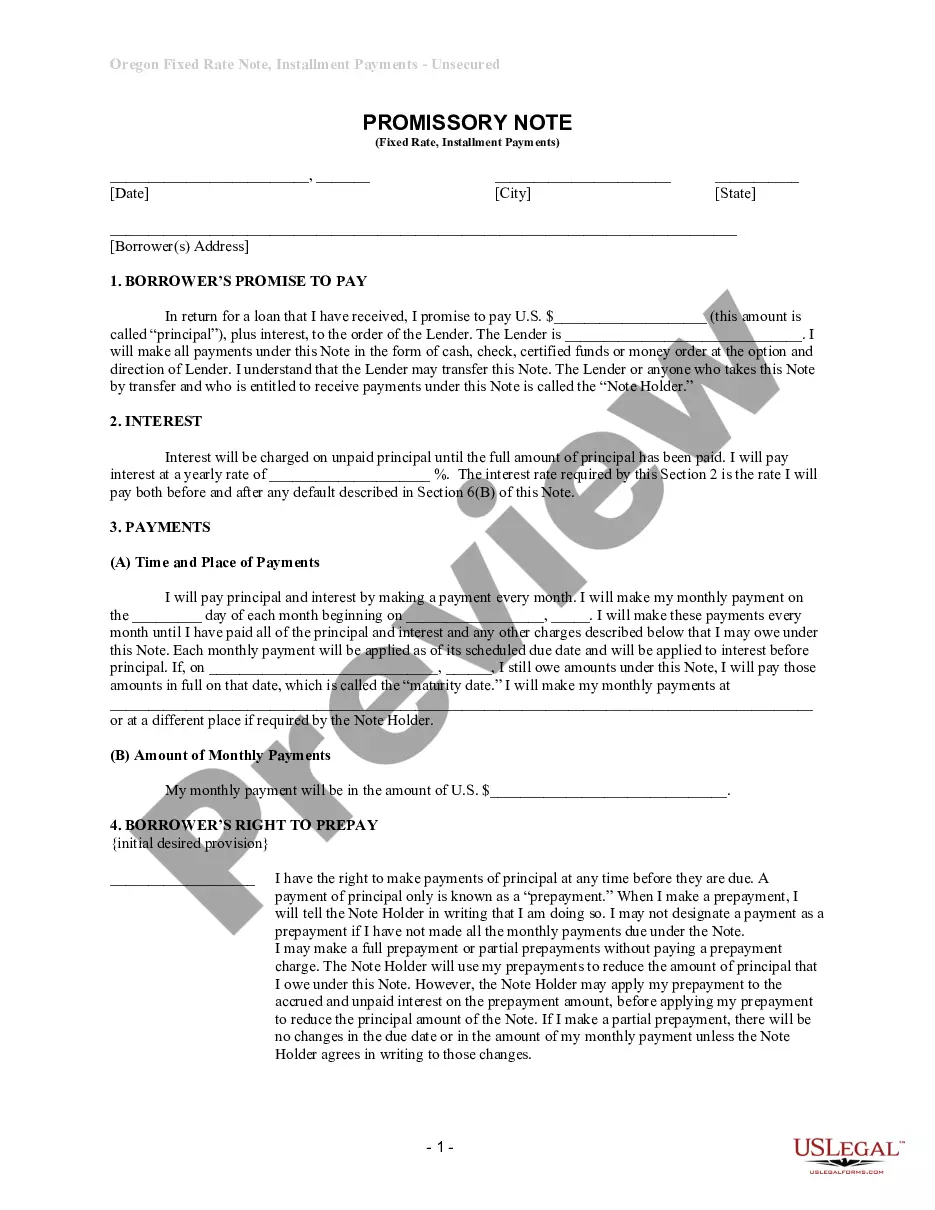

Bend Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out Oregon Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Regardless of an individual's social or career standing, completing legal documents is an unfortunate requirement in today's society.

Frequently, it’s virtually unfeasible for someone without legal training to construct such documents from scratch due to the complex language and legal intricacies involved.

This is where US Legal Forms can come to the rescue.

Confirm that the form you have located is appropriate for your region, as regulations vary from one state or area to another.

Examine the document and read a brief description (if available) of the scenarios the paper is applicable for.

- Our platform provides an extensive collection of over 85,000 state-specific documents, suitable for nearly any legal situation.

- US Legal Forms also serves as a valuable resource for associates or legal advisors looking to save time with our DIY papers.

- Whether you require the Bend Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate or any other document valid in your jurisdiction, everything is accessible with US Legal Forms.

- Here’s how to swiftly obtain the Bend Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate using our dependable platform.

- If you are already a customer, simply Log In to your account to retrieve the necessary form.

- If you are new to our library, ensure to follow these steps before downloading the Bend Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate.

Form popularity

FAQ

To fill out a sample promissory note, carefully read the template, and replace placeholder text with your specific details. Include the principal amount, interest rate, and any clauses related to late payments or defaults. A well-finished Bend Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate will clearly reflect the terms of your agreement. Consider using uslegalforms for reliable samples.

A promissory note typically includes the principal amount, interest rate, payment schedule, and terms of repayment. It also includes the names of the borrower and lender, and it may require signatures from both parties. When crafting a Bend Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, keep these elements in mind to ensure clarity and enforceability. Using a platform like uslegalforms can help streamline the process.

You typically file a promissory note in the county recorder's office where the property is located. For a Bend Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, ensure you submit the document with the correct legal description of the property. Filing helps establish the note's validity and protects your rights as a lender. Using resources like USLegalForms can simplify this process, providing you with the necessary forms and guidance for proper filing.

Several factors can make a promissory note invalid in real estate, including lack of proper signatures, missing essential details, or violation of local laws. If the note does not comply with state regulations or lacks necessary witnesses, it can be rendered void. To avoid these pitfalls, consider using reliable services like US Legal Forms when drafting a Bend Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate.

A promissory note can absolutely be secured by real property. This arrangement often enhances the lender's position, as the property serves as a form of assurance in case of default. With the Bend Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, investors can find more flexible financing options tailored to their needs.

To secure a promissory note with real property, you generally need to create a mortgage or deed of trust that outlines the pledge of the property as collateral. This involves filing the necessary documentation with local authorities to make the lien enforceable. The Bend Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate can streamline this process, giving you peace of mind.

The biggest problem in commercial real estate often involves financing options. Investors frequently encounter challenges when securing favorable terms that align with their business goals. The Bend Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate offers a reliable solution, allowing borrowers to obtain the necessary capital while ensuring stability in their payments.

Several banks are known for holding a significant volume of commercial real estate loans, including JPMorgan Chase, Wells Fargo, and Bank of America. These institutions often provide various financing options for businesses seeking to invest in commercial property. Exploring financing through these banks can provide useful capital for acquiring a Bend Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate.

Notarization is not always required for a secured promissory note, but it is highly recommended. Having the document notarized can add an extra layer of verification and authenticity. For your Bend Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, notarization can help reassure all parties involved that the document is valid and binding.

To create a secured promissory note, start by defining the terms of repayment and interest. Clearly identify the secured commercial real estate and include clauses that outline consequences for non-payment. Utilizing a platform like uslegalforms can streamline the process of drafting a Bend Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, ensuring all necessary components are included.