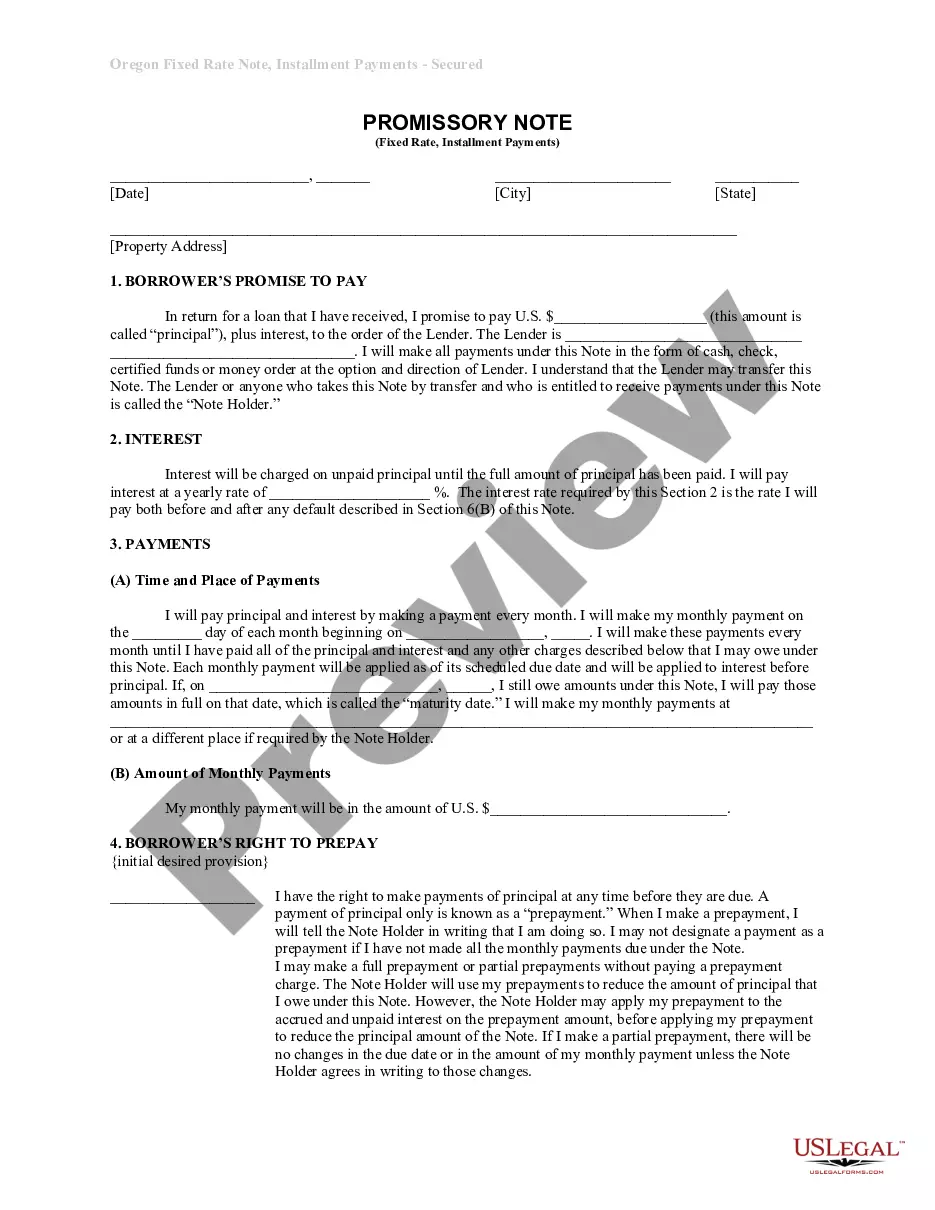

Eugene Oregon Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

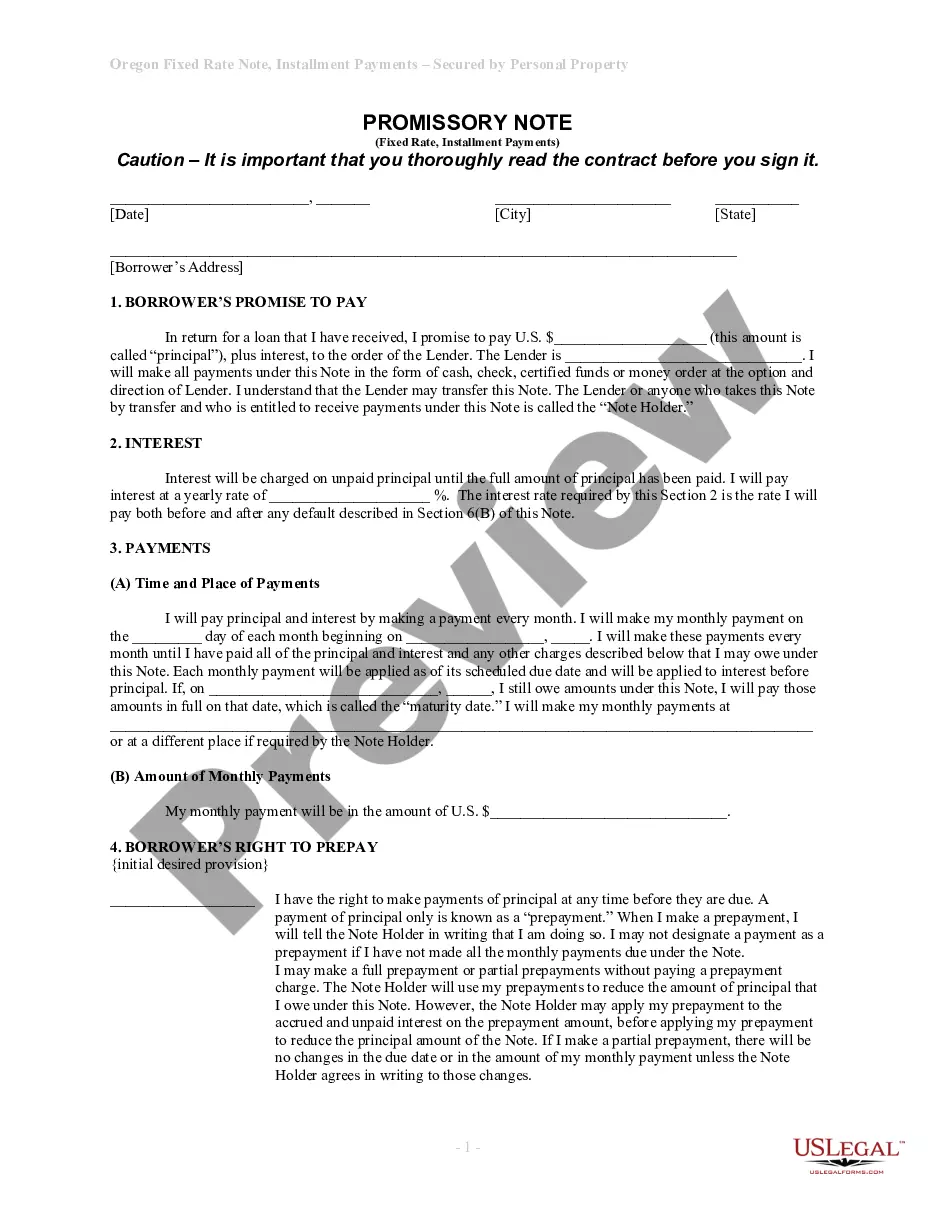

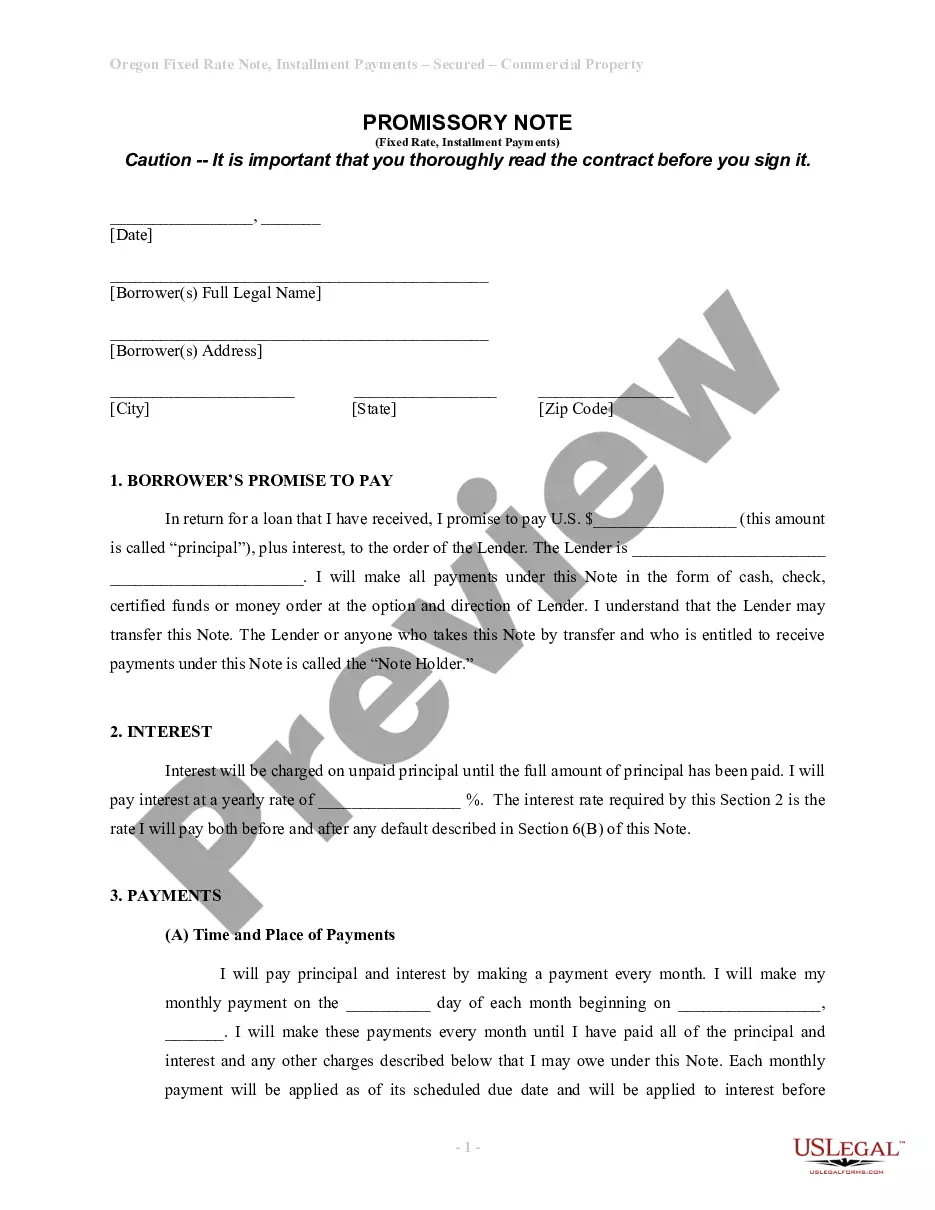

How to fill out Oregon Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

No matter your social or occupational standing, filling out legal documents is an unfortunate requirement in contemporary society.

Frequently, it's nearly unfeasible for an individual without legal education to draft this type of documentation from scratch, primarily due to the intricate language and legal nuances they encompass.

This is where US Legal Forms comes to the aid.

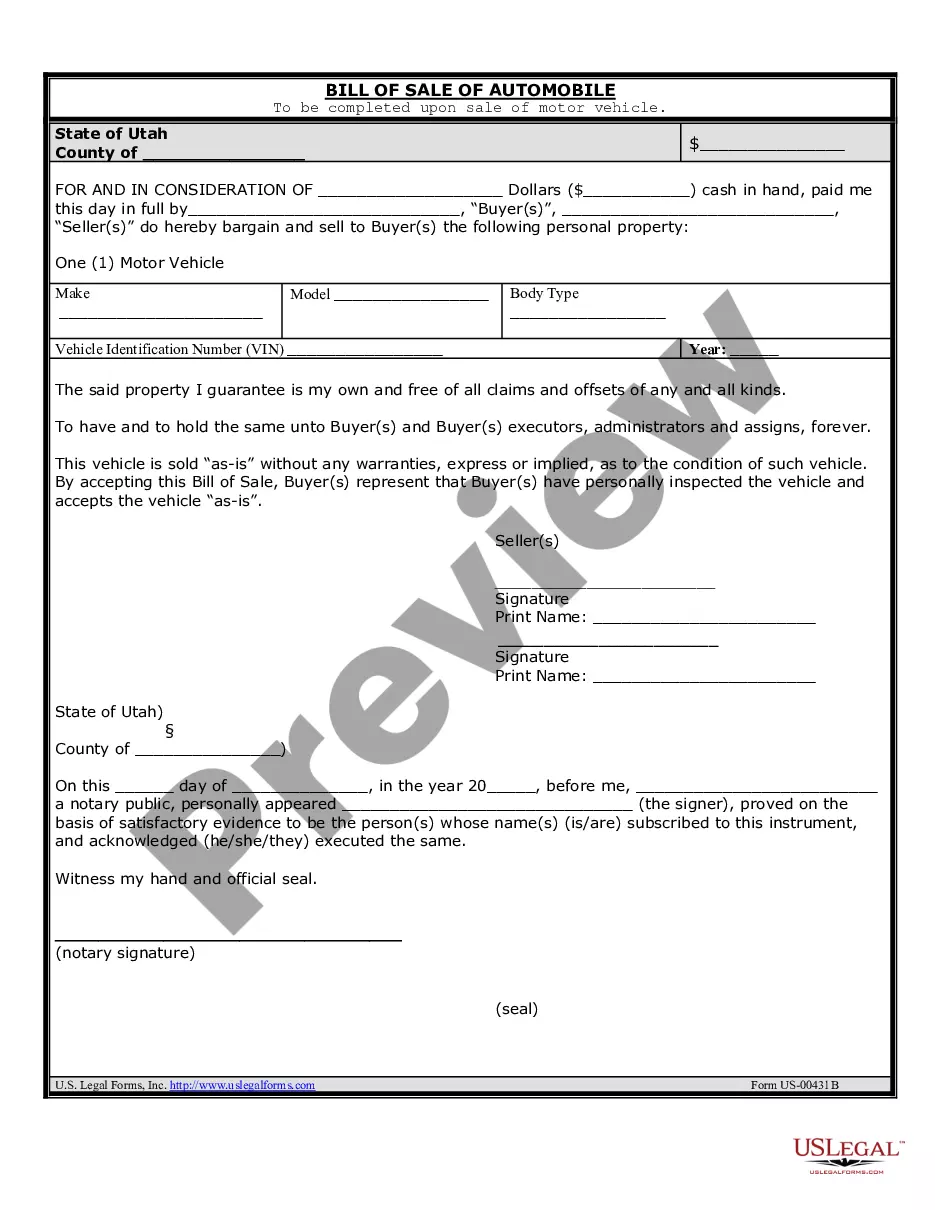

Confirm that the form you have located is tailored to your area since regulations of one state or locality do not apply to another.

Examine the form and review a brief description (if available) of scenarios for which the document can be utilized.

- Our service provides an extensive collection of more than 85,000 state-specific forms ready for use that cater to almost any legal situation.

- US Legal Forms is also an excellent resource for associates or legal advisors who aim to enhance their efficiency in terms of time using our DIY papers.

- Regardless of whether you need the Eugene Oregon Installments Fixed Rate Promissory Note Secured by Residential Real Estate or any other documentation suitable for your state or region, with US Legal Forms, everything is readily accessible.

- Here’s how to swiftly obtain the Eugene Oregon Installments Fixed Rate Promissory Note Secured by Residential Real Estate using our dependable service.

- If you are already a registered customer, merely Log In to your account to download the required form.

- If you are new to our library, ensure you follow these steps prior to downloading the Eugene Oregon Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

Form popularity

FAQ

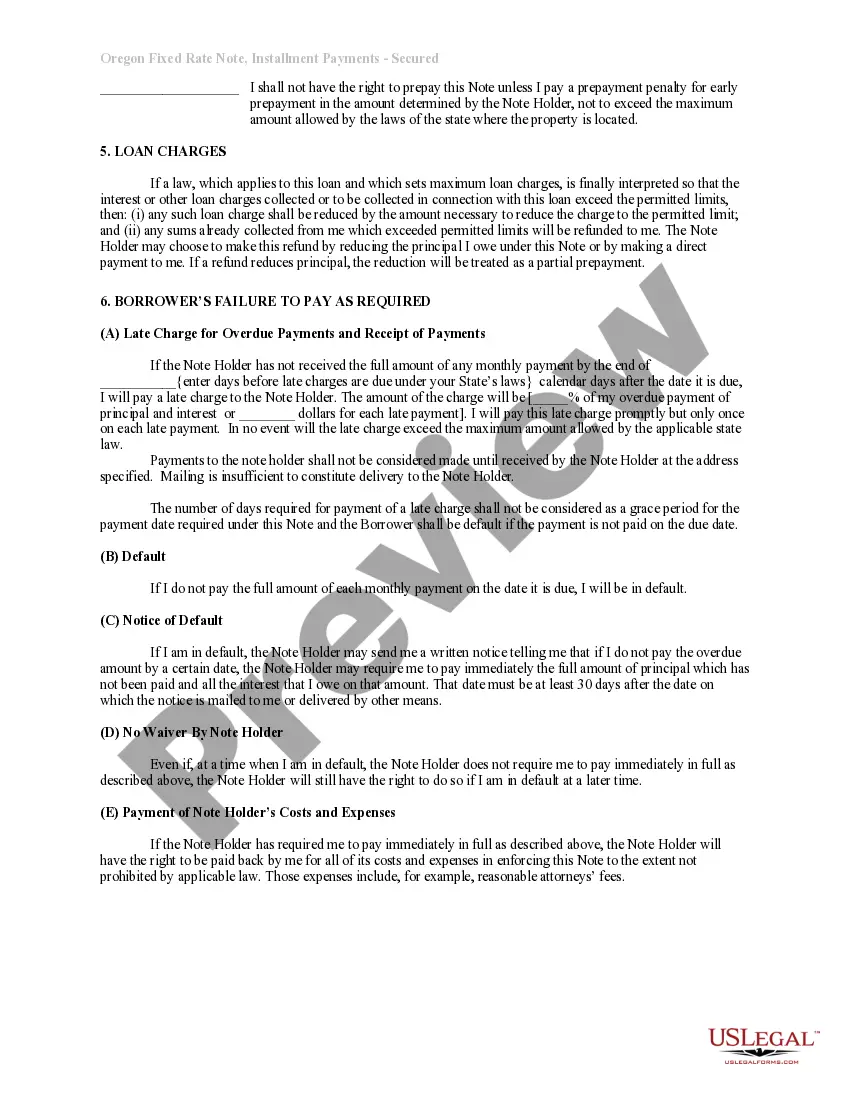

Yes, promissory notes can be backed by collateral, making them more secure. In the case of an Eugene Oregon Installments Fixed Rate Promissory Note Secured by Residential Real Estate, the residential property itself acts as collateral. This arrangement protects the lender, as they can claim the property if the borrower fails to make payments. Using platforms like uslegalforms can guide you in structuring these agreements correctly.

You can obtain a promissory note for your mortgage from various sources, including banks, credit unions, or online legal document providers like uslegalforms. These platforms often offer customizable templates for an Eugene Oregon Installments Fixed Rate Promissory Note Secured by Residential Real Estate. It's essential to use a note that complies with state laws, ensuring it serves its purpose effectively. Always review the document carefully to ensure it meets your needs.

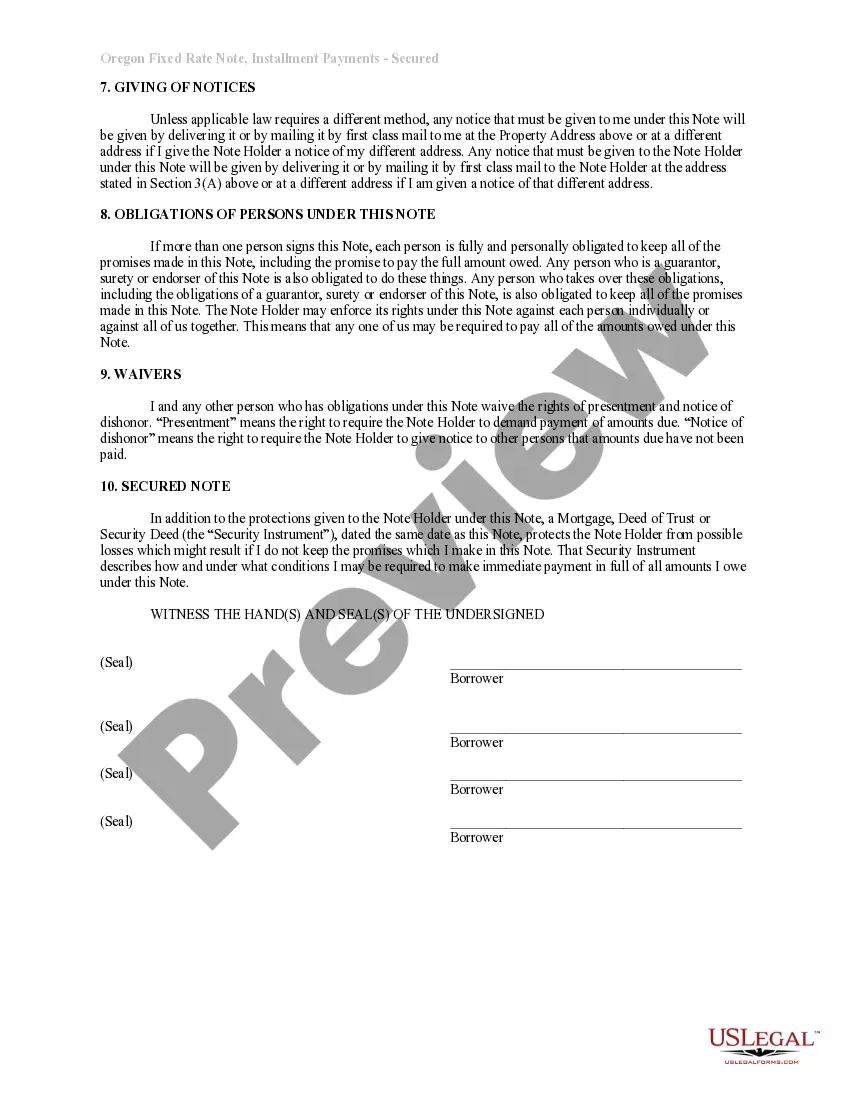

You typically do not file a promissory note with a specific authority; instead, you maintain it for your records. With the Eugene Oregon Installments Fixed Rate Promissory Note Secured by Residential Real Estate, it is essential to keep it accessible in case of future reference or disputes. Recording the note with the county recorder’s office is advisable for secured notes to establish a public record of your interest in the property.

Yes, a promissory note can be legal without notarization; however, enforcement may be more straightforward with a notarized document. For your Eugene Oregon Installments Fixed Rate Promissory Note Secured by Residential Real Estate, while notarization is not required, it can provide added security and help in proving the authenticity of the agreement. Its absence does not invalidate your note, but consideration of notarization is wise.

For a promissory note to be valid in Oregon, it must include certain essential elements. The note should clearly state the amount borrowed, the interest rate, the repayment terms, and the signatures of the involved parties. When creating your Eugene Oregon Installments Fixed Rate Promissory Note Secured by Residential Real Estate, ensure these terms are explicit to avoid misunderstandings or legal challenges.

An assignment of a promissory note in Oregon does not have to be notarized, but having it notarized can create stronger evidence of the transfer. Particularly regarding an Eugene Oregon Installments Fixed Rate Promissory Note Secured by Residential Real Estate, notarization may simplify future transactions involving the note. While it may not be legally required, it is often recommended for clarity and enforceability.

In Oregon, notarization of a promissory note is not legally required, including for the Eugene Oregon Installments Fixed Rate Promissory Note Secured by Residential Real Estate. However, having your note notarized adds an extra layer of authenticity and can make it easier to enforce in court if necessary. It provides a clear verification of identities involved in the agreement, which can be beneficial should any disputes arise.

When considering a Eugene Oregon Installments Fixed Rate Promissory Note Secured by Residential Real Estate, you should be aware of certain disadvantages. One potential issue is the risk of default; if the borrower fails to make payments, the lender may face challenges in recovering their investment. Additionally, this type of note can limit your liquidity, as it ties up capital in real estate, reducing immediate access to funds. Furthermore, the legal complexities involved in enforcing a promissory note may require you to seek professional help, which could add to your costs.

A promissory note may be considered invalid if it lacks essential details such as proper signatures, clear terms, or lawful consideration. Additionally, if it is not executed according to state laws, it may also be unenforceable. Ensure your Eugene Oregon Installments Fixed Rate Promissory Note Secured by Residential Real Estate meets all legal requirements to maintain its validity.