Allentown Pennsylvania Chapter 13 Plan

Description

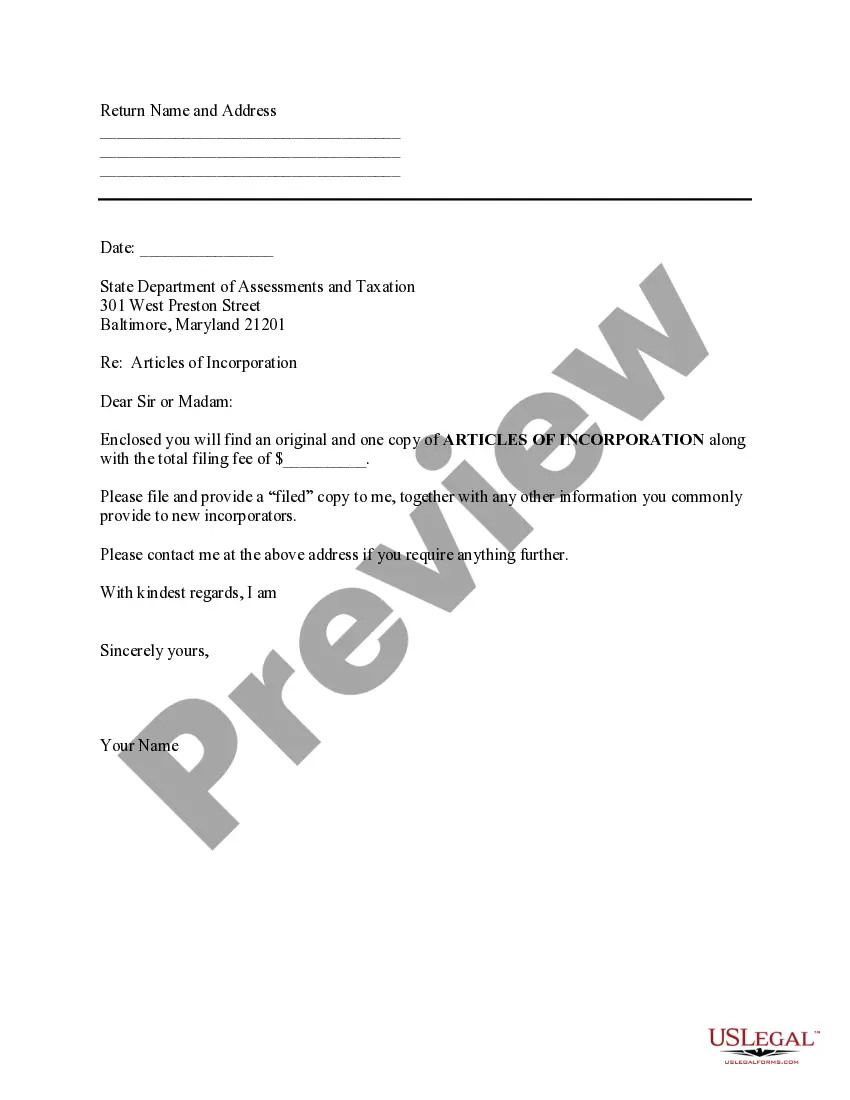

How to fill out Pennsylvania Chapter 13 Plan?

Are you searching for a reliable and cost-effective provider of legal documents to purchase the Allentown Pennsylvania Chapter 13 Plan? US Legal Forms is your ideal option.

Whether you need a basic agreement to establish rules for living together with your partner or a collection of forms to facilitate your separation or divorce through the legal system, we have you covered.

Our platform features over 85,000 current legal document templates for both personal and business needs. All templates we offer are tailored and structured according to the specific laws of different states and regions.

To obtain the document, you must Log In, locate the desired form, and click the Download button adjacent to it. Please remember that you can retrieve your previously acquired form templates at any time from the My documents section.

Now, you can create your account. After that, choose your subscription plan and continue to payment. Once the payment is completed, download the Allentown Pennsylvania Chapter 13 Plan in any available format.

You can revisit the site anytime and download the document again at no additional charge. Finding current legal forms has never been simpler. Try US Legal Forms today, and stop wasting your precious time sifting through legal paperwork online once and for all.

- Is this your first visit to our site? Don’t worry.

- You can easily create an account, but first, ensure that you do the following.

- Verify that the Allentown Pennsylvania Chapter 13 Plan aligns with the regulations of your state and local jurisdiction.

- Review the form’s description (if available) to understand who and what the document is meant for.

- If the form doesn't fit your legal needs, restart your search.

Form popularity

FAQ

There is no specific minimum amount of debt required to file for an Allentown Pennsylvania Chapter 13 Plan; however, you must have a regular income to propose a repayment plan. The court typically expects you to have a reasonable amount of debt to justify filing. It’s wise to consult with a professional to determine the best option for your financial situation. Uslegalforms can provide the necessary resources and support to help you assess your debts.

While it is possible to file for an Allentown Pennsylvania Chapter 13 Plan on your own, it is generally advisable to seek help. Filing alone can lead to mistakes that may delay your case or result in a denial. A knowledgeable attorney or a resource like uslegalforms can provide you with guidance to navigate the complexities of the filing process effectively. This support can make a significant difference in your outcome.

To begin filing for an Allentown Pennsylvania Chapter 13 Plan, you first need to gather your financial documents. This includes information about your debts, income, and assets. Next, you should complete the required credit counseling course before filing the petition with the court. Seeking assistance from professionals, like those from uslegalforms, can simplify this process.

Yes, an Allentown Pennsylvania Chapter 13 Plan can be denied for various reasons. Common reasons include failing to propose a feasible plan, not meeting income requirements, or not completing credit counseling on time. Additionally, if creditors file objections, the court may deny the plan. Ensuring that you meet all requirements can greatly improve your chances of approval.

Ineligibility for an Allentown Pennsylvania Chapter 13 Plan can stem from having secured debts above the allowable limit or not completing mandatory credit counseling. If you have previously filed for bankruptcy and certain conditions apply, this may also hinder your eligibility. To navigate these complex rules, consider using uslegalforms as a helpful resource to clarify your status.

Yes, it is possible not to qualify for an Allentown Pennsylvania Chapter 13 Plan if you exceed the debt limits or fail to meet the necessary requirements, such as having a steady income. Additionally, if you filed for Chapter 13 bankruptcy in the last two years, this can impact your eligibility. It's wise to consult with a knowledgeable service, like uslegalforms, to understand your specific qualifications.

Several factors can disqualify individuals from an Allentown Pennsylvania Chapter 13 Plan, including having unsecured debts that exceed the legal limit or having filed for Chapter 13 in the past few years. Additionally, failing to complete credit counseling before filing can also result in disqualification. Knowing these criteria in advance is essential, and resources from uslegalforms can guide you through the eligibility requirements.

Filling out an Allentown Pennsylvania Chapter 13 Plan involves gathering necessary financial information, including your income, expenses, and debts. You will need to complete a bankruptcy petition and schedules, which outline your financial situation. It is advisable to seek assistance from a legal professional or a reliable platform like uslegalforms, which can simplify the process and ensure that you submit your documents correctly.

In Allentown, Pennsylvania, you can file a Chapter 13 plan if your secured and unsecured debts do not exceed certain limits. As of now, the combined debt cap for individuals is around $2.7 million. This cap ensures you have manageable debts while allowing you to create a repayment plan. Consulting a legal platform like uslegalforms can provide guidance on your specific circumstances.

The average payment for an Allentown Pennsylvania Chapter 13 Plan varies based on your income and total debt. Generally, payments range from a few hundred to over a thousand dollars monthly. Your payment plan will be structured based on your disposable income after necessary expenses. To find a more tailored estimate, consider using uslegalforms to access tools that help calculate your potential payment.