This form is a Quitclaim Deed where the grantor is a corporation and the grantee is a limited liability company. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

Sioux Falls South Dakota Quitclaim Deed from Corporation to LLC

Description

How to fill out South Dakota Quitclaim Deed From Corporation To LLC?

If you have previously used our service, Log In to your account and retrieve the Sioux Falls South Dakota Quitclaim Deed from Corporation to LLC on your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your billing plan.

If this is your first time using our service, follow these straightforward steps to obtain your file.

You maintain ongoing access to all documents you have purchased: you can find them in your profile under the My documents menu whenever you need to reuse them. Utilize the US Legal Forms service to easily locate and store any template for your personal or professional requirements!

- Make sure you've found a suitable document. Browse the details and utilize the Preview option, if it exists, to verify if it satisfies your needs. If it doesn’t suit you, use the Search tab above to find the right one.

- Purchase the document. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and complete the payment. Use your credit card information or the PayPal method to finalize the purchase.

- Access your Sioux Falls South Dakota Quitclaim Deed from Corporation to LLC. Choose the file format for your document and save it on your device.

- Complete your form. Print it out or use online professional editors to fill it in and sign it digitally.

Form popularity

FAQ

Transfer Tax (Local Treasurer's Office): this tax is for the barter, sale, or any other method of ownership or title of real property transfer, at the maximum rate of 50% of 1%, or 75% of 1% in cities and municipalities within Metro Manila, of a property's worth.

A contract for deed is a contract where the seller remains the legal owner of the property and the buyer makes monthly payments to the seller to buy the house. The seller remains the legal owner of the property until the contract is paid.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

Who Pays Transfer Taxes: Buyer or Seller? Depending on the location of the property, the transfer tax can be paid either by the buyer or seller. The two parties must determine which side will cover the cost of the transfer tax as part of the negotiation around the sale.

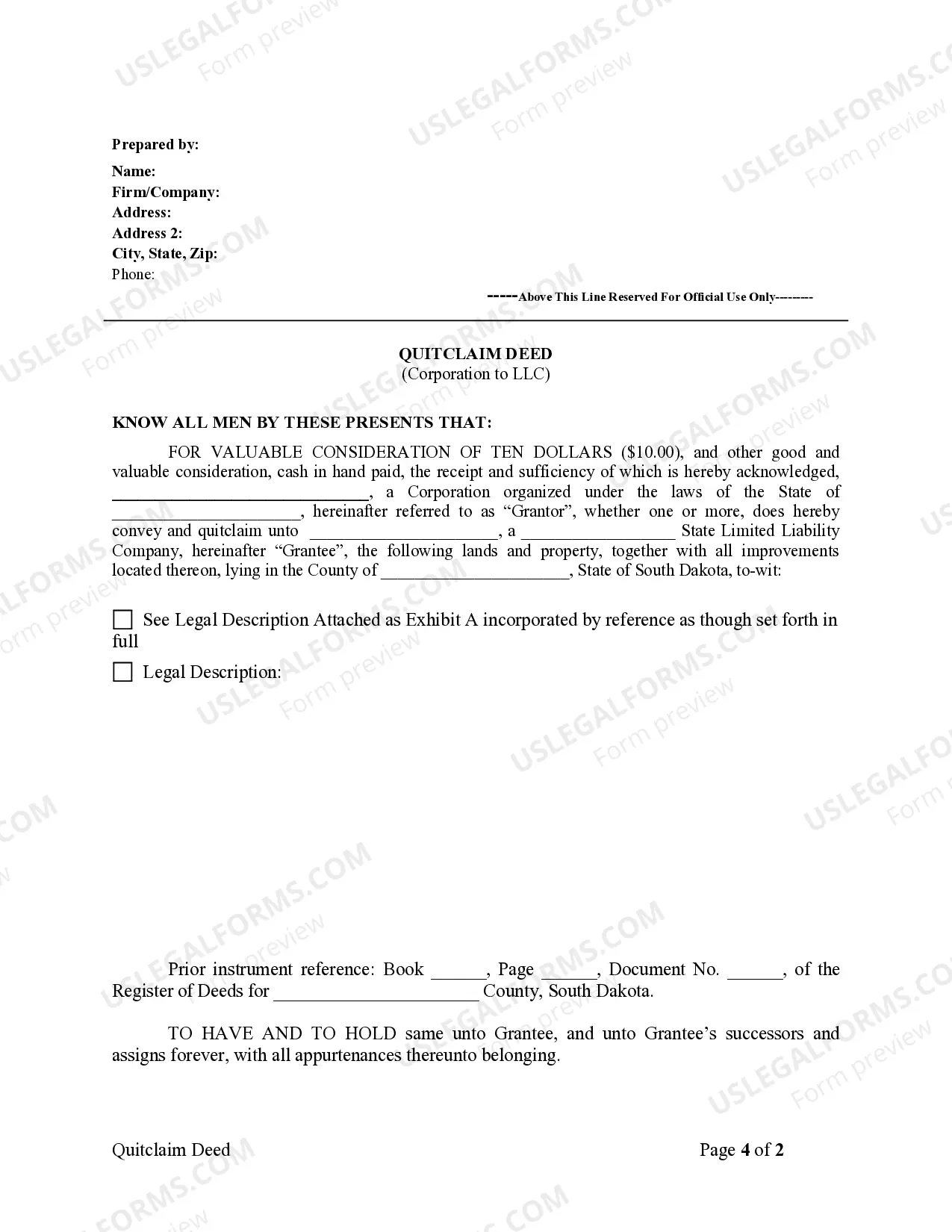

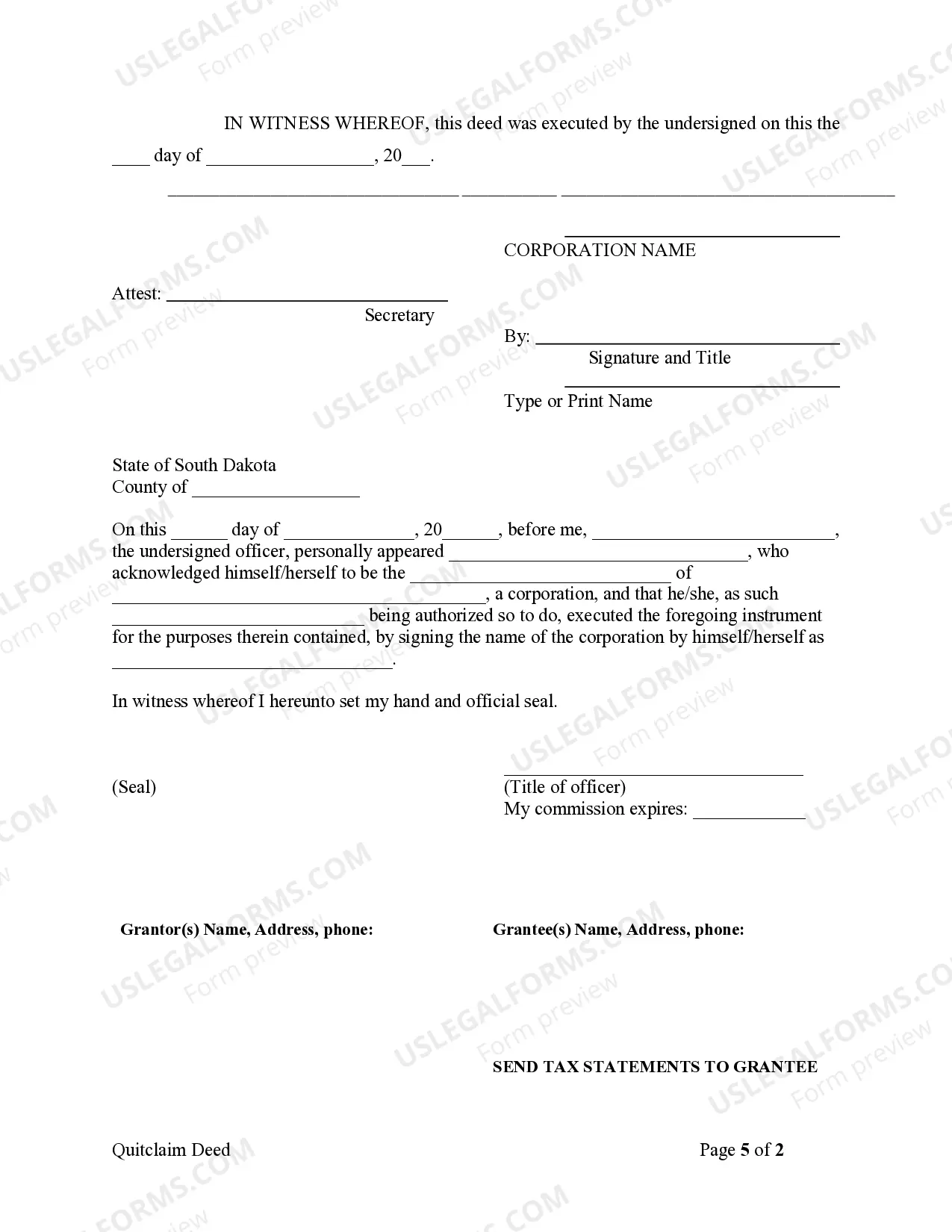

South Dakota Quitclaim Deed Laws Signing - According to state law, all quitclaim deeds are to be signed in front of a Notary Public or a witness that will be signing the deed (§ 43-25-26). Recording - Quitclaim deeds, along with their filing fees, are to be filed with the County Recorder's Office.

Pros and Cons of a Contract for Deed Pro 1: Flexibility. Typically, when homebuyers set out to purchase a new home, there are several rules that must be followed.Pro 2: Less Time Waiting.Con 1: In Case of Default.Con 2: Higher Interest Rates.

The sale, lease, or rental of tangible personal property or products transferred electronically is subject to sales tax.

The contract for deed shall state that the political subdivision agrees to convey all of the right, title, and interest of the political subdivision in and to such real property so sold and every part thereof upon the full performance thereof by the purchaser.

A South Dakota transfer-on-death deed?often called a TOD deed?is a written legal document that transfers property to one or more beneficiaries named in the document on the death of the owner. South Dakota TOD deeds were first authorized by the South Dakota Real Property Transfer on Death Act in 2014.

Imposition and amount of real estate transfer fee. A fee is hereby imposed at the rate of fifty cents for each five hundred dollars of value or fraction thereof upon the privilege of transferring title to real property in the State of South Dakota, which fee shall be paid by the grantor.