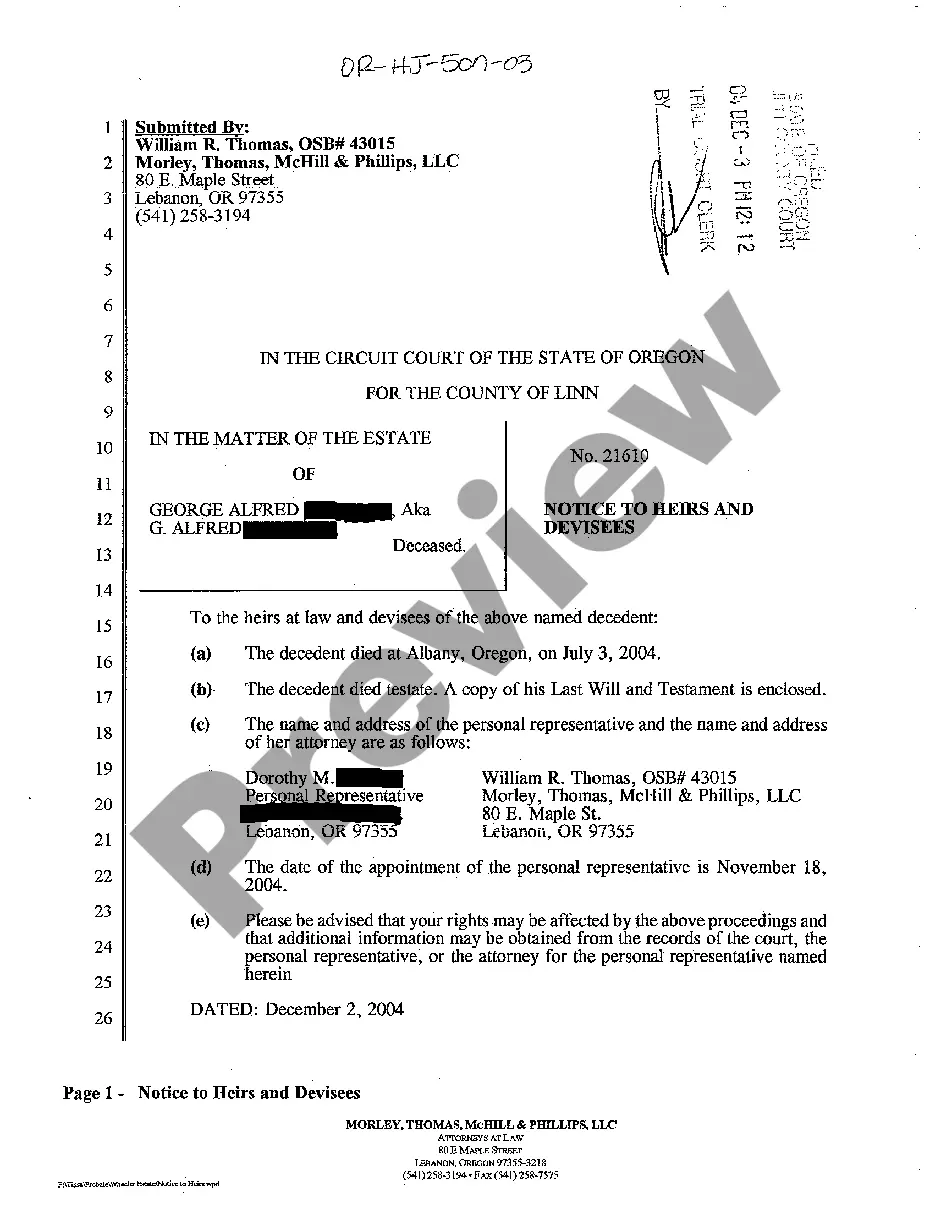

Portland Oregon Notice to Heirs and Devisees

Description

How to fill out Oregon Notice To Heirs And Devisees?

If you are looking for a legitimate form template, it’s quite challenging to find a superior service than the US Legal Forms website – one of the largest online collections.

With this collection, you can locate a vast array of templates for business and personal use categorized by type and location, or keywords.

With the exceptional search functionality, locating the latest Portland Oregon Notice to Heirs and Devisees is as straightforward as 1-2-3.

Process the payment. Use your credit card or PayPal account to finalize the registration process.

Acquire the template. Choose the format and save it on your device. Edit as needed. Complete, modify, print, and sign the acquired Portland Oregon Notice to Heirs and Devisees.

- Additionally, the accuracy of each document is verified by a team of qualified attorneys who frequently review the templates on our site and refresh them according to the latest state and county regulations.

- If you are already familiar with our platform and have a registered account, all you must do to obtain the Portland Oregon Notice to Heirs and Devisees is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, just adhere to the steps outlined below.

- Ensure you have located the document you require. Review its details and utilize the Preview function (if available) to check its contents. If it doesn't meet your requirements, utilize the Search bar at the top of the page to find the desired document.

- Validate your selection. Click the Buy now option. After that, choose your preferred subscription plan and provide the necessary information to create an account.

Form popularity

FAQ

Executors' year However, many beneficiaries don't realise that executors and administrators have twelve months before they are obliged to distribute the estate to the beneficiaries. Time runs from the date of death.

There is no time limit in applying for Probate. Unlike some legal processes, such as applying for compensation, your application will not be disqualified because it is late. Nor will you be penalised or fined for late application. However, this does not mean that delay is necessarily safe.

How Long Does Probate in Oregon Take? The timeline for probate can vary, but it will last at least four months because creditors must have time to file a claim against the estate.

Expect probate to take at least 5 months The estate's PR sends written notifications to any heirs or other persons named in the will. The PR also works to identify and value all estate assets, then files an inventory with the court. Five months can be sufficient to settle a small, straightforward estate.

Under Oregon inheritance laws, If you have a spouse but no descendants (children, grandchildren), your spouse will inherit everything. If you have children but no spouse, your children will inherit everything. If you have a spouse and descendants (with that spouse), your spouse inherits everything.

Under Oregon inheritance laws, If you have a spouse but no descendants (children, grandchildren), your spouse will inherit everything. If you have children but no spouse, your children will inherit everything. If you have a spouse and descendants (with that spouse), your spouse inherits everything.

Dying Without a Will in Oregon The court then follows intestate succession laws to determine who inherits your property and how much of it they get. Since there is no will to nominate an executor, the court appoints someone, usually a surviving spouse or an adult child, to be the executor of the decedent's will.

What to Do When a Loved One Dies in Oregon Step one ? Protect the Decedent's Property. If the deceased person owned any property, whether real property, vehicles, or personal items, the best thing to do is to consider that property frozen in time.Step Two ? Contact an Experienced Estate Lawyer.

In Oregon, the law states that the executor's compensation is based on the following: Probate property, including income and gains: (A) Seven percent of any sum not exceeding $1,000. (B) Four percent of all above $1,000 and not exceeding $10,000.

The order of the hierarchy starts with your spouse (if you are married), then your children, your grandchildren, your parents, your siblings, aunts and uncles, cousins, and so on. If you have absolutely no surviving relatives, the State of Oregon inherits from you.