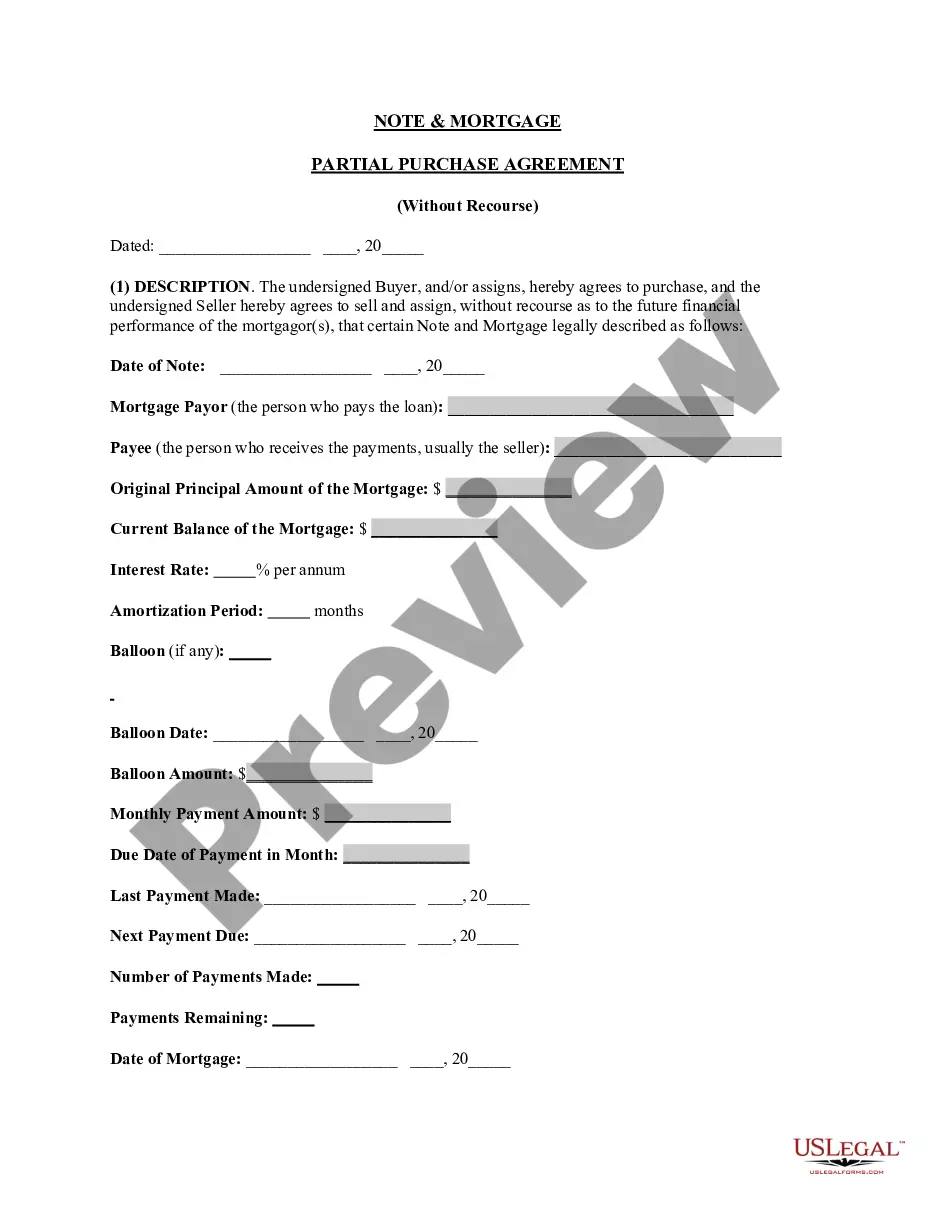

Texas Contract for Deed related forms. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

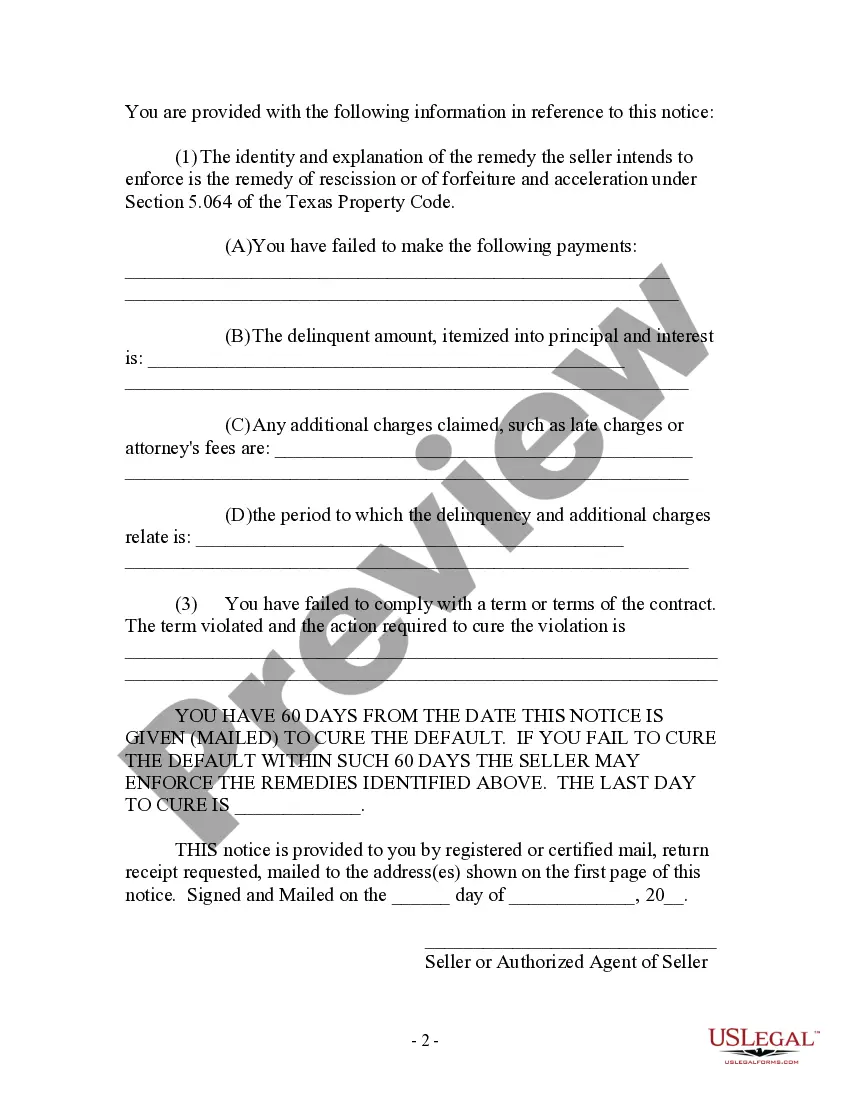

Fort Worth Texas Contract for Deed Notice of Default by Seller to Purchaser where Purchaser paid 40 percent or made 48 payments

Description

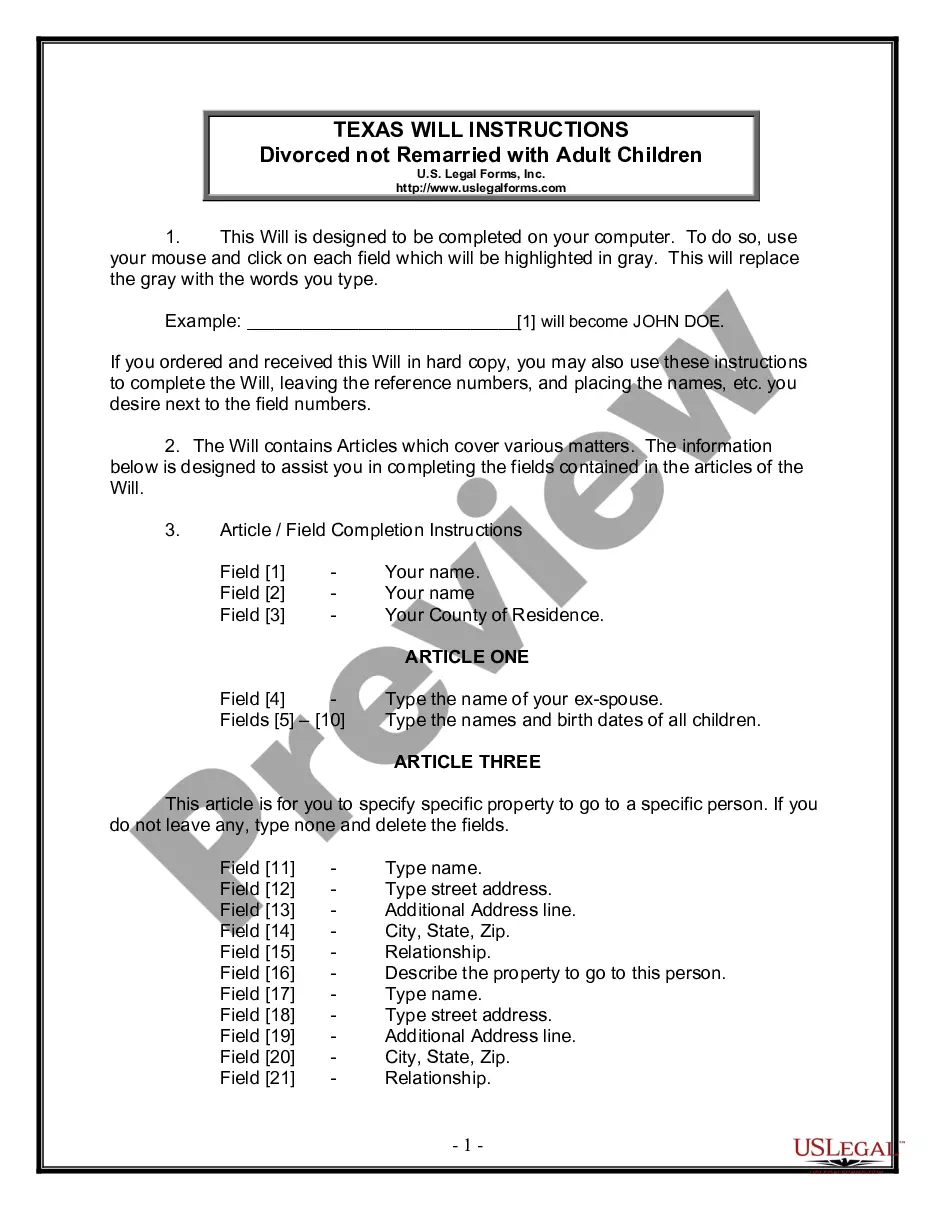

How to fill out Texas Contract For Deed Notice Of Default By Seller To Purchaser Where Purchaser Paid 40 Percent Or Made 48 Payments?

Obtaining validated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms collection.

It’s a digital repository of over 85,000 legal documents catering to personal and professional requirements as well as various real-world scenarios.

All the files are appropriately categorized by field of application and jurisdictional areas, making it simple and straightforward to look up the Fort Worth Texas Contract for Deed Notice of Default by Seller to Purchaser where Purchaser has remitted 40 percent or completed 48 payments.

Utilize the US Legal Forms library to keep your documentation organized and aligned with legal obligations, ensuring you always have necessary document templates for any requirements right at your fingertips!

- For those already familiar with our collection and who have used it previously, acquiring the Fort Worth Texas Contract for Deed Notice of Default by Seller to Purchaser where Purchaser has remitted 40 percent or completed 48 payments only takes a few clicks.

- Simply Log In to your account, choose the document, and click Download to save it on your device.

- New users will find that it requires just a few additional steps to finalize the process.

- Review the Preview mode and form description.

- Ensure you have selected the appropriate one that aligns with your needs and fully complies with your local jurisdiction requirements.

Form popularity

FAQ

?Most definitely,? says Denise Supplee, operations director of SparkRental. That's because in the laws governing real estate transactions, there's something called a ?specific performance? provision. This entitles buyers to force the seller to honor their obligations under the contract.

Most home sales involve the use of a standard real estate contract, which provides a five-day attorney review provision. During this time, the seller's attorney or the buyer's attorney can cancel the contract for any reason. This allows either party to back out without consequence.

If Your Deed Is Not Recorded, the Property Could Be Sold Out From Under You (and Other Scary Scenarios) In practical terms, failure to have your property deed recorded would mean that, if you ever wanted to sell, refinance your mortgage, or execute a home equity line of credit, you could not do so.

However, in many cases, a home seller who reneges on a purchase contract can be sued for breach of contract. A judge could order the seller to sign over a deed and complete the sale anyway. ?The buyer could sue for damages, but usually, they sue for the property,? Schorr says.

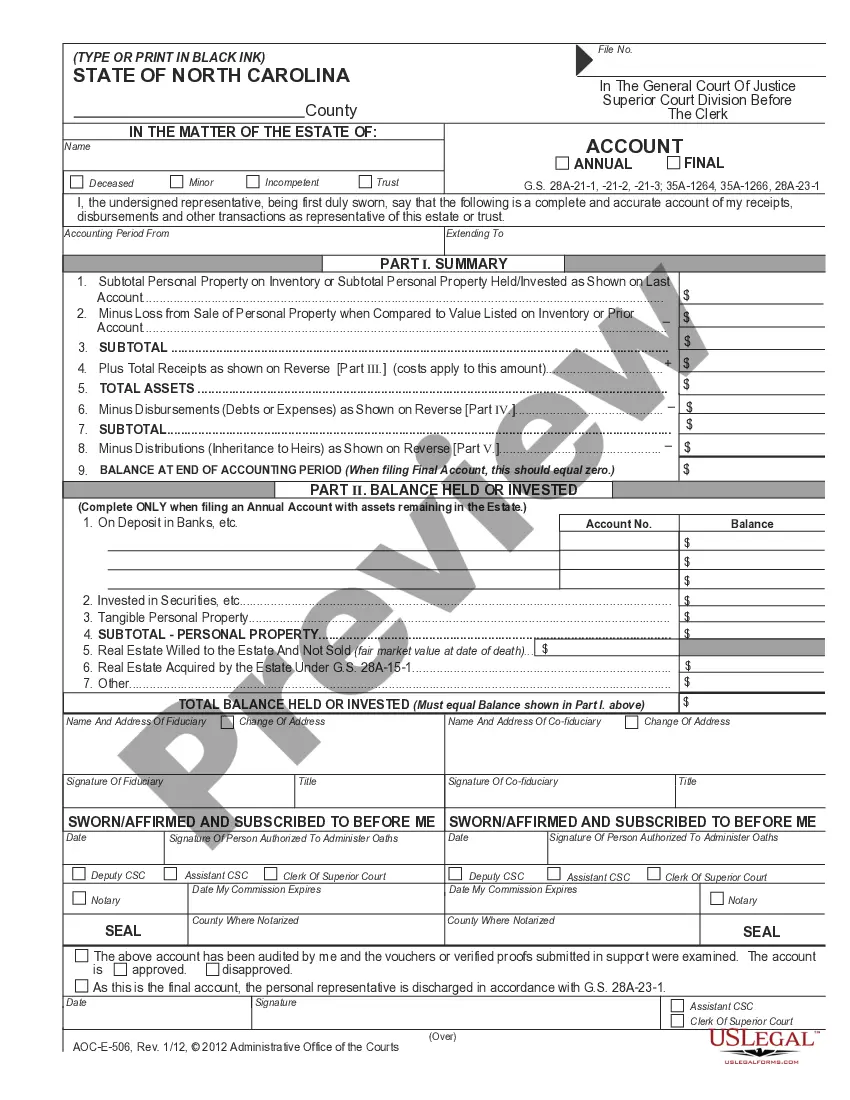

The buyer on a recorded executory contract gets the warranties that would come with a general warranty deed unless otherwise limited by the contract. Id. The seller that fails to transfer recorded, legal title after receipt of final payment can be subject to large liquidated damages statutory penalties. Id.

While a buyer can use any form of written notice to terminate the contract, a buyer's agent asked to help the buyer give the appropriate notice should use the promulgated form.

Cancelling for any reason: When you sign, the seller must inform you of your right to cancel for any reason within 14 days of signing. If you cancel, the notice must be written, signed, dated, and include the date of cancellation. Send it by certified mail, or hand deliver it to the seller (get receipt for delivery!).

1. What is a Deed of Sale? A Deed of Sale is a contract where the seller delivers property to the buyer and the buyer pays the purchase price. The Deed of Sale results in ownership over the property being transferred to the buyer upon its delivery.

If a deed is not recorded, then the grantor could sell the land to a second grantee. In that case, the second grantee would get to keep the land if they were the first to record their deed and did not have actual knowledge of the deed to the first grantee.

Yes, a home seller can back out of a real estate contract, but only in instances in which they're willing to compensate the buyer for their trouble, or they sold to a buyer who is also experiencing buyer's remorse. It also depends on when exactly you're trying to back out.