Bend Oregon Unsecured Installment Payment Promissory Note for Fixed Rate

Description

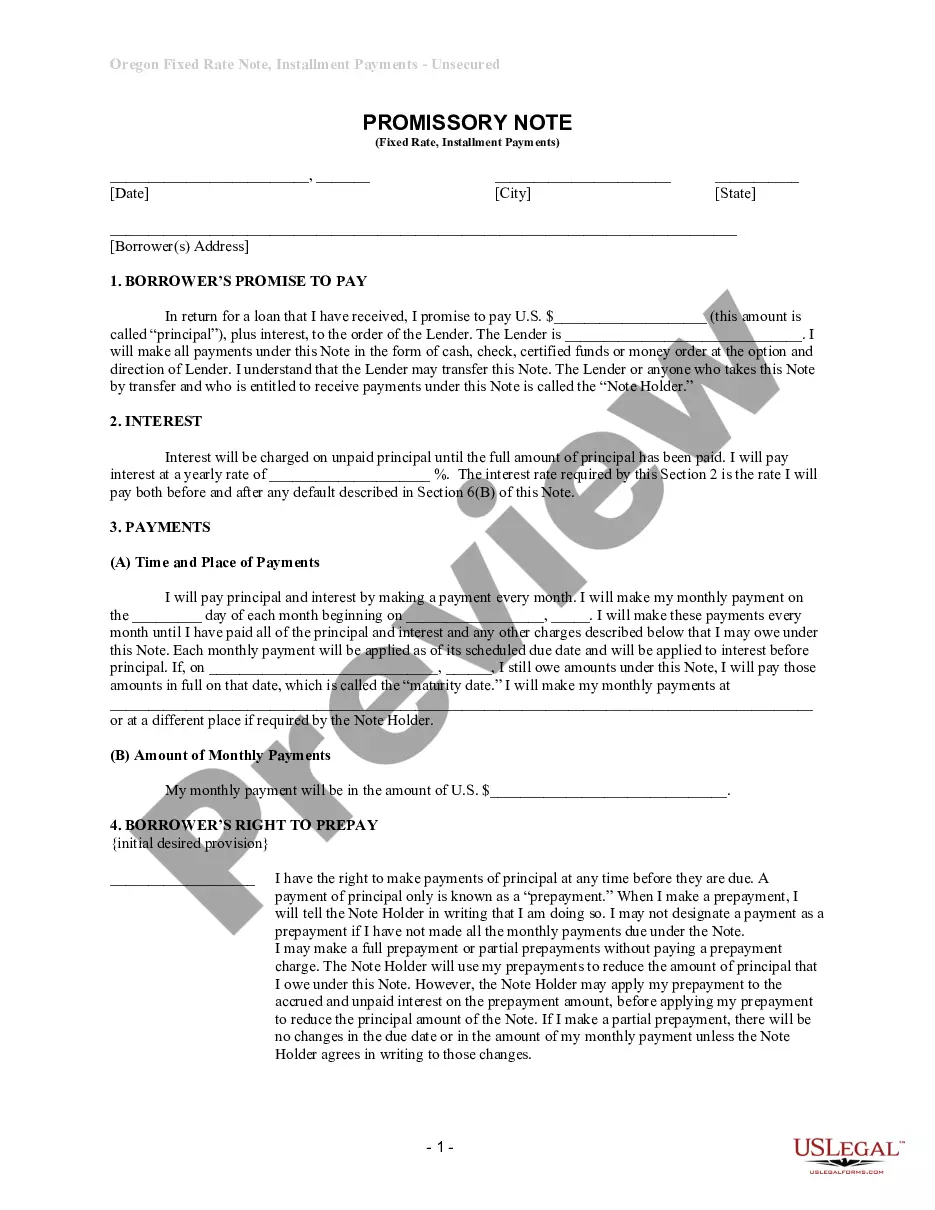

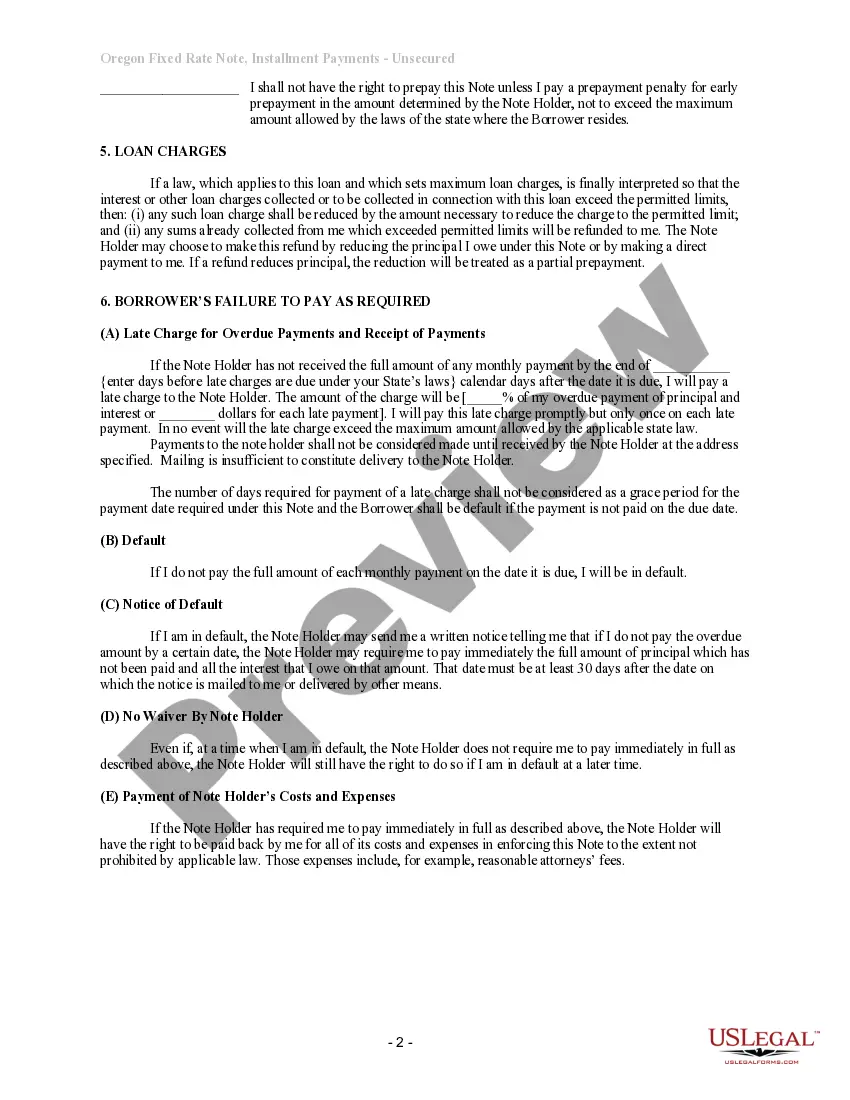

How to fill out Oregon Unsecured Installment Payment Promissory Note For Fixed Rate?

Obtaining validated templates tailored to your local regulations can be difficult unless you utilize the US Legal Forms repository.

It’s an online collection of over 85,000 legal documents for both personal and professional requirements and various real-life situations.

All the files are accurately categorized by area of use and jurisdiction sectors, so finding the Bend Oregon Unsecured Installment Payment Promissory Note for Fixed Rate becomes as simple as 123.

Maintaining documentation organized and in compliance with the law is crucial. Leverage the US Legal Forms library to always have essential document templates for any requirements right at your fingertips!

- Examine the Preview mode and form description.

- Ensure you’ve selected the correct one that satisfies your needs and aligns with your local jurisdiction criteria.

- Search for another template, if necessary.

- Once you notice any discrepancies, utilize the Search tab above to find the appropriate one. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

To obtain a Bend Oregon Unsecured Installment Payment Promissory Note for Fixed Rate, you can work with financial institutions, private lenders, or legal platforms like uslegalforms. These services offer templates and guidance to help you create or obtain a legally sound promissory note that meets your specific needs. Alternatively, you can contact a legal professional for personalized assistance.

The fair value of a Bend Oregon Unsecured Installment Payment Promissory Note for Fixed Rate typically reflects the amount due at maturity minus any discounts for risk and time. This value can fluctuate based on market conditions and the creditworthiness of the borrower. To determine an accurate fair value, consider factors such as interest rates, repayment terms, and overall demand in the market.

The reasonable interest rate for a promissory note can vary based on several factors, including the borrower's creditworthiness and current market conditions. Generally, you might find rates ranging from 5% to 15%. For a Bend Oregon Unsecured Installment Payment Promissory Note for Fixed Rate, you can explore competitive rates that align with your financial goals. Always compare different offers to ensure you secure the best possible terms for your situation.

When reporting a promissory note on your taxes, you may need to declare the interest earned as income. Keep records of the payments received throughout the year, as these may impact your tax obligations. If you have a Bend Oregon Unsecured Installment Payment Promissory Note for Fixed Rate, ensuring accurate records will help you comply with tax regulations.

To record a promissory note payment, maintain a clear ledger or record that details each payment made. Include the date, amount, and remaining balance after each transaction. Using a structured format can simplify tracking, especially for a Bend Oregon Unsecured Installment Payment Promissory Note for Fixed Rate, where regular payments and interest calculations are involved.

Yes, a handwritten promissory note can be legal and enforceable as long as it meets specific criteria. It should clearly outline the terms, include signatures from both parties, and state the amount owed. For a Bend Oregon Unsecured Installment Payment Promissory Note for Fixed Rate, it is advisable to include all crucial details to avoid any disputes in the future.

To write a promissory note for payment, start by including the date, names of the parties involved, and the amount owed. Clearly state the repayment terms, including the number of installments and interest rate. For a Bend Oregon Unsecured Installment Payment Promissory Note for Fixed Rate, be sure to specify a fixed interest rate to ensure clarity in repayment expectations.

An installment note and a promissory note are similar, but not identical. An installment note includes specific payment terms, typically with multiple payments over time, while a promissory note can be a single payment or structured similarly. When discussing a Bend Oregon Unsecured Installment Payment Promissory Note for Fixed Rate, you will often find it includes provisions for scheduled payments and interest rates.

Filling out a promissory note sample involves entering relevant details into each section of the note. Begin with the date, then enter the lender's name followed by the borrower's name. Provide the dollar amount, interest rate, and a clear repayment outline for your Bend Oregon Unsecured Installment Payment Promissory Note for Fixed Rate. Always double-check your entries for accuracy before signing.

A promissory note generally includes the date, the names of the borrower and lender, the amount borrowed, the interest rate, and the repayment terms. In the case of a Bend Oregon Unsecured Installment Payment Promissory Note for Fixed Rate, these elements must be clearly defined to avoid confusion. Additionally, the document should include a signature line for both parties. Having a proper format not only ensures clarity but also enhances the note's enforceability.