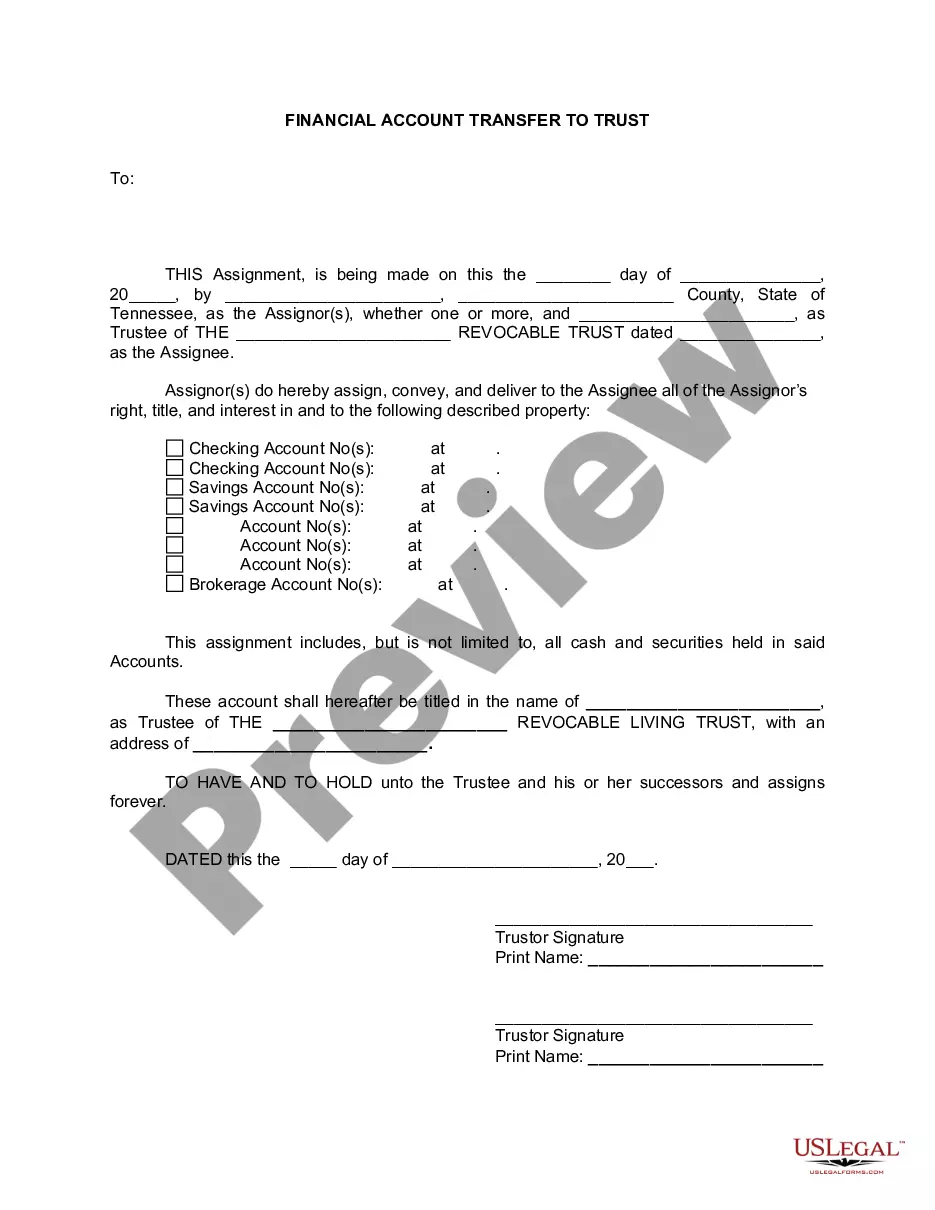

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Nashville Tennessee Financial Account Transfer to Living Trust

Description

How to fill out Tennessee Financial Account Transfer To Living Trust?

We consistently seek to minimize or avert legal complications when navigating intricate legal or financial issues.

To accomplish this, we engage attorney services that are typically quite costly.

However, not all legal situations are of equal intricacy.

Many of them can be managed independently.

Take advantage of US Legal Forms whenever you require to acquire and download the Nashville Tennessee Financial Account Transfer to Living Trust or any other form quickly and securely. Simply Log In to your account and click the Get button next to it. If you happen to misplace the document, you can always re-download it in the My documents tab.

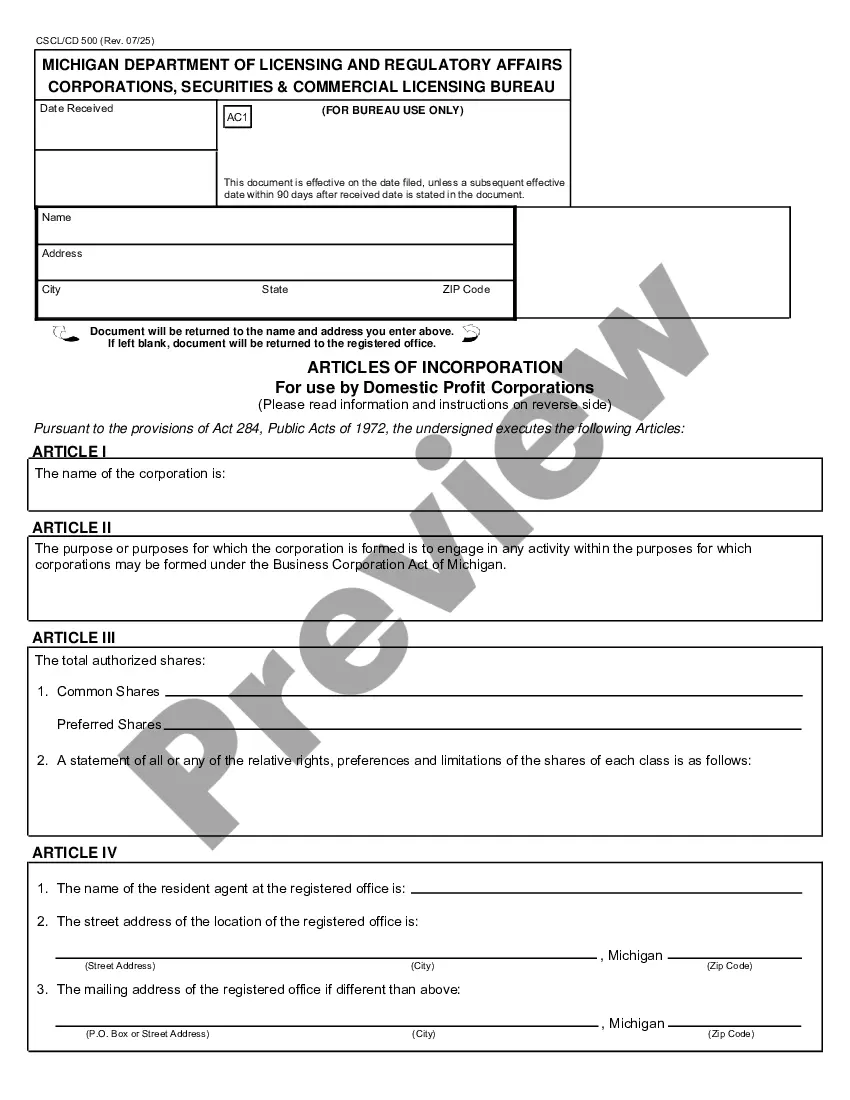

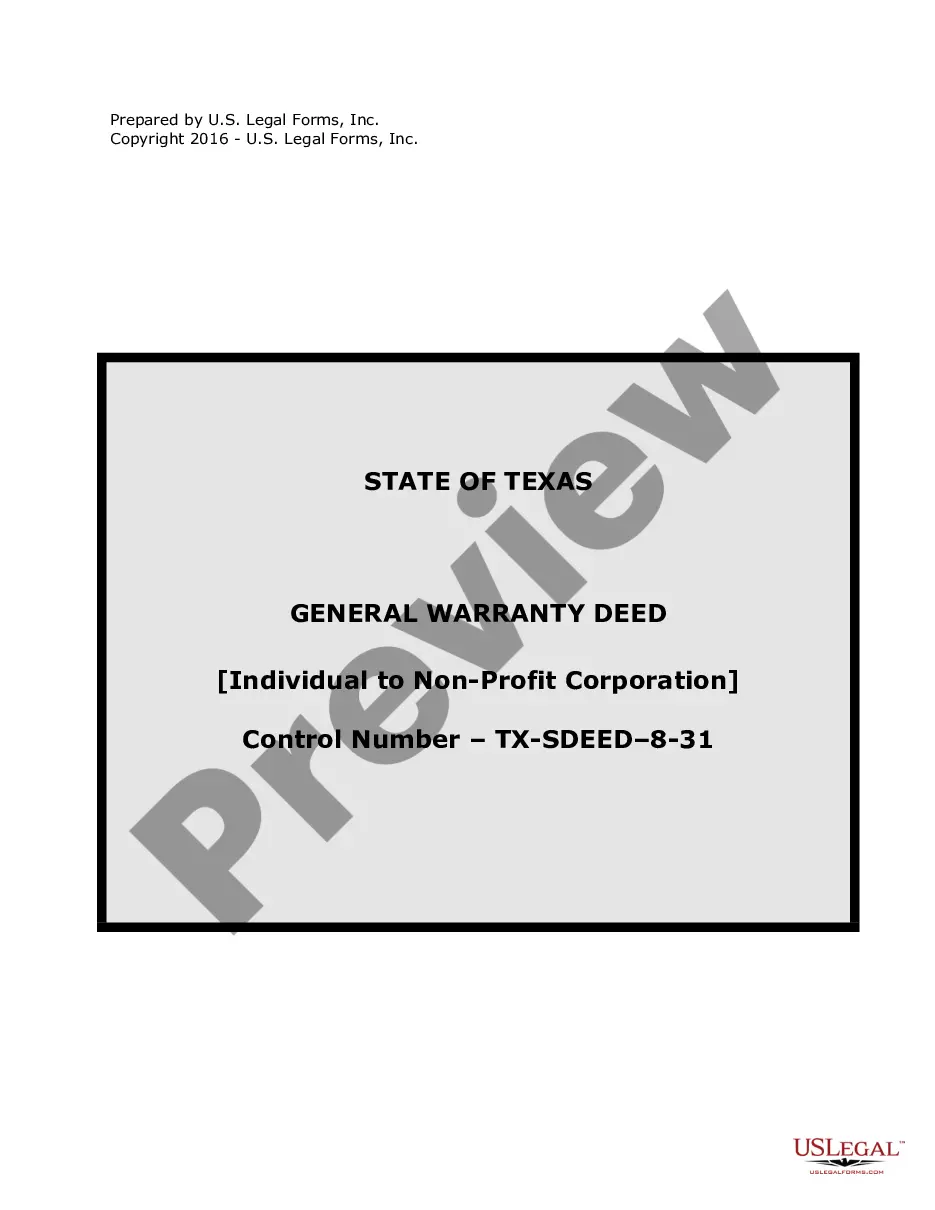

- US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and power of attorney to articles of incorporation and dissolution petitions.

- Our platform enables you to take control of your issues without the need for legal representation.

- We offer access to legal document templates that are not always publicly accessible.

- Our templates are specific to states and regions, making the search process significantly easier.

Form popularity

FAQ

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

Tennessee has not adopted the Uniform Probate Code. So if your property is worth more than $50,000, a living trust will enable your heirs to avoid the state's lengthy probate period ? and legal costs. Living trusts do cost money, though, so you should weigh the benefits with the outlay of $1,000 or more.

To transfer personal items to a trust, you or your attorney will list them on a property schedule that is referenced by and attached to the trust. However, note that it is more common to keep these assets just in your name and distribute them under your will than place them in a trust.

Trusts can hold many different types of assets, including cash, stocks, bonds, mutual funds, real estate and other property. Once the account is opened, you can transfer assets into the trust.

In many instances, placing your investment property in a living trust is more beneficial than using your personal name. It can help avoid probate and minimize estate taxes. It can separate your personal assets from your business assets.

A trust can give you more control over how your assets are distributed. You can name a trust as a direct beneficiary of an account. Upon your death, your assets transfer to the trust and distributions are made from the trust to its beneficiaries according to your wishes.

Assets that should not be used to fund your living trust include: Qualified retirement accounts ? 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

Using a revocable trust can help you avoid probate Assets that don't pass directly to heirs (such as a bank account, brokerage account, home, etc.) will go through probate before being distributed according to your will (if you had one) or at the court's discretion. Probate is an expensive, time-consuming process.

You can open a brokerage account as a trust account, a single ownership account or a joint ownership account. Other legal entities such as businesses can also operate brokerage accounts.