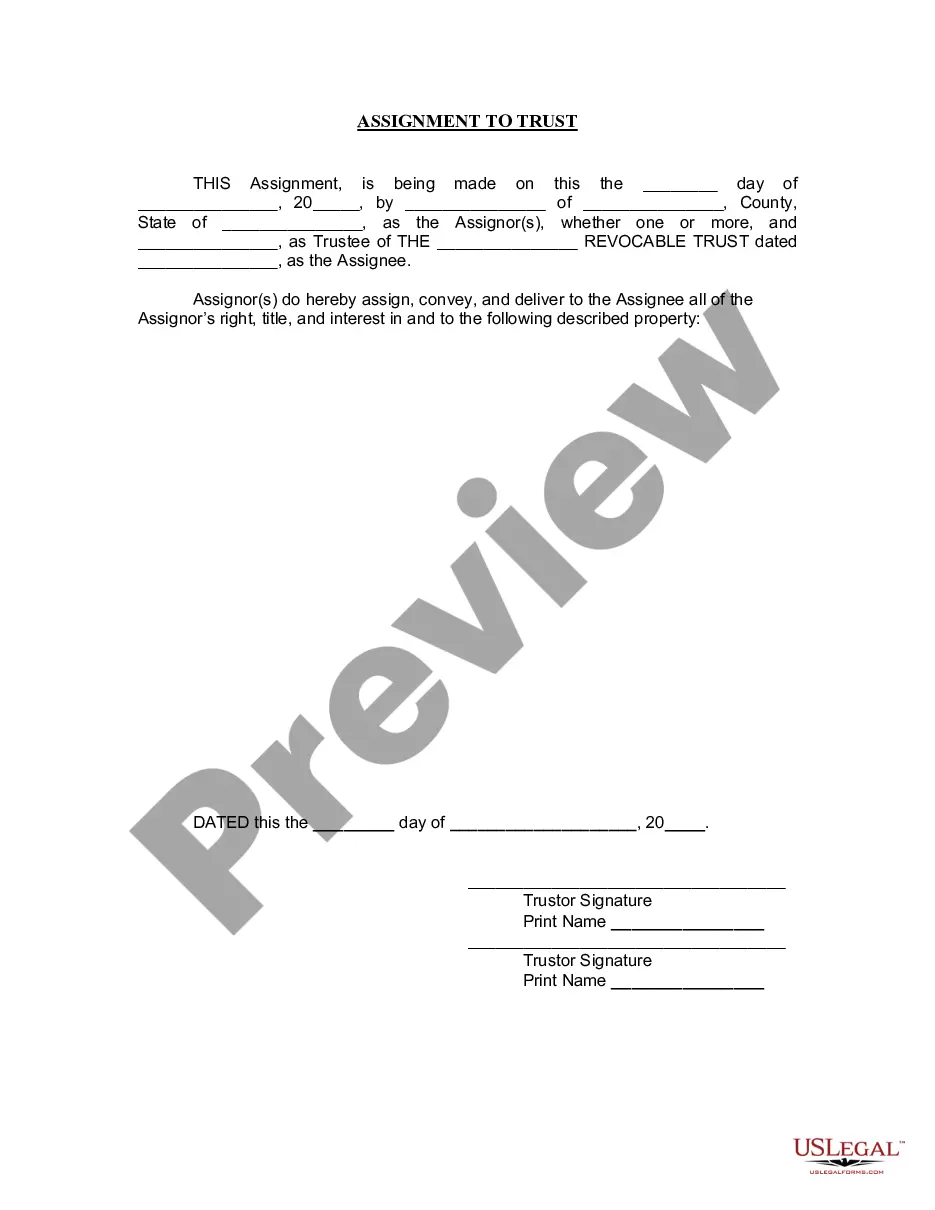

Gresham Oregon Assignment to Living Trust: A Comprehensive Overview Introduction: Gresham, Oregon, offers residents the opportunity to protect their assets and plan for the future through the Assignment to Living Trust process. This legal arrangement allows individuals to transfer ownership of their assets, both real and personal property, to a living trust for management and distribution purposes. This detailed description aims to provide a comprehensive understanding of the Gresham Oregon Assignment to Living Trust, outlining its purpose, benefits, and different types available. Purpose of Gresham Oregon Assignment to Living Trust: The primary purpose of the Gresham Oregon Assignment to Living Trust is to avoid probate, a lengthy and costly court-supervised process of distributing assets after an individual's passing. By assigning assets to a living trust, the individual ensures seamless transfer of assets to their designated beneficiaries, bypassing probate court intervention. Benefits of Gresham Oregon Assignment to Living Trust: 1. Probate avoidance: Assigning assets to a living trust in Gresham, Oregon eliminates the need for probate, saving beneficiaries time and money. 2. Privacy: Unlike probate, which is a public process, the Assignment to Living Trust allows asset distribution to remain private, shielding beneficiaries from unnecessary exposure. 3. Asset protection: With a living trust, the individual can safeguard assets from potential creditors or lawsuits, ensuring they are distributed according to their wishes. 4. Incapacity planning: Living trusts include provisions for managing assets in case the individual becomes mentally or physically incapacitated, allowing for a smooth transition of control to a designated successor trustee. Types of Gresham Oregon Assignment to Living Trusts: 1. Revocable Living Trust: This type of trust allows the individual to maintain control and make changes or revoke the trust during their lifetime. It offers flexibility and can be altered as circumstances or wishes change. 2. Irrevocable Living Trust: Once created, this trust cannot be altered or revoked without the consent of beneficiaries and the court. Irrevocable trusts offer tax benefits and protection against estate taxes and creditors but require careful consideration before implementation. 3. Testamentary Trust: This type of trust is created within a will and only takes effect upon the individual's death. Assets are transferred into the trust through probate, offering less immediate benefit in terms of probate avoidance. 4. Special Needs Trust: Designed to provide ongoing care and financial support for beneficiaries with special needs, this trust allows them to retain eligibility for government benefits while still benefiting from the trust assets. Conclusion: Gresham Oregon Assignment to Living Trust is a valuable estate planning tool that allows individuals to efficiently manage their assets, protect their beneficiaries, and avoid probate. Whether opting for a revocable, irrevocable, testamentary, or special needs trust, residents of Gresham can enjoy the benefits of privacy, asset protection, and incapacity planning. Seeking professional legal counsel is highly recommended ensuring a thorough understanding of the options and personalize the trust to individual needs and circumstances.

Gresham Oregon Assignment to Living Trust

Description

How to fill out Gresham Oregon Assignment To Living Trust?

If you are looking for a relevant form template, it’s difficult to find a more convenient service than the US Legal Forms site – one of the most comprehensive libraries on the web. Here you can find a huge number of form samples for business and individual purposes by types and states, or key phrases. With our high-quality search option, getting the newest Gresham Oregon Assignment to Living Trust is as elementary as 1-2-3. Additionally, the relevance of each document is verified by a team of skilled lawyers that regularly check the templates on our platform and revise them based on the most recent state and county demands.

If you already know about our system and have a registered account, all you should do to receive the Gresham Oregon Assignment to Living Trust is to log in to your account and click the Download option.

If you utilize US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have opened the sample you require. Read its explanation and use the Preview function (if available) to check its content. If it doesn’t meet your needs, use the Search field at the top of the screen to discover the proper document.

- Affirm your decision. Choose the Buy now option. Next, select the preferred pricing plan and provide credentials to sign up for an account.

- Make the purchase. Use your bank card or PayPal account to complete the registration procedure.

- Get the form. Select the format and download it on your device.

- Make changes. Fill out, modify, print, and sign the received Gresham Oregon Assignment to Living Trust.

Each form you save in your account has no expiration date and is yours permanently. It is possible to gain access to them using the My Forms menu, so if you want to get an additional copy for enhancing or creating a hard copy, feel free to return and download it once more whenever you want.

Make use of the US Legal Forms extensive catalogue to gain access to the Gresham Oregon Assignment to Living Trust you were looking for and a huge number of other professional and state-specific templates on one platform!

Form popularity

FAQ

Yes, you can create your own living trust in Oregon. However, it is essential to understand the legal requirements and implications involved in the Gresham Oregon Assignment to Living Trust. Take time to research the proper language and documentation needed to ensure your trust is valid and meets your estate planning goals. For added peace of mind, consider using platforms like US Legal Forms, which provide templates and guidance tailored to Oregon's laws.

One downside is the potential for decreased control over assets during a person's lifetime. When you create a Gresham Oregon Assignment to Living Trust, you may need to relinquish some immediate access to your assets. However, this trade-off can protect those assets from probate and ensure they are distributed according to your wishes. We recommend discussing this aspect with your estate planning advisor to make an informed decision.

While trust funds can offer advantages, they may also face criticism for being overly restrictive. Some may view them as tools that separate individuals from their inherited wealth. However, a Gresham Oregon Assignment to Living Trust can be tailored to provide specific guidelines and protection while allowing some access to beneficiaries. It’s vital to strike a balance between protection and accessibility.

One significant mistake parents make is not properly funding the trust. A Gresham Oregon Assignment to Living Trust only works if the assets are transferred into the trust. If they neglect to do this, the trust may not fulfill its purpose, leading to unexpected complications. It's crucial for parents to understand this step and ensure that their assets are adequately assigned to the trust.

If your parents want to streamline the transfer of their assets and avoid probate, a Gresham Oregon Assignment to Living Trust could be a wise choice. Trusts can protect assets and offer peace of mind regarding estate planning. Additionally, it allows them to have more control over how their assets are distributed in the future. Consulting with an estate planning expert can clarify if this approach fits their needs.

Some people view trusts as complex and intimidating. They may believe that trusts limit accessibility to assets during a person's lifetime. However, a Gresham Oregon Assignment to Living Trust can provide flexibility and control over your estate. It's essential to understand that while there are challenges, the benefits of properly structured trusts often outweigh these concerns.

Putting your property in a Gresham Oregon Assignment to Living Trust involves several straightforward steps. First, you should create the trust documentation, specifying the property's details and your intentions. Next, you need to transfer title to the property by recording a new deed, which can be done with assistance from a legal expert or through platforms like US Legal Forms. This process makes your property part of the trust, enhancing your estate planning efforts.

To complete a Gresham Oregon Assignment to Living Trust, the property owner needs to execute a deed that transfers ownership from the individual to the trust. This process typically involves drafting a new deed, signing it in front of a notary, and filing it with the county recorder's office. It's wise to consult with a legal professional to ensure all documents are properly prepared. Doing this secures your property within the trust and helps avoid potential disputes.