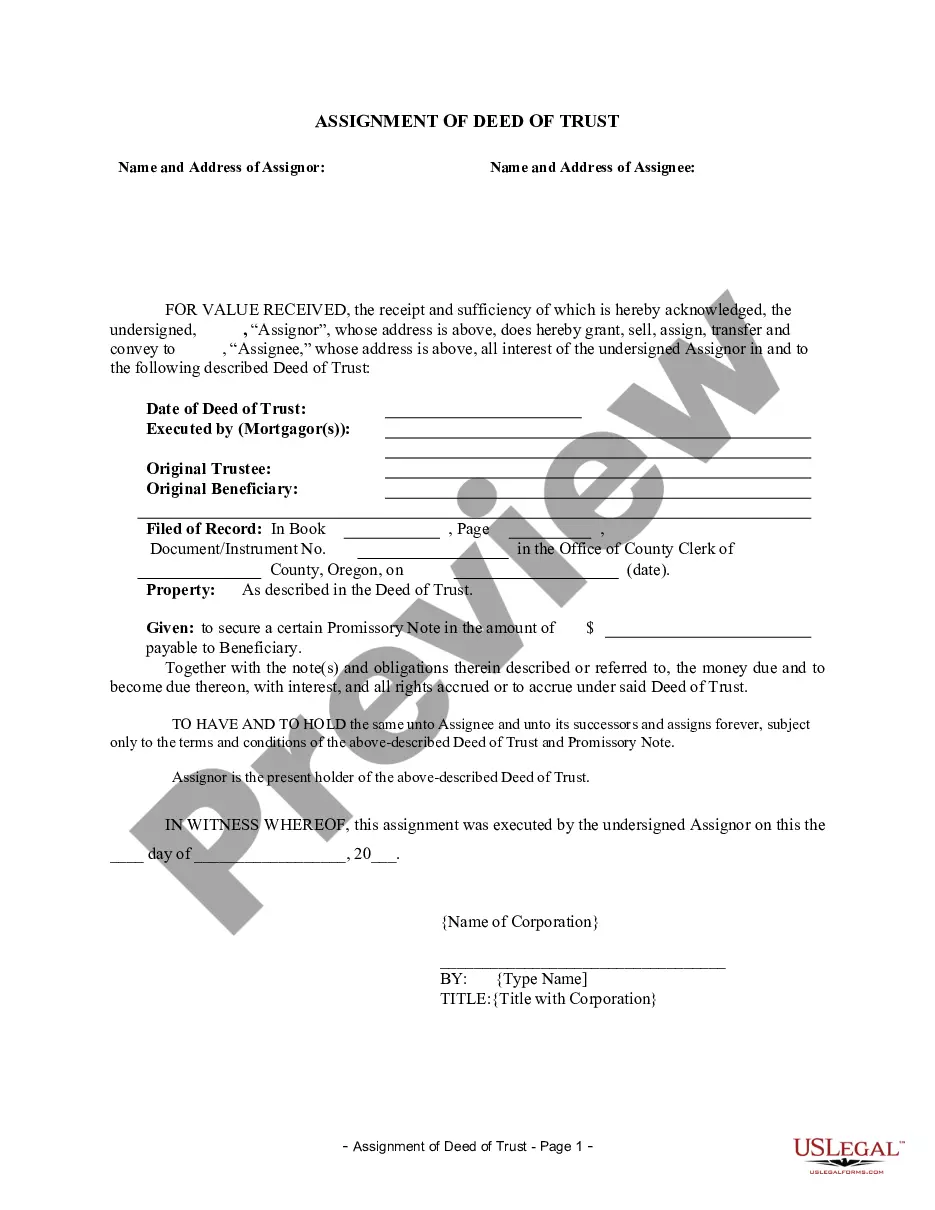

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Bend Oregon Assignment of Deed of Trust by Corporate Mortgage Holder

Description

How to fill out Oregon Assignment Of Deed Of Trust By Corporate Mortgage Holder?

If you are looking for an appropriate template, it’s tough to find a more suitable location than the US Legal Forms website – one of the most extensive collections available online.

Here you can obtain numerous document examples for business and personal use categorized by type and location, or keywords.

Utilizing our superior search functionality, locating the latest Bend Oregon Assignment of Deed of Trust by Corporate Mortgage Holder is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration procedure.

Retrieve the template. Choose the file format and save it on your device.

- Moreover, the accuracy of each document is confirmed by a team of qualified attorneys who routinely examine the templates on our site and refresh them according to the most current local and state regulations.

- If you are already familiar with our system and possess an active account, all you need to do to acquire the Bend Oregon Assignment of Deed of Trust by Corporate Mortgage Holder is to sign in to your account and click the Download button.

- If this is your first time using US Legal Forms, simply adhere to the guidelines outlined below.

- Ensure you have located the sample you require. Review its details and utilize the Preview option to examine its content. If it does not fit your needs, use the Search bar at the top of the page to find the correct document.

- Verify your choice. Click the Buy now button. Then, select your desired subscription option and enter your details to create an account.

Form popularity

FAQ

In the process of a Bend Oregon Assignment of Deed of Trust by Corporate Mortgage Holder, the corporate mortgage holder typically signs the document. This signature indicates the transfer of interest in the property secured by the deed of trust. Additionally, any other parties involved in the transaction, such as the borrower or a witness, may also need to sign to validate the assignment. To ensure compliance and streamline this process, consider using platforms like US Legal Forms.

The assignment of trust signifies a formal transfer of the interests and responsibilities encapsulated within a trust agreement to another individual or entity. This is particularly relevant when discussing the Bend Oregon Assignment of Deed of Trust by Corporate Mortgage Holder, as it clarifies who holds the rights under the trust. Understanding this concept can help you determine the continuity of obligations and management within the trust framework.

A corporate assignment refers to the transfer of rights or obligations from one corporation to another or to an individual, often concerning financial instruments like loans or trust agreements. In the context of Bend Oregon Assignment of Deed of Trust by Corporate Mortgage Holder, corporate assignments facilitate the management of debts and property interests, ensuring that all parties understand their rights and responsibilities. This process can enhance efficiency and clarity in corporate financial dealings.

A deed of transfer is a legal document that involves the movement of ownership or interest in property from one party to another. In contrast, a deed of assignment specifically refers to the transfer of rights or benefits from one party to another, often concerning obligations under a contract. In the context of Bend Oregon Assignment of Deed of Trust by Corporate Mortgage Holder, understanding this distinction helps clarify how property rights and financial responsibilities are handled.

A corporation Assignment of Deed of Trust mortgage involves a corporate entity who holds the deed of trust transferring their rights to another party. This legal document is essential when a corporation decides to assign its interest in the property to a new lender or buyer. It ensures that all obligations associated with the mortgage are properly organized. For a smooth process, using platforms like uslegalforms can provide necessary templates and guidance.

In a Bend Oregon Assignment of Deed of Trust by Corporate Mortgage Holder, the signer typically includes an authorized corporate officer. This officer acts on behalf of the corporation, ensuring legal compliance and proper authority. It is important for the signer to have an appropriate title and connection to the mortgage. This process helps to maintain the integrity of the assignment and protects all parties involved.

In a deed of trust, the grantee is the party who receives the property interest, usually the lender or mortgage holder. When you engage in a Bend Oregon Assignment of Deed of Trust by Corporate Mortgage Holder, understanding the role of the grantee is essential, as they hold the security interest in the property. The grantee's rights are tied to the trust deed, which offers them the ability to reclaim the property if the borrower defaults. By leveraging USLegalForms, you can ensure that all distinctions between grantees and other parties are clearly defined in your documents, minimizing confusion.

To complete an Assignment of mortgage in Bend, Oregon, you need to prepare the Assignment of Deed of Trust by Corporate Mortgage Holder document. First, ensure all necessary details are included, such as the names of the parties involved and the legal description of the property. After preparation, the assignment must be signed by the assignor and then typically needs to be notarized to validate its authenticity. For added convenience and accuracy, consider utilizing USLegalForms, which offers comprehensive forms and guidance throughout the assignment process.

In a Bend Oregon Assignment of Deed of Trust by Corporate Mortgage Holder, the title of the deed of trust requires signatures from both the borrower and the lender. The borrower is essentially the individual or entity that secures the mortgage, while the lender is typically the financial institution or corporate mortgage holder. Understanding who signs the document is crucial, as it solidifies the legal relationship between parties, protecting the lender’s interests and ensuring the borrower’s obligations. Using platforms like USLegalForms can simplify this process by providing clear instructions and ready-to-use templates.