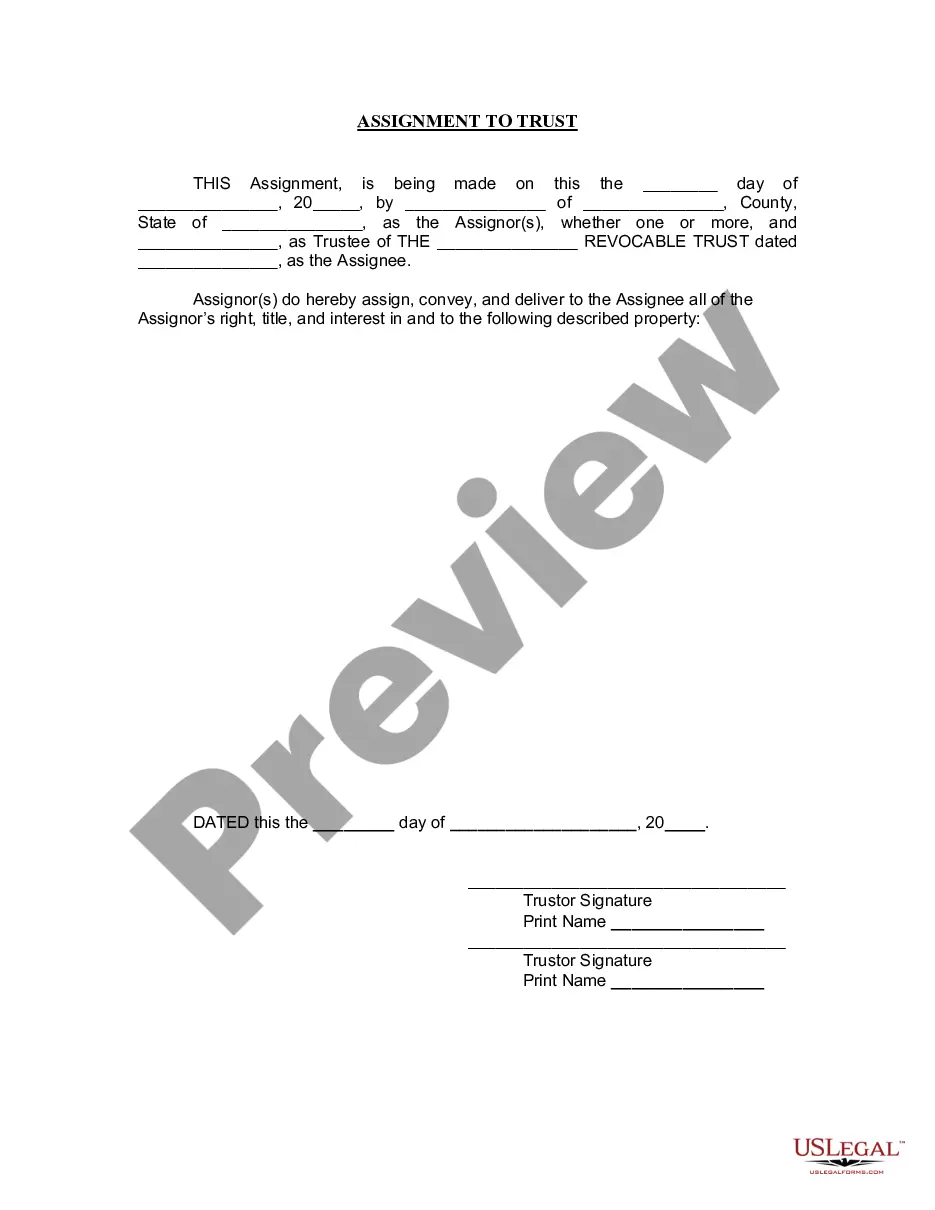

Portland Oregon Assignment to Living Trust

Description

How to fill out Oregon Assignment To Living Trust?

Are you searching for a trustworthy and affordable provider of legal documents to obtain the Portland Oregon Assignment to Living Trust? US Legal Forms is your primary option.

Whether you need a simple agreement to establish rules for living together with your partner or a set of forms to facilitate your separation or divorce through the legal system, we have you covered.

Our platform provides over 85,000 current legal document templates for personal and business use. All templates we offer are not generic but tailored according to the requirements of particular states and regions.

To download the document, you must Log In to your account, locate the desired form, and click the Download button next to it. Please remember that you can download your previously acquired document templates anytime from the My documents section.

Now you can set up your account. Then choose a subscription plan and proceed to payment. Once the payment is completed, download the Portland Oregon Assignment to Living Trust in any of the available file formats.

You can return to the website whenever you wish and redownload the document at no cost. Obtaining current legal documents has never been simpler. Try US Legal Forms today, and stop wasting your precious time looking for legal papers online once and for all.

- Is this your first visit to our platform? No problem.

- You can create an account with great ease, but before doing so, make sure to accomplish the following.

- Check if the Portland Oregon Assignment to Living Trust is compliant with the laws of your state and locality.

- Review the form's specifics (if available) to understand who and what the document is designated for.

- Restart the search if the form does not meet your particular needs.

Form popularity

FAQ

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

Pricing for and Individual Trust Plan and for a Joint Trust Plan. Pricing depends on the size of the Estate. $3,200 for Estates under $2 million. $4,200 for Estates between $2 million and $5 million, and Estates over $5 million are subject to a special fee agreement based on the complexity of the Estate.

Pricing for and Individual Trust Plan and for a Joint Trust Plan. Pricing depends on the size of the Estate. $3,200 for Estates under $2 million. $4,200 for Estates between $2 million and $5 million, and Estates over $5 million are subject to a special fee agreement based on the complexity of the Estate.

You live in your house, spend your money, and give gifts or sell assets as you want. After your death, you still have control because your assets are controlled by the trust under the terms you set up. The assets can be kept in trust until future dates you have chosen.

A basic trust plan may run anywhere from $2,000 to $3,000 or more, depending on complexity. There are additional costs for making changes and administration costs after your death. Different types of trusts and trustees can require different fees for administration and wealth management.

If your estate is likely to qualify, you might not need to worry about making a living trust just to avoid probate. Additionally, in Oregon, you can transfer real property using a transfer-on-death deed; this can keep your home out of probate without using a living trust.

Property is often transferred into a trust as part of inheritance tax planning however the trust needs to meet certain conditions and to be set up correctly by a solicitor. By putting a property into trust rather than making an outright gift, you are able to control how the property is used after it is given away.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

How to Create a Living Trust in Oregon Figure out which type of trust you need to make.Do a property inventory.Choose your trustee.Draw up the trust document.Sign the trust document in front of a notary public. Fund the trust by transferring your property into it.