Pittsburgh Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession

Description

How to fill out Pennsylvania Renunciation And Disclaimer Of Property Received By Intestate Succession?

If you’ve previously employed our service, Log In to your account and acquire the Pittsburgh Pennsylvania Renunciation And Disclaimer of Property Gained through Intestate Succession on your device by clicking the Download button. Ensure your subscription is current. If it isn’t, renew it following your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You have lasting access to every document you have purchased: you can find it in your profile within the My documents section whenever you wish to use it again. Utilize the US Legal Forms service to quickly discover and save any template for your personal or professional requirements!

- Confirm you’ve found an appropriate document. Review the description and utilize the Preview feature, if available, to verify if it fulfills your requirements. If it does not fit your needs, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription option.

- Create an account and complete a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Receive your Pittsburgh Pennsylvania Renunciation And Disclaimer of Property Acquired through Intestate Succession. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

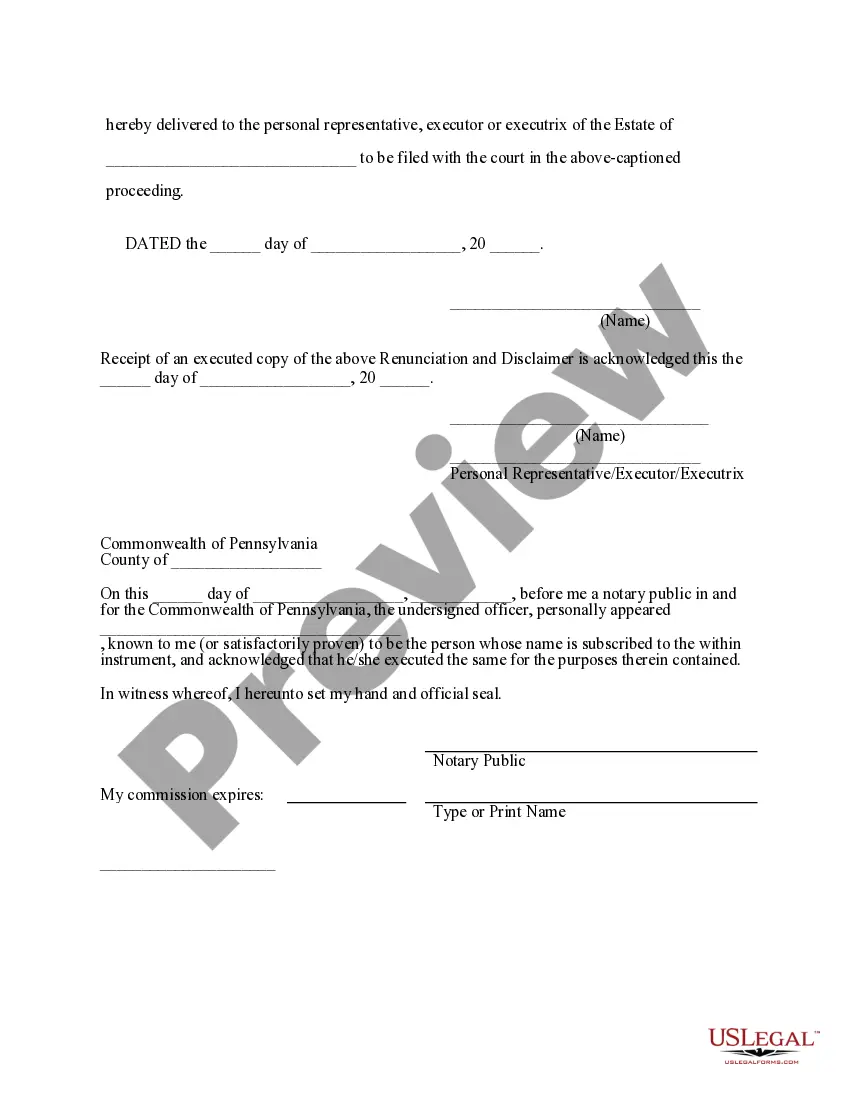

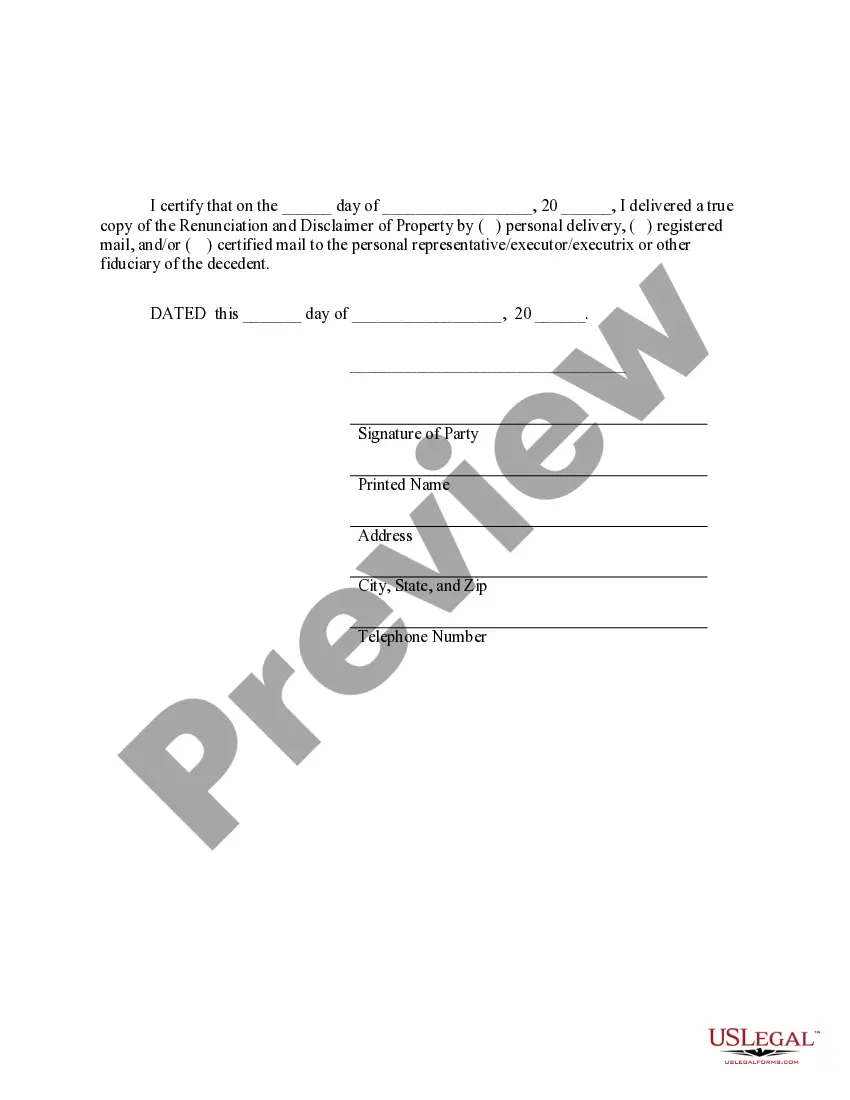

Writing a disclaimer of inheritance involves creating a simple, clear document stating your intention to refuse the inheritance. Ideally, it should include your name, a description of the property you're disclaiming, and a statement expressing your intent. Using platforms like USLegalForms can provide templates designed for a Pittsburgh Pennsylvania Renunciation and Disclaimer of Property Received by Intestate Succession, making the process smoother and more straightforward.

To refuse an inheritance in Pennsylvania, you must file a disclaimer with the probate court handling the estate. This disclaimer must follow specific legal requirements and be filed promptly after you become aware of your inheritance. By taking these steps, you can effectively execute a Pittsburgh Pennsylvania Renunciation and Disclaimer of Property Received by Intestate Succession while protecting your interests.

Disclaiming an inheritance in Pennsylvania involves submitting a written disclaimer to the relevant probate court. This document must express your intent to refuse the inheritance and is usually irrevocable. It is beneficial to consult with a legal professional to ensure compliance with the laws governing Pittsburgh Pennsylvania Renunciation and Disclaimer of Property Received by Intestate Succession to avoid future complications.

In Pennsylvania, the family exemption allows the surviving spouse and children to claim certain assets from the deceased's estate, regardless of the will. This exemption typically includes personal property and a monetary amount, which helps provide immediate financial relief. Knowing who qualifies for this exemption is important when navigating the intricate laws of Pittsburgh Pennsylvania Renunciation and Disclaimer of Property Received by Intestate Succession.

In Pennsylvania, the intestate succession order determines how a deceased person's assets are distributed when they die without a will. Generally, the first in line are the surviving spouse and children. If there are no children, the assets pass to other relatives, such as parents or siblings. Understanding this process is crucial for individuals considering a Pittsburgh Pennsylvania Renunciation and Disclaimer of Property Received by Intestate Succession.

Renunciation of a will refers to the act of a beneficiary rejecting the benefits outlined in the will. This decision allows the property to pass to alternative beneficiaries, which can be in accordance with the deceased's wishes. In the context of Pittsburgh Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession, understanding this concept helps individuals make informed choices about their inheritances and estate management.

A renunciation form is a legal document that an heir or beneficiary uses to officially decline their inheritance. This form must be completed correctly and submitted within specific time frames to be valid. By utilizing the Pittsburgh Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession process, individuals can simplify their estate matters and avoid complications, ensuring that their decisions align with their estate planning goals.

The purpose of renunciation is to allow an individual to formally reject their right to inherit property from an intestate estate. This can be beneficial for various reasons, such as tax planning or to prevent unwanted property from being transferred. When you engage in Pittsburgh Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession, you ensure your intentions are clear, preventing any potential legal disputes in the future.

To disclaim an inheritance in Pennsylvania, you must file a formal renunciation form with the court, stating your intention to reject the inheritance. This form should meet certain legal requirements to be valid. It is essential to understand that the disclaimer must be made voluntarily and cannot be under conditions. For assistance with this process, US Legal Forms offers documents and resources to make it easier.

Becoming an executor of an estate in Pennsylvania without a will typically requires filing a petition for letters of administration with the probate court. This process allows a court to appoint you as the personal representative of the estate. You will manage the estate according to Pennsylvania intestate laws, distributing assets to heirs. If you are unsure how to start, US Legal Forms can guide you through the legal requirements.