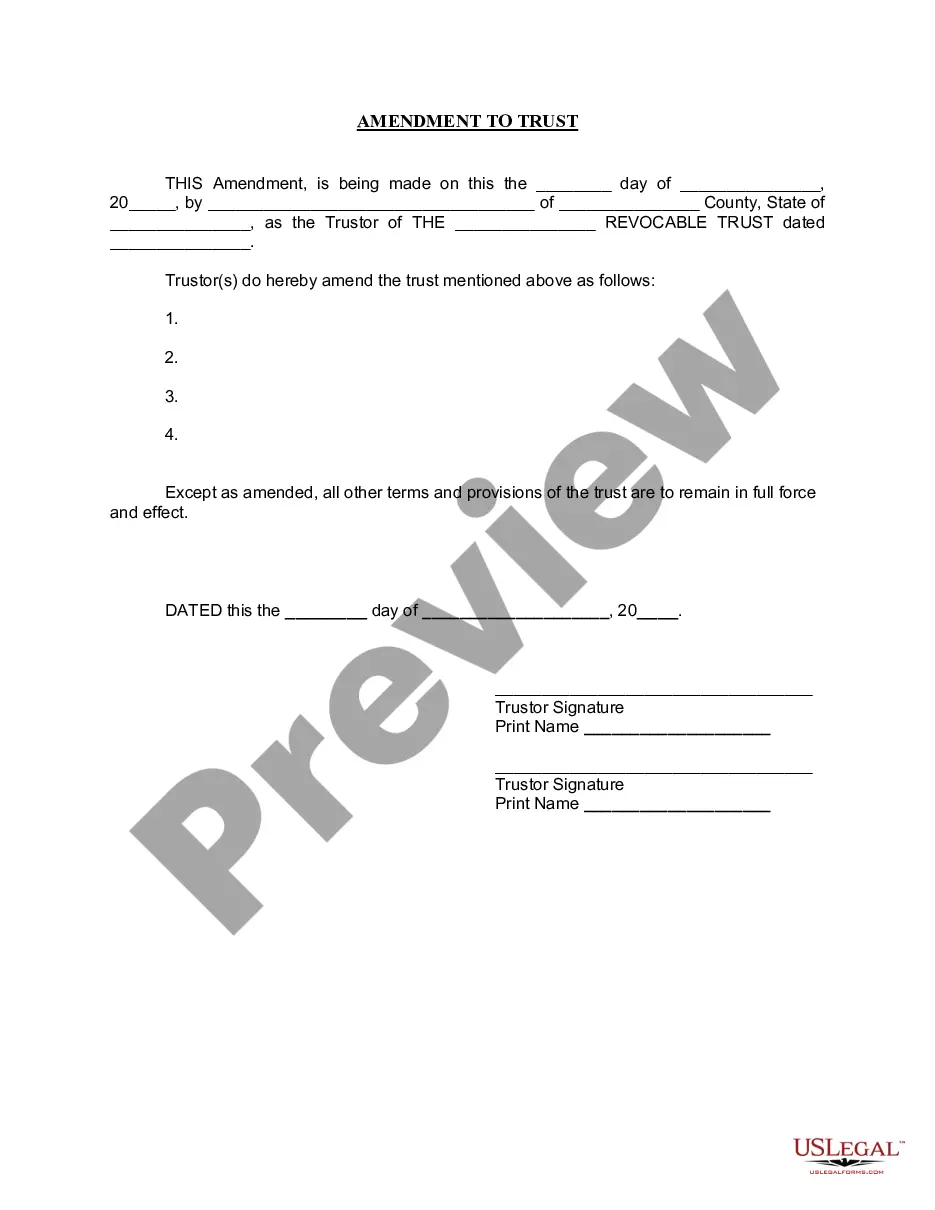

- Ensure you've found an appropriate document. Review the details and utilize the Preview feature, if available, to ensure it meets your needs. If it doesn't fit your requirements, use the Search tab above to find the correct one.

- Purchase the template. Hit the Buy Now button and choose either a monthly or yearly subscription plan.

- Create an account and process your payment. Use your credit card information or the PayPal option to finalize the transaction.

- Retrieve your Houston Texas Oil, Gas, and Mineral deed from Trust to an Individual Beneficiary - Single Trustee. Select the file format for your document and save it to your device.

- Finalize your document. Print it or take advantage of online professional editors to complete it and sign it digitally.

Form popularity

FAQ

Call the county where the minerals are located and ask how to transfer mineral ownership after death....They will probably require the following: Copy of the Death Certificate. Copy of the recorded will (or Affidavit of Heirship if there was no will) Probate documents. Completed W9 Form with the new owners' information.

After a divorce, mineral rights can be transferred by submitting the divorce decree and conveyances to the county (where the minerals are located) for recording. They usually go to the same agency that records titles and property deeds. The county will return the recorded original documents to the new owner.

Transfer Your Mineral Rights Transfer by deed: You can sell your mineral rights to another person or company by deed. Transfer by will: You can specify who you want to inherit your mineral rights in your will. Transfer by lease: You can lease mineral rights to a third party through a lease agreement.

If you want to transfer the rights to these minerals to another party, you can do so in a variety of ways: by deed, will, or lease....1 Part 1 of 2: Preparing to Transfer Mineral Rights The right to the oil, gas, or mineral deposits.A lease agreement to the minerals.A right to royalties.A combination of the above.

Mineral rights in Texas are the rights to mineral deposits that exist under the surface of a parcel of property. This right normally belongs to the owner of the surface estate; however, in Texas those rights can be transferred through sale or lease to a second party.

A Transfer Order is an authorization for payment by the owner directing the operator to pay the owner in accordance with the decimal interest set out in the Transfer Order at the address reflected on the Transfer Order.

When it comes to mineral rights, the standard admonition has long been consistent and emphatic: Avoid selling them. After all, simply owning mineral rights costs you nothing. There are no liability risks, and in most cases, taxes are assessed only on properties that are actively producing oil or gas.

In Texas, Oklahoma, Colorado and Montana, mineral owners can own the mineral rights indefinitely and there is no way for them to passively revert to the surface owner. If a surface owner wants to own the mineral rights under their land, they must find and contact the mineral owners and offer to purchase them.

Transfer by deed: You can sell your mineral rights to another person or company by deed. Transfer by will: You can specify who you want to inherit your mineral rights in your will. Transfer by lease: You can lease mineral rights to a third party through a lease agreement.