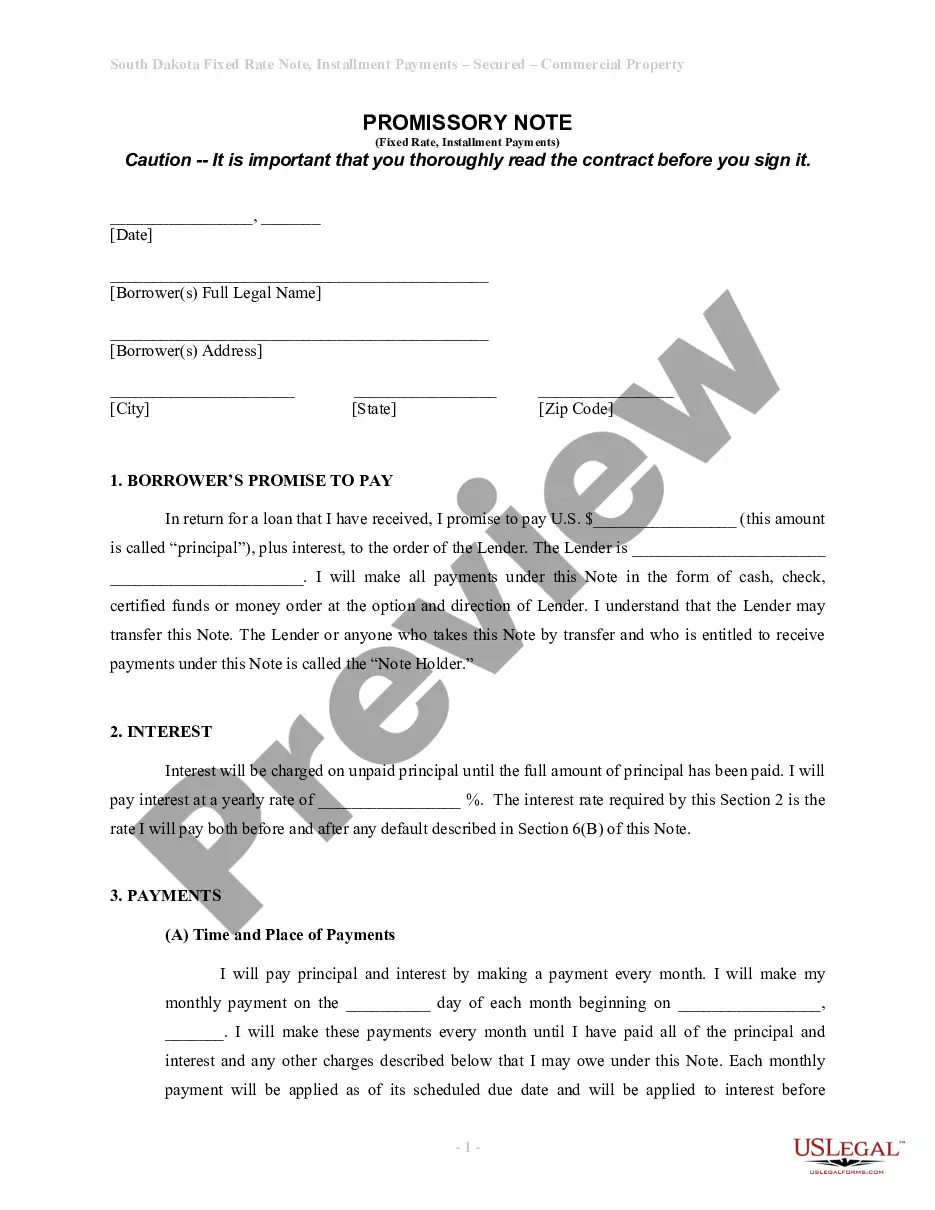

This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

Sioux Falls South Dakota Installments Fixed Rate Promissory Note Secured by Personal Property

Description

How to fill out South Dakota Installments Fixed Rate Promissory Note Secured By Personal Property?

Are you searching for a dependable and budget-friendly legal forms provider to purchase the Sioux Falls South Dakota Installments Fixed Rate Promissory Note Secured by Personal Property? US Legal Forms is your preferred choice.

Whether you require a simple agreement to establish guidelines for living with your partner or a collection of documents to advance your separation or divorce through the legal system, we have you covered. Our site offers over 85,000 current legal document templates for personal and business use. All templates we provide access to are not generic and are structured based on the regulations of specific states and regions.

To obtain the form, you must Log In to your account, find the necessary template, and click the Download button next to it. Please remember that you can download your previously acquired document templates anytime from the My documents tab.

Are you a newcomer to our platform? No need to worry. You can set up an account in minutes, but before that, ensure to do the following.

Now you can register for your account. Then select your subscription plan and proceed to payment. Once the payment is completed, download the Sioux Falls South Dakota Installments Fixed Rate Promissory Note Secured by Personal Property in any available file format. You can revisit the website whenever needed and redownload the form at no additional cost.

Acquiring up-to-date legal documents has never been simpler. Give US Legal Forms a try today, and say goodbye to wasting your precious time researching legal documents online for good.

- Verify that the Sioux Falls South Dakota Installments Fixed Rate Promissory Note Secured by Personal Property adheres to the laws of your state and locality.

- Review the details of the form (if available) to understand who and what the form is suitable for.

- Reinitiate your search if the template isn’t appropriate for your particular situation.

Form popularity

FAQ

Yes, a promissory note can serve as a security instrument in mortgage transactions. In the context of Sioux Falls South Dakota Installments Fixed Rate Promissory Notes Secured by Personal Property, this arrangement helps lenders ensure repayment by placing a lien on the property. This security enhances trust between lenders and borrowers, fostering a smoother transaction process.

Promissory notes can be a good investment depending on your financial goals and risk tolerance. Sioux Falls South Dakota Installments Fixed Rate Promissory Notes Secured by Personal Property provide a stable income stream with relatively low risk. Investors often find them attractive for their reliability and the fact they can be backed by tangible assets.

The income from a promissory note primarily comes from the interest payments made by the borrower. For Sioux Falls South Dakota Installments Fixed Rate Promissory Notes Secured by Personal Property, these payments are predetermined and can offer a stable return on investment. Investors appreciate this consistent income, as it aids in effective financial planning.

A promissory note is typically secured by collateral, which can include personal property in the case of Sioux Falls South Dakota Installments Fixed Rate Promissory Notes. This collateral provides assurance to the lender, which often results in more favorable terms for borrowers. By securing the note, both parties can feel more confident in their transaction.

Yes, notes, including Sioux Falls South Dakota Installments Fixed Rate Promissory Notes Secured by Personal Property, are commonly classified as fixed-income investments. They provide a reliable stream of interest payments, making them attractive to investors seeking stability. This predictability allows individuals to plan their finances effectively.

The primary difference between a bond and a promissory note lies in their structure and purpose. A bond is typically a long-term investment security issued by corporations or governments, while a promissory note is a simpler agreement between two parties. A Sioux Falls South Dakota Installments Fixed Rate Promissory Note Secured by Personal Property is easier to create and understand, making it accessible for personal loans. Ultimately, each serves different needs in the financing landscape.

A promissory note can be either secured or unsecured. In the context of a Sioux Falls South Dakota Installments Fixed Rate Promissory Note Secured by Personal Property, it is classified as secured. This means that the borrower provides collateral, such as personal property, to guarantee repayment. If the borrower defaults, the lender can claim the collateral to recover the owed funds.

Yes, a promissory note is a legally binding document. Once signed, it obligates the borrower to adhere to the specified payment terms, particularly in agreements like the Sioux Falls South Dakota Installments Fixed Rate Promissory Note Secured by Personal Property. This legal standing helps ensure that all parties are accountable for their commitments.

The collateral for a promissory note can vary, but it often includes personal property or assets. In the case of a Sioux Falls South Dakota Installments Fixed Rate Promissory Note Secured by Personal Property, cars or real estate might be utilized as collateral. This security helps protect lenders and gives borrowers access to necessary funds.

Promissory notes offer clear benefits like simplicity and flexibility in payment terms, especially with Sioux Falls South Dakota Installments Fixed Rate Promissory Note Secured by Personal Property. However, they also come with risks, such as the possibility of default from the borrower. It's essential to weigh these factors before entering into such agreements.