Allegheny Pennsylvania Mortgage is a type of short-term loan option available for residents in Allegheny County, Pennsylvania, who are looking to finance their property purchase or refinance their current mortgage. It is designed to offer borrowers quick access to funds to meet their financial needs. With a short mortgage term, borrowers can expect to repay the loan within a shorter period compared to traditional long-term mortgages. This allows for faster-gained equity, reduced interest payments, and quicker loan payoff. Allegheny Pennsylvania Mortgage — Short is an excellent option for individuals who are planning to sell their property within a few years or those who prefer to pay off their mortgage debt earlier. Here are some important keywords relevant to Allegheny Pennsylvania Mortgage — Short: 1. Allegheny County Mortgage: This refers to mortgage loans available specifically for individuals residing in Allegheny County, Pennsylvania. 2. Short-term Mortgage: A mortgage with a shorter duration, typically ranging from 5 to 10 years, allowing borrowers to pay off the loan more quickly. 3. Quick Access to Funds: Borrowers can access the loan amount swiftly, enabling them to address immediate financial needs, such as home renovations or debt consolidation. 4. Property Purchase: Short-term mortgages can be utilized to finance the purchase of a new property within Allegheny County. 5. Refinance: Existing homeowners in Allegheny County can refinance their mortgage with a short-term option to lower their interest rates or change the terms of their loan. 6. Equity Gain: With a shorter mortgage term, borrowers can build equity in their property at a faster pace, increasing their net worth. 7. Reduced Interest Payments: By opting for a short-term mortgage, borrowers can save a significant amount of money on interest payments compared to conventional long-term loans. 8. Loan Payoff: The shorter loan term allows borrowers to pay off their mortgage debt earlier, offering them financial freedom and reducing long-term obligations. 9. Property Sale: Short-term mortgages are particularly suitable for individuals planning to sell their property within a few years, as the loan can be repaid before putting the property on the market. By offering Allegheny Pennsylvania Mortgage — Short, lenders cater to the specific needs of individuals in Allegheny County who prefer shorter loan terms and quicker loan payoffs. This mortgage option provides borrowers with financial flexibility, reduced interest costs, and the opportunity to build equity rapidly. Whether one is purchasing a property or looking to refinance an existing mortgage, choosing a short-term mortgage can be a smart financial decision for Allegheny County residents.

Allegheny Pennsylvania Mortgage - Short

State:

Pennsylvania

Control #:

PA-0011

Format:

Word;

Rich Text

Instant download

Description

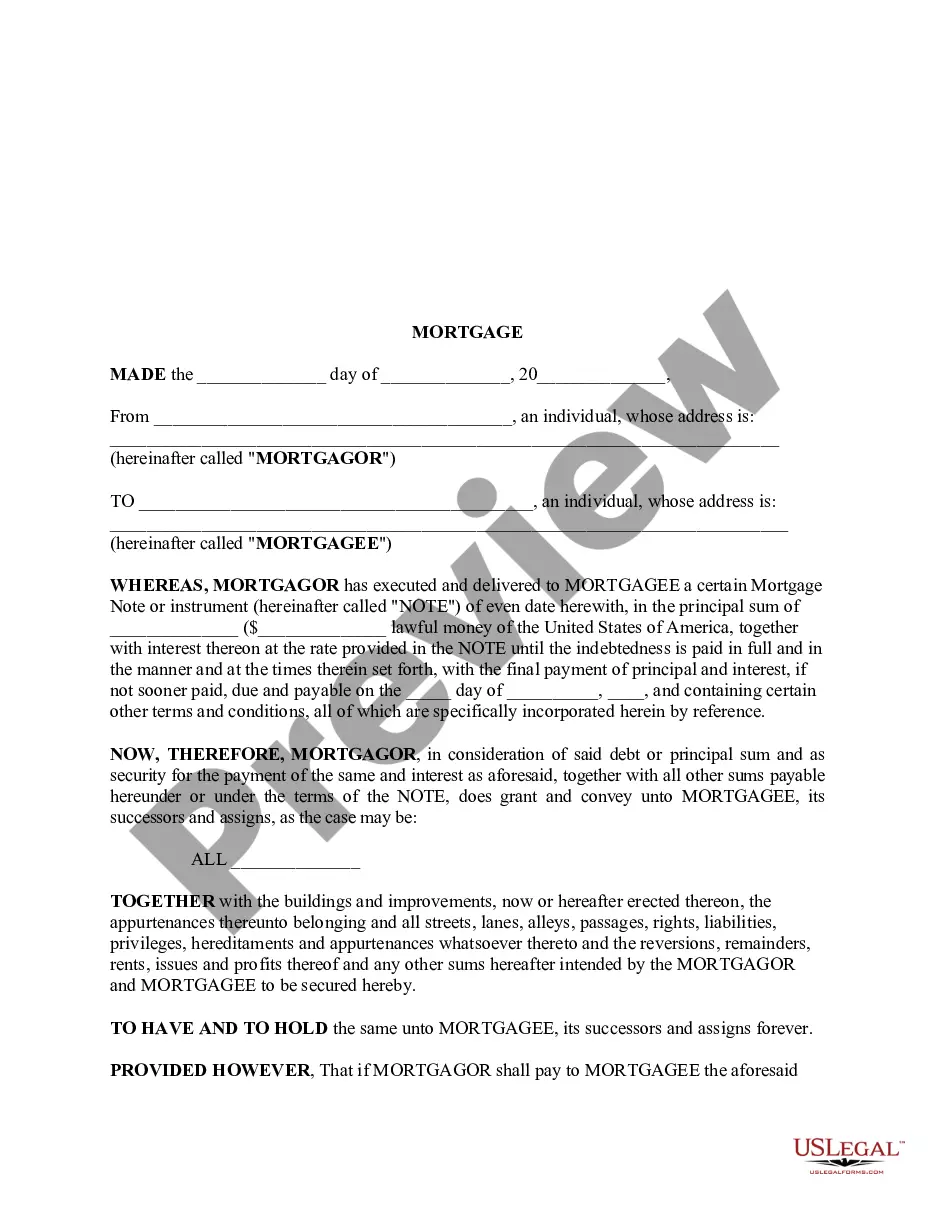

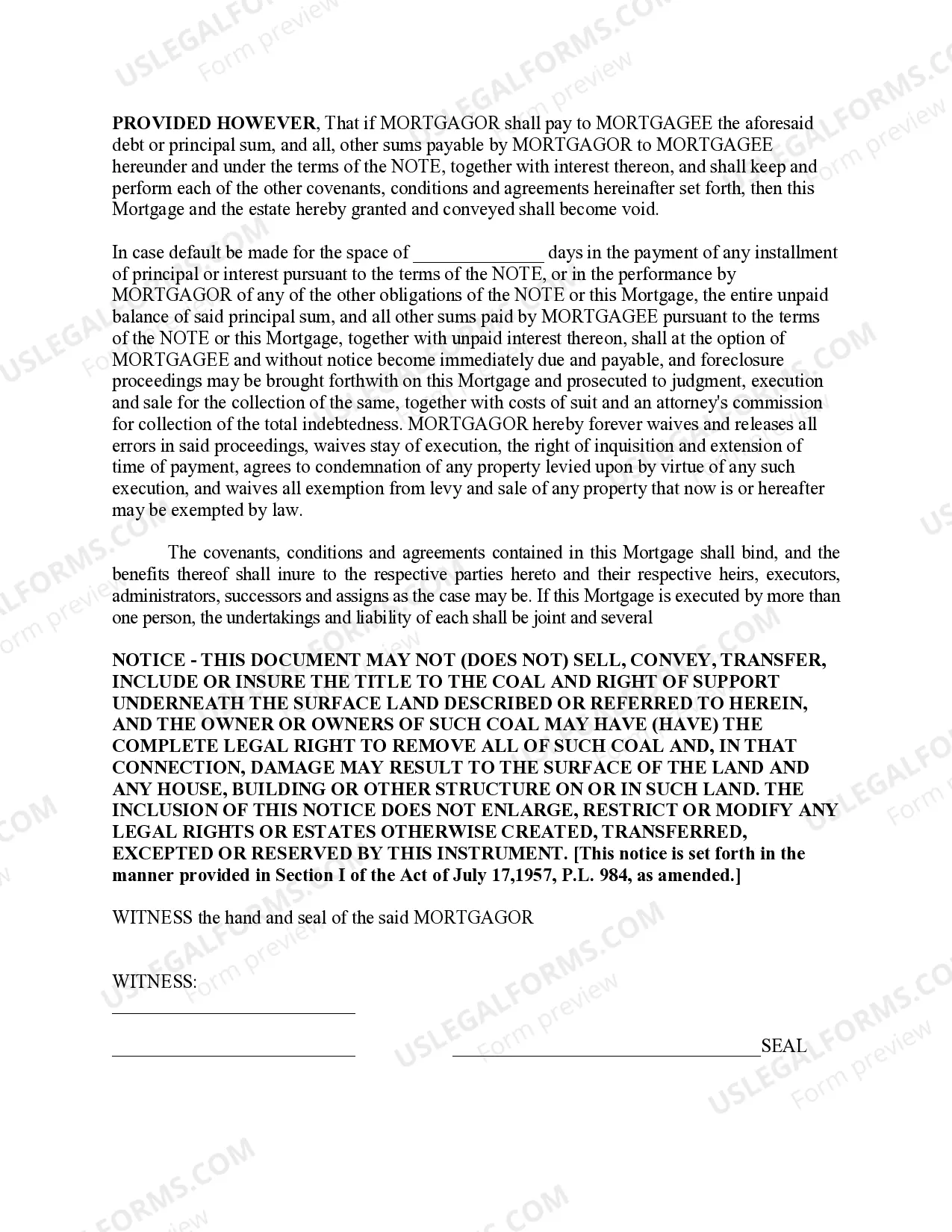

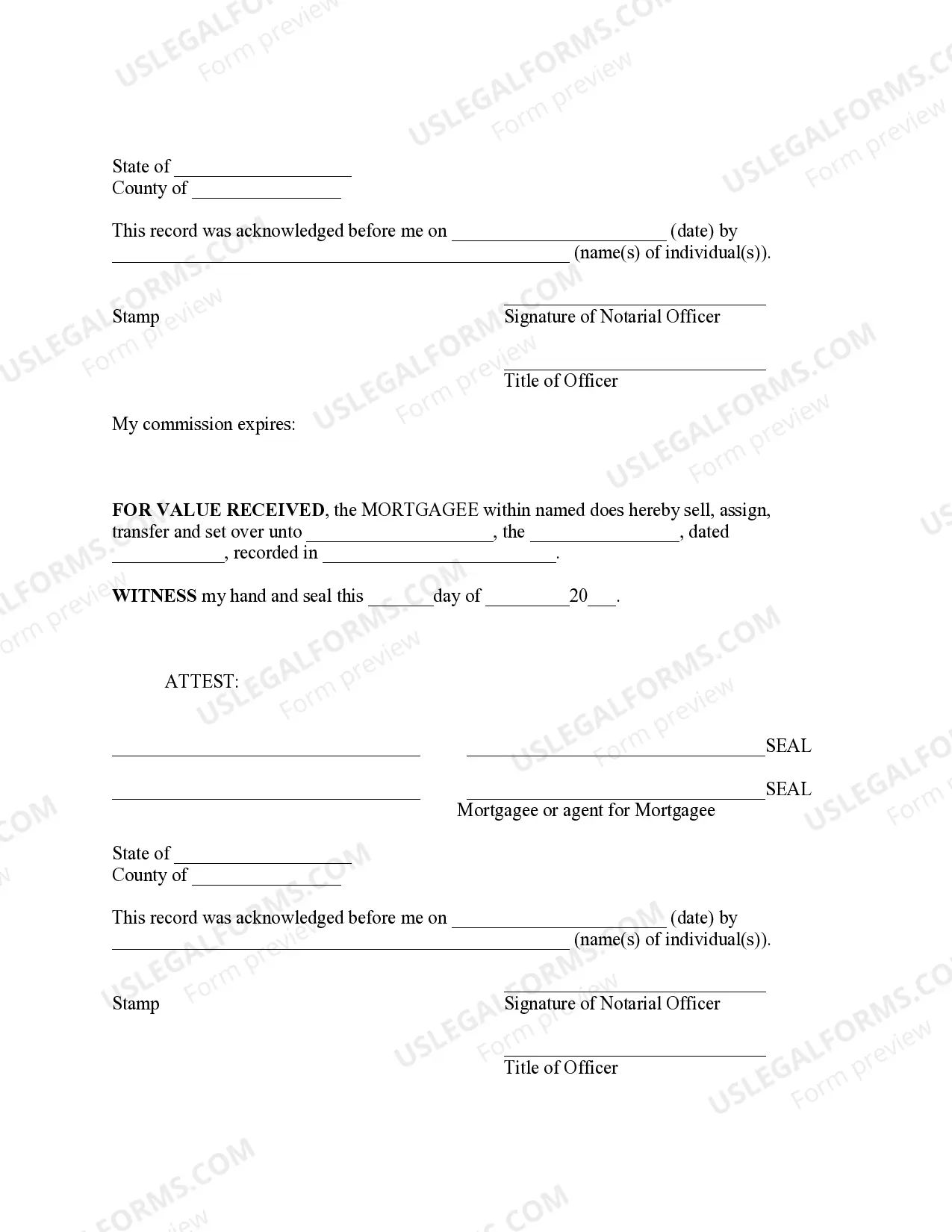

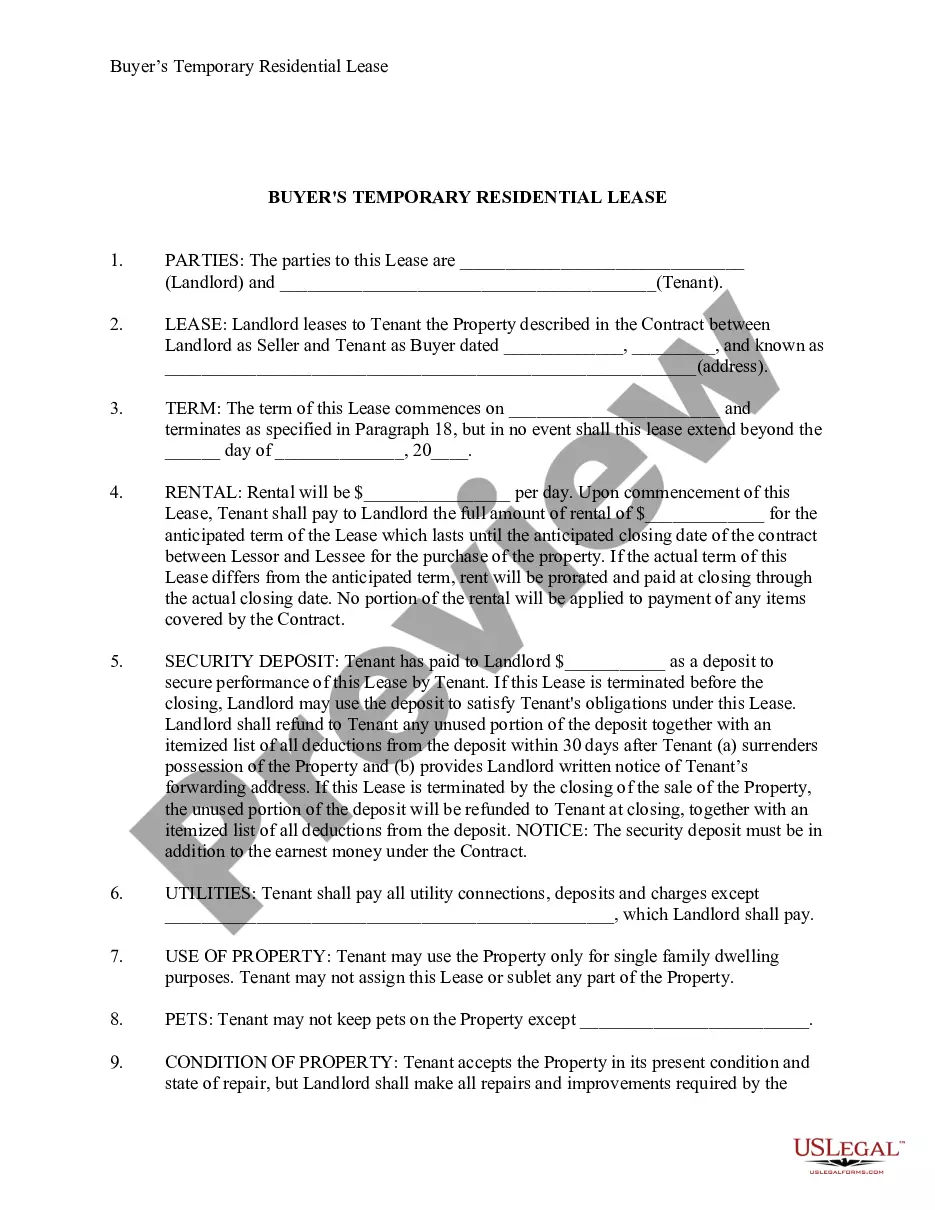

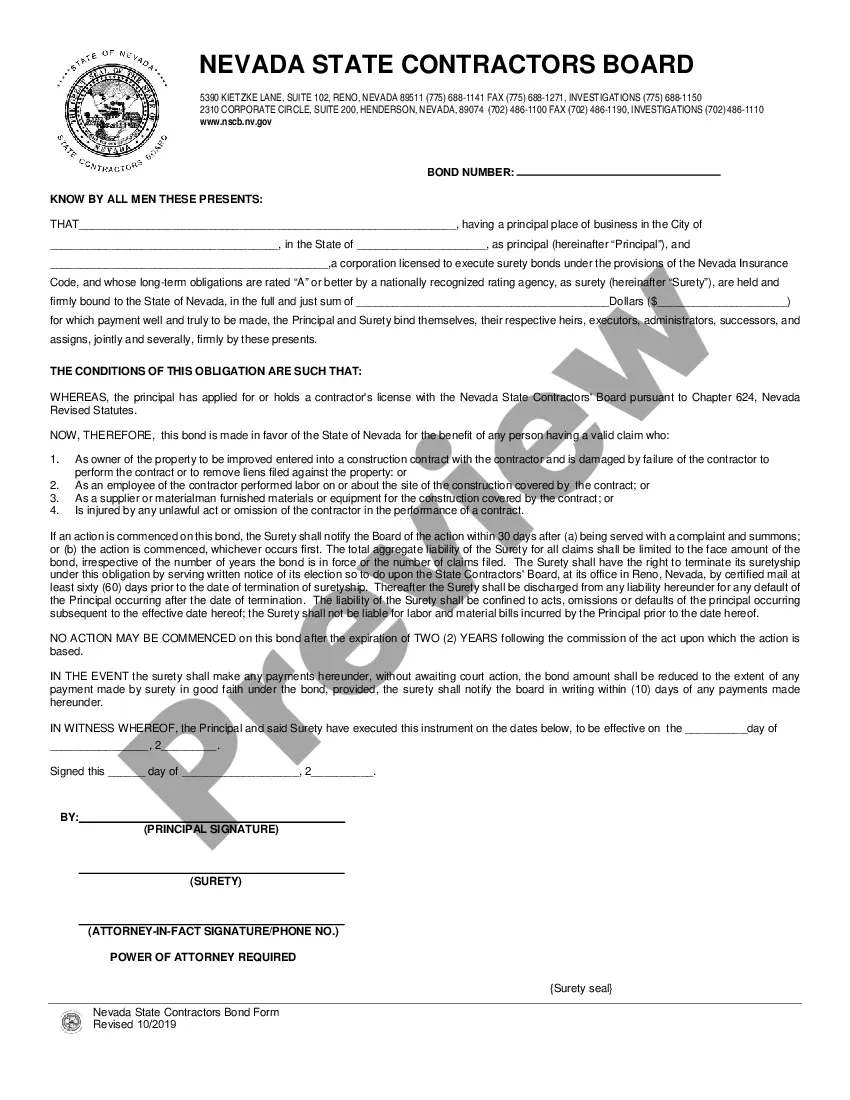

A deed of trust of mortgage is an instrument whereby a person grants to another a security interest in real estate to secure the payment of a promissory note.

Allegheny Pennsylvania Mortgage is a type of short-term loan option available for residents in Allegheny County, Pennsylvania, who are looking to finance their property purchase or refinance their current mortgage. It is designed to offer borrowers quick access to funds to meet their financial needs. With a short mortgage term, borrowers can expect to repay the loan within a shorter period compared to traditional long-term mortgages. This allows for faster-gained equity, reduced interest payments, and quicker loan payoff. Allegheny Pennsylvania Mortgage — Short is an excellent option for individuals who are planning to sell their property within a few years or those who prefer to pay off their mortgage debt earlier. Here are some important keywords relevant to Allegheny Pennsylvania Mortgage — Short: 1. Allegheny County Mortgage: This refers to mortgage loans available specifically for individuals residing in Allegheny County, Pennsylvania. 2. Short-term Mortgage: A mortgage with a shorter duration, typically ranging from 5 to 10 years, allowing borrowers to pay off the loan more quickly. 3. Quick Access to Funds: Borrowers can access the loan amount swiftly, enabling them to address immediate financial needs, such as home renovations or debt consolidation. 4. Property Purchase: Short-term mortgages can be utilized to finance the purchase of a new property within Allegheny County. 5. Refinance: Existing homeowners in Allegheny County can refinance their mortgage with a short-term option to lower their interest rates or change the terms of their loan. 6. Equity Gain: With a shorter mortgage term, borrowers can build equity in their property at a faster pace, increasing their net worth. 7. Reduced Interest Payments: By opting for a short-term mortgage, borrowers can save a significant amount of money on interest payments compared to conventional long-term loans. 8. Loan Payoff: The shorter loan term allows borrowers to pay off their mortgage debt earlier, offering them financial freedom and reducing long-term obligations. 9. Property Sale: Short-term mortgages are particularly suitable for individuals planning to sell their property within a few years, as the loan can be repaid before putting the property on the market. By offering Allegheny Pennsylvania Mortgage — Short, lenders cater to the specific needs of individuals in Allegheny County who prefer shorter loan terms and quicker loan payoffs. This mortgage option provides borrowers with financial flexibility, reduced interest costs, and the opportunity to build equity rapidly. Whether one is purchasing a property or looking to refinance an existing mortgage, choosing a short-term mortgage can be a smart financial decision for Allegheny County residents.

Free preview

How to fill out Allegheny Pennsylvania Mortgage - Short?

If you’ve already used our service before, log in to your account and save the Allegheny Pennsylvania Mortgage - Short on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Make sure you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Allegheny Pennsylvania Mortgage - Short. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!