Philadelphia Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession

Description

How to fill out Pennsylvania Renunciation And Disclaimer Of Property Received By Intestate Succession?

Acquiring verified templates tailored to your regional laws can be difficult unless you utilize the US Legal Forms repository.

It’s an online collection of over 85,000 legal documents catering to both personal and professional requirements and various real-world situations.

All the files are accurately categorized by usage area and jurisdictional regions, making it simple and quick to locate the Philadelphia Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession.

Ensure your documents are organized and compliant with legal standards. Utilize the US Legal Forms library to keep essential templates for any requirements at your fingertips!

- Review the Preview mode and document description.

- Ensure you’ve chosen the correct one that fulfills your requirements and fully aligns with your local law stipulations.

- Look for another template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the correct one. If it meets your needs, proceed to the next step.

- Complete the purchase.

Form popularity

FAQ

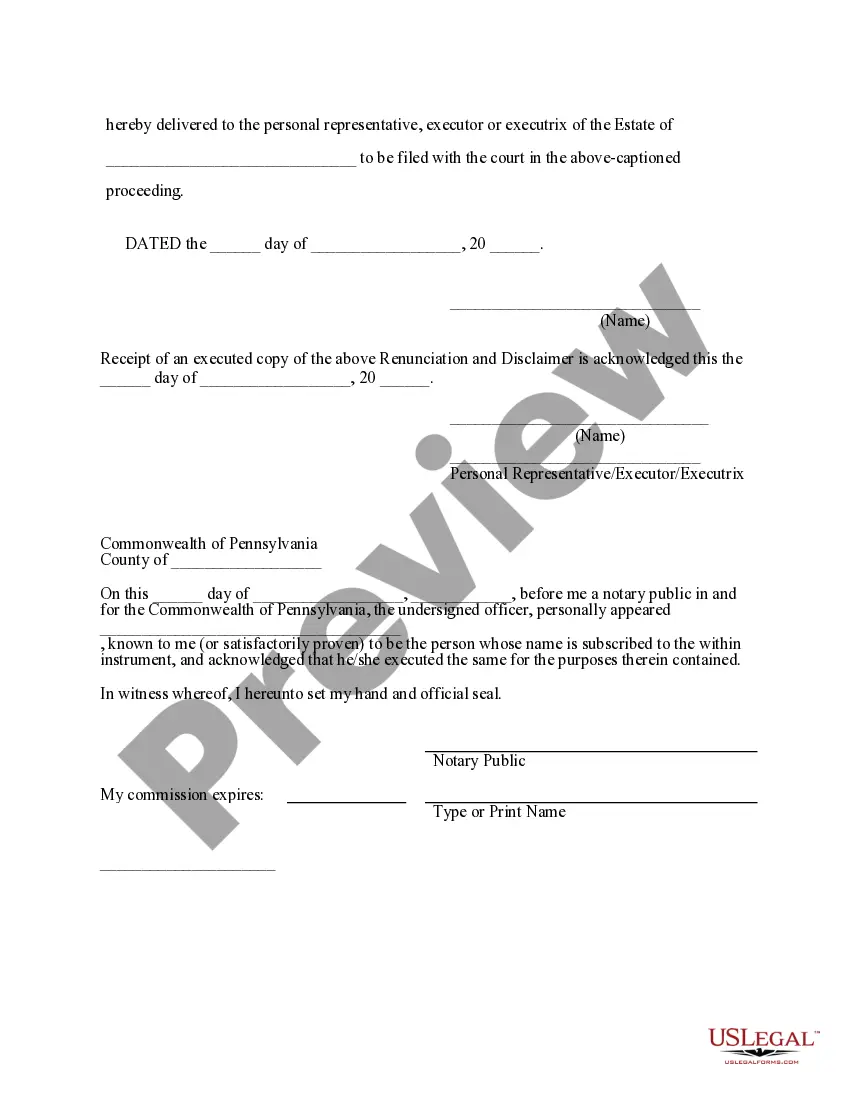

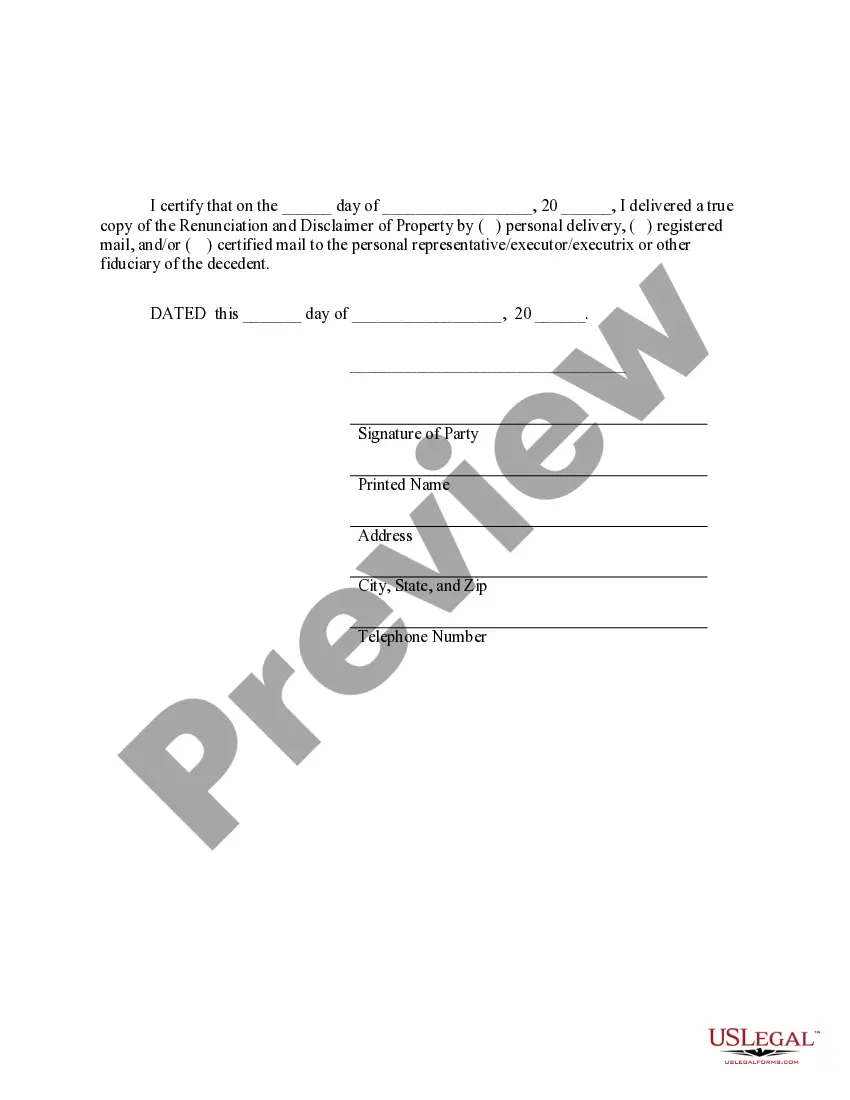

Filling out a renunciation form in Pennsylvania involves a few key steps. First, gather relevant information, including your name, the decedent's name, and specifics about the estate. Next, accurately complete the form, making sure to include all required signatures and notarization. If you're unsure, consider platforms like uslegalforms to help you navigate this essential process with confidence.

To renounce an executor in Pennsylvania, you must submit a written statement indicating your decision to withdraw as an executor. This statement should include your name, the name of the decedent, and your reasons for renunciation. Once filed in the appropriate court, your renunciation will be recognized. Utilizing resources from uslegalforms can provide templates and support throughout this process.

A letter of renunciation serves to formally express your decision to decline any interest in property you received through intestate succession. This document is crucial as it helps clarify your intentions and prevents any future claims on the property. In Philadelphia, using a letter of renunciation can make the process smoother and more straightforward for all parties involved. Consider using uslegalforms for templates and legal advice.

Filling out a renunciation form in Philadelphia requires a clear understanding of your intent to renounce property received through intestate succession. Start by gathering the necessary information, such as your name, relationship to the deceased, and details about the property. Ensure that you complete the form accurately and sign it in the presence of a notary. If you need assistance, platforms like uslegalforms can provide helpful guidance.

The purpose of renunciation is to legally refuse inheritance or ownership of property received through intestate succession. By executing a Philadelphia Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession, you can prevent the property from complicating your estate planning or affecting your finances. This process not only simplifies inheritance matters but also allows the property to pass directly to the next eligible heirs. If you consider renunciation, our platform, US Legal Forms, offers valuable resources and seamless documentation to aid in this process.

Writing a disclaimer of inheritance involves stating your intent to renounce the property in clear, formal language. Include details such as the date of the decedent's death, your relationship to them, and the specific property you are renouncing. Utilizing the information on Philadelphia Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession will provide valuable insights for crafting an effective disclaimer.

The process to disclaim an inheritance requires you to file a written disclaimer with the appropriate court or executor of the estate. The disclaimer must meet specific legal requirements set forth by Pennsylvania law. To assist you through the Philadelphia Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession process, consider seeking help from legal forms or resources.

In Pennsylvania, family exemption allows certain relatives, such as spouses and children, to claim specific property from the estate, regardless of the deceased's will. This right ensures that family members have access to essential support after a loved one passes away. Knowing about the Philadelphia Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession can help those who wish to manage their inheritance effectively.

Intestate succession in Philadelphia refers to the legal process that determines how a deceased person's assets are distributed when they die without a valid will. The state's laws dictate inheritance rights based on family relationships. Understanding the Philadelphia Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession can help beneficiaries navigate their options.

Refusing an inheritance in Pennsylvania involves filing a written statement known as a disclaimer. This action must clearly indicate your decision to renounce any claim to the property received through intestate succession. Utilizing the Philadelphia Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession process is essential for proper execution.