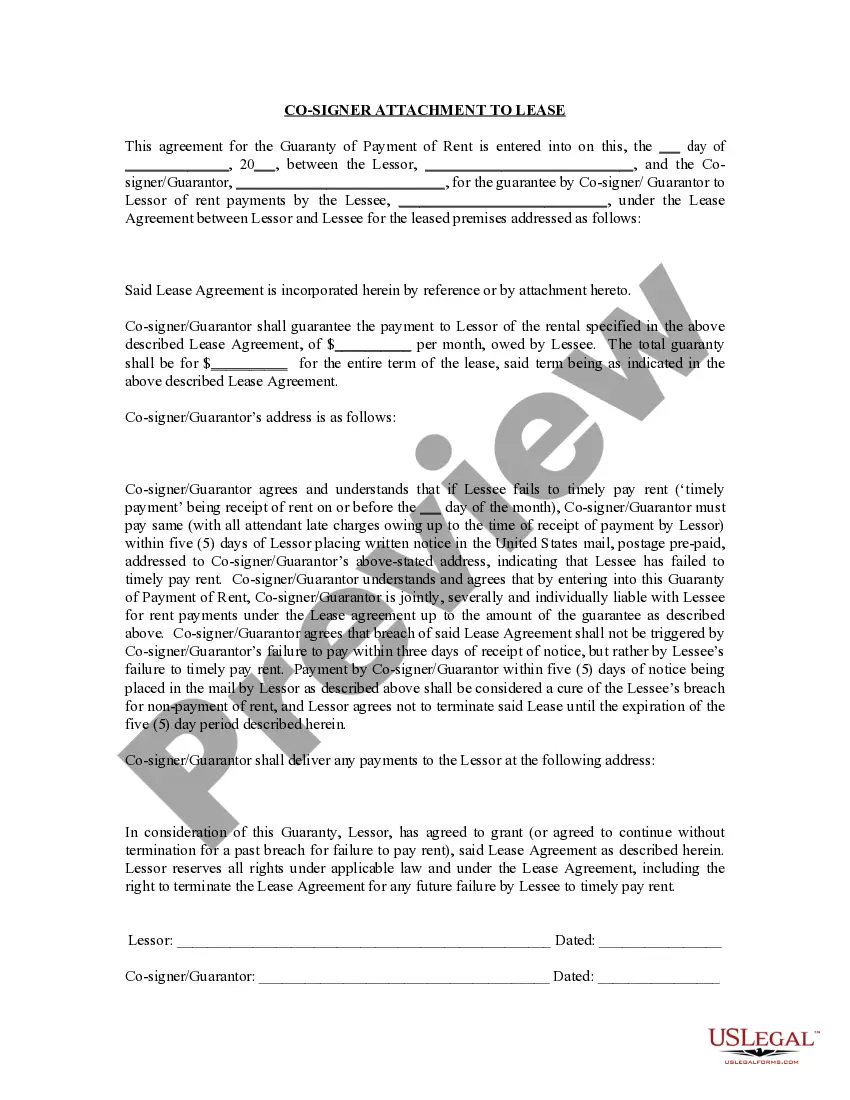

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Portland Oregon Guaranty Attachment to Lease for Guarantor or Cosigner

Description

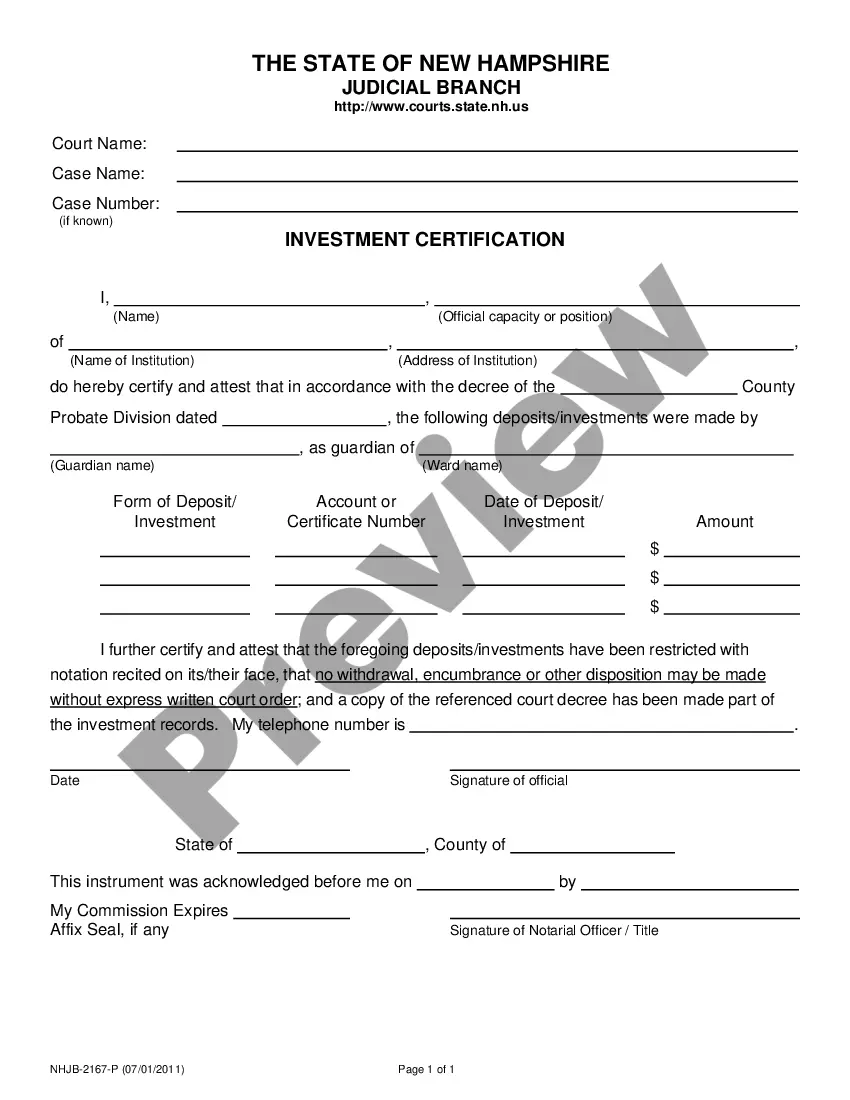

How to fill out Oregon Guaranty Attachment To Lease For Guarantor Or Cosigner?

If you are looking for an applicable form template, it’s difficult to select a superior platform than the US Legal Forms site – likely the most extensive collections on the web.

With this collection, you can discover a vast array of form examples for business and personal use by categories and regions, or keywords.

With the top-notch search feature, locating the latest Portland Oregon Guaranty Attachment to Lease for Guarantor or Cosigner is as simple as 1-2-3.

Execute the payment transaction. Use your credit card or PayPal account to complete the registration process.

Obtain the form. Choose the format and save it to your device.

- Additionally, the relevance of each document is validated by a team of expert attorneys who routinely review the templates on our website and refresh them according to the latest state and county regulations.

- If you are already familiar with our platform and have an account, all you need to acquire the Portland Oregon Guaranty Attachment to Lease for Guarantor or Cosigner is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, just adhere to the steps below.

- Ensure you have located the form you need. Read its description and utilize the Preview feature to examine its content. If it does not satisfy your requirements, use the Search box at the top of the page to find the relevant document.

- Verify your choice. Click on the Buy now button. Following that, select your desired subscription plan and enter details to register for an account.

Form popularity

FAQ

A cosigner has more financial responsibility than a guarantor since the cosigner is responsible for rent on day one. The guarantor only steps in if a renter can't make payments. Plus, if a cosigner is a roommate, he or she has to pick up the slack if the other roommates can't make rent.

signer is equally liable for a loan, while a guarantor becomes responsible for a loan if the borrower cannot pay it. While the terms may seem interchangeable if you're just hearing them for the first time, there is a distinct difference in responsibilities between the two.

When you cosign on a lease, you're making a legal promise to uphold the terms of the lease and to pay rent if the lessee does not. As a cosigner, your credit could be affected whether or not the person you're cosigning with pays their rent. This uncertainty makes cosigning for an apartment risky.

Cosigning a mortgage means co-owning the property, and a cosigner's name will be on both the property title and the mortgage. A guarantor is just supporting a mortgage application, and doesn't have to co-own the property. The role of the guarantor is more desirable to parents, but lenders often prefer cosigners.

Separate to the tenancy agreement, your guarantor will have to sign a 'guarantor agreement' which will confirm their responsibilities. Their main obligation will be to pay the rent if you cannot. They might also be liable for covering any other costs you incurred during the tenancy, such as damage to the property.

Cosigners have equal responsibility for payment of monthly rental costs, while a guarantor is generally sought for payment only when the property occupant is unable to make the rental payment.

Cosigners have equal responsibility for payment of monthly rental costs, while a guarantor is generally sought for payment only when the property occupant is unable to make the rental payment.

When you cosign a lease, you are agreeing to become 100 percent responsible for that lease. In other words, if your friend decides to skip town in their brand-new car and simultaneously stop paying their $300/month car lease payments, it's on you to foot the bill.

The most important difference between a cosigner and a guarantor is that a cosigner is immediately responsible for paying rent, just as the tenant is. A guarantor is only responsible for paying rent when the tenant fails to do so themselves.

Possible disadvantages of cosigning a loan It could limit your borrowing power. Potential creditors decide whether or not to lend you money by looking at your existing debt-to-income ratio.It could lower your credit scores.It could damage your relationship with the borrower.