Oregon Assignment to Living Trust

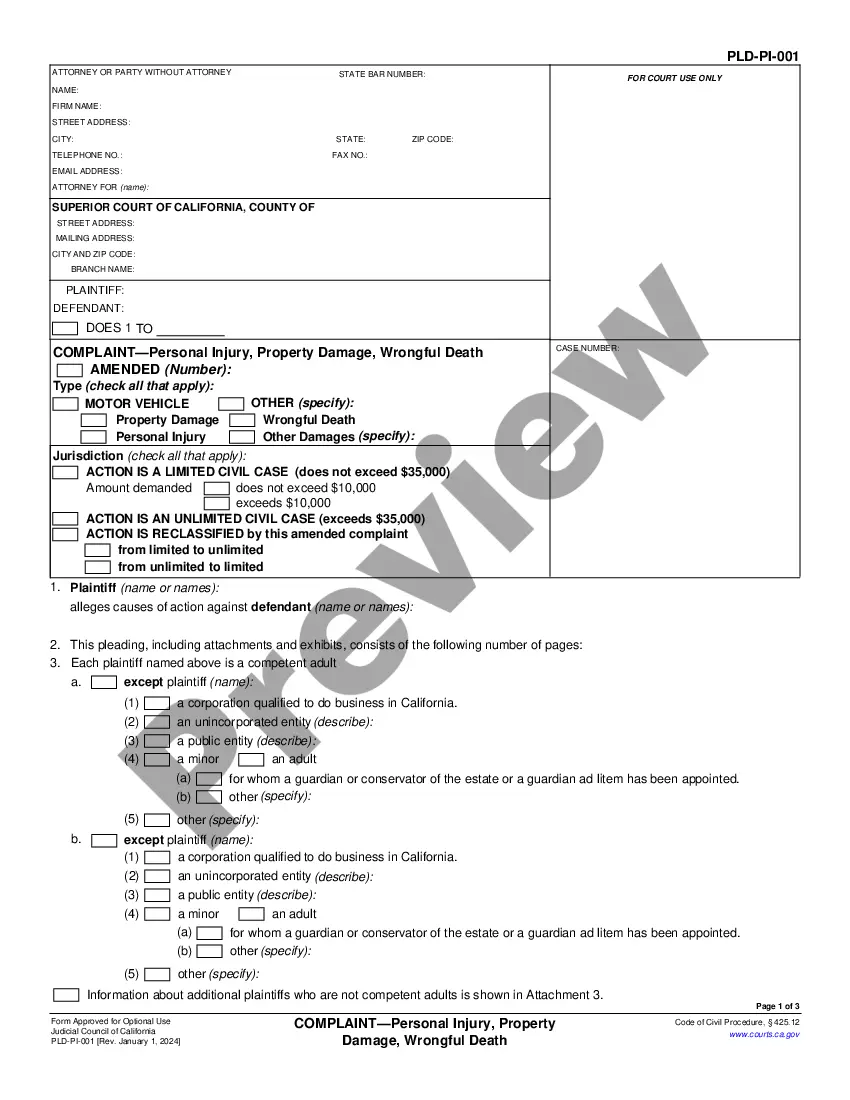

What is this form?

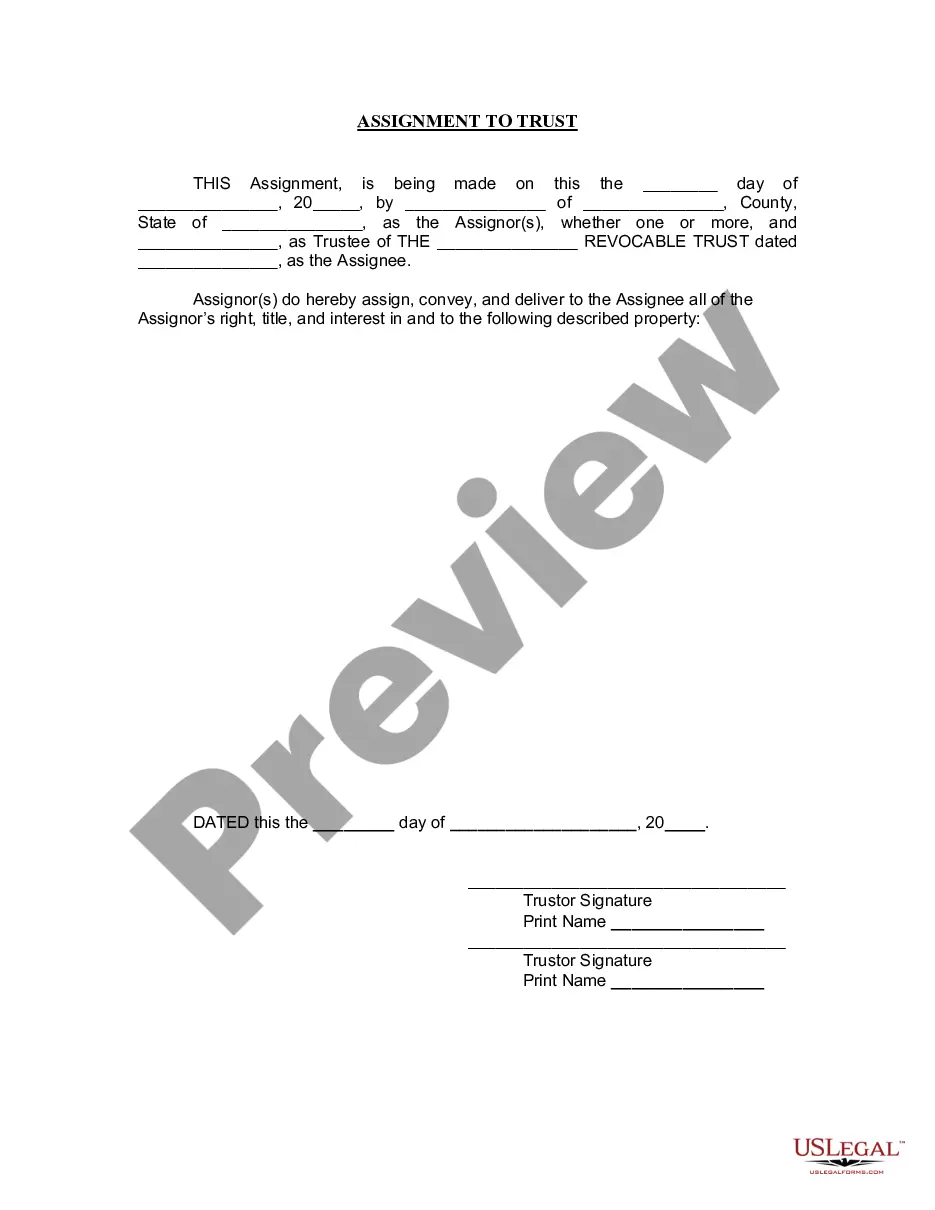

The Assignment to Living Trust form is a legal document that transfers all rights, title, and interest in specific property to a Living Trust. A Living Trust is established during the lifetime of an individual and holds their assets, usually for estate planning purposes. This form serves to properly reallocate ownership of property into the trust, differentiating it from other property transfer documents.

Main sections of this form

- Date of the assignment

- Name and address of the Assignor(s)

- Name of the Trustee of the Living Trust

- Signature of the Assignor(s)

- Notary acknowledgment section

Common use cases

This form is typically used when an individual wishes to assign specific property, such as real estate or other assets, to a Living Trust. It is advisable to use this form when planning an estate to ensure that the designated assets are managed according to the terms of the trust and to avoid probate in the future.

Who this form is for

This form is intended for:

- Individuals creating a Living Trust as part of their estate planning

- Trustees managing or administering a Living Trust

- Anyone wishing to transfer property into a Living Trust for tax or personal purposes

Instructions for completing this form

- Identify the date of the assignment.

- Fill in the name and address of the Assignor(s).

- Enter the name of the Trustee of the Living Trust.

- Sign and print the name of the Assignor(s) in the designated spaces.

- Complete the notary acknowledgment section, including the date and the name of the notary public.

Is notarization required?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to include all necessary signatures.

- Not completing the date of the assignment.

- Omitting the notary acknowledgment section or not having it filled out correctly.

Advantages of online completion

- Convenience of completing the form at your own pace.

- Editable fields allow for customization to meet specific needs.

- Access to reliable templates drafted by licensed attorneys.

Looking for another form?

Form popularity

FAQ

Sure you can write your own revocable living trust.The discussion of your need for a revocable living trust is in another of my articles, but it is safe to say that if you own real property and have a significant estate (over about $50,000), then you could use a trust and it would help your loved ones.

Figure out which type of trust you need to make. There are single trusts, which will be what you want to use if you're single. Do a property inventory. Choose your trustee. Draw up the trust document. Sign the trust document in front of a notary public. Fund the trust by transferring your property into it.

A living trust is an important part of your estate plan. Most people can create a living trust without an attorney using software or an online service.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.

To allow the settlor to keep his estate plans private, the trust instrument is generally not recorded, and the trustee uses the certification of trust in the place of disclosing the entire contents of the trust instrument.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

You should still have a durable power of attorney for finances.You may even want to empower your attorney-in-fact to transfer into your living trust any property that becomes yours after you become incapacitated. Only a durable power of attorney for finances can grant that authority.

The best way to find a trust is to ask the person who created it or the person who manages it. If the trust owns real estate, then a deed to the trust has probably been recorded in the county where the real estate is.