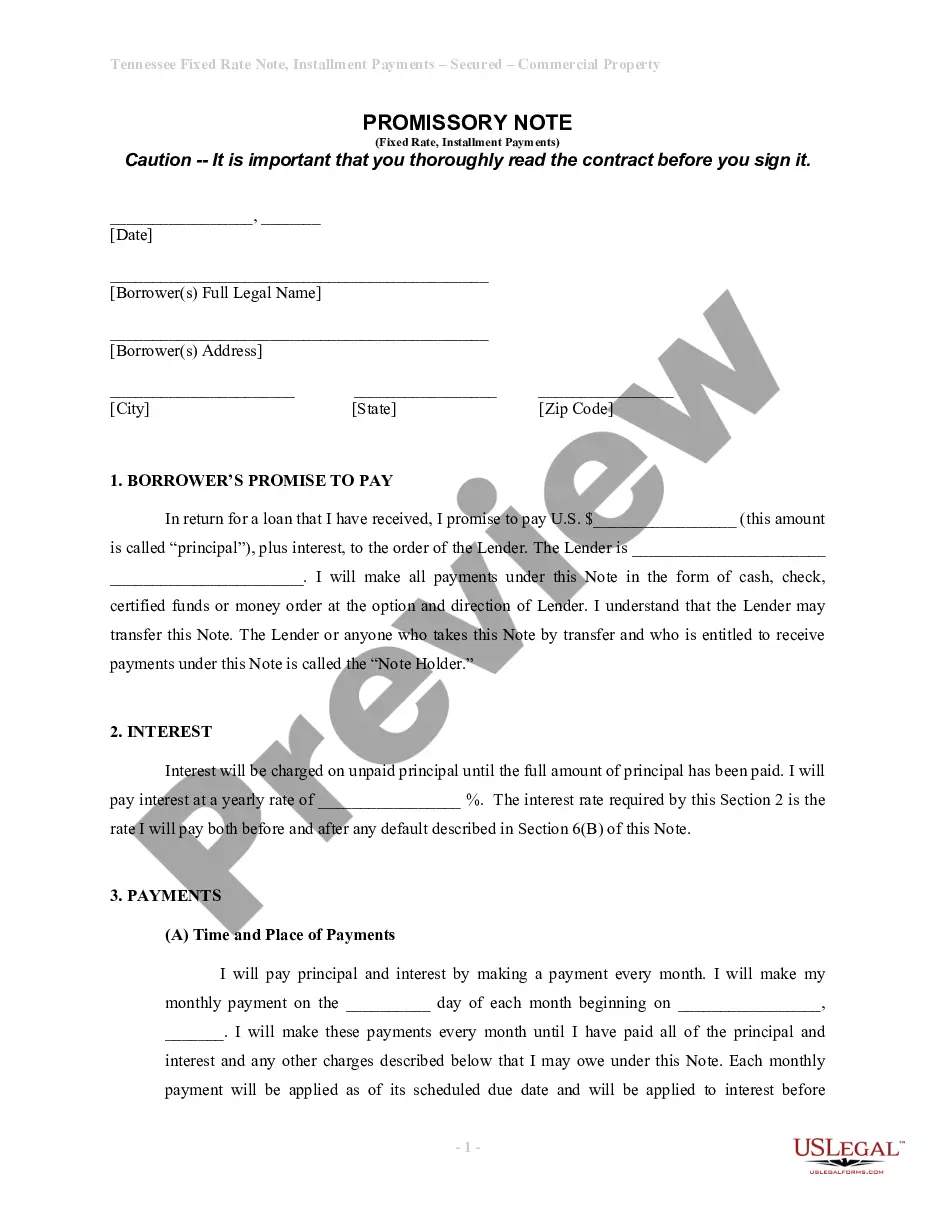

This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

Memphis Tennessee Installments Fixed Rate Promissory Note Secured by Personal Property

Description

How to fill out Tennessee Installments Fixed Rate Promissory Note Secured By Personal Property?

Take advantage of the US Legal Forms and gain instant access to any sample form you require.

Our user-friendly website filled with a multitude of templates makes it easy to locate and acquire nearly any document sample you desire.

You can save, complete, and authenticate the Memphis Tennessee Installments Fixed Rate Promissory Note Secured by Personal Property in just minutes instead of spending hours online searching for the right template.

Utilizing our collection is an excellent method to enhance the safety of your form submissions.

If you do not have an account yet, follow the guidelines outlined below.

Navigate to the page with the template you need. Ensure it is the form you were looking for: confirm its title and description, and use the Preview option if available. Otherwise, utilize the Search bar to find the correct one.

- Our knowledgeable attorneys routinely review all documents to ensure that the forms are appropriate for a specific area and adhere to the latest laws and regulations.

- How do you acquire the Memphis Tennessee Installments Fixed Rate Promissory Note Secured by Personal Property.

- If you possess a subscription, simply Log In to your account.

- The Download button will be activated for all the samples you view.

- Additionally, you can access all previously saved documents under the My documents section.

Form popularity

FAQ

Promissory Note Drafting Cost The amount a lawyer charges will vary based on the area of law, experience, and geographic location. ContractsCounsel's marketplace data shows the average promissory note drafting costs are $466.37 across all states and industries.

Promissory Note Drafting Cost The amount a lawyer charges will vary based on the area of law, experience, and geographic location. ContractsCounsel's marketplace data shows the average promissory note drafting costs are $466.37 across all states and industries.

If you are borrowing money from a lending institution, they will have someone on staff who creates a promissory note. However, if you need a promissory note for a personal loan or a loan between friends and family, you can contact a lawyer or financial professional to help you create a promissory note.

In Tennessee, there is no legal requirement to have a promissory note notarized. To make the document into a legal document, a Tennessee promissory note must be signed and dated by the borrower.

Loans from banks or other institutional lenders are always made using a number of documents, two of which are a promissory and security agreement. In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

Promissory notes are debt instruments. They can be issued by financial institutions. However, they can also be issued by small companies or individuals. They enable a person or a business to obtain financing without going through a bank.

Generally, a Secured Promissory Note will be secured using an additional document. If the property being used as collateral is personal property, the Note will be secured using a Security Agreement. If the property being used as collateral is real property, the Note will be secured using a Deed of Trust.

Secured Promissory Notes By assuring that the property attached to the note is of sufficient value to cover the amount of the loan, the payee thus has a guarantee of being repaid. The property that secures a note is called collateral, which can be either real estate or personal property.

Financial institutions such as banks and lenders often use promissory notes when issuing real estate mortgage loans or student loans. Companies or individuals also use promissory notes when issuing or taking on personal loans or corporate loans.