Portland Oregon Employer-At-Injury Program (EAIP) Reimbursement Request Form

Description

How to fill out Oregon Employer-At-Injury Program (EAIP) Reimbursement Request Form?

Finding validated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms library.

It’s a digital archive of over 85,000 legal documents catering to both personal and professional requirements and various real-world circumstances.

All the papers are appropriately categorized by field of use and jurisdiction, making it as simple as ABC to find the Portland Oregon Employer-At-Injury Program (EAIP) Reimbursement Request Form.

Maintaining organized documentation that adheres to legal standards is crucial. Leverage the US Legal Forms library to always have necessary document templates at your fingertips!

- For those already acquainted with our collection and have utilized it previously, obtaining the Portland Oregon Employer-At-Injury Program (EAIP) Reimbursement Request Form requires just a few clicks.

- Simply Log In to your account, select the document, and click Download to save it to your device.

- New users will have a few extra steps to finish the process.

- Follow the instructions below to commence with the most extensive online form collection.

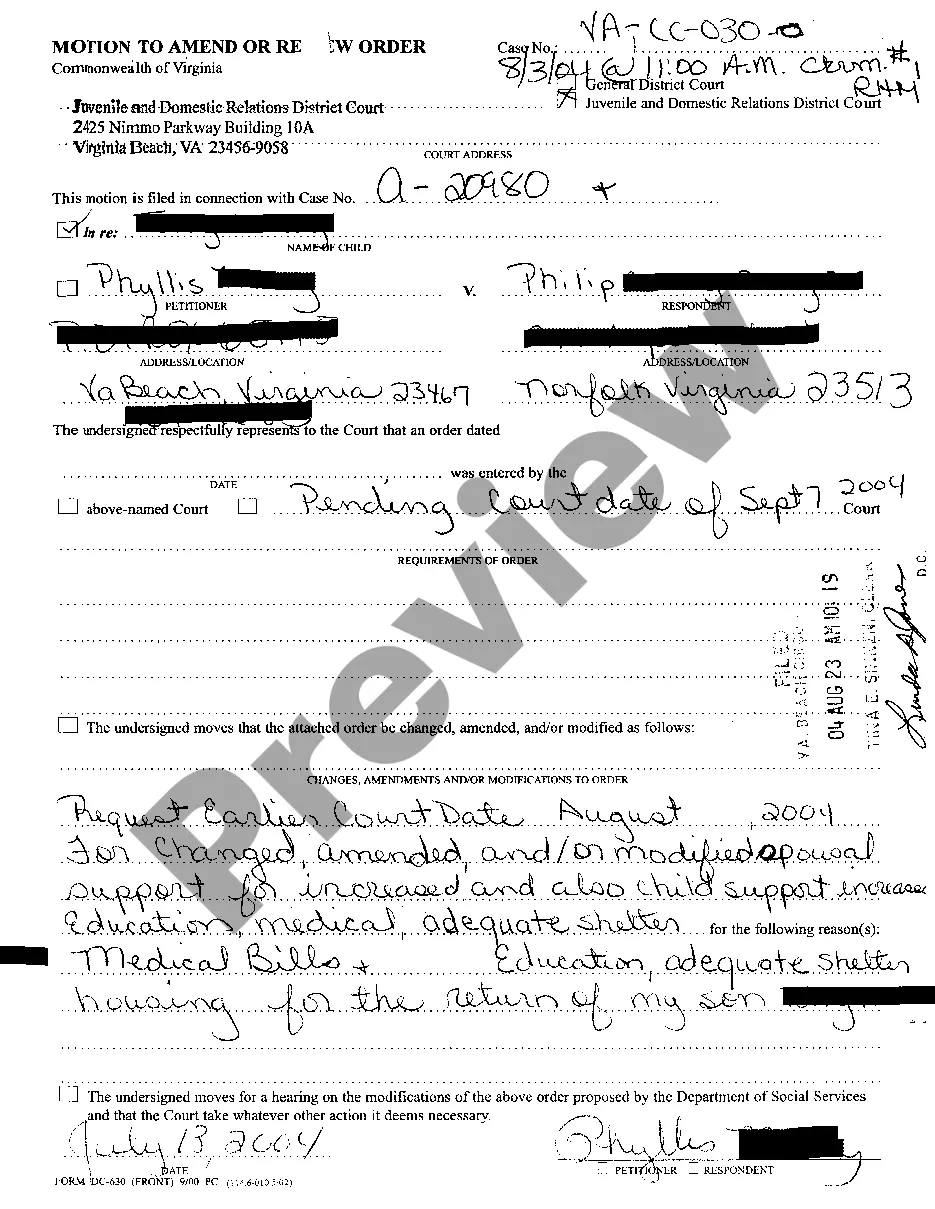

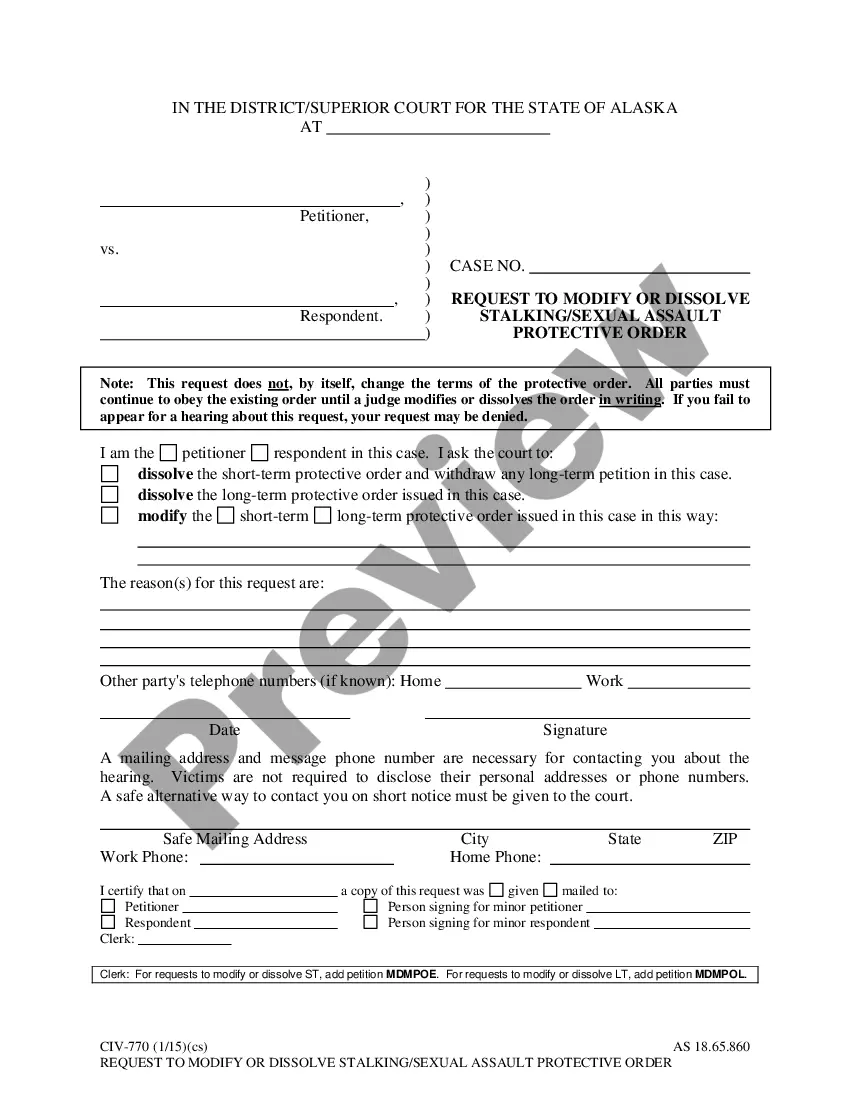

- Review the Preview mode and form details. Ensure you have chosen the correct one that fits your needs and fully complies with your regional authority's standards.

Form popularity

FAQ

When workers are employees, the employer is responsible to provide workers' compensation coverage. Oregon does not require coverage for independent contractors. People often believe workers to be independent contractors when they are not, particularly in certain industries where they are common.

?Tell your employer about your work-related injury or illness right away. Fill out Form 801 ?Report of Job Injury or Illness? and turn it in to your employer. Your employer should send it to its workers' compensation insurance carrier within five days of your notice. Your employer should provide you this form.

How do I file a workers compensation claim in my state? You must tell your employer that you were injured within 30 days of the injury. Your employer then has 7 days to file a First Report of Injury and give you a copy.

How Do You Get Workers' Comp Exempt? To get an exemption for workers' compensation coverage, your business must go through your state's screening process. You may have to apply for or renew your exemption by filing a ?Notice of Election to be Exempt From Workers' Compensation? with your local workers' comp office.

Talk to a lawyer about filing a claim today: OhioAs soon as possibleOne yearOregonAs soon as possible2 yearsPennsylvania21 days3 years (or 300 weeks from last exposure for occupational illnesses)Rhode Island30 days2 yearsSouth Carolina90 days2 years from injury or discovery11 more rows

You will receive two-thirds (66 2/3 percent) of your average weekly wage. There are minimum and maximum amounts you can receive, but few workers reach these limits. By law, SAIF and all workers' comp insurance companies must pay this percentage.

Sole proprietors in Oregon are not required to have workers' compensation insurance, though they can choose to purchase it. It's always a good idea to carry workers' comp, as health insurance plans can deny claims for injuries related to work.

Oregon requires most employers to carry workers' compensation insurance for their employees. If you employ workers in Oregon, you probably need workers' compensation coverage.

Limited liability companies where all the members are family members are exempt.

The Preferred Worker Program helps qualified Oregon workers who have permanent restrictions from on-the-job injuries and who are not able to return to their regular employment because of those injuries. Preferred workers can offer Oregon employers a chance to save money by hiring them.