Texas Contract for Deed related forms. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

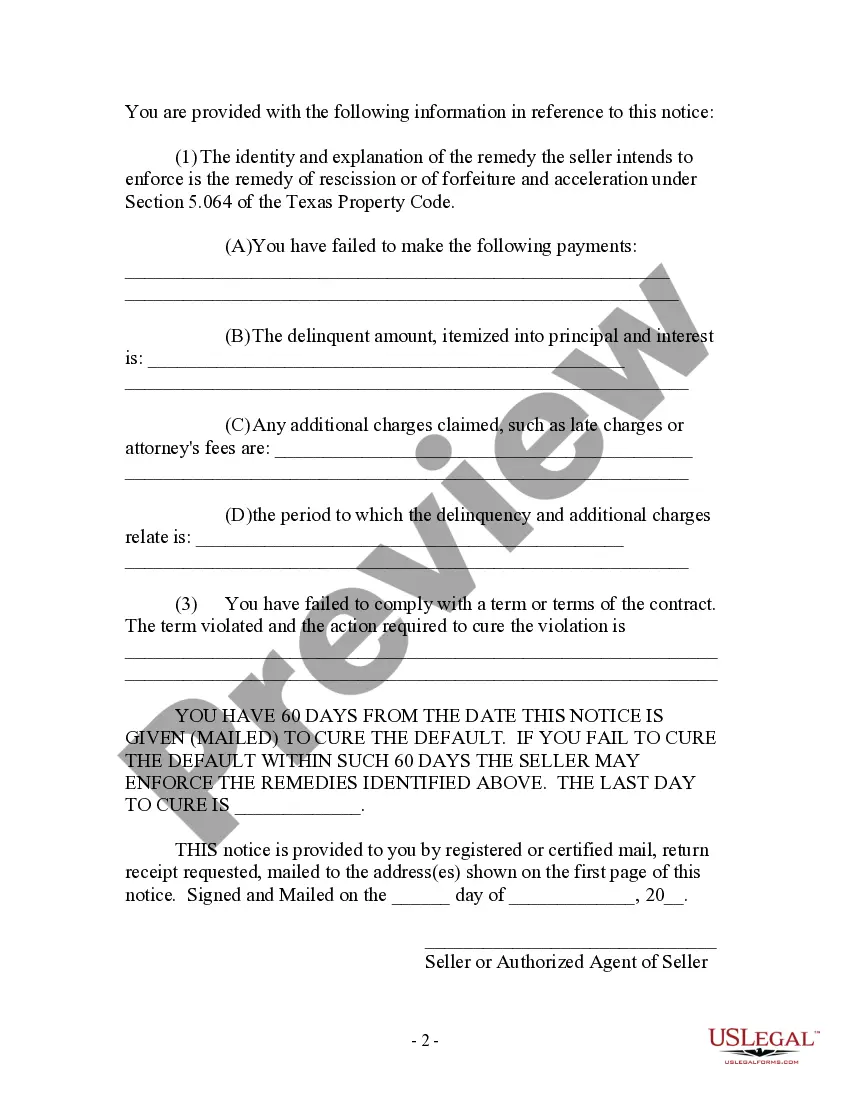

Frisco Texas Contract for Deed Notice of Default by Seller to Purchaser where Purchaser paid 40 percent or made 48 payments

Description

How to fill out Texas Contract For Deed Notice Of Default By Seller To Purchaser Where Purchaser Paid 40 Percent Or Made 48 Payments?

If you are looking for an appropriate form template, it’s incredibly challenging to find a better source than the US Legal Forms website – arguably the most extensive online collections.

With this collection, you can obtain thousands of form examples for business and personal use categorized by types and regions, or keywords.

Utilizing our premium search feature, acquiring the latest Frisco Texas Contract for Deed Notice of Default by Seller to Purchaser where Purchaser paid 40 percent or completed 48 payments is as straightforward as 1-2-3.

Obtain the form. Choose the file type and download it to your device.

Edit the document. Fill in, modify, print, and sign the obtained Frisco Texas Contract for Deed Notice of Default by Seller to Purchaser where Purchaser paid 40 percent or made 48 payments.

- If you are familiar with our system and possess an account, all you need to do to access the Frisco Texas Contract for Deed Notice of Default by Seller to Purchaser where Purchaser paid 40 percent or made 48 payments is to Log In to your user profile and select the Download option.

- If you are utilizing US Legal Forms for the first time, simply follow the instructions below.

- Ensure you have opened the form you desire. Review its details and use the Preview feature (if available) to check its content. If it doesn’t suit your requirements, use the Search field at the top of the page to find the required document.

- Verify your selection. Click on the Buy now option. After that, choose your preferred subscription plan and provide the necessary information to create an account.

- Complete the purchase. Utilize your credit card or PayPal account to finish the registration process.

Form popularity

FAQ

In Texas, you can typically get the deed to your house through your county's clerk office or through an attorney who handles property transactions. The deed should be recorded there to confirm your ownership officially. If you’re working under a Frisco Texas Contract for Deed, it’s important to ensure that the recording occurs once contractual obligations are met.

Under Texas law, a forged deed is void. However, a deed procured by fraud is voidable rather than void. The legal terms ?Void? and ?Voidable? sound alike, but they are vastly different. A void instrument passes no title, and is treated as a nullity.

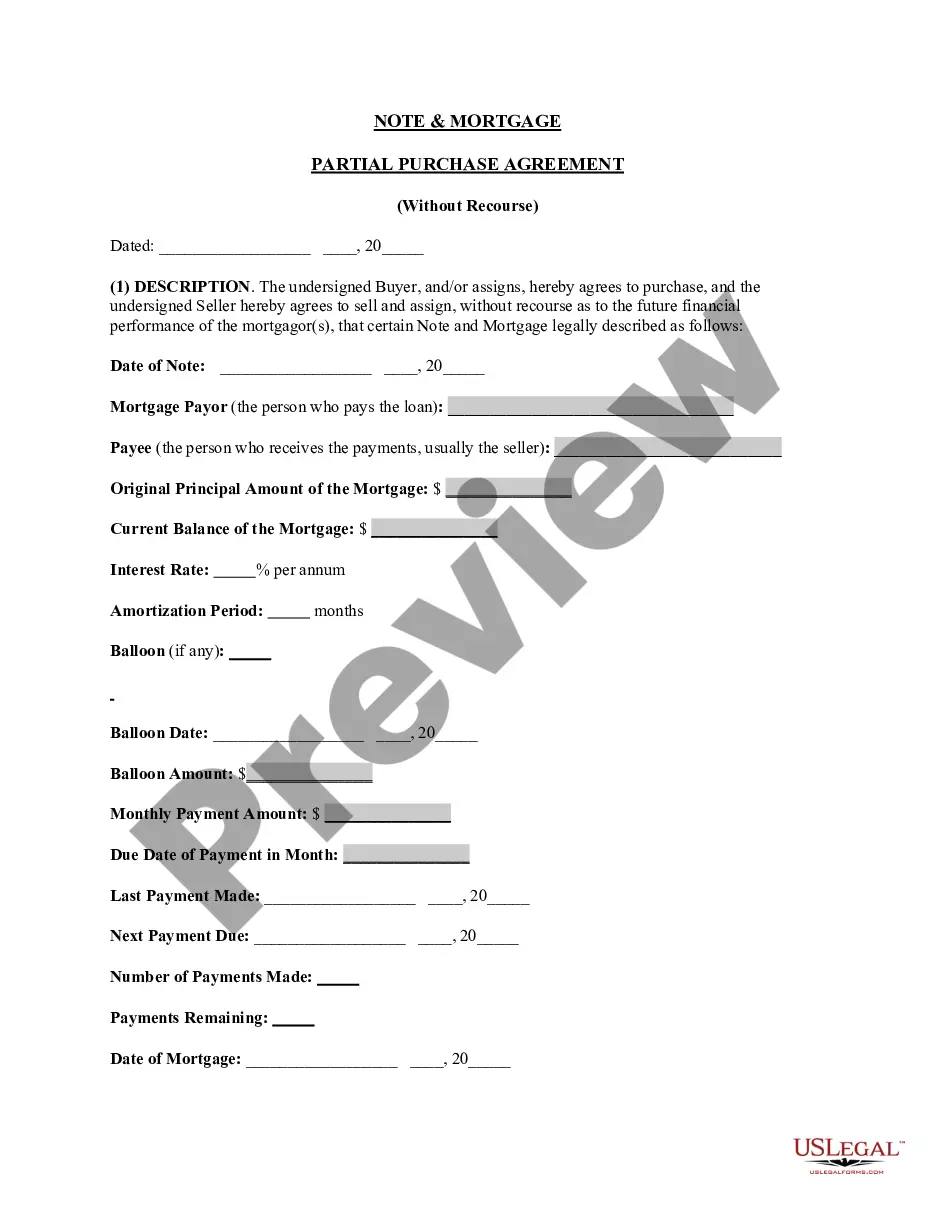

The long-term purchase contract requires the buyer to make monthly or other periodic payments over a long period of time. The contract provides that the seller will deed the property to the buyer after the buyer completes all payments. History of Contract-for-Deed Law in Texas.

A Deed of Sale is a contract where the seller delivers property to the buyer and the buyer pays the purchase price. The Deed of Sale results in ownership over the property being transferred to the buyer upon its delivery.

If you've paid more than 40% or made more than 48 payments, or if you recorded your contract in the property records and you defaulted on payment after Sept. 1, 2015, you have the right to cure within 60 days of the notice. If not, the seller can post, file, and serve notice of sale as a foreclosure.

They are split between the buyer and the seller and can sometimes be negotiable. Usually, the homebuyer pays somewhere between 2 to 5 percent of the purchase price, but this varies by situation. There are many factors that impact closing costs, two main ones being the location and the property's assigned value.

Until the unrecord deed is processed, and title transferred, the holders of the title still own the property. They can mortgage the property or sell it. The plan for the children to receive and record the deed may not have legal authority.

Prop. Code § 5.077(d)(1); Failure by a Seller to transfer legal, recorded title to the property within 30 days after receiving the Buyer's final payment in violation of Prop. Code § 5.079, gives rise to liquidated damages of $250/day for days 31-90 (following receipt of final payment) and $500/day thereafter.

Record (file) your contract for deed in the deed records of the county where the property is located. Once recorded, the contract is treated the same as warranty deed with a vendor's lien. If you get behind on payments, the seller must post, file, and serve notice of sale as a foreclosure before you can be removed.

Oregon closing costs are split between the buyer and seller in most transactions. Sellers typically pay all commissions, owner's title insurance, title transfer fees, recording fees, and prorated property taxes.