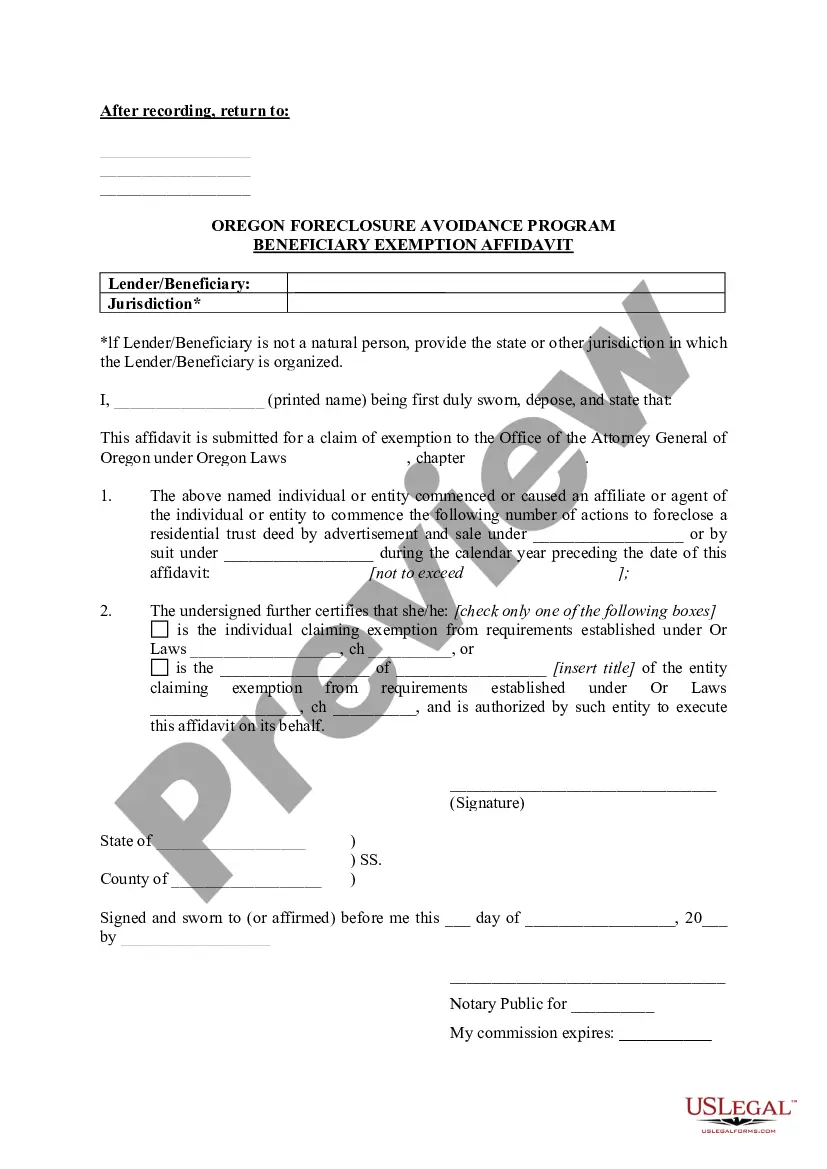

The Hillsboro Oregon Foreclosure Avoidance Program is a government initiative aimed at providing assistance to homeowners facing foreclosure in Hillsboro, Oregon. This program offers various resources and solutions to help individuals prevent the loss of their homes. Here are the different types of Hillsboro Oregon Foreclosure Avoidance Programs available: 1. Loan Modification: This program aims to modify the terms of the existing mortgage to make it more affordable for homeowners. It may involve lowering the interest rate, extending the loan term, or reducing the principal balance. 2. Repayment Plan: Homeowners who have fallen behind on their mortgage payments may be eligible for a repayment plan. This option allows them to catch up on missed payments over an extended period while keeping their home. 3. Short Sale: In certain circumstances, homeowners may qualify for a short sale, where the property is sold for less than what is owed on the mortgage. The program helps negotiate with lenders and facilitates the sale to minimize financial damage for the homeowner. 4. Deed in Lieu of Foreclosure: Homeowners facing imminent foreclosure may consider voluntarily transferring ownership of the property to the lender to avoid the foreclosure process. The program assists in negotiating a favorable agreement between the homeowner and the lender. 5. Foreclosure Mediation: This program provides homeowners with the opportunity to participate in mediation sessions with their lenders to find a mutually beneficial solution and potentially halt the foreclosure process. The Hillsboro Oregon Foreclosure Avoidance Program is designed to support homeowners in distress, ensuring that they have access to the necessary resources and guidance to explore alternatives to foreclosure. By utilizing these programs, homeowners can take proactive measures to resolve their mortgage payment challenges and preserve their homes. Assistance is available through government agencies, housing counseling organizations, and legal aid services, all aimed at helping homeowners through these difficult times. If you are facing foreclosure in Hillsboro, Oregon, it is strongly recommended reaching out to these programs and professionals who can guide you towards effective solutions to avoid foreclosure and secure your housing stability.

Hillsboro Oregon Foreclosure Avoidance Program Beneficiary Exemption Affidavit

Description

How to fill out Oregon Foreclosure Avoidance Program Beneficiary Exemption Affidavit?

Locating authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms repository. It’s an online collection of over 85,000 legal documents catering to both personal and professional requirements as well as various real-world scenarios.

For those already familiar with our inventory and have previously used it, obtaining the Hillsboro Oregon Foreclosure Avoidance Program takes merely a few clicks. All you have to do is Log In to your account, select the document, and click Download to save it to your device. New users will need to complete a few additional steps to finalize the process.

Follow the instructions below to begin using the most comprehensive online document collection.

Maintaining documentation organized and in compliance with legal standards is of utmost significance. Leverage the US Legal Forms library to always have essential document templates readily available for any requirements!

- Examine the Preview mode and document description. Ensure you’ve selected the right one that fulfills your needs and aligns completely with your local jurisdiction requirements.

- Search for an alternative template, if necessary. If you find any discrepancies, use the Search tab above to locate the correct one. If it meets your needs, proceed to the next step.

- Purchase the document. Click on the Buy Now button and choose your preferred subscription plan. You will need to create an account to gain access to the library’s resources.

- Complete your purchase. Enter your credit card information or utilize your PayPal account to settle the transaction.

- Download the Hillsboro Oregon Foreclosure Avoidance Program. Store the template on your device for further completion and access it in the My documents section of your profile whenever you need it again.

Form popularity

FAQ

The 120 day rule for foreclosure mandates that lenders must wait at least 120 days after a homeowner misses their first mortgage payment before initiating foreclosure proceedings. This rule gives homeowners an opportunity to explore options to remedy their situation, such as the Hillsboro Oregon Foreclosure Avoidance Program Beneficiary Exemption Affidavit. During this period, homeowners can seek assistance from financial advisors or legal experts to help negotiate with lenders. Utilizing services from US Legal Forms can equip you with necessary documents and guidance during this critical window.

Homeowners facing foreclosure can take proactive steps to stop the process by engaging in programs such as the Hillsboro Oregon Foreclosure Avoidance Program Beneficiary Exemption Affidavit. Additionally, attorneys, housing counselors, and financial advisors can provide vital support in stopping foreclosure. They help homeowners understand their rights and explore options to negotiate with creditors, potentially leading to a positive resolution. You can also utilize resources available through platforms like US Legal Forms for assistance.

The foreclosure process in Oregon can typically take anywhere from six months to over a year, depending on various factors involved. This timeframe is influenced by the type of foreclosure and any potential legal challenges. Homeowners participating in the Hillsboro Oregon Foreclosure Avoidance Program may find ways to extend this timeline as they seek alternatives to mitigate the situation. Understanding this timeline is crucial for homeowners facing financial difficulties.

Banks and other lenders typically use a trust deed. A trust deed can be foreclosed by a lawsuit in the circuit court of the county where the property is located. This type of foreclosure is referred to as a judicial foreclosure and is now common for residential loans in Oregon.

After the sale, the owner has 180 days to buy the property back from the purchaser for an amount equal to the auction price paid, plus interest and anything the purchaser had to pay for such items as taxes and maintenance. This is known as a right of redemption.

Judicial foreclosures, in which the lender files a lawsuit in court, are also possible in Oregon. No redemption period following a nonjudicial foreclosure in Oregon. In Oregon, there is no redemption period after a nonjudicial foreclosure.

SALEM, ORE. ? The foreclosure moratorium in Oregon will end this week on Dec. 31, 2021. The moratorium was established to prevent foreclosures for those who lost income or were unable to pay their mortgage as a result of the COVID-19 pandemic.

In general, mortgage companies start foreclosure processes about 3-6 months after the first missed mortgage payment. Late fees are charged after 10-15 days, however, most mortgage companies recognize that homeowners may be facing short-term financial hardships.

Again, most residential foreclosures in Oregon are nonjudicial. Here's how the process works. Before filing a notice of default, the lender provides you (the borrower) with notice about participating in a resolution conference (mediation).

How Can I Stop a Foreclosure in Oregon? A few potential ways to stop a foreclosure include reinstating the loan, redeeming the property before the sale, or filing for bankruptcy. (Of course, if you're able to work out a loss mitigation option, like a loan modification, that will also stop a foreclosure.)