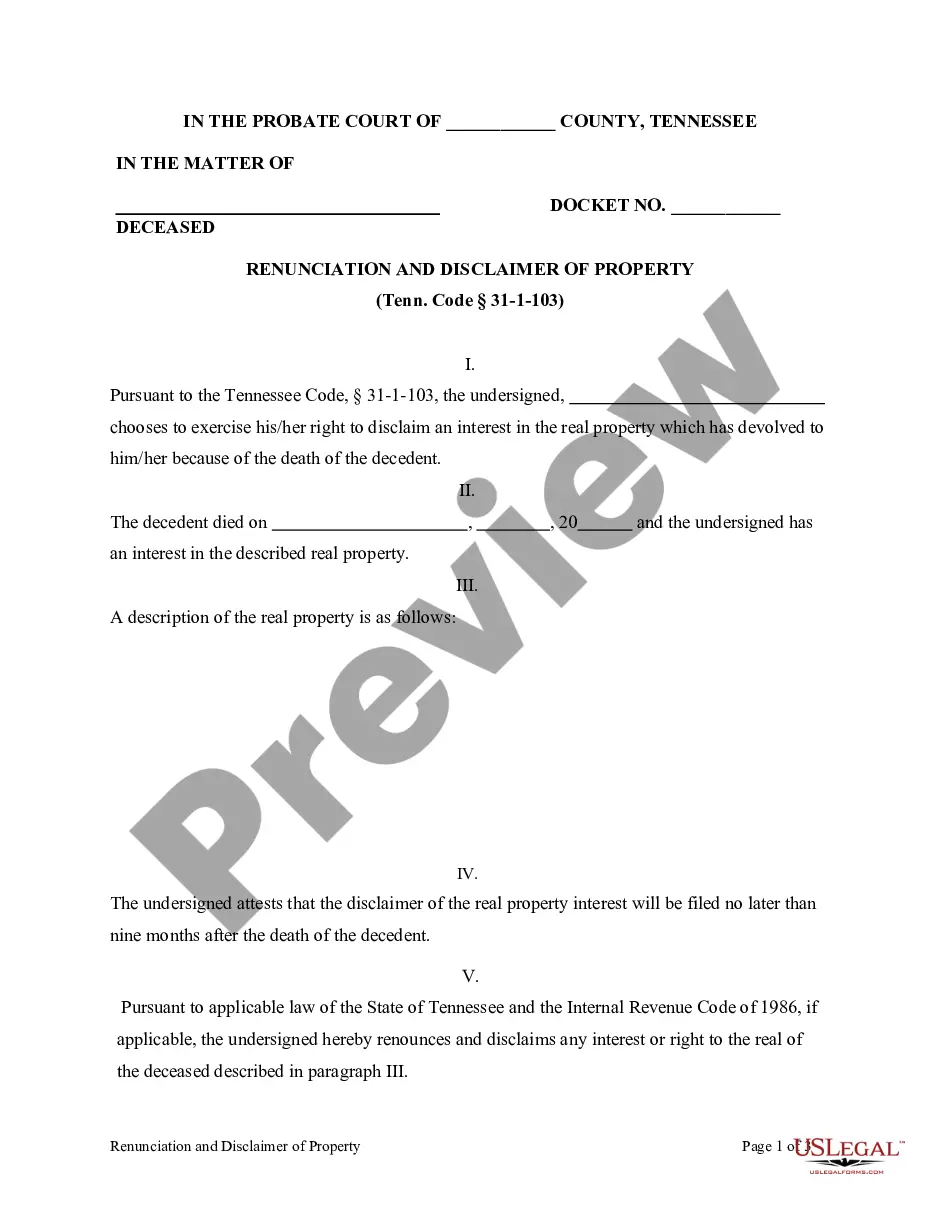

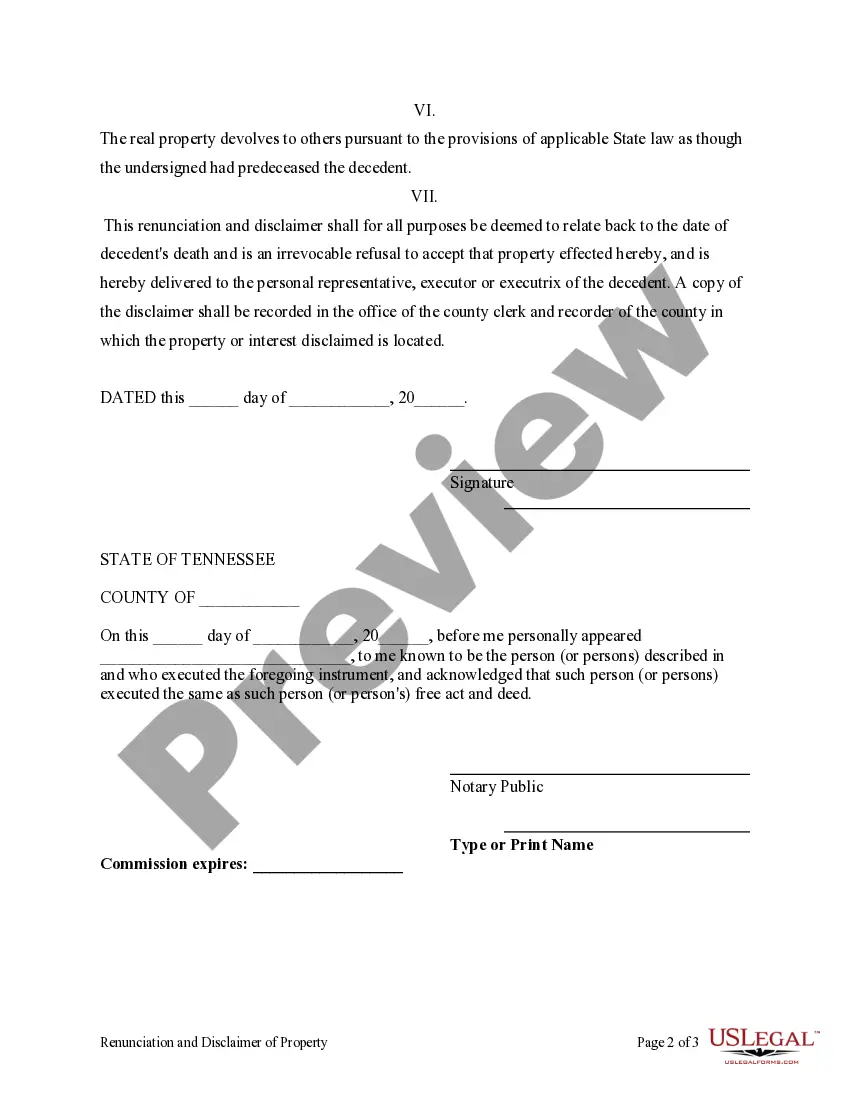

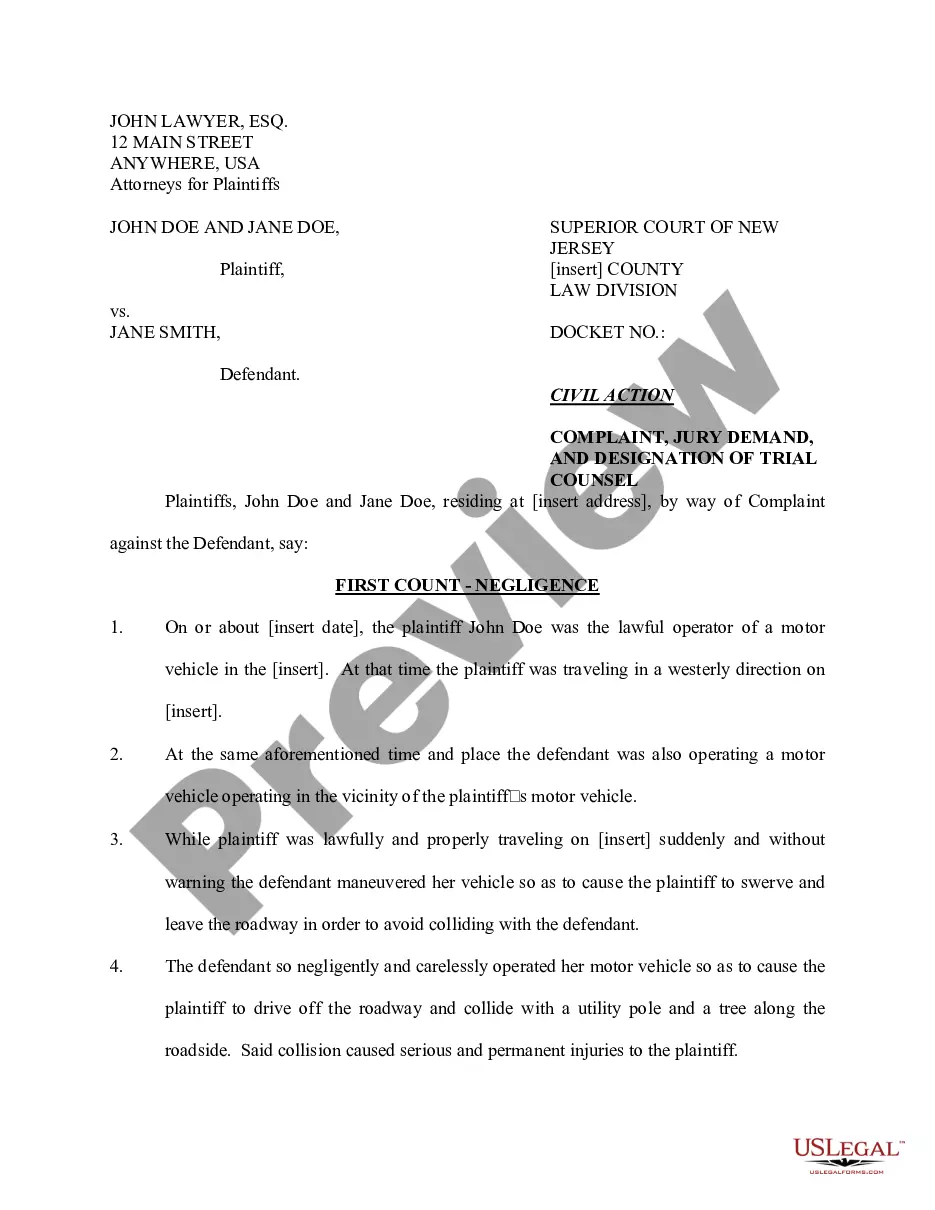

This form is a Renunciation and Disclaimer of a Real Property Interest, where the beneficiary gained an interest in the real property upon the death of the decedent, but, will terminate his/her interest in the real property pursuant to the Tennessee Code, Title 31, Chapter 1. The real property will pass to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Nashville Tennessee Renunciation And Disclaimer of Real Property Interest

Description

How to fill out Tennessee Renunciation And Disclaimer Of Real Property Interest?

Utilize the US Legal Forms and gain instant access to any form template you need.

Our user-friendly platform filled with numerous documents simplifies the process of locating and acquiring nearly any document sample you require.

You can download, complete, and sign the Nashville Tennessee Renunciation And Disclaimer of Real Property Interest within minutes instead of spending hours online searching for an appropriate template.

Using our collection is a fantastic method to enhance the security of your record submissions.

- Our experienced attorneys frequently review all the documents to ensure that the forms are applicable to a specific region and meet current laws and regulations.

- How do you acquire the Nashville Tennessee Renunciation And Disclaimer of Real Property Interest.

- If you have an account, simply Log In to your account. The Download option will appear on all the documents you view.

Form popularity

FAQ

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.

If you are asked to sign a Disclaimer Deed proceed with caution. If you are told ?it's not a big deal? -think again! If you're the one signing a Disclaimer Deed to real property here's the deal: You affirmatively state that you have NO interest in the real property and NEVER had an interest in the real property.

§ 19?1502. (3) ?Disclaimer? means the refusal to accept an interest in or power over property. (4) ?Fiduciary? means a personal representative, trustee, agent acting under a power of attorney, or other person authorized to act as a fiduciary with respect to the property of another person.

Key Takeaways. Common reasons for disclaiming an inheritance include not wishing to pay taxes on the assets or ensuring that the inheritance goes to another beneficiary?for example, a grandchild. Specific IRS requirements must be followed in order for a disclaimer to be qualified under federal law.

If a family member has recently passed away owning real property, there may not be a need for a full probate administration. Instead, Tennessee law allows for the filing of a muniment of title and an affidavit of heirship to transfer property.

Renunciation of inheritance means that an heir renounces his/her right to inherit any of legacy when the heir does not want to inherit the legacy of the ancestor (a deceased person).

Tennessee does not allow real estate to be transferred with transfer-on-death deeds.

In the context of a contract, a renunciation occurs when one party, by words or conduct, evinces an intention not to perform, or expressly declares that they will be unable to perform their obligations under the contract in some essential respect. The renunciation may occur before or at the time of performance.

Disclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line. It's not typical for people to disclaim inheritance assets.

Under Tennessee law, real property is not included in the probate estate and vests immediately in the heirs or devisees upon death of the owner, unless the will specifically directs for the real property to be administered through the estate and gives the executor the powers and authority to do so.