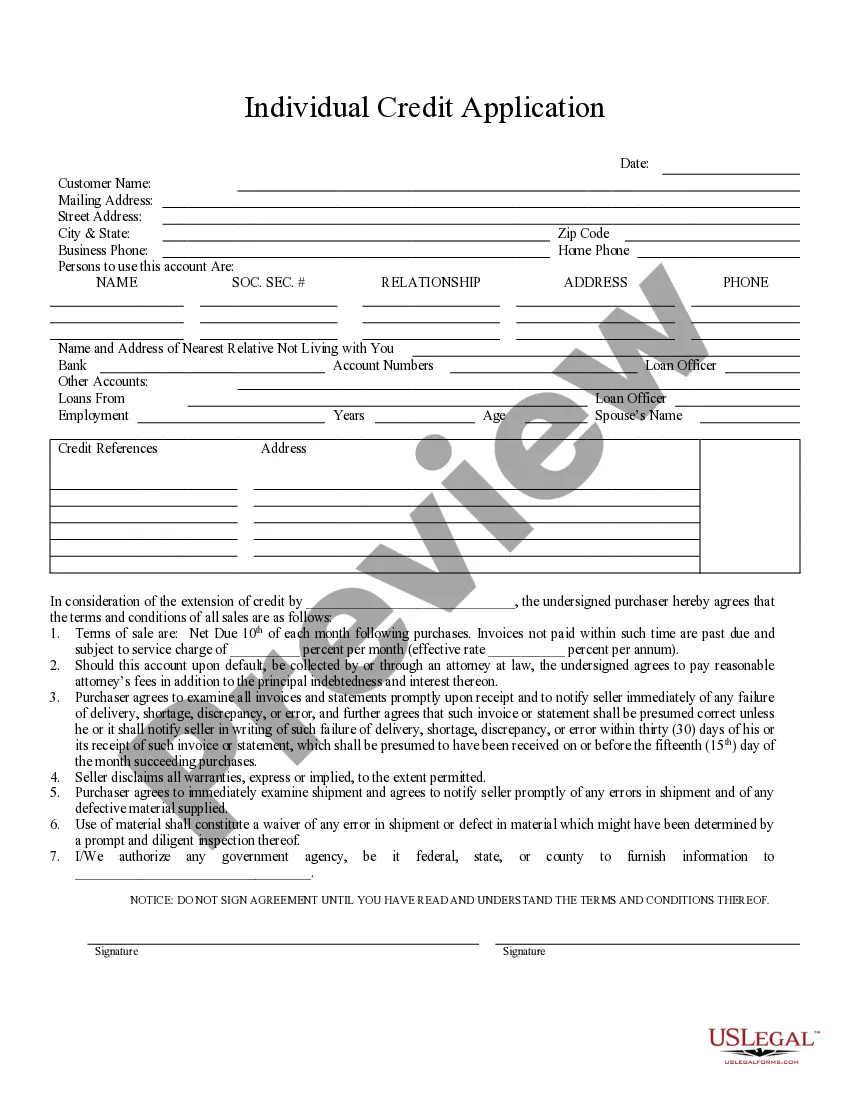

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Title: Eugene Oregon Individual Credit Application: A Comprehensive Guide Introduction: The Eugene Oregon Individual Credit Application is a crucial document utilized by individuals seeking credit for various purposes in Eugene, Oregon. Credit applications are an essential part of financial transactions, allowing individuals to apply for loans, credit cards, mortgages, and other forms of credit. Understanding the different types of credit applications available in Eugene, Oregon is essential for anyone looking to secure credit successfully. Types of Eugene Oregon Individual Credit Applications: 1. Mortgage Loan Application: The Eugene Oregon Mortgage Loan Application is specifically designed for individuals seeking financing for purchasing or refinancing real estate properties in Eugene or its surrounding areas. This application requires detailed information about the applicant's employment history, assets, liabilities, and creditworthiness. 2. Personal Loan Application: The Eugene Oregon Personal Loan Application is suitable for individuals who require financial assistance for personal expenses such as education, medical bills, debt consolidation, or major purchases. It requires information about the applicant's income, employment, assets, debts, and credit history. 3. Auto Loan Application: The Eugene Oregon Auto Loan Application is tailored for individuals looking to purchase a vehicle in Eugene or its nearby areas. This application requires details about the type of vehicle, its cost, the applicant's income, employment history, and creditworthiness. 4. Credit Card Application: The Eugene Oregon Credit Card Application is designed for individuals looking to obtain a credit card that can be used for making purchases and building credit. This application usually asks for personal information, income details, and an understanding of the applicant's financial responsibilities. Key Elements of Eugene Oregon Individual Credit Applications: 1. Personal Information: Applicants are required to provide their full name, date of birth, Social Security number, contact details, and current address in Eugene, Oregon. 2. Employment Details: Credit applications typically require details of the applicant's current employer, position, and length of employment. They may also inquire about previous employment history for a comprehensive understanding. 3. Financial Information: Applicants must provide accurate information regarding their income, including gross and net income, sources of income, and any additional sources of funds, such as investments or rental income. 4. Assets and Liabilities: Credit applications ask applicants to list their existing assets (e.g., real estate, vehicles, investments) and liabilities (e.g., outstanding debts, loans, mortgages). 5. Credit History: Applicants are often required to disclose their credit history, including information about previous loans, credit cards, bankruptcies, and any delinquencies or defaults. 6. References: Some credit applications may require applicants to provide personal or professional references to ensure credibility and reliability. Conclusion: The Eugene Oregon Individual Credit Application is a vital tool for individuals seeking credit for various purposes in Eugene, Oregon. By understanding the different types of credit applications available and providing accurate and complete information, applicants can enhance their chances of securing credit successfully.