Bend Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder

Description

How to fill out Oregon Full Reconveyance Of Deed Of Trust - Individual Lender Or Holder?

Are you seeking a dependable and affordable provider of legal forms to obtain the Bend Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder? US Legal Forms is your ideal choice.

Regardless of whether you require a straightforward agreement to establish guidelines for living with your partner or a collection of documents to facilitate your separation or divorce through the legal system, we have you covered. Our site features over 85,000 current legal document templates for both personal and business needs. All templates we provide are specifically tailored based on the regulations of various states and regions.

To download the document, you must Log In to your account, locate the necessary form, and click the Download button adjacent to it. Keep in mind that you can download your previously acquired form templates at any moment in the My documents section.

Is this your first visit to our site? No need to worry. You can create an account in a matter of minutes, but before doing so, ensure that you.

Now you can register for your account. Then select a subscription plan and proceed with the payment. After the payment is completed, download the Bend Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder in any available file format. You can return to the website at any time to redownload the document at no additional cost.

Locating current legal documents has never been simpler. Give US Legal Forms a try today and say goodbye to spending hours trying to comprehend legal paperwork online once and for all.

- Verify if the Bend Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder meets the standards of your state and local jurisdiction.

- Review the description of the form (if available) to understand who and what the document serves.

- Restart your search if the form does not fit your particular situation.

Form popularity

FAQ

Yes, in the deed of trust system, the lender is typically referred to as the beneficiary. This is because the beneficiary holds the right to receive payment from the borrower. Understanding this terminology is important when discussing the Bend Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder, as it clearly defines who stands to gain from the agreement. Being aware of these roles can help you navigate your real estate transaction more effectively.

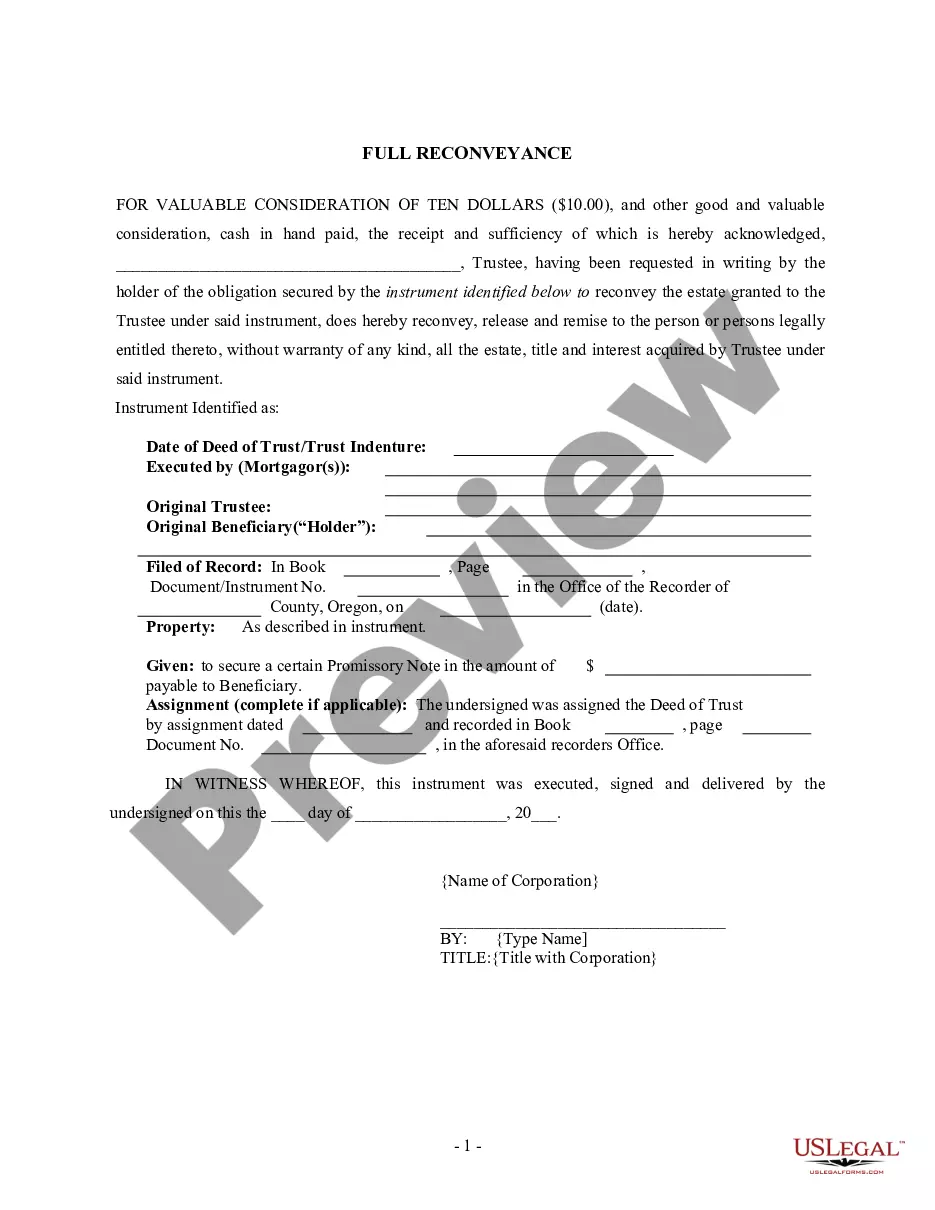

Filling out a full reconveyance form involves several careful steps. First, gather critical information, such as the borrower's name, the property’s legal description, and the lender's information. Next, correctly complete all required sections of the Full Reconveyance of Deed of Trust - Individual Lender or Holder form, ensuring accuracy to avoid processing delays. After completing the form, submit it to the relevant authorities, either online through platforms like US Legal Forms or in person.

In Oregon, the beneficiary of a trust deed is typically the lender or the entity that is financing the property. This party holds the rights to the property until the borrower fully repays the obligation secured by the trust deed. It's crucial to grasp the role of the beneficiary when considering the Bend Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder.

Yes, Oregon recognizes beneficiary deeds, which allow property owners to transfer their property upon death without it going through probate. A beneficiary deed helps streamline the process and can provide peace of mind when planning your estate. If you're looking at Bend Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder, knowing about these deeds can enhance your overall estate planning.

Oregon primarily utilizes a deed of trust rather than a traditional mortgage. A deed of trust involves three parties: the borrower, the lender, and the trustee, which can often simplify the foreclosure process. For those exploring options in Bend Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder, understanding the distinctions between these instruments is beneficial for making informed financial decisions.

In Oregon, a trustee on a deed of trust can typically be an individual or a corporation that holds the legal title to the property for the benefit of the lender. This means that the trustee can be an individual, such as a friend or family member, or it can be a corporate entity, like a bank or title company. When you consider the Bend Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder, having a proper trustee is essential to ensure everything functions smoothly.

A document known as a substitution of trustee and full reconveyance identifies the person who has the authority to reconvey the property and remove the lien. Most importantly, a deed of full reconveyance, known as a satisfaction of mortgage in some states, transfers title back to the borrower.

When you pay off your loan and you have a mortgage, the lender will send you ? or the local recorder of deeds or office that handles the filing of real estate documents ? a release of mortgage. This release of mortgage is recorded or filed and gives notice to the world that the lien is no more.

If and when the loan is fully repaid, the lender will record a release (or satisfaction) of mortgage or a reconveyance of deed (used in conjunction with deeds of trust) in the county land records. This document removes the mortgage lien from the property.