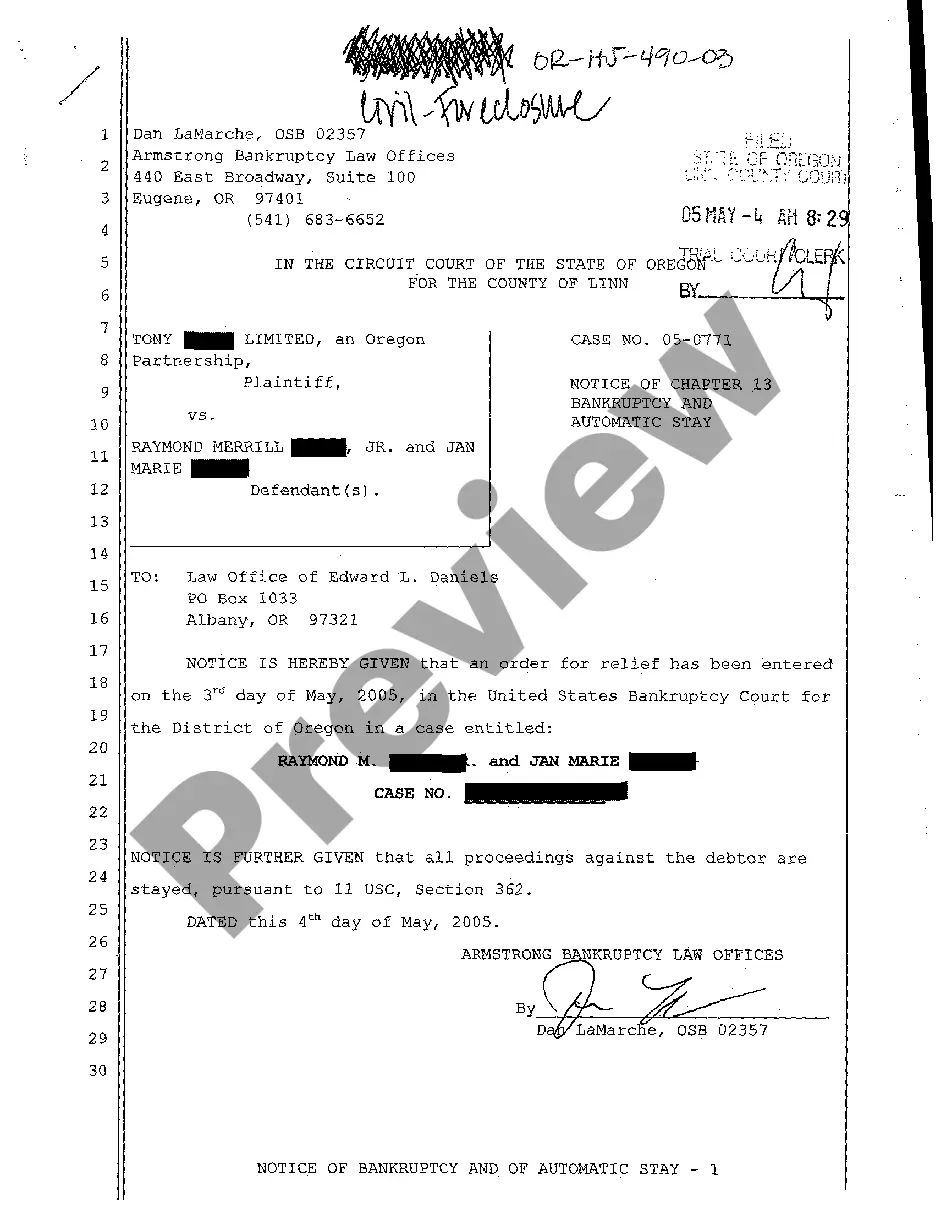

Gresham Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay: An In-depth Explanation When facing overwhelming financial burdens, individuals and couples residing in Gresham, Oregon may explore Chapter 13 bankruptcy as a viable solution to regain control over their debts and achieve a fresh financial start. Essential to this process is the "Gresham Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay," which holds significant importance for both debtors and creditors. Within this notice, we can identify various types of notices, each serving a specific purpose and ensuring a smooth bankruptcy proceeding. 1. Notice to Creditors: The Notice to Creditors is a crucial component of the Gresham Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay. It informs all creditors involved in the bankruptcy case that the debtor has filed for Chapter 13 bankruptcy protection. This notification is sent via mail or electronically to all known creditors, providing them with detailed information on the debtor's plans to repay their debts over an extended period of time. 2. Notice of Chapter 13 Plan: The Notice of Chapter 13 Plan is another type of notice included within the Gresham Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay. This notice outlines the proposed repayment plan, specifying how the debtor intends to pay off outstanding debts in a manageable manner over a three to five-year period. It is essential for debtors to carefully construct a feasible Chapter 13 Plan to gain acceptance from the court and creditors. 3. Notice to Secured Creditors: Secured creditors possess a claim over specific assets, like a house or a vehicle, which they can repossess if payments are not made. The Notice to Secured Creditors included in the Gresham Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay provides detailed information to these creditors, explaining how their claims will be treated in the proposed repayment plan. It ensures that secured creditors are informed about any necessary modifications or adjustments that may arise during the Chapter 13 bankruptcy proceedings. 4. Notice to Unsecured Creditors: Unsecured creditors, who lack collateral against their claims, can be informed through the Notice to Unsecured Creditors within the Gresham Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay. This notice outlines the projected treatment of these creditors' claims within the repayment plan, detailing potential repayment amounts and the timeframe in which they can expect to receive payments. The Automatic Stay component of the Gresham Oregon Notice of Chapter 13 Bankruptcy safeguards debtors from creditor actions upon filing for bankruptcy. It grants an immediate halt to collection efforts, creditor lawsuits, wage garnishments, foreclosure proceedings, and other forms of detrimental creditor actions. This stay ensures a temporary respite during which the debtor can work towards regaining financial stability and adhering to the terms outlined in the proposed Chapter 13 repayment plan. In summary, the Gresham Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay plays a pivotal role in the Chapter 13 bankruptcy process. It comprises various notices tailored to creditors' needs, ensuring transparent communication between debtors and their financial counterparts. Additionally, it implements an Automatic Stay, providing temporary protection from creditor actions, allowing debtors to focus on their debt reorganization efforts and reclaiming control over their financial futures.

Gresham Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay

Description

How to fill out Gresham Oregon Notice Of Chapter 13 Bankruptcy And Automatic Stay?

If you’ve already utilized our service before, log in to your account and download the Gresham Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Ensure you’ve found an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Gresham Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!

Form popularity

FAQ

The basis for relief from the automatic stay can include scenarios where the creditor demonstrates adequate protection of their interest or if the debtor fails to make required payments. When you receive a Gresham Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay, it is essential to understand these grounds, as they will influence the court's decision. Knowing these factors can help you prepare your strategy and maintain control over your financial situation.

Responding to a motion for relief from automatic stay involves filing a written objection with the court and presenting your reasons for opposing the motion. If you have received a Gresham Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay, it is crucial to adhere to any provided deadlines and present your case effectively. Engaging with legal support can further strengthen your response and ensure you navigate this process smoothly.

In a Chapter 13 bankruptcy, the automatic stay generally lasts until the court discharges your bankruptcy case or until a specific motion is made to lift the stay. This pause on collection actions gives individuals time to repay their debts over a structured plan, as specified in the Gresham Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay. Understanding this timeline is essential for effectively managing financial obligations during the bankruptcy process.

Relief from stay in Chapter 13 bankruptcy refers to a request made by a creditor to the court to allow them to continue with collection activities. This process occurs when a creditor believes that they should not be bound by the automatic stay that normally halts such actions during the bankruptcy case. The Gresham Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay provides guidelines for addressing these requests, helping debtors protect their interests while navigating the legal structure.

Chapter 7 bankruptcy is designed to clear most unsecured debt, allowing for a fresh financial start. However, it does not eliminate certain types of debt, such as student loans or tax obligations. If your focus is on alleviating your debt burden, the Gresham Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay can provide a structured plan for repayment, rather than complete debt discharge. Understanding each option helps you make informed decisions about your financial future.

Filing for bankruptcy in Oregon can be straightforward if you understand the requirements and processes involved. While it involves a fair amount of paperwork and documentation, resources like uslegalforms can guide you through your Gresham Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay. With preparation and the right tools, many individuals find the process manageable and empowering.

An automatic stay offers immediate protection from creditors once you file for bankruptcy. This means that collection activities, wage garnishments, and foreclosure actions are paused, giving you a valuable opportunity to plan your financial recovery. The automatic stay serves as a shield, allowing you to focus on formulating a repayment plan through your Gresham Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay without the stress of immediate threats from creditors.

The amount of debt needed to file for bankruptcy varies based on your financial situation and the type of bankruptcy you choose. In Chapter 13, there are limits on unsecured and secured debt. To qualify, your unsecured debts must be less than $465,275 and your secured debts must be less than $1,395,875 in 2023. Understanding these limits is crucial for properly navigating your Gresham Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay.

Filing for bankruptcy without a lawyer in Oregon is possible, but it requires careful attention to detail. You must gather financial documents, complete necessary forms, and file them with the bankruptcy court. Numerous online resources and platforms, like uslegalforms, simplify this process by providing templates and guidelines specifically for the Gresham Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay.

Yes, there is an automatic stay in Chapter 13 bankruptcy. When you file for Gresham Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay, the automatic stay goes into effect immediately. This stay halts most collection actions against you, providing temporary relief from creditors. It's an essential aspect of the process that helps you regain control over your financial situation.