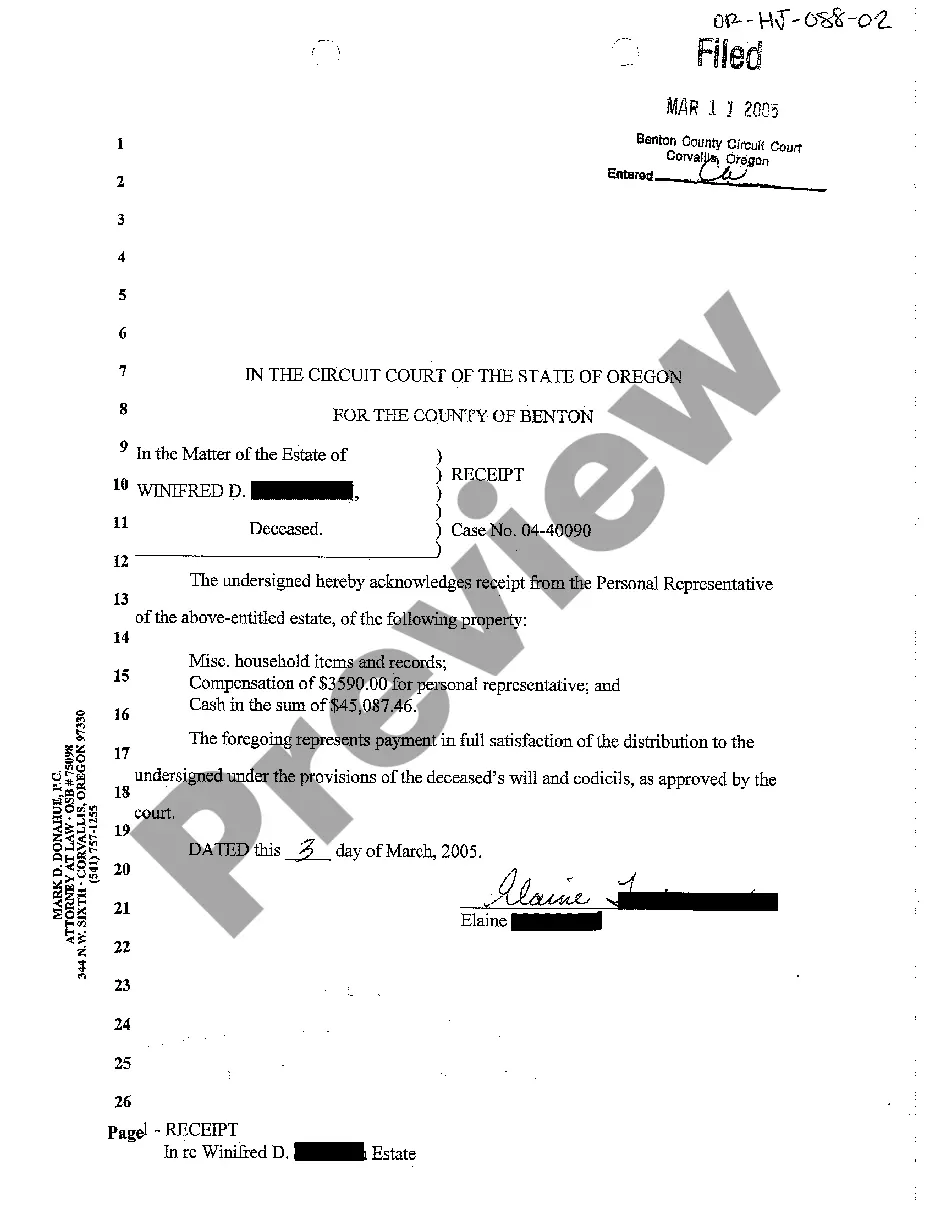

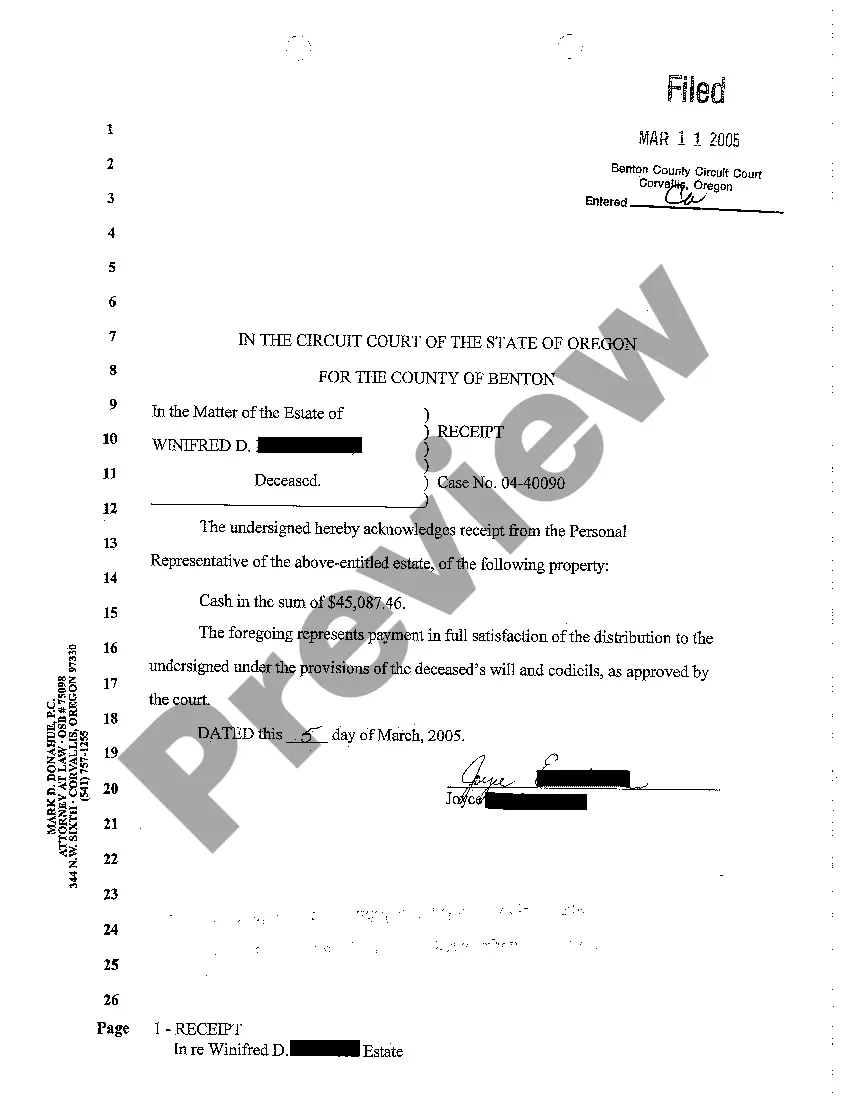

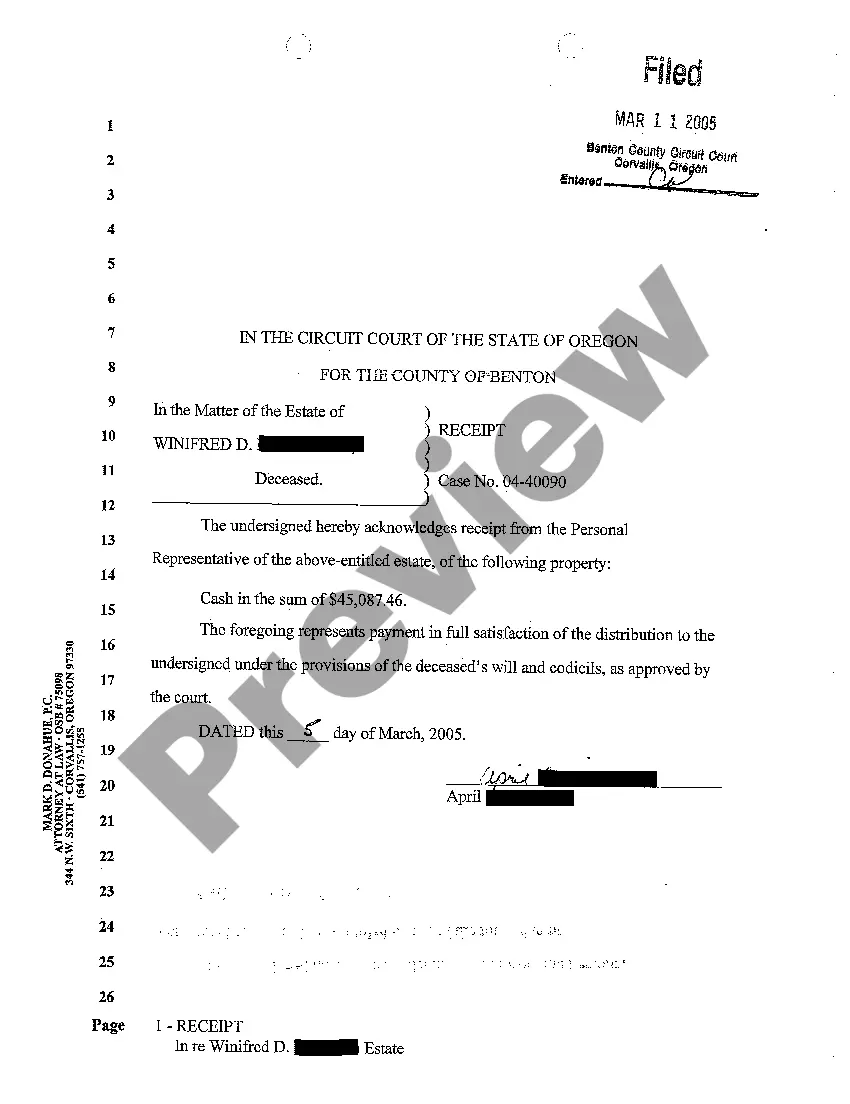

Bend Oregon Receipts

Description

How to fill out Oregon Receipts?

Do you require a reliable and budget-friendly provider of legal documents to acquire the Bend Oregon Receipts? US Legal Forms is your ideal choice.

Whether you need a basic agreement to establish guidelines for living with your partner or a collection of forms to facilitate your divorce process through the court, we have you covered. Our platform presents over 85,000 current legal document templates for individual and business needs. All templates we provide are not generic and are tailored to meet the specifications of particular states and counties.

To obtain the form, you must Log In to your account, find the necessary template, and click the Download button next to it. Please keep in mind that you can download your previously acquired form templates at any time from the My documents section.

Is this your first visit to our site? No problem. You can easily create an account, but before that, make sure to do the following.

Now you can establish your account. Then choose the subscription option and proceed with the payment. Once the payment is completed, download the Bend Oregon Receipts in any available file format. You can return to the site at any time and re-download the form without incurring any additional costs.

Finding current legal forms has never been simpler. Try US Legal Forms today and eliminate the need to spend hours searching for legal documents online once and for all.

- Verify if the Bend Oregon Receipts complies with the laws of your state and locality.

- Examine the details of the form (if provided) to understand who and what the form is meant for.

- Restart the search if the template does not fit your particular circumstances.

Form popularity

FAQ

Transportation fees in Bend largely depend on the mode of travel you choose. Public transit fares are quite affordable, making it a budget-friendly option. If you opt for rideshare services or taxis, those costs will vary based on distance and demand. Keeping track of these expenses through Bend Oregon Receipts can help you manage your budget effectively.

Bend, like the rest of Oregon, does not have a state sales tax. However, residents are subject to property taxes and other local taxes. Understanding these tax structures is important for budgeting and financial planning. For tracking your tax-related expenses, you can use Bend Oregon Receipts to stay organized and informed.

Yes, Bend offers a public transportation system called Cascades East Transit. This service includes various routes that connect key areas of the city, making it easier for residents and visitors to navigate. Utilizing public transportation can help you save on travel costs and reduce your carbon footprint. If you need to keep track of transit expenses, consider using Bend Oregon Receipts to manage your costs effectively.

In Bend, property taxes are calculated based on the assessed value of the property, which is determined by the Deschutes County Assessor's office. The tax rate applied varies and typically funds local services such as schools, roads, and public safety. Homeowners can find their Bend Oregon receipts indicating the amount they owe based on the assessed value. Using these receipts can ensure you stay informed about your property tax obligations.

Setting up a payment plan with the Oregon Department of Revenue is a straightforward process. Start by contacting the department's collections unit through their website or customer service line. They will guide you regarding the required forms and eligibility criteria. Make sure to have your Bend Oregon receipts available for reference, as they can assist with your payment history.

You may now check on the status of Oregon tax refunds on the DOR website. The automated phone system is still available as in past years for those who do not have computer access. That number in the Salem area is 503-378-4988 or toll free throughout the rest of Oregon at 1-800-356-4222.

Who is not subject to the CAT? ???? Exempted entities include but are not limited to: Nonprofit organizations, including business entities that have been recognized by the IRS as tax-exempt organizations described in section 501(c)(3) of the Internal Revenue Code.

Access the Treasurer and Tax Collector's website at . Follow the instructions on the screen. That's it!

What is the sales tax rate in Bend, Oregon? The minimum combined 2022 sales tax rate for Bend, Oregon is 0%. This is the total of state, county and city sales tax rates. The Oregon sales tax rate is currently 0%.

Please call (213)893-7935 or visit us at 225 N. Hill Street, Los Angeles, CA 90012. We are located on the first floor in Room 122.