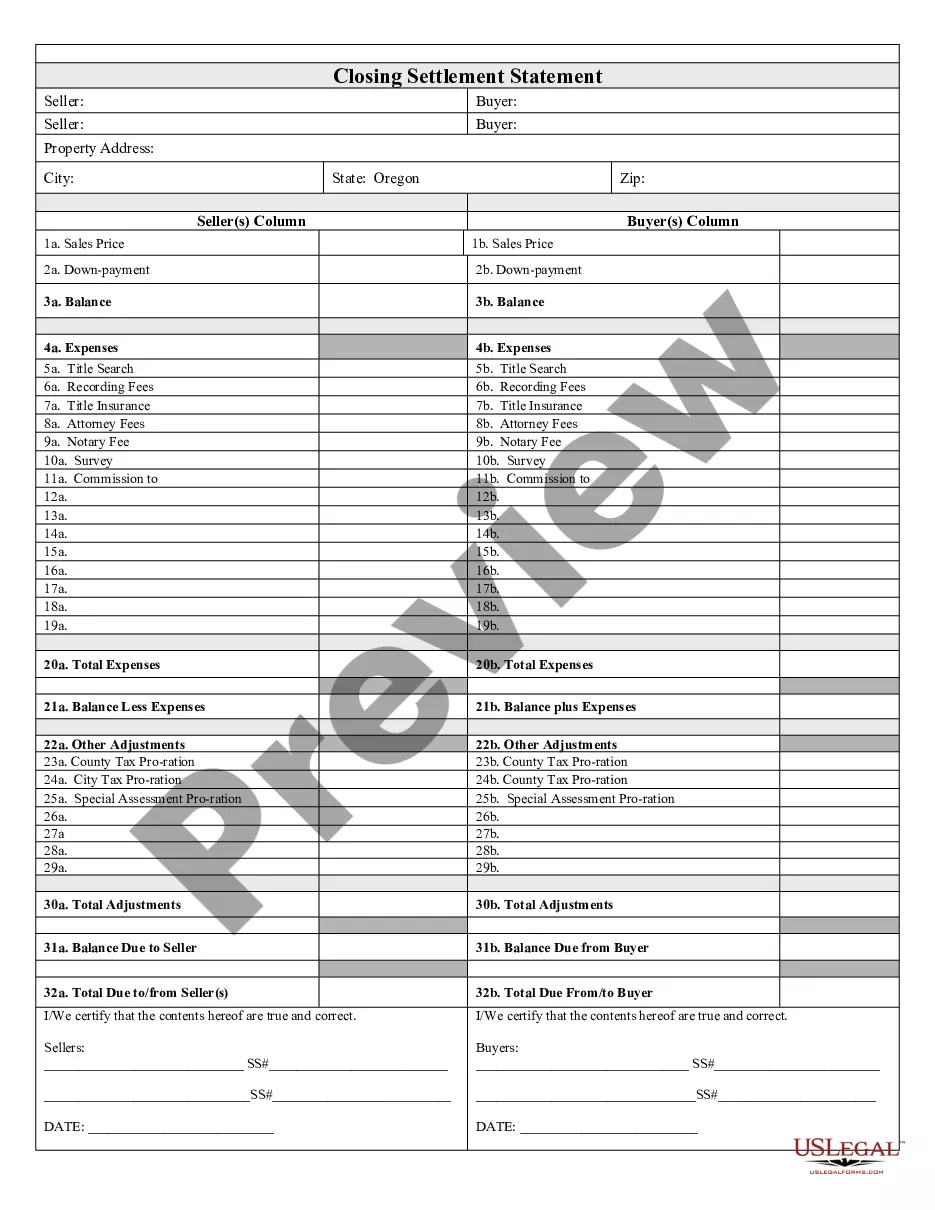

Bend Oregon Closing Statement

Description

How to fill out Oregon Closing Statement?

If you have previously utilized our service, sign in to your account and download the Bend Oregon Closing Statement to your device by clicking the Download button. Ensure your subscription is active. If it is not, renew it based on your payment plan.

If this is your initial experience with our service, follow these straightforward steps to acquire your document.

You have uninterrupted access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to access it again. Utilize the US Legal Forms service to effortlessly locate and store any template for your personal or professional requirements!

- Ensure you have found a suitable document. Browse the description and make use of the Preview feature, if available, to verify if it suits your requirements. If it does not suit you, use the Search tab above to locate the right one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Enter your credit card information or use the PayPal option to finalize the purchase.

- Receive your Bend Oregon Closing Statement. Choose the file format for your document and save it on your device.

- Finish your document. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

Your Bend Oregon Closing Statement will detail all financial transactions involved in your property sale. This includes itemized closing costs, credits, and debits relevant to both the buyer and seller. Expect to see line items for commissions, taxes, and other fees. Reviewing this document carefully allows for better financial transparency and helps you avoid surprises at closing.

For a $300,000 house in Oregon, closing costs usually fall between $3,000 to $9,000. This range accounts for various fees outlined in your Bend Oregon Closing Statement. Keep in mind that factors such as the property location and lender requirements can influence these fees. Seeking assistance from experts can provide clarity and help you plan accordingly.

The closing statement is typically prepared by the title company or escrow agent overseeing the real estate transaction. They gather all financial details and present this document to both the buyer and seller at closing. If you need assistance with this process, consider using USLegalForms, which can help clarify the roles involved and provide essential resources.

To obtain a Bend Oregon Closing Statement, start by contacting your real estate agent or the title company handling your transaction. They will generate this important document once all details are finalized. Additionally, you can utilize platforms like USLegalForms, which offer templates and guidance to help you navigate the closing process smoothly.

Average closing costs by state StateAverage closing costs with taxesAverage closing costs without taxesOregon$4,327$3,862Pennsylvania$10,634$4,221Rhode Island$5,568$3,419South Carolina$3,447$2,50147 more rows ?

How Much Are Closing Costs in Oregon? So, to sum it all up, closing costs in Oregon for property buyers range from 2% to 5% of the purchase price. As for sellers, closing expenses usually range from 6% to 10% of the house's final sale price.

Average closing costs by state StateAverage closing costs with taxesAverage closing costs without taxesOregon$4,327$3,862Pennsylvania$10,634$4,221Rhode Island$5,568$3,419South Carolina$3,447$2,50147 more rows ?

Oregon closing costs are split between the buyer and seller in most transactions. Sellers typically pay all commissions, owner's title insurance, title transfer fees, recording fees, and prorated property taxes.

On average, sellers in Oregon can expect to pay 2.45% of their home's final sale price in closing costs. For a $518,377 home ? the median home value in Oregon ? you'd pay around $12,687. Realtor commission fees are also paid at closing and are usually the biggest expense for sellers in Oregon.

Does the Buyer or the Seller Pay Closing Costs? Closing costs are paid according to the terms of the purchase contract made between the buyer and seller. Usually the buyer pays for most of the closing costs, but there are instances when the seller may have to pay some fees at closing too.