This form is a Quitclaim Deed where the Grantor is a Trust and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Pittsburgh Pennsylvania Quitclaim Deed from a Trust to a Trust

Description

How to fill out Pennsylvania Quitclaim Deed From A Trust To A Trust?

We consistently aim to reduce or evade legal repercussions when handling intricate legal or financial matters.

To achieve this, we seek legal alternatives that are typically quite costly.

Nevertheless, not all legal issues are of equal complexity.

Many can be managed by ourselves.

Take advantage of US Legal Forms whenever you need to locate and retrieve the Pittsburgh Pennsylvania Quitclaim Deed from a Trust to a Trust or any other form securely and effortlessly.

- US Legal Forms is an online repository of current DIY legal templates covering everything from wills and powers of attorney to articles of incorporation and divorce petitions.

- Our repository empowers you to manage your matters independently without needing to consult an attorney.

- We offer access to legal document templates that are not always readily available.

- Our templates are specific to states and regions, which greatly simplifies the search process.

Form popularity

FAQ

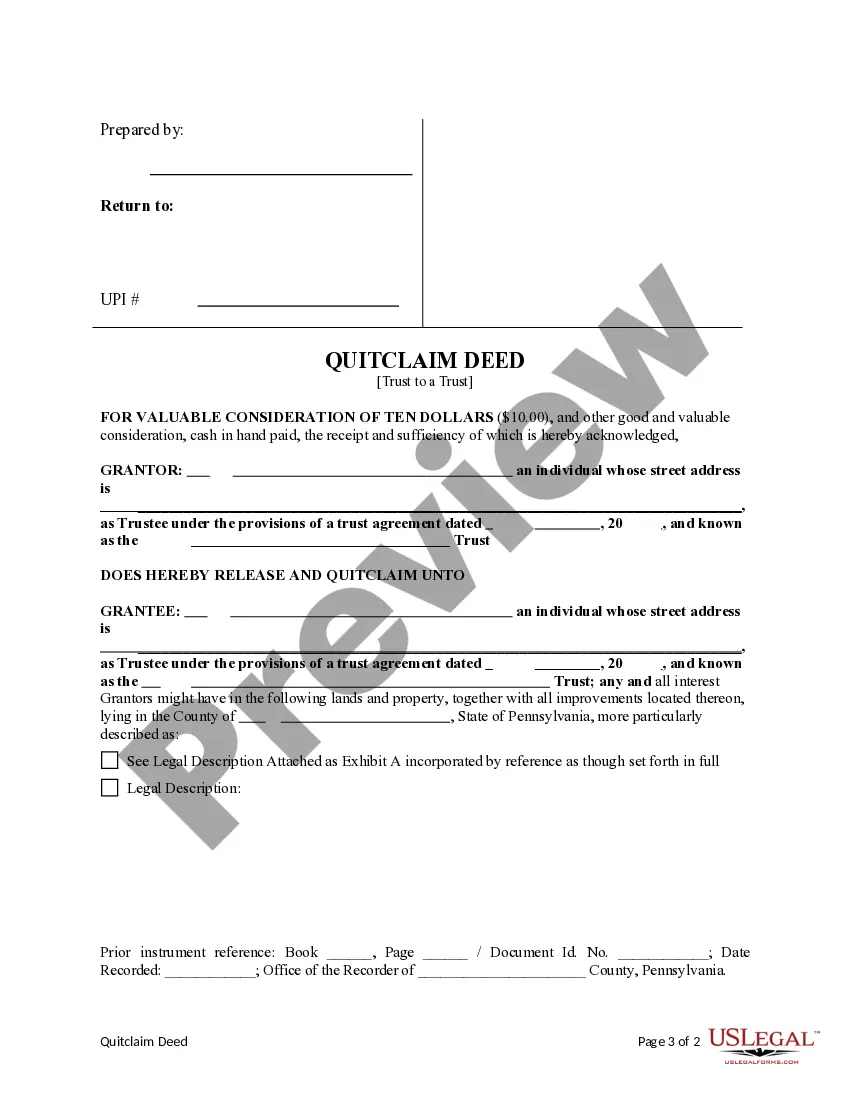

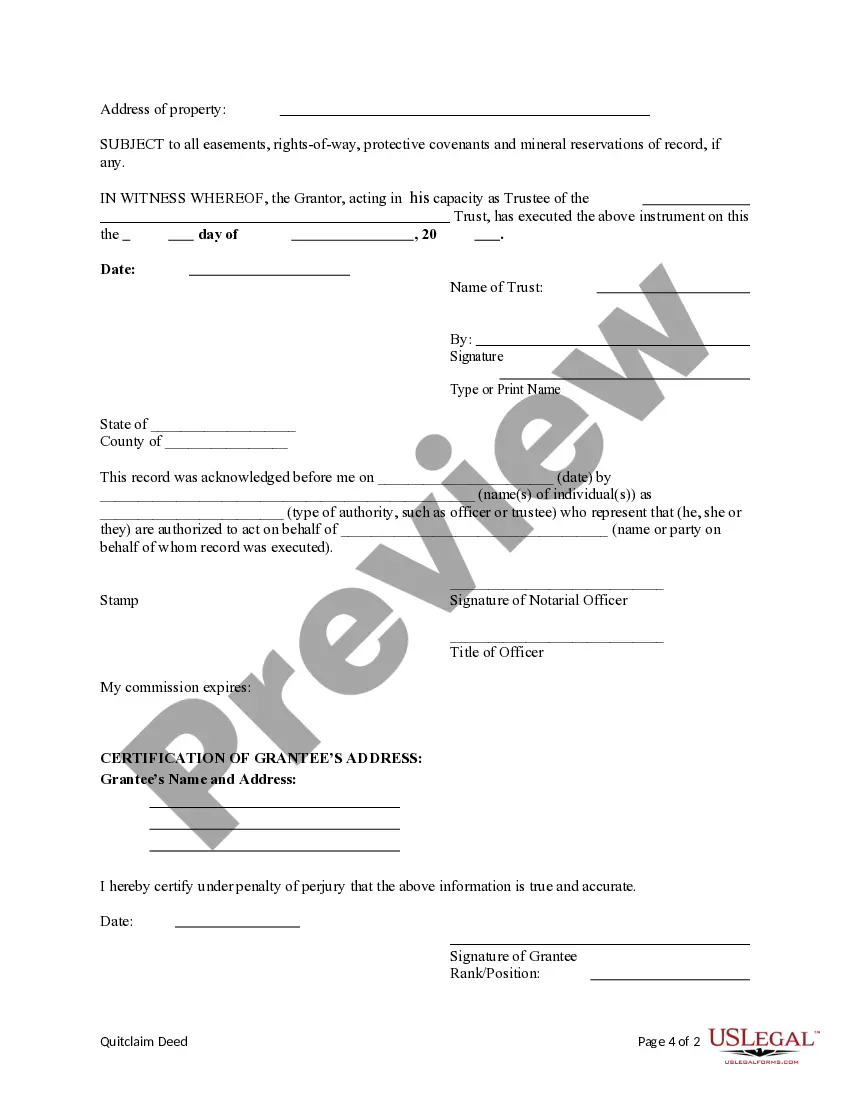

In Pennsylvania, a quitclaim deed must include the names of both the grantor and grantee, the property description, and it must be signed in front of a notary. Additionally, the deed should comply with state regulations regarding any fees and recording requirements. To make this process smoother, USLegalForms offers resources tailored to help you create a valid Pittsburgh Pennsylvania quitclaim deed from a trust to a trust.

Certainly, you can execute a quitclaim deed on your own if you are comfortable with the legal process. It requires you to gather details about the property and adhere to specific formatting rules set by Pennsylvania law. However, for accurate documentation and compliance, consider leveraging USLegalForms, which helps you navigate the creation of a Pittsburgh Pennsylvania quitclaim deed from a trust to a trust effectively.

Yes, you can complete a quitclaim deed by yourself, provided you understand the necessary steps. It involves drafting the deed, ensuring it meets Pennsylvania’s legal requirements, and filing it correctly. However, if you want peace of mind and accuracy, using a platform like USLegalForms can guide you through the process of creating a Pittsburgh Pennsylvania quitclaim deed from a trust to a trust effortlessly.

To file a quitclaim deed in Pennsylvania, you need to prepare the deed document including details such as the grantor, grantee, and property description. After you complete the document, have it signed before a notary. Once notarized, you must submit the quitclaim deed to the local county recorder of deeds for recording. Utilizing a service like USLegalForms can simplify this process and ensure that your Pittsburgh Pennsylvania quitclaim deed from a trust to a trust is filed correctly.

A trust can provide ongoing asset management and protection that a simple gift cannot. With a quitclaim deed from a trust to a trust, you ensure that your property is handled according to your specific instructions. Trusts can help avoid probate, maintain privacy, and protect assets from creditors, making them a strategically advantageous choice for estate planning over gifting.

While trusts offer numerous advantages, they also come with some drawbacks. Establishing a trust often requires legal assistance, which can incur additional costs. Additionally, there are ongoing administrative responsibilities to manage the trust properly. You might consider leveraging uslegalforms to create the necessary documents for a quitclaim deed in Pittsburgh, Pennsylvania, streamlining the process for you.

Gifting a house provides an immediate transfer of property, while putting it in a trust retains control for you until your death. With a quitclaim deed from a trust to a trust, you can ensure that the property is managed according to your wishes during your lifetime and after. Evaluating these options can clarify which route aligns best with your estate planning goals.

A quitclaim deed allows property ownership to be transferred quickly, while a trust offers long-term control over your assets. If you are considering transferring property in Pittsburgh, Pennsylvania, a quitclaim deed from a trust to a trust might simplify the process. However, trusts can provide additional benefits, such as privacy and probate avoidance, making them a better option for comprehensive estate planning.

Deciding whether to gift your house or put it in a trust depends on your unique situation. A quitclaim deed can facilitate the transfer of property in Pittsburgh, Pennsylvania, though a trust provides more control and protection. By placing your house in a trust, you can manage it during your lifetime and designate beneficiaries for when you pass on. Ultimately, consulting a legal expert can help you make the best choice for your circumstances.

Yes, you can place a house in a trust in Pennsylvania. Doing so can help with estate planning, asset protection, and avoiding probate. When considering a Pittsburgh Pennsylvania Quitclaim Deed from a Trust to a Trust, it is important to work with experts who can guide you through the necessary steps.