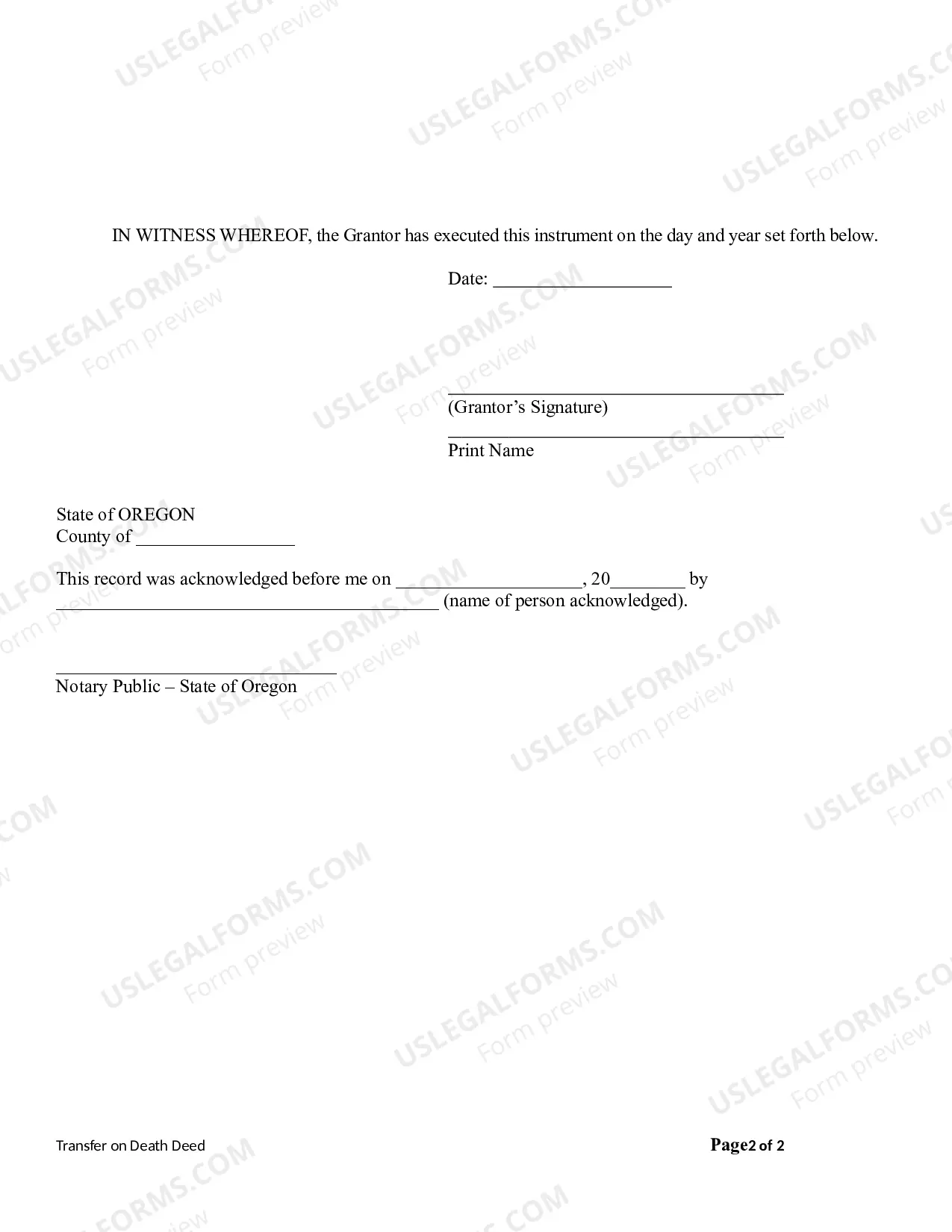

This form is a Transfer on Death Deed where the Grantor/Owner is an individual and the Grantee beneficiary is an individual. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. This deed must be recorded prior to Grantor's death. This deed complies with all state statutory laws.

Gresham Oregon Transfer on Death Deed from an individual Owner/Grantor to an individual Beneficiary.

Description

How to fill out Oregon Transfer On Death Deed From An Individual Owner/Grantor To An Individual Beneficiary.?

Locating authenticated templates tailored to your regional laws can be difficult unless you utilize the US Legal Forms repository.

It’s an online collection of over 85,000 legal documents for both personal and professional requirements and various real-world scenarios.

All the files are appropriately categorized by their purpose and jurisdictional areas, making it as simple as pie to find the Gresham Oregon Transfer on Death Deed from a private Owner/Grantor to a private Beneficiary.

Purchase the document. Click on the Buy Now button and select yourdesired subscription plan. You will need to create an account to gain access to the library’s resources.

- For anyone already acquainted with our catalog and has used it previously, acquiring the Gresham Oregon Transfer on Death Deed from a private Owner/Grantor to a private Beneficiary takes merely a few clicks.

- Simply Log In to your account, choose the document, and click Download to save it onto your device.

- The procedure will require just a few additional steps for new users.

- Review the Preview mode and document description. Ensure you’ve chosen the appropriate one that satisfies your needs and fully aligns with your regional jurisdiction criteria.

- Search for another template, if necessary. If you notice any discrepancy, use the Search tab above to locate the suitable one. If it meets your needs, proceed to the next step.

Form popularity

FAQ

You don't necessarily need an attorney to create a transfer on death deed, but having professional guidance can streamline the process. If you are unsure about the legal requirements specific to your area, it may be beneficial to consult with a lawyer. However, for those seeking a Gresham Oregon Transfer on Death Deed from an individual Owner/Grantor to an individual Beneficiary, using platforms like USLegalForms can provide the information and templates you need to handle the process confidently.

Writing a beneficiary deed involves a few important steps. First, draft the deed including details such as the property description and the names of both the grantor and beneficiary. Be sure to specify that the transfer occurs upon the grantor's death. For those creating a Gresham Oregon Transfer on Death Deed from an individual Owner/Grantor to an individual Beneficiary, using templates from USLegalForms can make this process simpler and more efficient.

Yes, Minnesota allows for transfer on death deeds. This enables individual owners or grantors to transfer their property to designated beneficiaries without the need for probate. If you are exploring the process for a Gresham Oregon Transfer on Death Deed from an individual Owner/Grantor to an individual Beneficiary, understanding the state laws is crucial for a successful transfer. Resources like USLegalForms can assist you in navigating these legal documents.

Maryland does not permit transfer on death deeds. Instead, the state provides alternatives like a will or a living trust for transferring property upon death. If you are seeking a Gresham Oregon Transfer on Death Deed from an individual Owner/Grantor to an individual Beneficiary, options may differ from state to state. It's essential to verify specific state laws and consider how they apply to your situation.

You generally do not need a lawyer to execute a Gresham Oregon Transfer on Death Deed from an individual Owner/Grantor to an individual Beneficiary. However, seeking legal advice can ensure your interests are fully protected. Platforms like uslegalforms offer comprehensive guides and templates that can assist you in creating a valid deed without legal representation.

One disadvantage of a Gresham Oregon Transfer on Death Deed from an individual Owner/Grantor to an individual Beneficiary is that it may not address all estate issues, such as debts or taxes. Additionally, if you do not keep the deed updated, it may not reflect your wishes over time. It's crucial to consider all estate planning options to find what best fits your situation.

While you do not need a lawyer to file a Gresham Oregon Transfer on Death Deed from an individual Owner/Grantor to an individual Beneficiary, consulting one can be beneficial. A lawyer can provide clarity on legal language and help ensure that the form complies with Oregon laws. This can prevent potential complications down the line.

To file a Gresham Oregon Transfer on Death Deed from an individual Owner/Grantor to an individual Beneficiary, you first need to complete the deed form. After filling it out accurately, you must sign the document in front of a notary public. Finally, you will need to record the deed with the appropriate county clerk's office to ensure it is legally recognized.

To transfer a property deed from a deceased relative in Oregon, you’ll first need to determine if the property was transferred on death. If not, probate may be necessary. You can utilize US Legal Forms to find the required documentation needed for such situations and ensure the process respects the wishes outlined in your relative's estate plan.

One disadvantage of a Gresham Oregon Transfer on Death Deed from an individual Owner/Grantor to an individual Beneficiary is that it may not prevent estate taxes from applying to the property upon the Owner/Grantor’s death. Additionally, if the Owner/Grantor has creditors, those creditors may still have claims against the property. It’s essential to consider these factors carefully when planning your estate.