Bend Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out Oregon Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Irrespective of societal or occupational standing, completing law-related paperwork is a regrettable requirement in today's work milieu.

Frequently, it’s nearly impossible for an individual without legal expertise to compile such documents from the outset, primarily due to the intricate jargon and legal subtleties they encompass.

This is where US Legal Forms proves advantageous.

Confirm that the form you have selected is appropriate for your locality, as the laws of one state or area are not applicable to another.

You’re all set! Now you can continue to print the form or complete it online. If you encounter any issues retrieving your purchased documents, you can easily locate them in the My documents section.

- Our service offers an extensive library with over 85,000 ready-to-use, state-specific forms that are suitable for nearly any legal circumstance.

- US Legal Forms also acts as a valuable resource for associates or legal advisers looking to conserve time by using our DIY papers.

- Whether you need the Bend Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, or any other document that is valid in your region, with US Legal Forms, you have everything within reach.

- Below is the procedure for quickly obtaining the Bend Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries using our reliable service.

- If you are currently a member, you can proceed to Log In to your account to download the required form.

- However, if you are new to our platform, ensure to follow these steps before downloading the Bend Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries.

Form popularity

FAQ

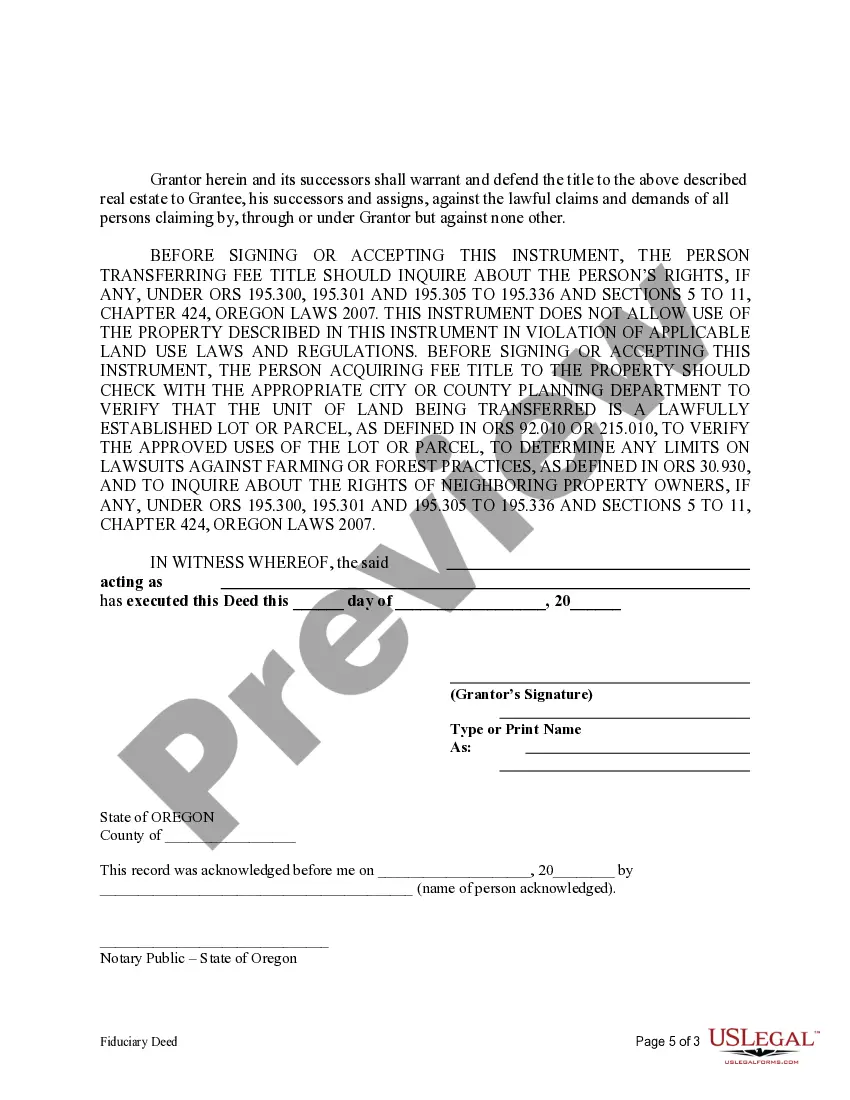

A trust deed in Oregon is a legal document that establishes a trust to manage property. This important instrument allows executors, trustees, trustors, administrators, and other fiduciaries to hold and manage assets on behalf of beneficiaries. Specifically, the Bend Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries ensures that the property is used according to the intentions of the trustor. By utilizing this deed, you promote transparency and proper management of trust assets.

Fiduciary deeds facilitate the transfer of property by fiduciaries under their legal authority, ensuring the transaction is valid and recognized. They do not provide the guarantees found in a warranty deed, but they are essential for the legal functioning of estate and trust management. You can find more information about utilizing a Bend Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries through platforms like uslegalforms, which offer valuable resources to navigate these legal procedures.

An executor's deed is specifically designed for executors to transfer property held in an estate, while a warranty deed provides a broader protection to the buyer regarding the title. Executors typically use the executor's deed to fulfill their responsibilities, whereas buyers receive warranty deeds for greater title security. Understanding the nuances between these deeds is crucial when dealing with a Bend Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries.

The primary benefit of a fiduciary lies in their legal responsibility to act in the best interests of another party. This includes managing and distributing assets with care and diligence. In situations that involve a Bend Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries, having a fiduciary ensures the estate is handled responsibly and aligns with the deceased's wishes.

A trustee commonly uses a fiduciary deed to transfer property as part of their duties. This deed allows the trustee to act on behalf of the beneficiaries of the trust, ensuring the proper distribution of assets. By utilizing a Bend Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries, trustees can effectively execute their responsibilities while maintaining legal compliance.

The strongest type of deed is typically considered to be a warranty deed. This deed provides the greatest protection to the buyer, offering guarantees that the title is clear of any encumbrances. When utilizing a Bend Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries, it is essential to understand its purpose in conveying property interests without the full warranties found in a warranty deed.

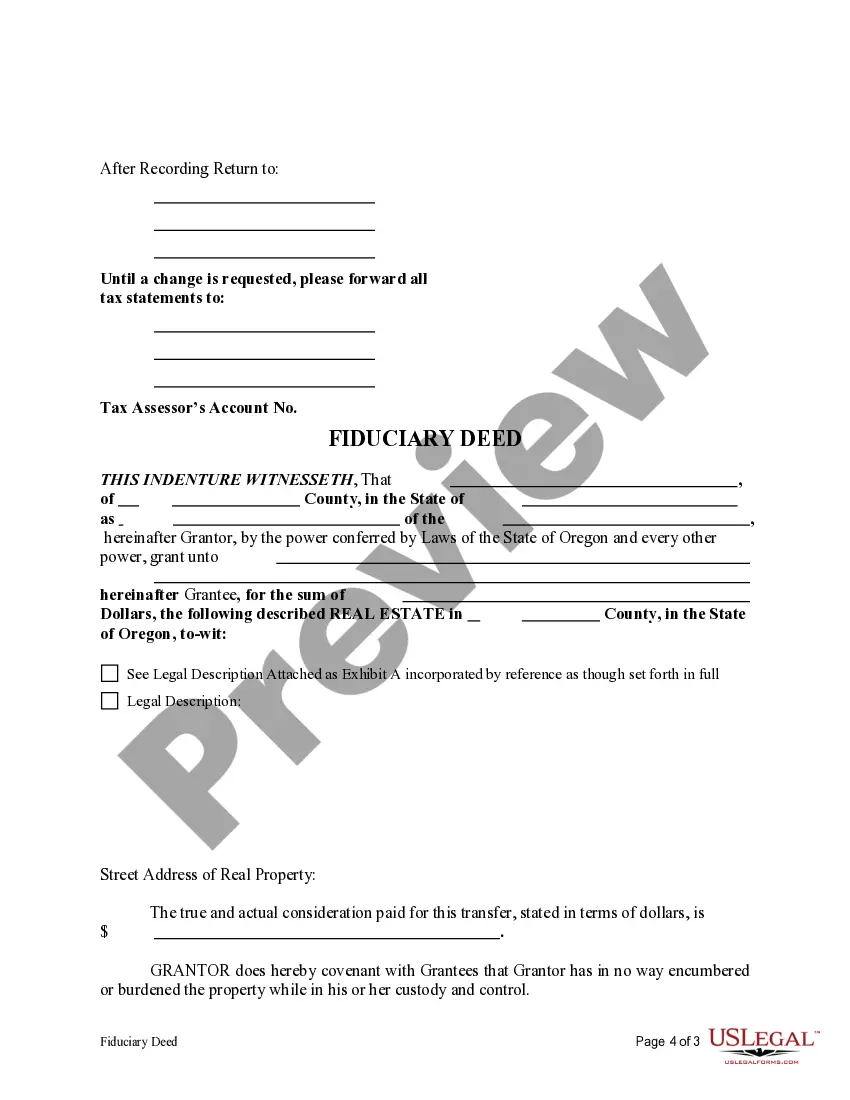

A fiduciary deed serves as a legal instrument that allows a fiduciary, such as an executor or trustee, to convey property on behalf of an estate or trust. This type of deed ensures that the fiduciary has the authority to manage and transfer assets efficiently. When dealing with a Bend Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries, it simplifies the transfer process while adhering to state laws.

The primary purpose of a fiduciary deed is to enable fiduciaries to transfer property on behalf of another individual legally. This deed provides the necessary legal framework, ensuring the transaction adheres to the governing laws and the terms of the trust or estate. By using a Bend Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries, you facilitate a smooth transfer of ownership, minimizing potential disputes or complications. Utilizing platforms like uslegalforms can help create these deeds efficiently.

A fiduciary title refers to the legal authority granted to an individual to manage assets on behalf of another person. This title is critical for fulfilling obligations outlined in a will or trust. When the fiduciary acts, such as executing a Bend Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries, they must adhere to their legal responsibilities to act in the best interest of the beneficiaries. Understanding fiduciary title is vital for anyone involved in estate planning or property transfers.

The primary difference lies in their purpose and the entities involved. A warranty deed guarantees that the seller has full ownership rights and provides protection against future claims. In contrast, a fiduciary deed is utilized by individuals acting in a fiduciary capacity, such as executors or trustees, and does not provide the same level of guarantees. Knowing these distinctions can improve your understanding of property transactions, especially with a Bend Oregon Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries.