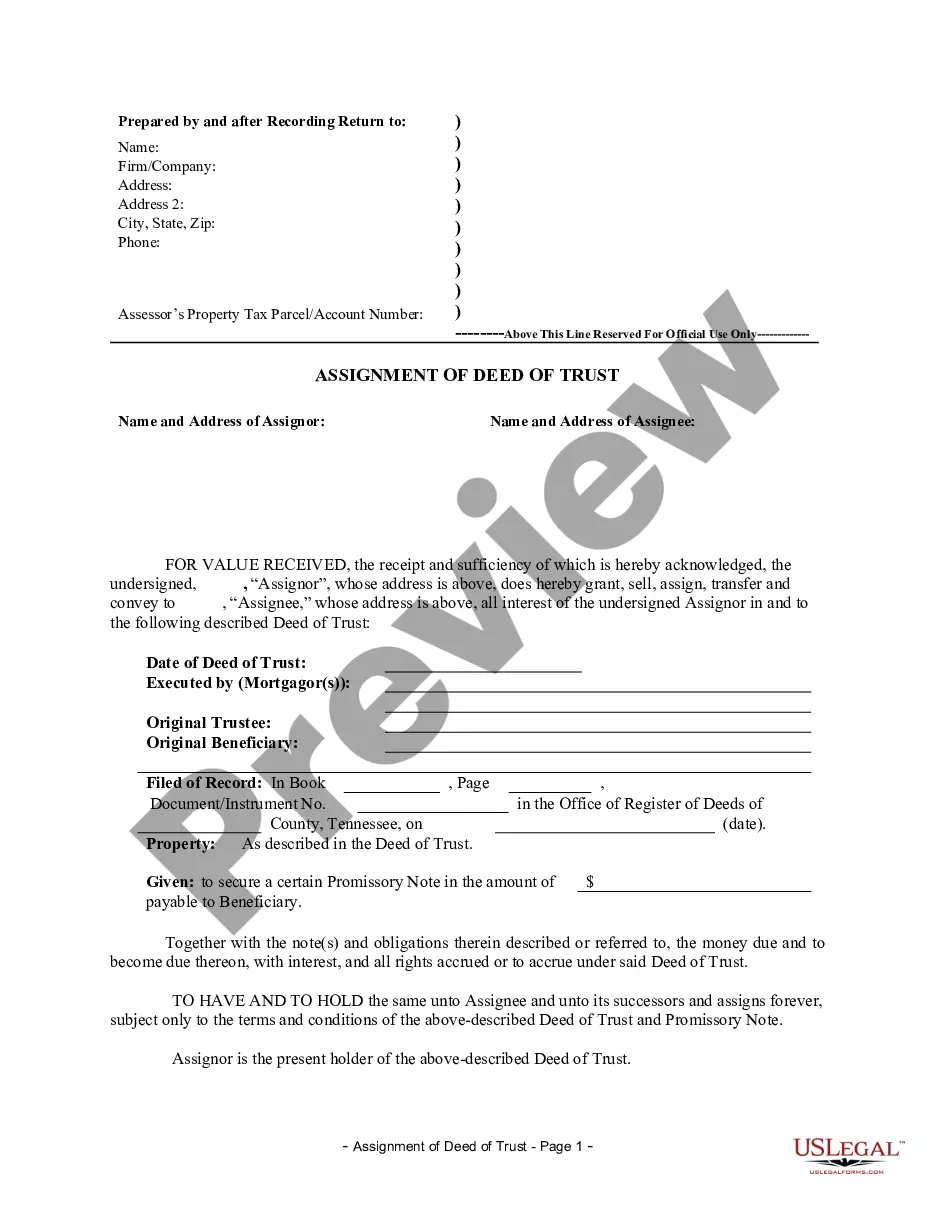

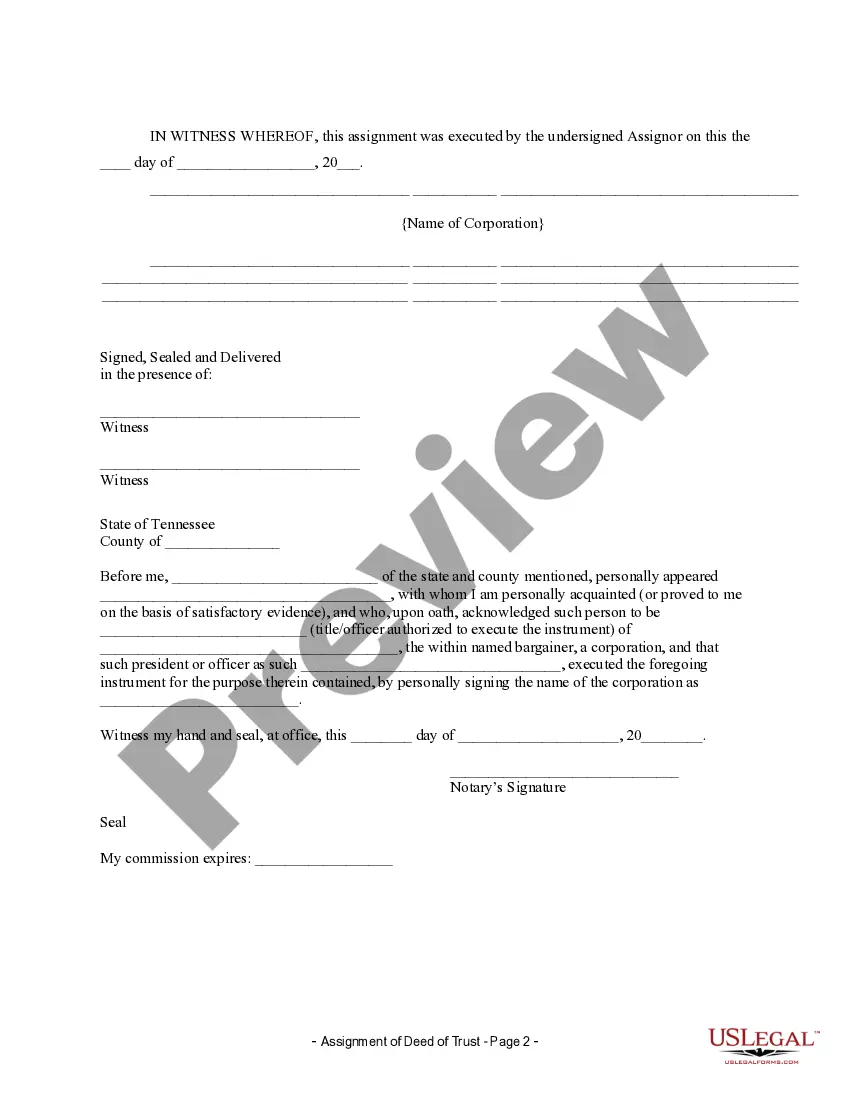

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Memphis Tennessee Assignment of Deed of Trust by Corporate Mortgage Holder

Description

How to fill out Tennessee Assignment Of Deed Of Trust By Corporate Mortgage Holder?

We consistently seek to reduce or evade legal complications when addressing intricate legal or financial issues.

To achieve this, we enroll in costly legal services that are typically exorbitant.

However, not every legal issue holds the same level of complexity.

The majority can be managed independently by ourselves.

- US Legal Forms serves as an online repository of current do-it-yourself legal documents encompassing everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our platform empowers you to manage your affairs independently, negating the necessity of lawyer services.

- We provide access to legal document templates that aren’t universally accessible.

- Our templates are tailored to specific states and regions, streamlining the search process.

Form popularity

FAQ

Many banks and mortgage lenders sell outstanding loans in order to free up money to lend to new borrowers, and use an assignment of mortgage to legally grant the loan obligation to the new mortgage holder.

Collateral Assignment of Deeds of Trust means that agreement executed by Borrower in favor of Lender in which Borrower collaterally assigns to Lender all of the Borrower's rights, title and interest in and to those deeds of trust which secure repayment of the Pledged Accounts.

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest.

When your mortgage lender decides he wants to sell your mortgage loan to another lender, your mortgage lender will sign an assignment of deed of trust in favor of the new lender. This assignment gives the new lender the same lien on your property that your original lender had under the mortgage loan.

A corporate assignment of a mortgage occurs when the third party that assumes the obligation for the loan is a corporation. Again, this corporation might be a lender that is officially incorporated, or it might be some other business (or even individual) that is legally considered a corporation.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

The difference between a deed of sale and a deed of assignment is that the deed of sale is used once and has no conditions other than the purchase price of the property, while the deed of assignment can be used anytime to transfer contractual rights from one party to another.

A deed of assignment refers to a legal document that records the transfer of ownership of a real estate property from one party to another. It states that a specific piece of property will belong to the assignee and no longer belong to the assignor starting from a specified date.

Definition. An assignment of a deed of trust is simply the movement of the deed of trust from one party to another, a party that was not originally involved in the deed creation when the property was bought. A corporate assignment is simply an assignment of the deed of trust between different businesses.

Definition. An assignment of a deed of trust is simply the movement of the deed of trust from one party to another, a party that was not originally involved in the deed creation when the property was bought. A corporate assignment is simply an assignment of the deed of trust between different businesses.