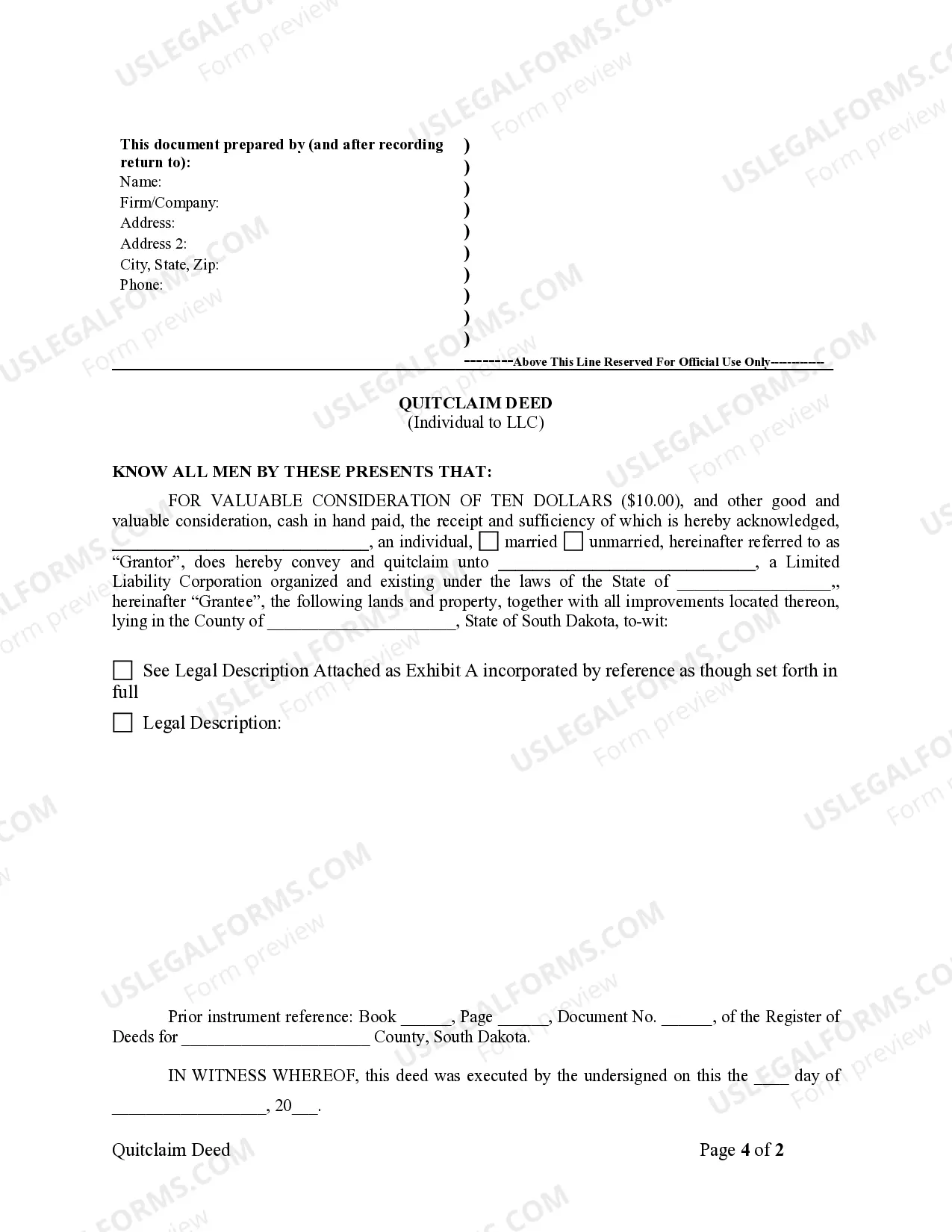

This form is a Quitclaim Deed where the grantor is an unmarried individual and the grantee is a limited liability company. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

Sioux Falls South Dakota Quitclaim Deed from Individual to LLC

Description

How to fill out South Dakota Quitclaim Deed From Individual To LLC?

If you have previously employed our service, Log In to your account and retrieve the Sioux Falls South Dakota Quitclaim Deed from Individual to LLC on your device by clicking the Download button. Ensure that your subscription is active. If it isn’t, renew it based on your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You have lifelong access to every document you have purchased: you can find it in your profile under the My documents menu whenever you need to access it again. Utilize the US Legal Forms service to effortlessly discover and store any template for your personal or professional requirements!

- Ensure you’ve located a suitable document. Browse through the description and utilize the Preview option, if available, to determine if it fulfills your requirements. If it does not suit you, use the Search tab above to find the right one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and make a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Obtain your Sioux Falls South Dakota Quitclaim Deed from Individual to LLC. Select the file format for your document and save it to your device.

- Complete your sample. Print it or leverage professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

A quitclaim deed mainly benefits individuals looking to transfer property quickly and without complications. This deed is particularly advantageous when transferring property among family members or into an LLC for asset protection. It allows for uncomplicated exchanges, as it does not guarantee ownership beyond what the grantor currently holds. If you are contemplating a Sioux Falls South Dakota Quitclaim Deed from Individual to LLC, you can optimize benefits through this straightforward approach.

A contract for deed in South Dakota is a financing arrangement where the seller retains title to the property while the buyer makes payments. Once the buyer pays the agreed amount, they receive the title. This method can simplify purchasing property without immediate bank financing. Consider how this intersects with your plans involving a Sioux Falls South Dakota Quitclaim Deed from Individual to LLC to achieve your property goals.

To find out who owns property in South Dakota, you can search public records through the county register of deeds office. These offices maintain records of property ownership, including deeds and transfers. Online tools may also be available depending on the county. For effective results, consider using resources like USLegalForms to assist with your exploration of property ownership, particularly when dealing with a Sioux Falls South Dakota Quitclaim Deed from Individual to LLC.

Yes, South Dakota does allow a transfer on death deed. This deed enables property owners to transfer real estate to beneficiaries upon their death without going through probate. It can be a simple option for those wishing to streamline the inheritance process. If you're considering a Sioux Falls South Dakota Quitclaim Deed from Individual to LLC, understanding available options is essential.

Several examples of items that exempt from South Dakota sales tax are prescription medications, farm machinery, advertising services, replacement parts, and livestock. These categories may have some further qualifications before the special rate applies, such as a price cap on clothing items.

Who Pays Transfer Taxes: Buyer or Seller? Depending on the location of the property, the transfer tax can be paid either by the buyer or seller. The two parties must determine which side will cover the cost of the transfer tax as part of the negotiation around the sale.

A contract for deed is a contract where the seller remains the legal owner of the property and the buyer makes monthly payments to the seller to buy the house. The seller remains the legal owner of the property until the contract is paid.

If you don't have a will or a Transfer on Death Deed, your real estate must go through the probate court and your property will pass to your heirs according to Texas law. Probate can be lengthy and expensive, with attorney fees and court costs paid from your estate.

Transfer Tax (Local Treasurer's Office): this tax is for the barter, sale, or any other method of ownership or title of real property transfer, at the maximum rate of 50% of 1%, or 75% of 1% in cities and municipalities within Metro Manila, of a property's worth.

A South Dakota transfer-on-death deed?often called a TOD deed?is a written legal document that transfers property to one or more beneficiaries named in the document on the death of the owner. South Dakota TOD deeds were first authorized by the South Dakota Real Property Transfer on Death Act in 2014.