Eugene Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

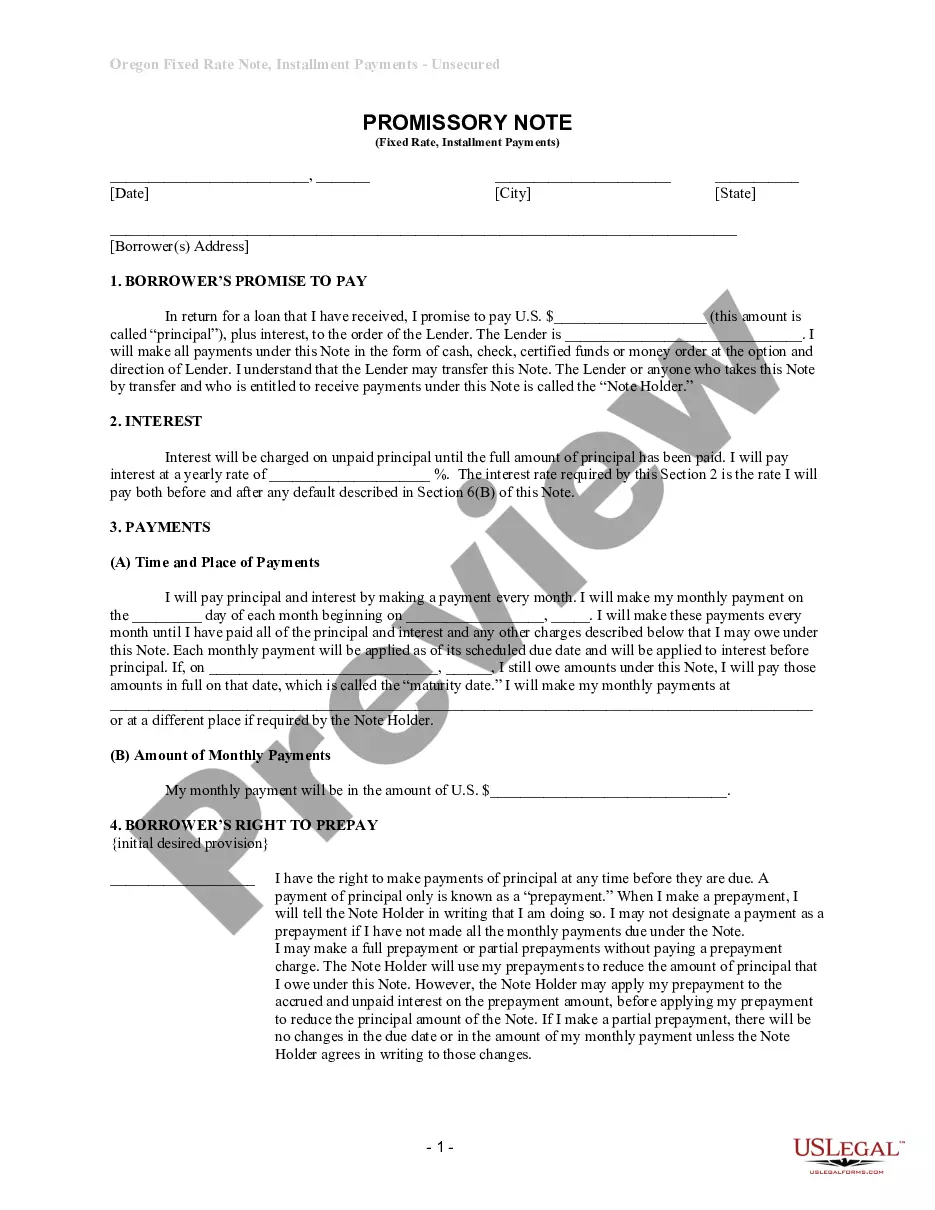

How to fill out Oregon Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Are you searching for a dependable and budget-friendly provider of legal documents to obtain the Eugene Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate? US Legal Forms is your ideal option.

Whether you require a straightforward agreement to outline guidelines for living together with your partner or a collection of documents to facilitate your divorce proceedings through the courthouse, we have you covered. Our platform offers over 85,000 contemporary legal document templates for personal and business use. All templates provided are not one-size-fits-all and are tailored based on the specifications of individual states and regions.

To download the document, you need to Log In to your account, locate the necessary form, and click the Download button adjacent to it. Please remember that you can access your previously acquired document templates at any time from the My documents section.

Is this your first visit to our site? No problem. You can quickly create an account, but first, ensure to do the following.

Now, you can establish your account. Then select a subscription plan and proceed with the payment. Once the payment is finalized, download the Eugene Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate in any available file format. You may revisit the website at any time and redownload the document at no additional cost.

Locating current legal forms has never been simpler. Try US Legal Forms now, and say goodbye to spending hours seeking legal paperwork online once and for all.

- Verify if the Eugene Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate complies with the regulations of your state and locality.

- Review the form’s description (if available) to understand who it is intended for and its purpose.

- Restart your search if the form does not meet your legal needs.

Form popularity

FAQ

Yes, a promissory note can indeed be secured. This type of note requires the borrower to pledge an asset, such as commercial real estate, as collateral. This arrangement provides additional security for the lender and can often lead to better repayment terms. If you are interested in an Eugene Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, consider using platforms like USLegalForms to obtain guidance and templates for your specific needs.

To write a secured promissory note, include the necessary details such as the date, names, and the exact amount. Outline the repayment terms and interest rate, making sure to detail the collateral that secures the note. If you are focusing on an Eugene Oregon Installments Fixed Rate Promissory Note secured by commercial real estate, explicitly mention the property and relevant information to ensure clarity for both parties.

Filling out a promissory demand note is straightforward. Begin with the date and the parties' names and contact details. Specify the amount loaned, interest rate, and payment timing—indicating that payment is due upon demand. If it's related to an Eugene Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, include the description of the secured property to clarify the terms.

One disadvantage of a promissory note is that, if not properly secured, it may become difficult to enforce repayment. A Eugene Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate mitigates this risk by attaching the note to a tangible asset, providing additional assurance. However, if the borrower defaults and the note lacks collateral, the lender might face challenges recovering the owed amount. It is essential to understand these dynamics when considering your options.

Yes, a secured promissory note should generally be recorded to protect the interests of the lender. When the note is tied to commercial real estate, recording it provides legal backing and priority in case of default. For loans structured as Eugene Oregon Installments Fixed Rate Promissory Notes Secured by Commercial Real Estate, using platforms like US Legal Forms can help streamline the process of drafting and recording all necessary documents to safeguard your investments.

Typically, you do not need to file a promissory note with any government office unless it is secured by a specific asset, like real estate. For enhanced security in transactions involving a Eugene Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, you may want to file a deed of trust or mortgage that signifies the security interest. Making sure your documents are correctly filed protects both the lender and borrower in the deal.

To secure a promissory note with real estate, you need to clearly outline the property as collateral in the note's terms. This usually involves drafting a mortgage or deed of trust document, which legally ties the promissory note to the real property. Utilizing platforms like uslegalforms can make this process easier by providing templates and guidance for Eugene Oregon Installments Fixed Rate Promissory Notes Secured by Commercial Real Estate.

Securing a promissory note typically involves using collateral that can be claimed by the lender in case of default. Common forms of collateral include real estate or other valuable assets. For deals involving Eugene Oregon Installments Fixed Rate Promissory Notes Secured by Commercial Real Estate, having real estate as collateral can significantly enhance the security for lenders.