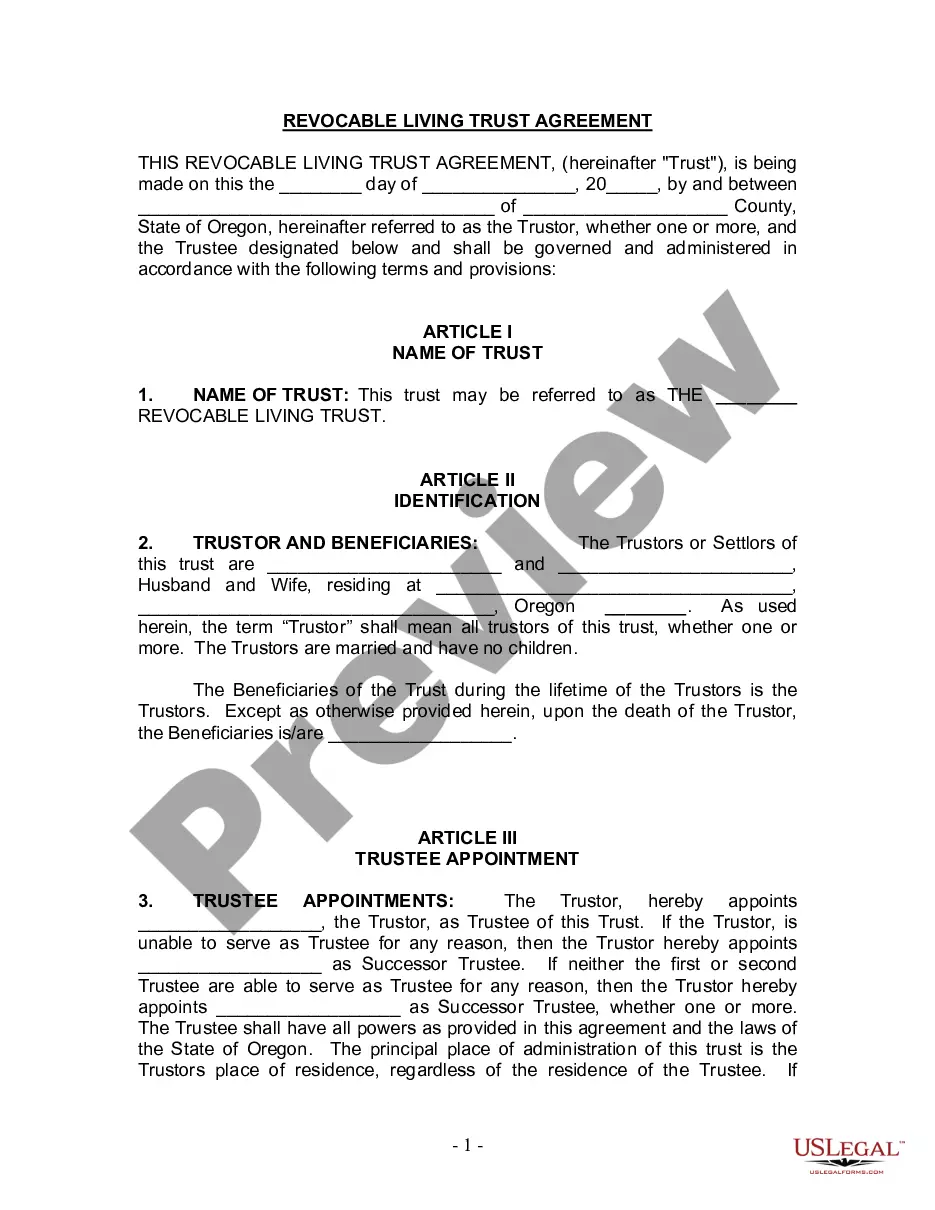

Portland Oregon Living Trust for Husband and Wife with No Children

Description

How to fill out Oregon Living Trust For Husband And Wife With No Children?

Regardless of one's social or professional position, finalizing legal paperwork is an unfortunate requirement in today's society.

Frequently, it's nearly unfeasible for an individual without a legal background to devise such documents from the ground up, primarily because of the intricate terminology and legal nuances involved.

This is where US Legal Forms can come to the rescue.

Ensure that the document you have selected is tailored to your locality, as the laws of one region will not apply to another.

Review the document and read through a brief description (if available) of the situations for which the paper can be utilized.

- Our service offers an extensive collection of over 85,000 ready-to-use state-specific documents that are suitable for nearly any legal circumstance.

- US Legal Forms also serves as a valuable tool for associates or legal advisors who seek to conserve time using our DIY forms.

- Whether you need the Portland Oregon Living Trust for Husband and Wife with No Children or any other documents that will be accepted in your region, everything is readily available through US Legal Forms.

- Here's how to swiftly obtain the Portland Oregon Living Trust for Husband and Wife with No Children using our reliable service.

- If you are already a member, you may continue to Log In to your account to access the required form.

- If you are new to our platform, please be sure to follow these instructions before downloading the Portland Oregon Living Trust for Husband and Wife with No Children.

Form popularity

FAQ

In some cases, upon the death of the first spouse, a Joint Trust may need to be separated into two Trusts, and assets may need to be divided. Separate Trust: With Separate Trusts, because there are two Trusts already, there often is much more flexibility and an easier process to navigate after the first spouse's death.

Separate trusts may offer better protection from creditors, if this is a concern. For example, at the death of the first spouse, the deceased spouse's trust becomes irrevocable, which makes it harder to access by creditors. And yet the surviving spouse can still access it for income and other needs.

A basic trust plan may run anywhere from $2,000 to $3,000 or more, depending on complexity. There are additional costs for making changes and administration costs after your death. Different types of trusts and trustees can require different fees for administration and wealth management.

An irrevocable living trust cannot be altered once it is final. A living trust Oregon allows you to bypass probate for the assets in your trust.

Typically, when a married couple utilizes a Revocable Living Trust-based estate plan, each spouse creates and funds his or her own separate Revocable Living Trust. This results in two trusts. However, in the right circumstances, a married couple may be better served by creating a single Joint Trust.

A married couple has many reasons to establish a living trust. A living trust can help their estate survive onerous estate taxes, avoid probate if they both die, and side step the need for a conservatorship if either one (or both) become incapacitated.

The Joint Trust. Typically, when a married couple utilizes a Revocable Living Trust-based estate plan, each spouse creates and funds his or her own separate Revocable Living Trust. This results in two trusts. However, in the right circumstances, a married couple may be better served by creating a single Joint Trust.

A joint revocable trust is probably the easiest form of living revocable trusts for a married couple to use. A joint revocable trust merges the estate planning of a couple using a single trust document. Joint trusts and individual trusts each have advantages and disadvantages.

Joint trusts are easier to manage during a couple's lifetime. Since all assets are held in one trust, ownership mimics how many couples hold their assets - jointly. Both spouses having equal control of the management of joint assets held by the trust.

In general, most experts agree that Separate Trusts can provide more asset protection. Joint Trust: Marital assets are all together in a single trust. This means there's less asset protection, because if there's ever a judgment over one of the spouses, all of the assets could end up being at risk.