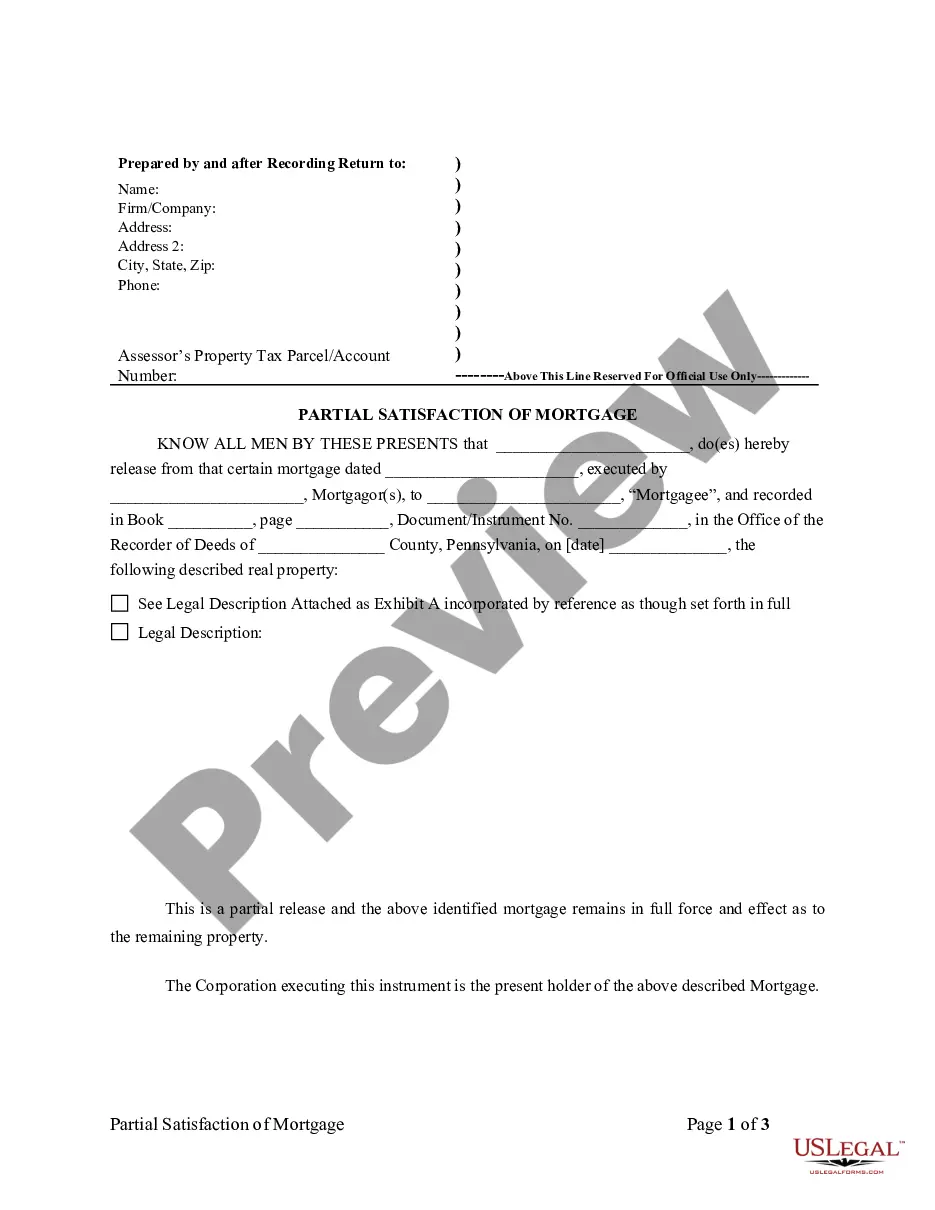

Philadelphia Pennsylvania Partial Release of Property From Mortgage for Corporation

Description

How to fill out Pennsylvania Partial Release Of Property From Mortgage For Corporation?

Utilize the US Legal Forms and gain immediate access to any document you require.

Our user-friendly platform with a vast collection of document templates simplifies the process of locating and obtaining nearly any document sample you may need.

You can save, complete, and validate the Philadelphia Pennsylvania Partial Release of Property From Mortgage for Corporation in just a few minutes instead of spending hours online searching for the proper template.

Using our catalog is an excellent method to enhance the security of your record filing. Our knowledgeable attorneys consistently review all documents to ensure that the forms are suitable for a specific state and comply with new regulations and laws.

US Legal Forms is one of the largest and most reliable template libraries available online.

Our company is always here to assist you with any legal procedure, even if it's just downloading the Philadelphia Pennsylvania Partial Release of Property From Mortgage for Corporation. Enjoy our form catalog and make your document experience as easy as possible!

- Obtain the Philadelphia Pennsylvania Partial Release of Property From Mortgage for Corporation.

- If you possess a profile, simply Log In to your account. The Download option will be available on all the templates you view.

- Additionally, you can access all your previously saved documents in the My documents section.

- If you do not have an account yet, follow the steps below.

- Locate the form you need. Ensure that it is the correct document: verify its name and description, and use the Preview feature when available. Alternatively, use the Search bar to find the right one.

- Initiate the saving process. Choose Buy Now and select your preferred pricing plan. Then, create an account and pay for your purchase using a credit card or PayPal.

- Download the document. Specify the format to receive the Philadelphia Pennsylvania Partial Release of Property From Mortgage for Corporation and edit and complete, or sign it to meet your requirements.

Form popularity

FAQ

A partial release deed is a legal document that removes a specific property from a mortgage agreement while leaving the remaining properties and debts intact. This deed acts as proof that a portion of the mortgage obligation has been fulfilled for the designated property. In the context of a Philadelphia Pennsylvania Partial Release of Property From Mortgage for Corporation, this document can facilitate corporate flexibility in asset management. To ensure proper completion, consider using services like US Legal Forms for reliable templates.

To obtain a partial release of a mortgage, start by contacting your mortgage lender to discuss your intentions. You will likely need to provide documentation to support your request, such as evidence of property value and your remaining mortgage balance. A Philadelphia Pennsylvania Partial Release of Property From Mortgage for Corporation involves negotiating terms with the lender, which can help your organization better manage its real estate holdings. Utilizing platforms like US Legal Forms simplifies the process with templates and guidance.

A partial release is often included in real estate transactions where only a portion of the collateral is being released from a mortgage. This can occur when selling part of a property or refinancing. Understanding when to include a partial release is vital for corporations, especially regarding a Philadelphia Pennsylvania Partial Release of Property From Mortgage for Corporation.

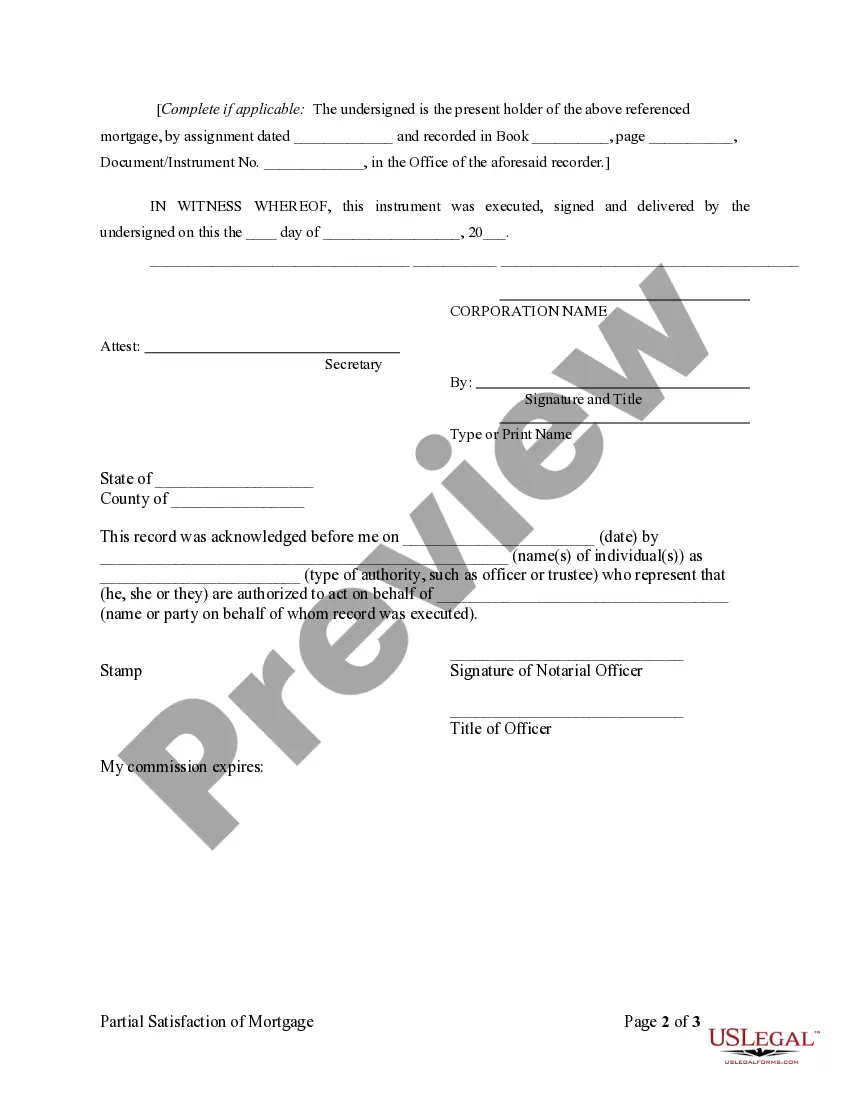

Filing a quitclaim deed in Pennsylvania requires you to gather the necessary information, including the property description and the names of the parties involved. After preparing the deed, you must have it notarized. Finally, file the deed with the county recorder of deeds to officially document the transfer, an important step in matters relating to a Philadelphia Pennsylvania Partial Release of Property From Mortgage for Corporation.

Yes, you can prepare a quitclaim deed yourself, but careful attention to detail is essential. You’ll need to ensure that the deed includes all required information and is executed properly. For transactions involving significant property interests, such as a Philadelphia Pennsylvania Partial Release of Property From Mortgage for Corporation, using a platform like USLegalForms can help simplify the process and ensure compliance.

To obtain a partial release of a mortgage, you should first contact your lender and request the release. They may require specific documentation demonstrating the need for the partial release, such as evidence showing the property is no longer part of a mortgage obligation. Understanding the terms is crucial, especially in cases concerning a Philadelphia Pennsylvania Partial Release of Property From Mortgage for Corporation.

To record a release of your mortgage, you need to obtain a satisfaction or release document from your lender. Once you have this document, take it to your local recording office along with any required fees. Recording the release ensures that the mortgage lien is removed from your property title, which is especially important for a Philadelphia Pennsylvania Partial Release of Property From Mortgage for Corporation.

Filing a quitclaim deed in Pennsylvania involves several steps. First, obtain the deed form and fill it out with accurate details. Next, have the document notarized before recording it with your county's office. This process helps ensure that any property transfers, including the Philadelphia Pennsylvania Partial Release of Property From Mortgage for Corporation, are legally recognized.

Obtaining a partial release of a mortgage can vary in difficulty based on the lender's policies and the specific circumstances of the property involved. Typically, if the corporation is in good standing with the lender and has a solid payment history, the process may be relatively straightforward. However, working with a specialized service like USLegalForms can simplify the process by providing accurate documentation and support tailored to your needs.

To initiate a partial release of a mortgage, the corporation must provide various documents, including proof of payment, a request form, and any necessary approvals from the lender. The lender may require an appraisal or other documentation to assess the value of the property being released. Utilizing platforms like USLegalForms can streamline this process, ensuring you have all needed forms and guidelines ready to achieve the Philadelphia Pennsylvania Partial Release of Property From Mortgage for Corporation.