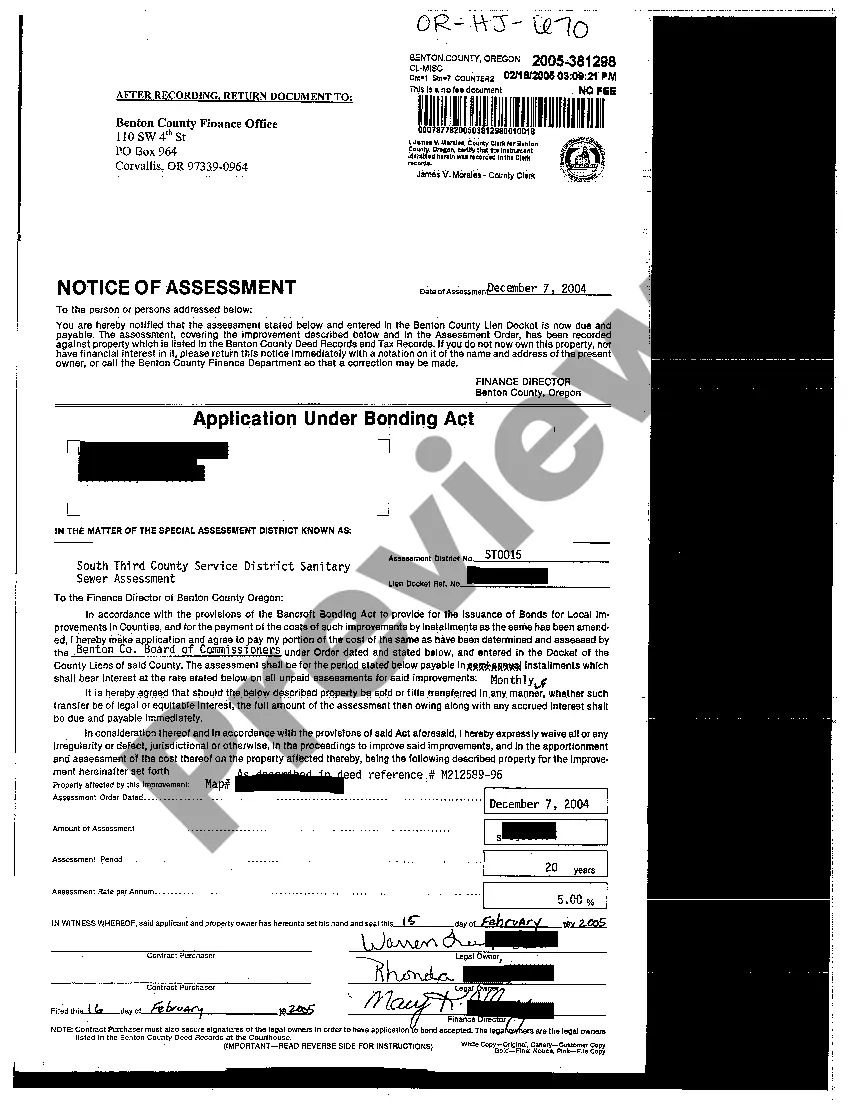

Eugene Oregon Notice of Assessment for County Improvements is a document issued by the county government to inform property owners about the assessment value of their properties. This notice is a significant part of the property tax assessment process and provides detailed information about the property's assessed value, any changes made to the assessment, and the resulting tax liabilities. When it comes to County Improvements, there are several types of Eugene Oregon Notice of Assessment that property owners may encounter: 1. Land Improvements Assessment: This notice specifically focuses on any enhancements or modifications made to the land associated with the property. It includes improvements such as landscaping, drainage systems, irrigation, or any other modifications performed on the land to enhance its value. 2. Building Improvements Assessment: This particular notice deals with any changes, additions, or repairs done to the structures or buildings on the property. It encompasses modifications like renovations, expansions, or the addition of new amenities that increase the overall value of the property. 3. Infrastructure Improvements Assessment: The infrastructure notice of assessment pertains to improvements made to public infrastructure near the property, such as roads, sidewalks, water supply, sewage systems, or any other communal enhancements that positively impact the property's value. 4. Environmental or Sustainability Improvements Assessment: This notice focuses on any eco-friendly or sustainable improvements made to the property. It includes upgrades like renewable energy installations (solar panels, wind turbines), energy-efficient systems, water conservation measures, or any environmental initiatives that aim to reduce the property's carbon footprint. The Eugene Oregon Notice of Assessment for County Improvements is essential to property owners as it determines the property taxes that they will be required to pay based on the assessed value. By providing accurate and detailed information about the assessment and any modifications made, property owners can review and understand their tax obligations and take appropriate measures if they wish to appeal the assessment. It is crucial for property owners to thoroughly examine the notice and seek clarification from the county authorities if they have any queries or concerns regarding the assessment calculation or the improvements made on the property.

Eugene Oregon Notice of Assessment for County Improvements

Description

How to fill out Eugene Oregon Notice Of Assessment For County Improvements?

If you are looking for an authentic form template, it’s incredibly challenging to select a superior service compared to the US Legal Forms website – one of the most extensive repositories on the web.

Here you can discover countless document samples for organizational and personal use by category and location, or key terms.

With our enhanced search feature, finding the latest Eugene Oregon Notice of Assessment for County Improvements is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finish the registration process.

Obtain the form. Select the format and download it to your device. Edit the document. Fill out, modify, print, and sign the acquired Eugene Oregon Notice of Assessment for County Improvements.

- Additionally, the validity of each document is verified by a team of qualified attorneys who frequently review the templates on our website and update them according to the most recent state and county laws.

- If you are already familiar with our system and possess a registered account, all you must do to access the Eugene Oregon Notice of Assessment for County Improvements is to Log In to your account and click the Download button.

- If this is your first time using US Legal Forms, simply adhere to the instructions below.

- Ensure you have opened the form you need. Review its description and utilize the Preview function to verify its contents. If it does not fulfill your requirements, use the Search field at the top of the page to locate the correct document.

- Validate your choice. Click the Buy now button. After that, choose your desired subscription plan and provide your information to register for an account.

Form popularity

FAQ

Oregon assesses property value based on several factors, including recent sales, property location, and improvements made. The Eugene Oregon Notice of Assessment for County Improvements reflects these considerations by using comparable market data. Assessors analyze both the physical characteristics and economic factors to ensure a fair valuation. Understanding the assessment process can help you better prepare for any changes in your property tax.

In Oregon, there is no specific age at which you automatically stop paying property tax. However, seniors may qualify for special programs that provide exemptions or deferrals on taxes, including those related to the Eugene Oregon Notice of Assessment for County Improvements. Eligibility usually depends on income and age. It's essential to consult your local taxing authority to explore available options.

Yes, in Oregon, tax assessors have the right to enter your property to perform assessments. They must adhere to privacy laws and notify homeowners about scheduled visits, particularly related to the Eugene Oregon Notice of Assessment for County Improvements. This process ensures that property values reflect accurate characteristics and improvements. If you have concerns about a property visit, it's best to contact your local assessor.

A property tax assessment aims for accuracy, reflecting current market values based on comparable properties. The Eugene Oregon Notice of Assessment for County Improvements typically undergoes regular reviews to maintain fairness and consistency. However, discrepancies may arise, and homeowners are encouraged to verify their assessments and seek a review if they find errors. Understanding your assessment helps you manage your property tax obligations effectively.

The assessment process in Oregon falls under the jurisdiction of the county assessor. This official is responsible for determining property values, including the Eugene Oregon Notice of Assessment for County Improvements. They ensure that assessments comply with state laws and regulations. To stay informed about your assessment, reach out to your local assessor's office.

Typically, the assessed value in Oregon is about 90% of the property's real market value, although this percentage can vary with each property and locality. The Eugene Oregon Notice of Assessment for County Improvements will highlight this relationship, helping you understand how your property value translates into your taxes. Knowing this percentage aids property owners in financial planning and tax obligations.

In Oregon, assessed value is calculated based on the real market value of your property, considering any recent sales data and improvements made. Additionally, local jurisdictions may apply specific formulas to adjust this figure, influencing how the Eugene Oregon Notice of Assessment for County Improvements is framed. Property owners can access this information through county assessor offices for transparency.

In Oregon, the assessed value is determined by applying specific factors such as the property's market value and various exclusions or limitations set by state law. The process also considers local improvements and any applicable tax measures, which means the Eugene Oregon Notice of Assessment for County Improvements becomes crucial for understanding how your property's value may be calculated. This assessment process aims to maintain equity among property owners.

The maximum assessed property value is generally determined using the property's real market value, which reflects its worth in the current real estate market. Additionally, local regulations and rules may play a role in limiting the assessed value for purposes like the Eugene Oregon Notice of Assessment for County Improvements. This process ensures that property assessments remain fair and consistent over time.

Oregon does tax seniors, but there are programs available to help reduce their overall tax burden. Seniors may qualify for property tax relief or deferral programs that make payments more manageable. When you review the Eugene Oregon Notice of Assessment for County Improvements, you may find helpful information regarding available programs. Recording your eligibility can provide significant financial benefits.