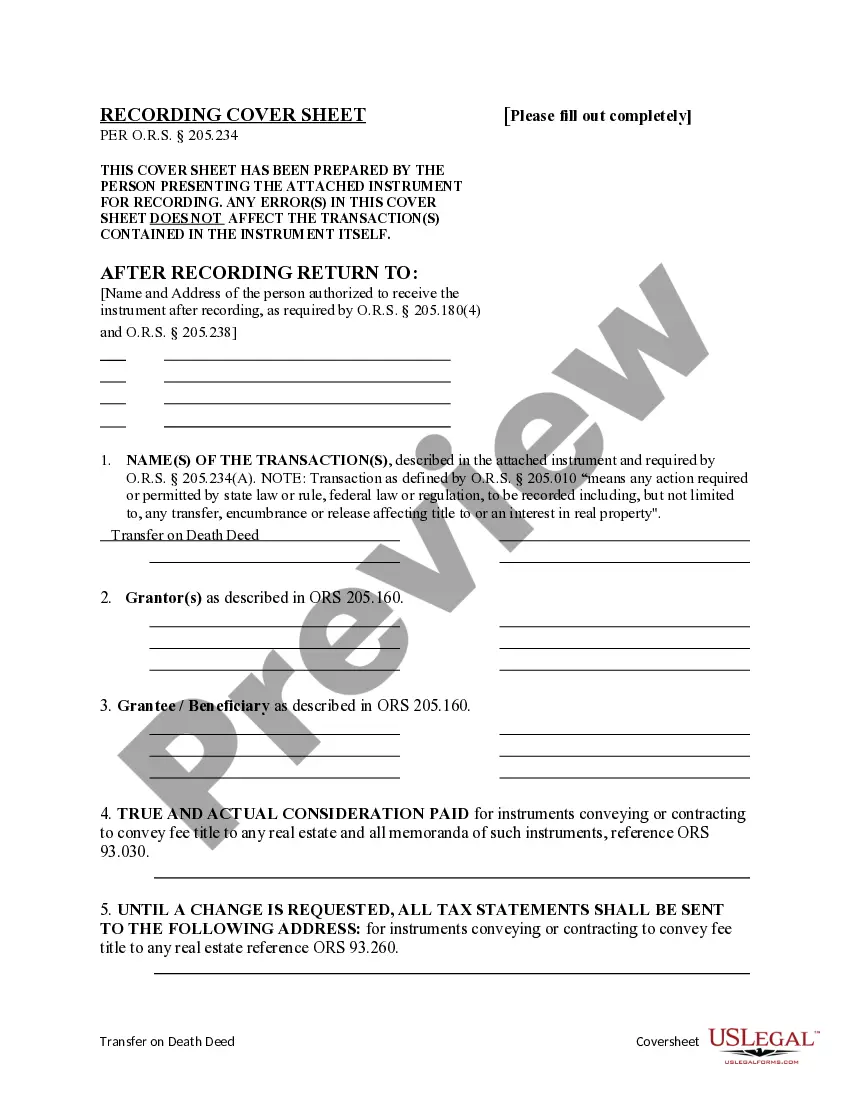

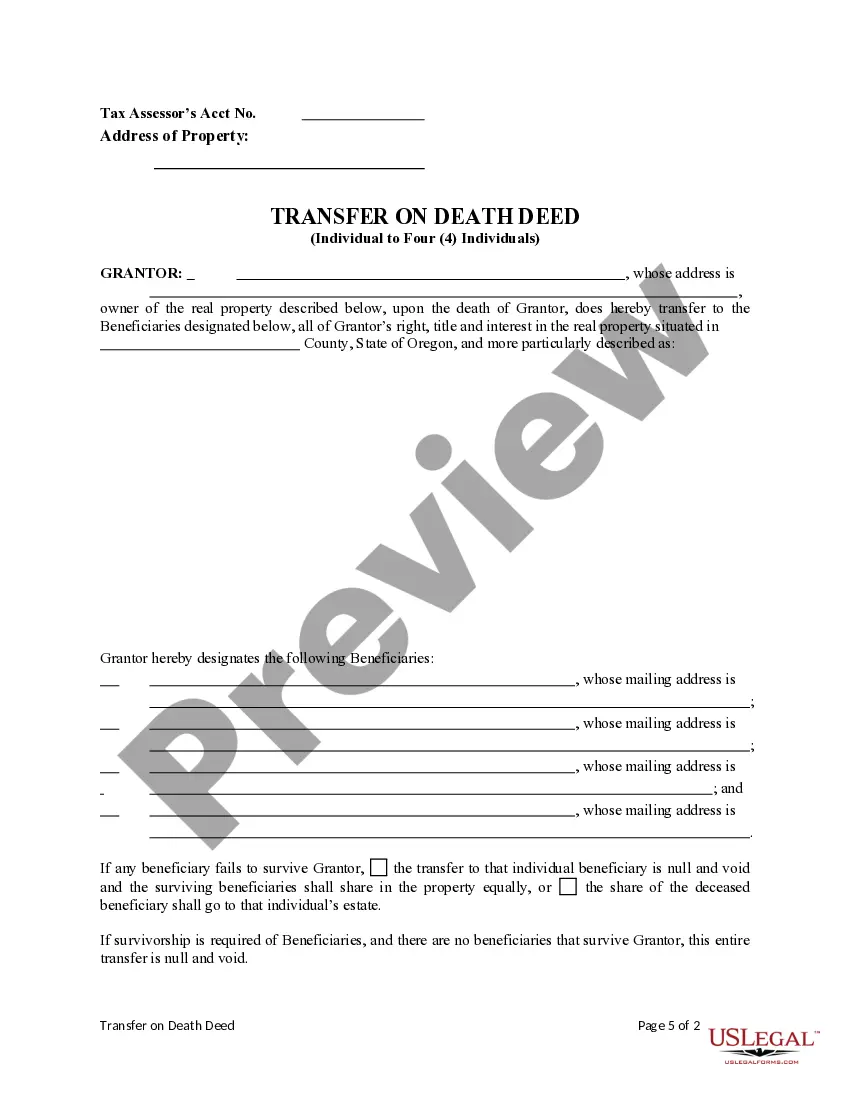

This form is a Transfer on Death Deed where the Grantor/Owner is an individual and the Grantee beneficiaries are four individuals. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. This deed must be recorded prior to Grantor's death. This deed complies with all state statutory laws.

Gresham Oregon Transfer on Death Deed from an individual Owner/Grantor to four individual Beneficiaries.

Description

How to fill out Oregon Transfer On Death Deed From An Individual Owner/Grantor To Four Individual Beneficiaries.?

Locating confirmed templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms library.

It is an online repository of over 85,000 legal forms for both personal and professional requirements and various real-life scenarios.

All documents are accurately sorted by area of use and jurisdiction, making the search for the Gresham Oregon Transfer on Death Deed from an individual Owner/Grantor to four individual Beneficiaries as quick and straightforward as ABC.

Maintaining documentation orderly and compliant with legal standards is of utmost importance. Utilize the US Legal Forms library to always have crucial document templates for any requirements right at your fingertips!

- For those already acquainted with our catalog and who have utilized it in the past, retrieving the Gresham Oregon Transfer on Death Deed from an individual Owner/Grantor to four individual Beneficiaries takes just a few clicks.

- Simply Log In to your account, choose the document, and click Download to save it onto your device.

- The process will require a few additional steps for new users.

- Follow the instructions below to get started with the most comprehensive online form catalog.

- Review the Preview mode and form description. Ensure you’ve selected the appropriate one that fits your needs and aligns with your local jurisdiction criteria.

Form popularity

FAQ

Yes, transfers on death deeds are legal in Oregon. This type of deed allows an individual Owner or Grantor to pass property directly to Beneficiaries without going through probate. Specifically, in a Gresham Oregon Transfer on Death Deed from an individual Owner/Grantor to four individual Beneficiaries, the beneficiaries can claim the property upon the Owner's passing while avoiding the lengthy probate process. This makes estate planning simpler and more efficient for individuals looking to ensure their property goes to their loved ones.

Choosing between a transfer on death deed and naming a beneficiary after death depends on your specific situation. A TOD deed allows for straightforward transfers without going through probate, which can save time and reduce costs. However, in certain circumstances, having a designated beneficiary might offer more flexibility. Evaluating your needs with the help of a platform like uslegalforms can provide clarity to navigate the Gresham Oregon Transfer on Death Deed from an individual Owner/Grantor to four individual Beneficiaries.

While a transfer on death deed offers benefits, it may also present risks. For instance, if the owner becomes incapacitated and has not created any other estate planning documents, decisions regarding the property may remain unresolved. Additionally, the Gresham Oregon Transfer on Death Deed from an individual Owner/Grantor to four individual Beneficiaries may lead to unequal distributions if not carefully outlined. Thus, proper guidance is essential.

A transfer on death deed typically does not avoid inheritance tax. Instead, the assets transferred through this deed may still be subject to tax depending on the overall estate value and state regulations. However, with careful planning, the Gresham Oregon Transfer on Death Deed from an individual Owner/Grantor to four individual Beneficiaries can help streamline the distribution process, making it easier for beneficiaries to manage potential tax implications.

Transfer on death (TOD) accounts can lead to complications when not properly structured. In many cases, individuals overlook the importance of designating beneficiaries correctly. This oversight can result in disputes among heirs or unintended distribution of assets. Moreover, the Gresham Oregon Transfer on Death Deed from an individual Owner/Grantor to four individual Beneficiaries will only be effective if the deed is executed correctly.

You can obtain a transfer on death deed form from various resources, including online legal document services like USLegalForms. This platform provides easy access to professionally drafted forms, including the Gresham Oregon Transfer on Death Deed from an individual Owner/Grantor to four individual Beneficiaries. Make sure to choose a reputable source to ensure you receive a legally compliant document.

To file a transfer on death deed in Oregon, you should first complete the deed form accurately. Once completed, you must file it with your county's recording office. It's essential to keep a copy for your records. The Gresham Oregon Transfer on Death Deed from an individual Owner/Grantor to four individual Beneficiaries should meet all state requirements for a valid deed.

While you can draft a transfer on death deed without a lawyer, it is often advisable to seek legal assistance, especially for the Gresham Oregon Transfer on Death Deed from an individual Owner/Grantor to four individual Beneficiaries. An experienced attorney can ensure compliance with state laws and help create a deed that meets your specific needs. This proactive approach can save you from potential challenges in the future.

You are not legally required to hire an attorney for a transfer on death deed in Oregon, including the Gresham Oregon Transfer on Death Deed from an individual Owner/Grantor to four individual Beneficiaries. However, consulting an attorney can provide peace of mind and ensure that the deed is executed correctly. A qualified legal professional can help clarify any uncertainties or concerns you may have.

Minnesota does indeed permit transfer on death deeds, but they differ in structure from the Gresham Oregon Transfer on Death Deed from an individual Owner/Grantor to four individual Beneficiaries. In Minnesota, this deed allows the property owner to designate beneficiaries who will automatically receive the property upon the owner’s death without going through probate. Ensure to check local resources or consult professionals in Minnesota for specific guidelines.