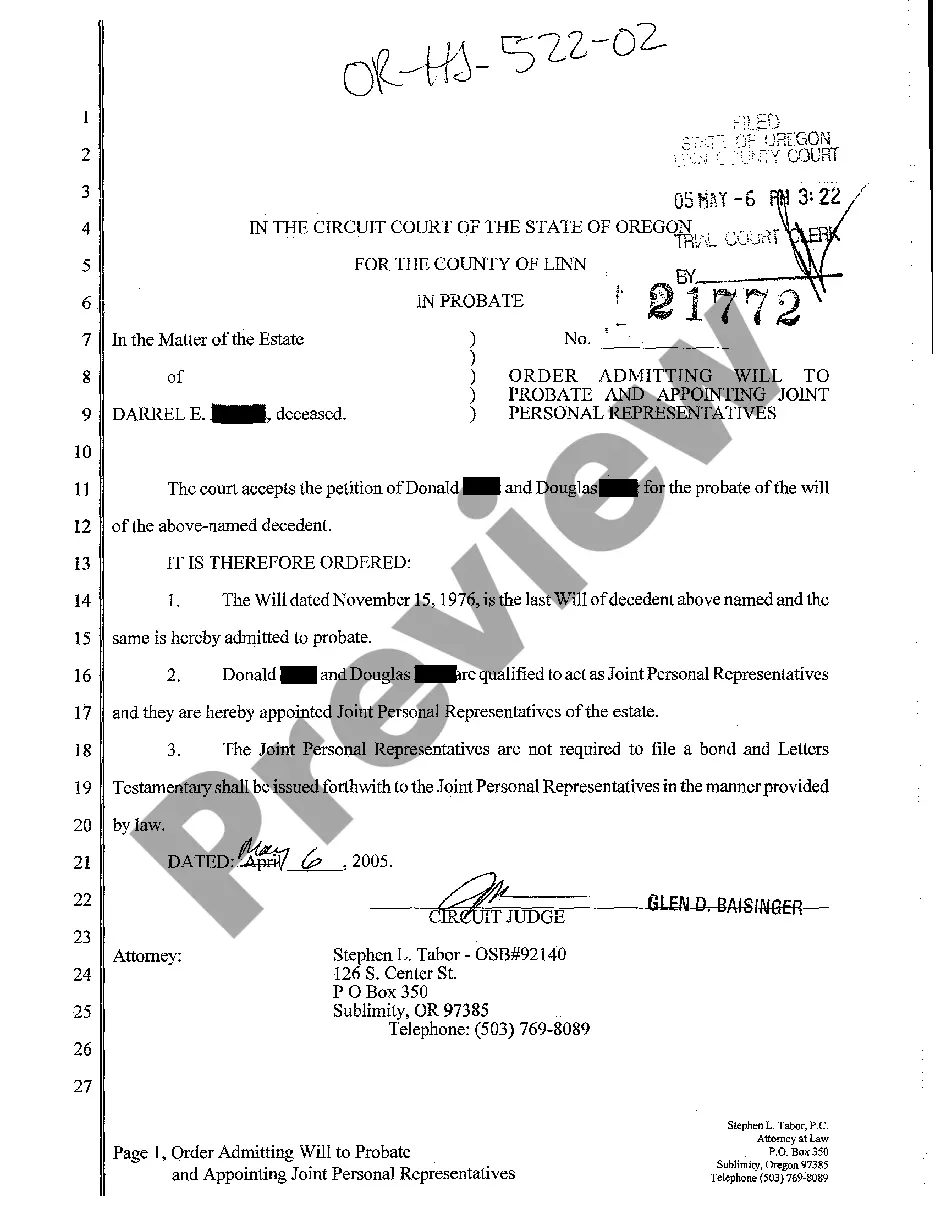

Portland Oregon Order Admitting Will to Probate and Appointing Joint Personal Representatives

Description

How to fill out Portland Oregon Order Admitting Will To Probate And Appointing Joint Personal Representatives?

We constantly endeavor to reduce or evade legal repercussions when handling intricate legal or financial issues. To achieve this, we enlist legal representation services that are generally quite costly.

Nonetheless, not every legal predicament is equally convoluted. The majority can be managed independently.

US Legal Forms is a web-based directory of revised self-service legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our repository empowers you to manage your affairs without resorting to a lawyer.

We offer access to legal document templates that aren’t universally available. Our templates are specific to states and regions, which greatly eases the search process.

You can set up your account in a matter of minutes.

- Take advantage of US Legal Forms when you need to locate and securely download the Portland Oregon Order Admitting Will to Probate and Appointing Joint Personal Representatives or any other form quickly.

- Just Log In to your account and select the Get button adjacent to it.

- If you happen to misplace the document, you can readily download it again from within the My documents section.

- The procedure is just as simple if you’re not accustomed to the website!

Form popularity

FAQ

In Oregon, you must be at least 18 years old and of sound mind to make a will. If you are married or emancipated, you can make a will before you turn 18. Your will must be in writing and must be signed by you and two witnesses. Some people cannot serve as witnesses to your will.

Under Oregon inheritance laws, If you have a spouse but no descendants (children, grandchildren), your spouse will inherit everything. If you have children but no spouse, your children will inherit everything. If you have a spouse and descendants (with that spouse), your spouse inherits everything.

A personal representative is a person, appointed by will or the court, to administer the decedent's estate.

Expect probate to take at least 5 months The estate's PR sends written notifications to any heirs or other persons named in the will. The PR also works to identify and value all estate assets, then files an inventory with the court. Five months can be sufficient to settle a small, straightforward estate.

You must petition the probate court to admit any will to probate and to appoint you as the personal representative. The petition contains some basic background information of the decedent and this information is described in ORS 113.035 -Petition for appointment of personal representative and probate of will.

Each spouse needs a separate Will. In a Will, you are stating your wishes regarding how you'd like your property distributed. Your right to control the distribution of assets after your death is an unalienable right; in other words, these decisions cannot be made by your spouse on your behalf.

As per the law, the joint assets are owned by both individuals hence both individuals i.e. husband & wife should make a Will ? either two separate Wills or one single Joint Will.

Do All Estates Have to Go Through Probate in Oregon? All estates must go through probate unless they meet one of the few exceptions. However, some estates may qualify for a simplified version or probate that is less complicated and time-consuming. It is known as a small estate proceeding.

Under Oregon statute, the personal representative gets a percentage of the value of the assets. This percentage decreases as the value of the assets increases. For the 1st $1000, the personal representative gets 7% or $70. For the next $9000, the personal representative gets 4% or $360.

There is no need for probate or letters of administration unless there are other assets that are not jointly owned. The property might have a mortgage. However, if the partners are tenants in common, the surviving partner does not automatically inherit the other person's share.