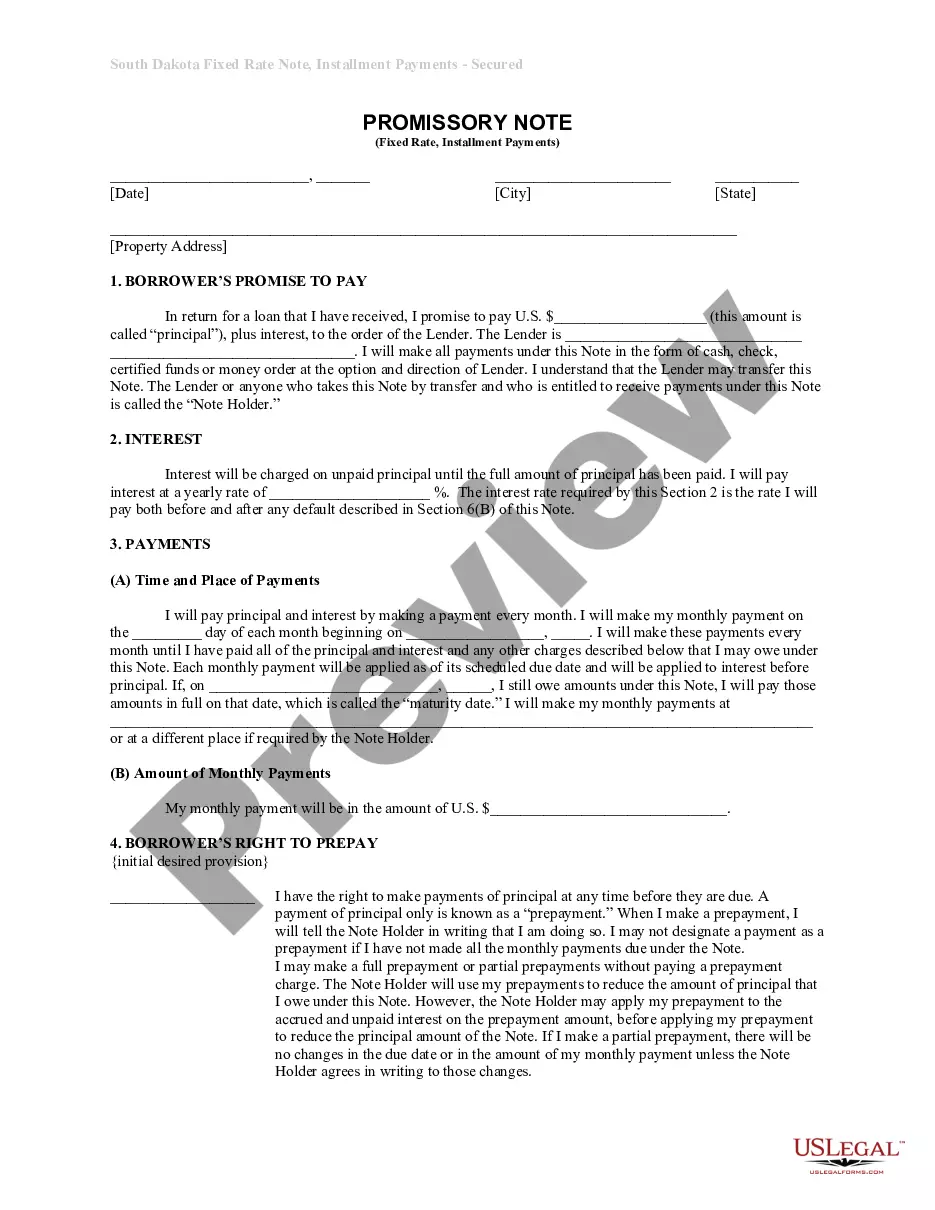

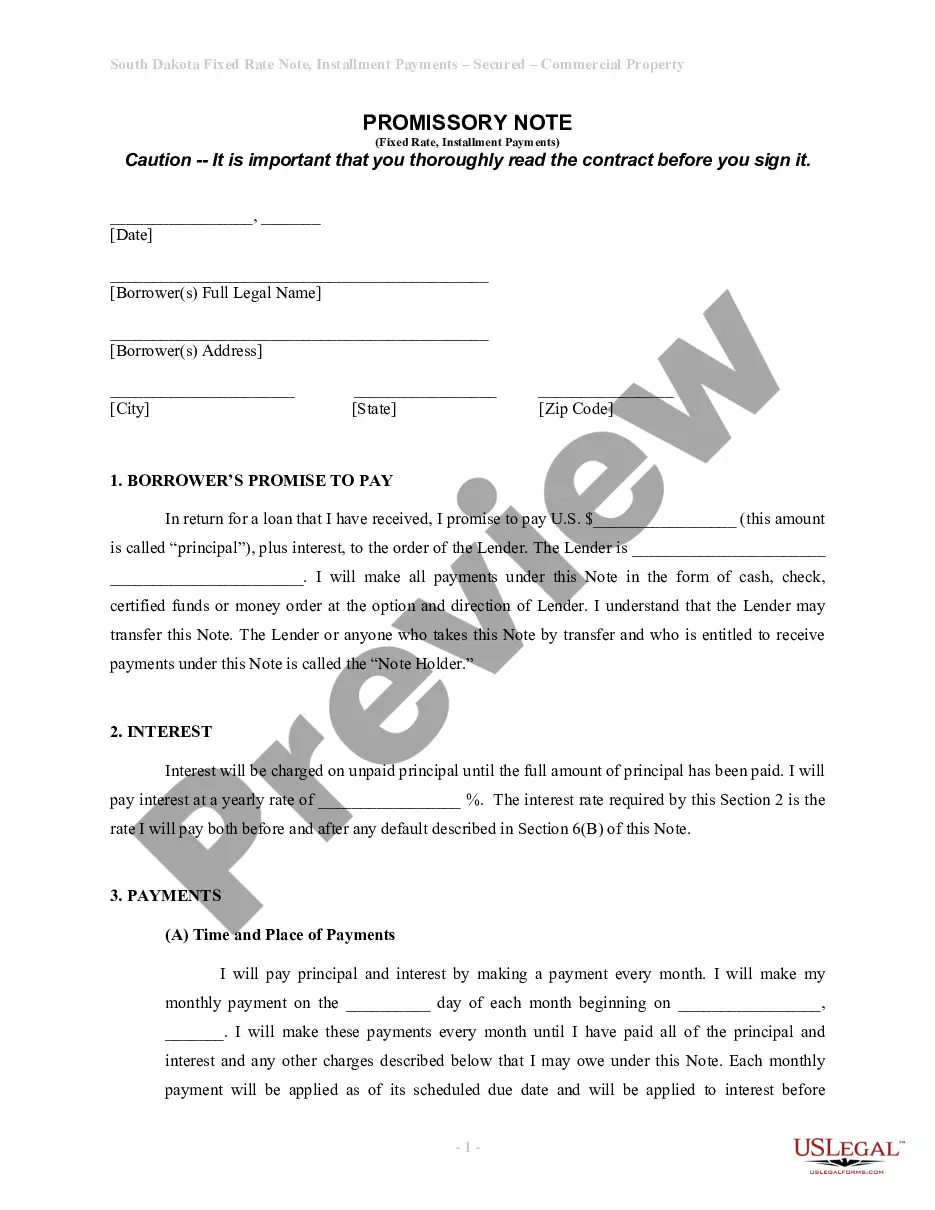

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

Sioux Falls South Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out South Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Do you require a reliable and affordable provider of legal forms to acquire the Sioux Falls South Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate? US Legal Forms is your ideal choice.

Whether you need a straightforward agreement to establish rules for living together with your partner or a collection of documents to facilitate your divorce in court, we have you covered. Our site offers more than 85,000 current legal document templates for personal and business purposes. All templates that we provide are not generic and are tailored based on the regulations of individual states and counties.

To obtain the form, you must Log In to your account, locate the required template, and click the Download button next to it. Please remember, you can download your previously acquired document templates at any moment in the My documents section.

Is it your first time visiting our site? No problem. You can create an account with great ease, but ensure to do the following beforehand.

Now you can set up your account. Then choose a subscription option and continue to payment. After the payment is completed, download the Sioux Falls South Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate in any of the provided formats. You can revisit the website at any time and redownload the form at no additional cost.

Acquiring up-to-date legal forms has never been simpler. Try US Legal Forms now, and say goodbye to spending hours learning about legal documents online.

- Verify if the Sioux Falls South Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate aligns with the regulations of your state and local jurisdiction.

- Review the description of the form (if available) to understand who and what the form is intended for.

- Initiate the search again if the template does not fit your legal needs.

Form popularity

FAQ

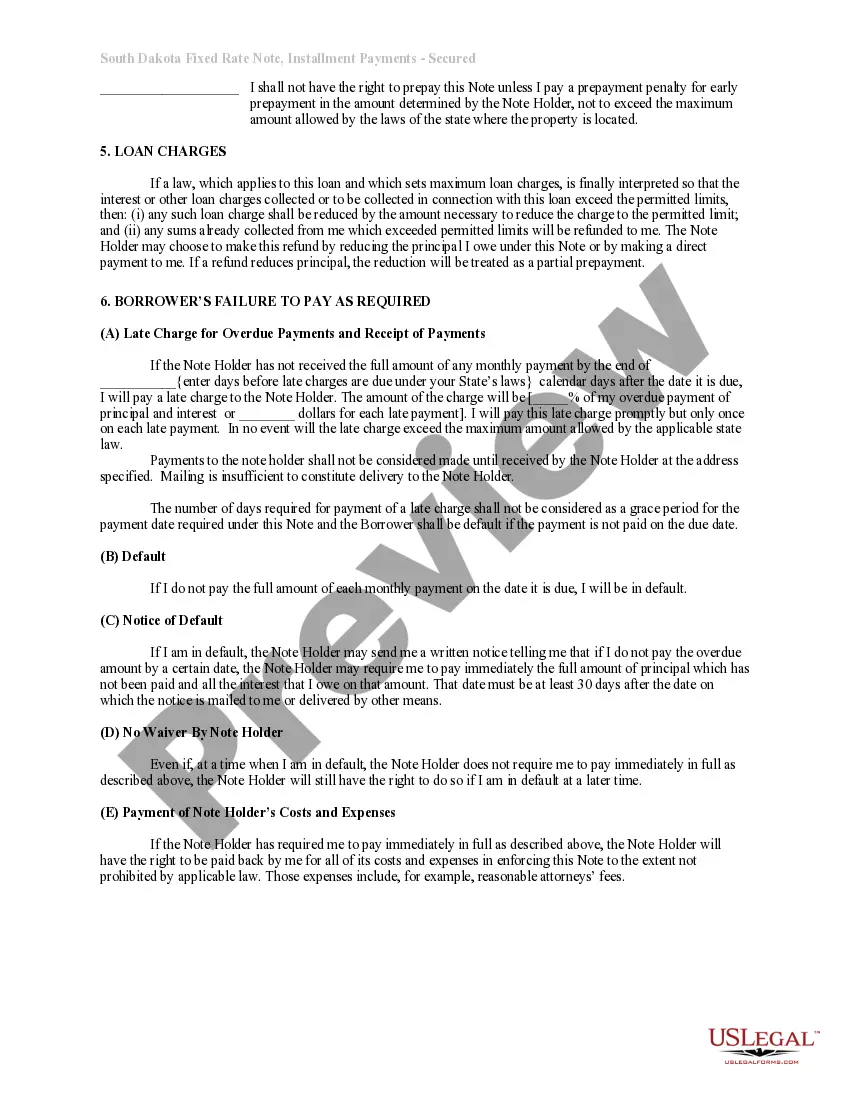

If you default on a promissory note, the lender can take action to recover the owed amount. This may include initiating legal proceedings or, in the case of a Sioux Falls South Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate, starting foreclosure on the secured property. It's vital to understand these consequences before entering into any financial agreement.

Securing a promissory note usually involves attaching collateral that the lender can claim if the borrower defaults. For instance, with a Sioux Falls South Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate, the residential property serves as the collateral, providing assurance to the lender. This provision encourages responsible borrowing and fosters trust between the parties involved.

Conditions for a promissory note typically include the principal amount, interest rate, repayment schedule, and any collateral involved. In a Sioux Falls South Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate, the property itself often acts as security, ensuring the lender's stake is protected. Clarity around these terms helps both parties understand their rights and obligations.

The person who signs the promissory note is primarily liable for the debt. This means that if the borrower fails to repay the amount specified, the lender can seek repayment from this individual. In the case of a Sioux Falls South Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate, the borrower takes on full responsibility, ensuring a clear understanding of obligations in the financial agreement.

Yes, a promissory note is often used as security for a mortgage. In the context of a Sioux Falls South Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate, the note provides the lender with a formal claim against the borrower's property. This ensures that the lender has recourse if the borrower defaults on their mortgage obligations.

To turn a promissory note into a security, you generally need to comply with specific regulatory requirements established by the Securities and Exchange Commission (SEC). This process can involve registration, disclosures, and possibly creating a security offering. Utilizing services like US Legal Forms can simplify the creation and compliance of a Sioux Falls South Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

Promissory notes can be a good investment depending on their structure and security. A Sioux Falls South Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate presents a level of stability due to its backing by property. Investors often appreciate the fixed rate of return provided by these notes, making them a viable option for diversifying an investment portfolio.

A promissory note can indeed be a form of security, as it represents a legal commitment to repay a debt. With a Sioux Falls South Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate, the note's value derives from the underlying collateral, making it an attractive option for both borrowers and lenders. This enhanced security feature generally leads to more favorable financing terms.

A promissory note is often secured by an asset, such as real estate. Specifically, a Sioux Falls South Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate is backed by the property itself, providing a level of security for the lender. This means that if the borrower defaults, the lender can claim the property to recover their investment.

Promissory notes can be classified as securities in certain contexts, particularly when they are traded or used for investment purposes. In the case of a Sioux Falls South Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate, the note may be treated as a security under applicable laws. Understanding the security classification is crucial for both borrowers and investors to ensure proper compliance.