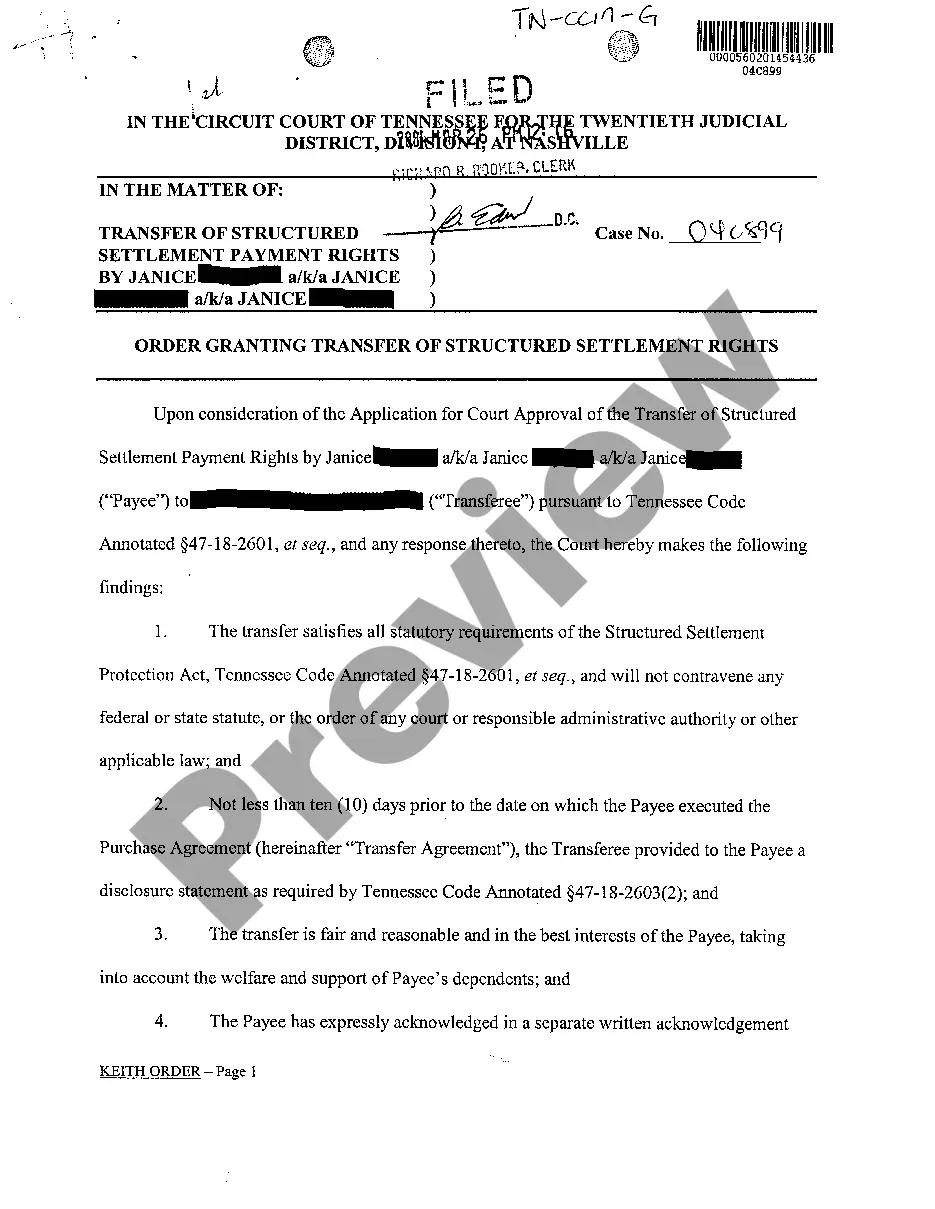

Nashville Tennessee Order Granting Transfer of Structure Settlement

Description

How to fill out Nashville Tennessee Order Granting Transfer Of Structure Settlement?

We consistently aim to minimize or avert legal harm when navigating intricate legal or financial matters.

To achieve this, we pursue legal remedies that are often significantly expensive.

However, not all legal issues are equally complicated; many can be handled independently.

US Legal Forms is a digital repository of current DIY legal documents addressing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. If you happen to misplace the document, you can always retrieve it again from the My documents tab.

- Our collection empowers you to manage your affairs independently without engaging a lawyer's services.

- We provide access to legal form templates that are not always accessible to the general public.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

- Benefit from US Legal Forms whenever you require to obtain and download the Nashville Tennessee Order Granting Transfer of Structure Settlement or any other form quickly and securely.

Form popularity

FAQ

A structured settlement factoring transaction means a transfer of structured settlement payment rights (including portions of structured settlement payments) made for consideration by means of sale, assignment, pledge, or other form of encumbrance or alienation for consideration.

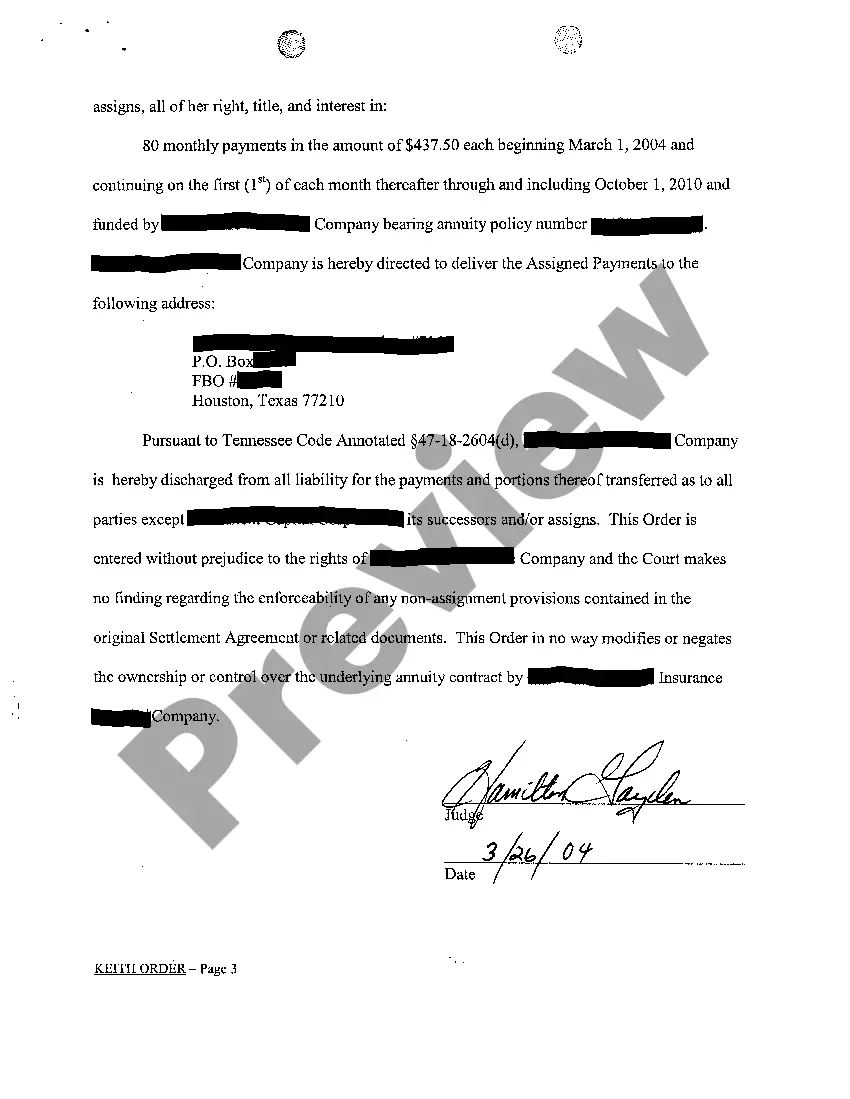

The lump sum you receive from the buyer, or factoring company, can be as low as 50 percent of your total future payments, but typically will be between 60 and 80 percent. So if you get $1,000 a month through your structured settlement, you could sell each payment for anywhere from $500 to $800.

Put simply, a structured settlement is not a loan or a bank account, and the only way to receive money from your settlement is to stick to your payment schedule or sell part or all of your payments to a reputable company for a lump sum of cash.

Cashing out a structured settlement involves a court approval process which takes about 45 to 90 days. Selling future payments offers more flexibility. Interest rates are rising for annuities in 2022, making purchasing an annuity more intriguing for buying companies.

Structured settlement annuities are not taxable ? they're completely tax-exempt. It's a common question that we are asked by personal injury attorneys, and in certain situations, the tax-exempt nature of structured settlement annuities results in significant tax savings to the client.

Structured settlement payments do not count as income for tax purposes, even when the structured settlement earns interest over time.

You can sell your structured settlement to a factoring company for immediate cash. Although you must first obtain court approval, you have the legal right to cash out your payments, either in part or in full, to a structured settlement buyer.

You cannot borrow against your structured settlement, but you can sell all or a portion of it for a lump sum of cash. You can also seek pre-settlement funding or lawsuit advances to cover legal bills prior to a lawsuit settlement.

Structured settlements are usually set up so payments are made for the life of the injured party?with a guaranteed minimum number of years. If the claimant dies before the guaranteed minimum number of years is reached, the remaining guaranteed settlement portion can go to a structured settlement beneficiary.

Structured settlement companies, also known as factoring companies, will buy your structured settlement or annuity payments for a lump sum of cash.