Allegheny Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession

Description

How to fill out Pennsylvania Renunciation And Disclaimer Of Property Received By Intestate Succession?

Irrespective of social or occupational standing, filling out legal documents is a regrettable requirement in today's professional landscape.

Frequently, it’s nearly unfeasible for an individual without legal training to create this kind of documentation from the ground up, primarily because of the intricate terminology and legal subtleties they entail.

This is where US Legal Forms can come to the rescue.

Make sure the form you have located is appropriate for your jurisdiction since the regulations of one state or region do not apply to another.

Examine the document and consult a brief overview (if available) of the scenarios for which the document may be utilized.

- Our service offers an extensive library with over 85,000 state-specific forms that are applicable to nearly any legal situation.

- US Legal Forms also serves as a valuable resource for associates or legal advisors seeking to optimize their time with our DIY documents.

- Regardless of whether you seek the Allegheny Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession or another document that will hold validity in your region, with US Legal Forms, everything is at your disposal.

- Here’s how to swiftly acquire the Allegheny Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession using our dependable service.

- If you are already a member, you can go ahead and Log In to your account to download the required document.

- However, if you are new to our collection, ensure that you follow these instructions before obtaining the Allegheny Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession.

Form popularity

FAQ

A renunciation form in Pennsylvania is a legal document that allows an individual to formally refuse their share of property inherited through intestate succession. Specifically, it relates to the Allegheny Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession. This form helps clarify your wishes and can prevent future disputes over the property. For guidance on filling out this form correctly, visit platforms such as US Legal Forms for templates and assistance.

To renounce an executor in Pennsylvania, you should first prepare a written notice stating your intention to renounce the appointment. This document must comply with the guidelines set for Allegheny Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession. Make sure to send the notice to the court and any interested parties. If you need detailed assistance, consider using resources from legal sites like US Legal Forms.

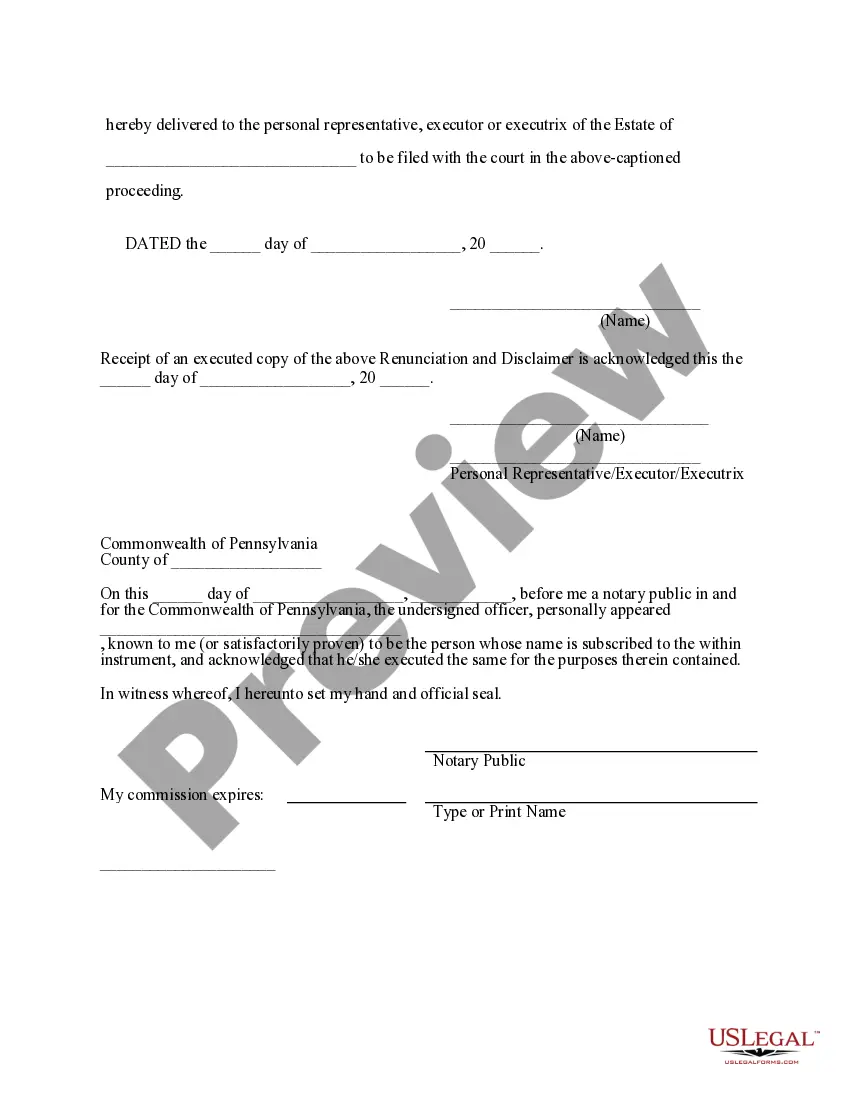

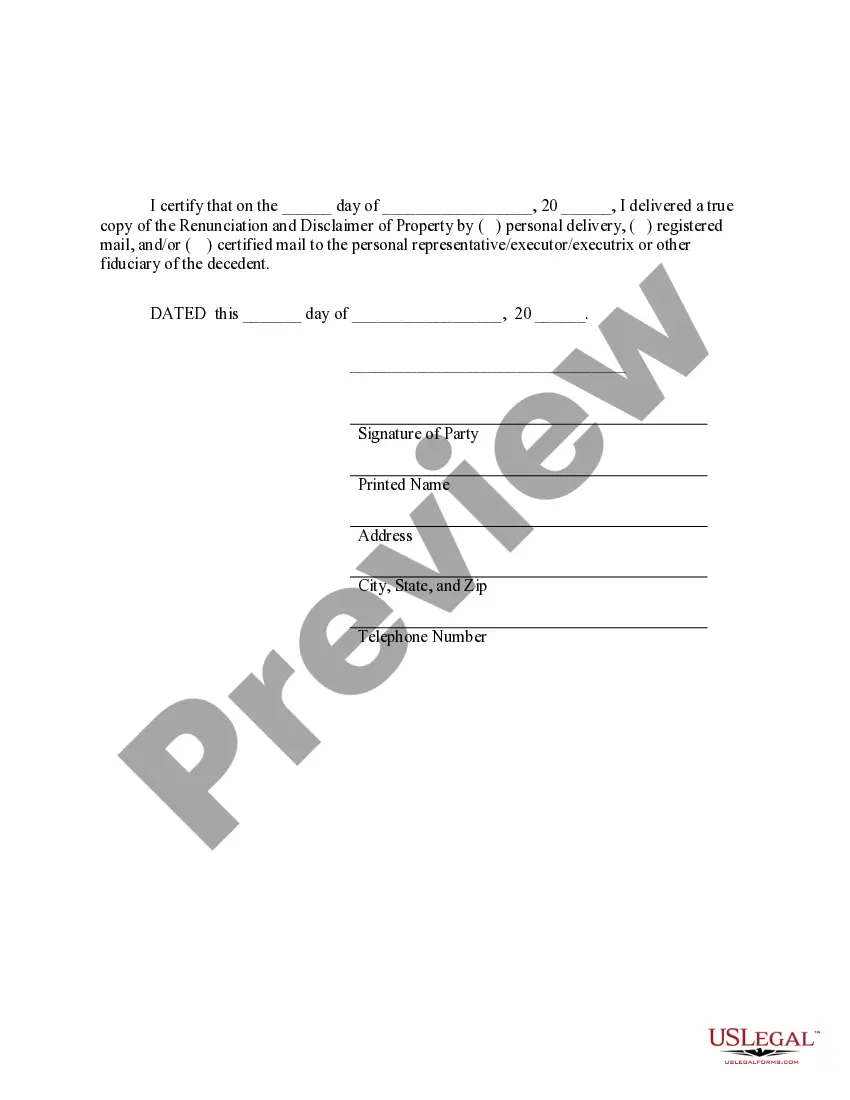

Filling out a renunciation form involves providing specific information about the property you wish to renounce. First, obtain the proper form for Allegheny Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession, which you can find on legal platforms like US Legal Forms. Next, clearly state your intention to renounce the property, include your details, and sign the document. Finally, ensure to submit the form to the appropriate court for processing.

To refuse an inheritance in Pennsylvania, you must formally indicate your decision not to accept it. This process includes preparing a legal disclaimer that meets Pennsylvania's statutory requirements. Submitting this disclaimer to the probate court is essential for the validity of your refusal. Platforms like USLegalForms can provide valuable assistance to help you successfully navigate the Allegheny Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession.

Writing a disclaimer of inheritance sample involves clear and formal language. Start by including the decedent's name, the property you are disclaiming, and a statement expressing your intention to refuse the inheritance. Ending with your signature and the date reinforces your decision. For guidance or templates, using a resource like USLegalForms can be incredibly beneficial in ensuring compliance with Pennsylvania laws.

In Pennsylvania, property transfers without a will follow intestacy laws. The state determines who inherits based on their relationship to the deceased. Typically, surviving spouses, children, and other relatives are prioritized during this transfer. Understanding the Allegheny Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession is vital if you are involved in this process.

To disclaim an inheritance in Pennsylvania, you must take specific legal steps. First, you should create a written disclaimer that indicates your decision to reject the inheritance. Make sure to file this document with the appropriate probate office, ensuring it meets all legal requirements for the Allegheny Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession. Checking templates on platforms like USLegalForms can simplify your preparation.

In Pennsylvania, certain relatives may claim a family exemption from the estate of a deceased individual. Typically, a surviving spouse and minor children have the right to claim a specified monetary amount from the estate. This provision is designed to provide some financial support to immediate family members during the transition. For more details about the Allegheny Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession, consider checking reliable legal platforms.

To disclaim an inheritance, you must formally refuse the property or benefits received through intestate succession. Start by notifying the probate court and preparing a written disclaimer that clearly states your intent. It's essential to ensure that your disclaimer complies with Pennsylvania laws, especially regarding the timing and format. Using resources like USLegalForms can streamline this process effectively.

Filling out a renunciation form in Pennsylvania is straightforward. Begin by obtaining the official form, which you can find through platforms like USLegalForms. Make sure to provide accurate details, including your name, the decedent's name, and the specific property you renounce. After signing the form, submit it to the appropriate probate court to complete the Allegheny Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession.