Allegheny Pennsylvania Heirship Affidavit - Descent

Description

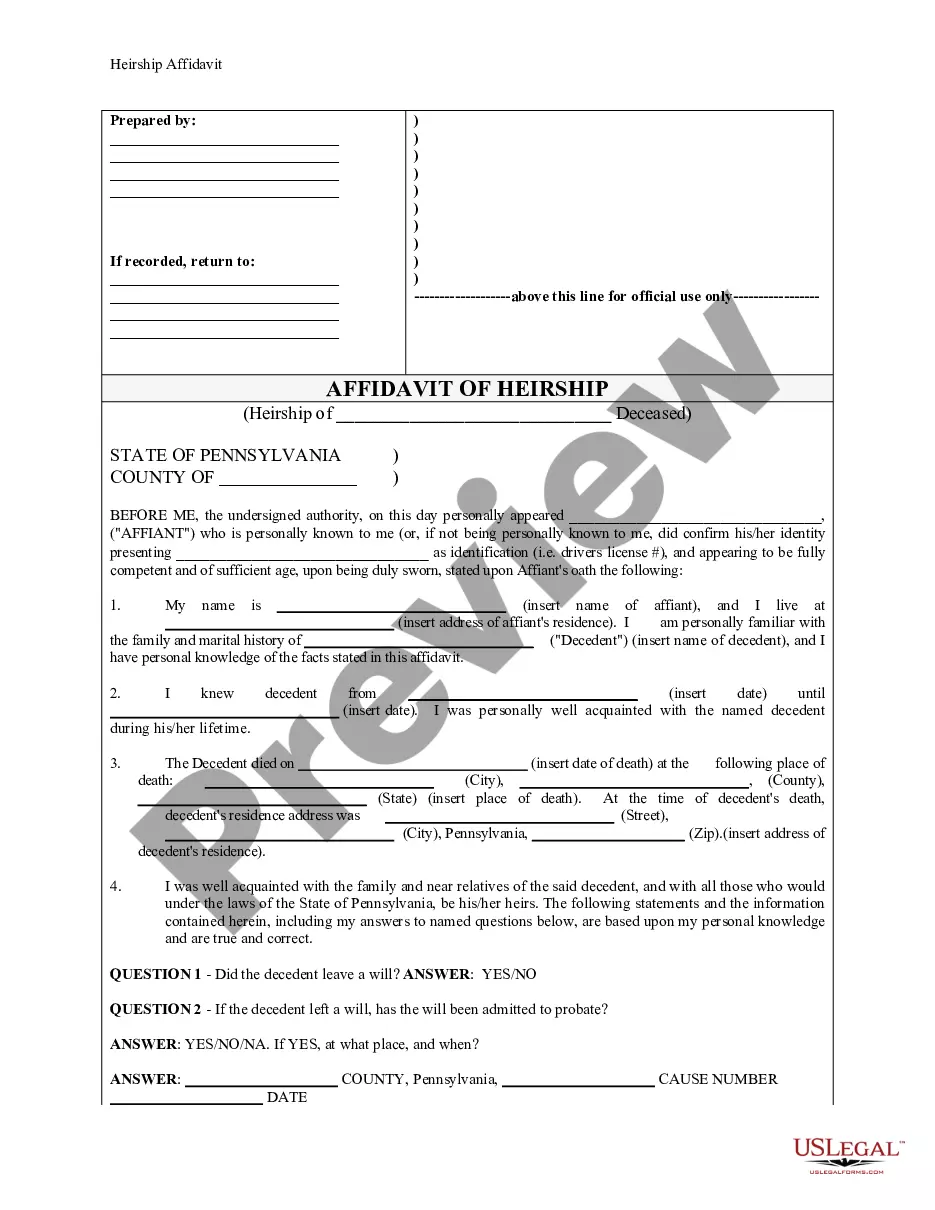

How to fill out Pennsylvania Heirship Affidavit - Descent?

We consistently endeavor to minimize or avert legal complications when managing intricate legal or financial situations.

To achieve this, we enroll in legal services that, generally, are quite expensive.

However, not every legal issue is as complicated.

Many of them can be addressed by ourselves.

Take advantage of US Legal Forms whenever you require to locate and download the Allegheny Pennsylvania Heirship Affidavit - Descent or any other form quickly and securely. Simply Log In to your account and click the Get button next to it. If you misplace the form, you can always re-download it from the My documents tab. The process is equally straightforward if you’re new to the platform! You can establish your account in just a few minutes. Ensure to verify if the Allegheny Pennsylvania Heirship Affidavit - Descent adheres to the laws and regulations of your state and region. Additionally, it’s essential that you review the form’s outline (if provided), and if you notice any inconsistencies with what you initially sought, look for a different form. After confirming that the Allegheny Pennsylvania Heirship Affidavit - Descent is appropriate for your situation, you can select a subscription plan and process a payment. Then, you can download the form in any desired format. For over 24 years in the market, we’ve assisted millions of individuals by providing ready-to-customize and current legal documents. Maximize the benefits of US Legal Forms today to conserve time and resources!

- US Legal Forms is an online repository of current DIY legal documents covering a range of topics from wills and power of attorney to incorporation articles and dissolution petitions.

- Our platform empowers you to handle your affairs independently without needing legal counsel.

- We provide access to legal form templates that are not always readily available.

- Our templates are specific to states and regions, which significantly simplifies the search process.

Form popularity

FAQ

To fill out a renunciation form in Pennsylvania, start by gathering necessary details about the estate and the beneficiaries. Clearly indicate the relationship to the deceased and your intent to renounce rights to the inheritance. Our platform provides templates and guidance for completing your Allegheny Pennsylvania Heirship Affidavit - Descent and any renunciation forms accurately.

In Pennsylvania, a family exemption allows for a deduction of up to $3,500 from the taxable estate. This deduction specifically applies to the transfer of property to a spouse or children residing in the state. Understanding this deduced amount can help when preparing your Allegheny Pennsylvania Heirship Affidavit - Descent.

The inheritance tax in Allegheny County, PA follows the same state guidelines, with rates varying based on the heir's relationship to the deceased. For instance, children and spouses are taxed at 4.5%, while siblings are taxed at 12%. Knowing these rates helps you effectively prepare your Allegheny Pennsylvania Heirship Affidavit - Descent and address potential tax implications.

Filling out a proof of heirship affidavit involves collecting all relevant documents proving your relationship to the deceased. You will need to clearly state the names, addresses, and details of heirs, ensuring accuracy. Utilizing the resources available on our platform can simplify the process of completing your Allegheny Pennsylvania Heirship Affidavit - Descent.

To avoid inheritance tax in Pennsylvania, consider using certain exemptions and deductions. Establishing trusts or gifting assets while alive can help mitigate tax liability. Additionally, creating an Allegheny Pennsylvania Heirship Affidavit - Descent can clarify ownership and simplify the transfer process, which may help reduce taxable amounts.

In Pennsylvania, the order of inheritance without a will generally follows a specific hierarchy. First, the estate goes to the surviving spouse, then to children, and if there are no children, to parents, siblings, and so on, as outlined in the laws of intestacy. Understanding this process can be essential if you've filed an Allegheny Pennsylvania Heirship Affidavit - Descent, as it can influence the distribution of the estate. Familiarizing yourself with these laws can help ensure that heirs receive fair treatment.

To create an affidavit of heirship, you generally need the deceased's death certificate and personal identifying information about the deceased. You must also provide details of the heirs, including their relationships to the deceased. Utilizing the Allegheny Pennsylvania Heirship Affidavit - Descent service can help you ensure that all necessary information is accurately recorded and legally acceptable. This can streamline your paperwork and ease the process.

To file a claim against an estate in Pennsylvania, first, identify the estate's personal representative. Then prepare the claim in writing and file it with the Register of Wills or Orphans' Court in the county where the estate is probated. If you have an Allegheny Pennsylvania Heirship Affidavit - Descent, it may simplify your position. Always keep copies of your claim and any correspondence for your records.

A short certificate in Allegheny County is an official document that certifies the appointment of an executor or administrator of an estate. This certificate verifies that the appointed individual has the legal authority to manage the deceased's assets, as outlined in the Allegheny Pennsylvania Heirship Affidavit - Descent. You will often need this certificate to access bank accounts or property owned by the deceased. It's a crucial step in settling the estate.

Yes, you can sell a house with an Allegheny Pennsylvania Heirship Affidavit - Descent. This document establishes your legal right to sell the property by confirming your relationship to the deceased. Often, the affidavit makes the process smoother, as it provides clarity on ownership, which potential buyers appreciate. Just ensure any necessary documents are in place before finalizing the sale.