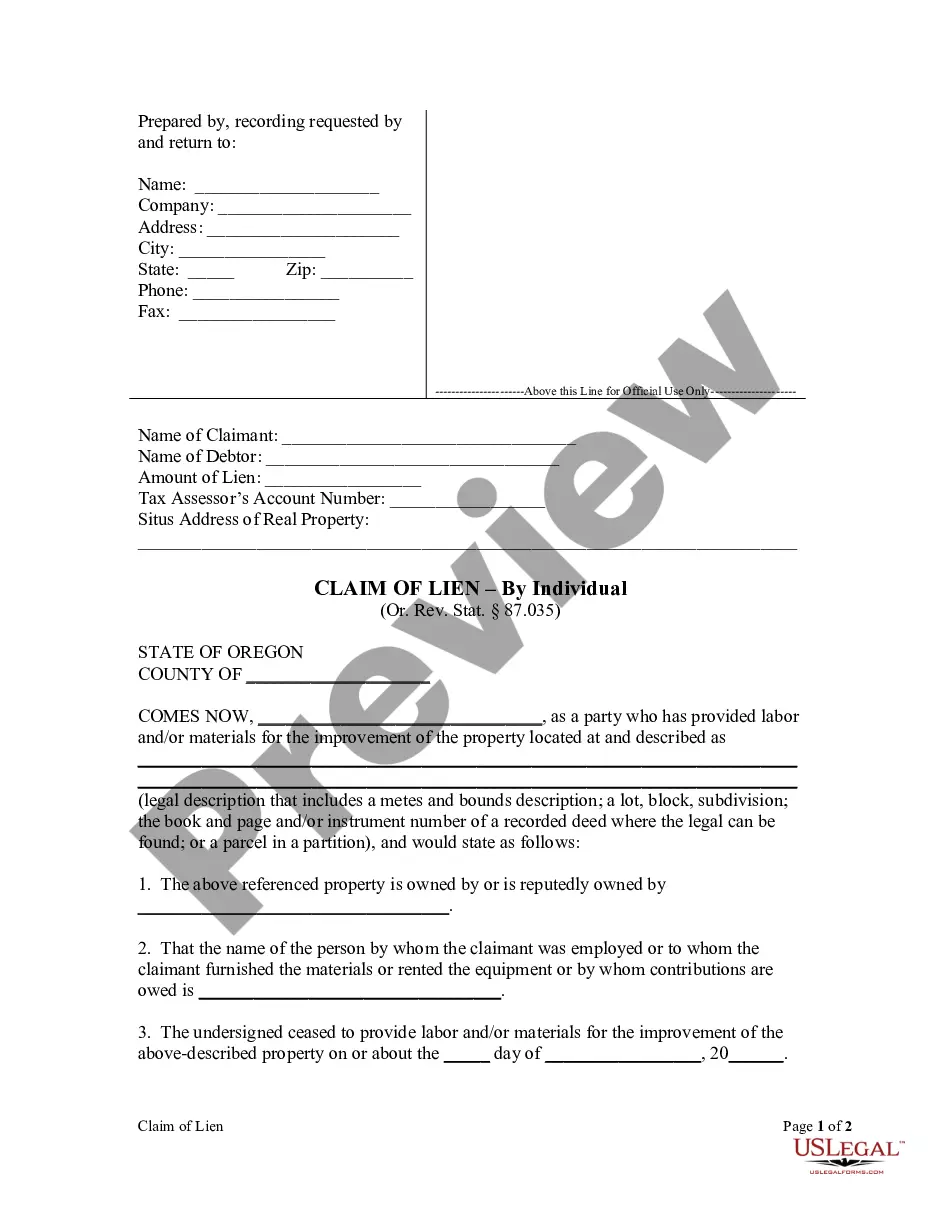

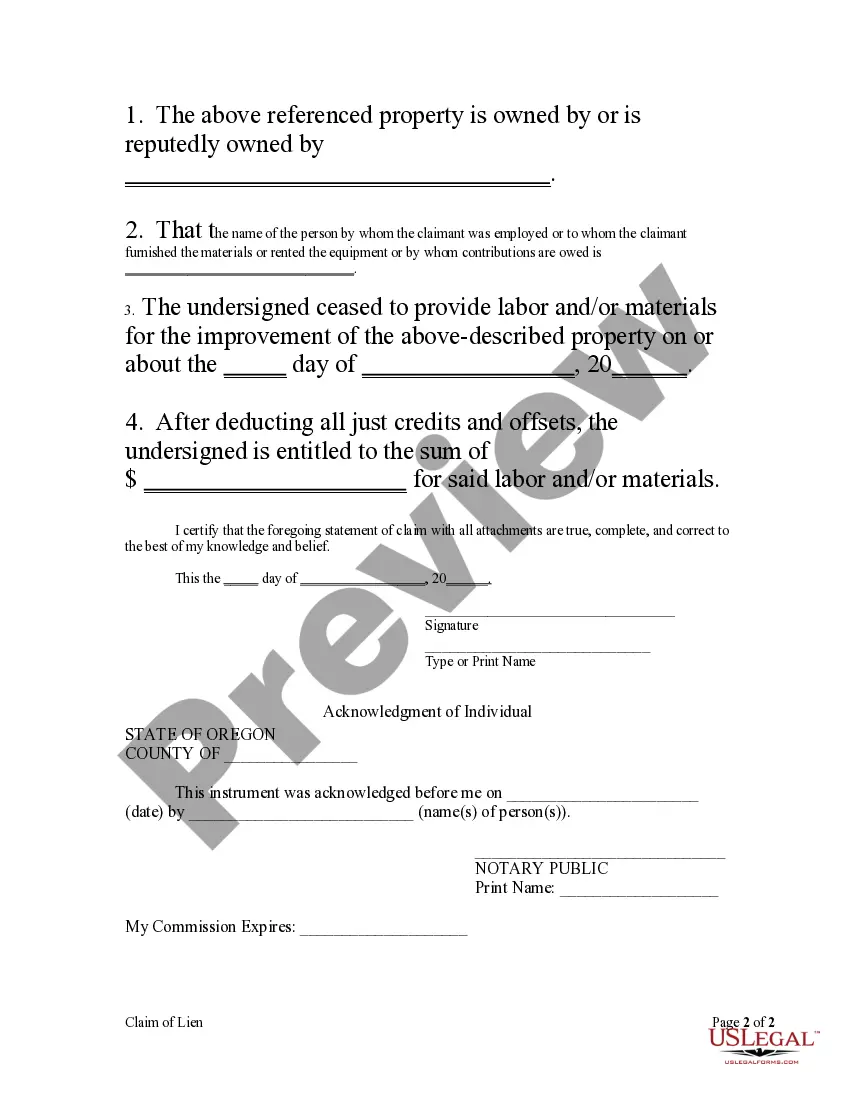

Every person claiming a lien created under ORS 87.010 (1) or (2) shall perfect the lien no later than 75 days after the person has ceased to provide labor, rent equipment or furnish materials or 75 days after completion of construction, whichever is earlier. Every other person claiming a lien created under ORS 87.010 shall perfect the lien not later than 75 days after the completion of construction. All liens claimed shall be perfected as provided by subsections (2) to (4) of this section. A lien created under ORS 87.010 shall be perfected by filing a claim of lien with the recording officer of the county or counties in which the improvement, or some part thereof, is situated.

Bend Oregon Claim of Lien by Individual

Description

How to fill out Oregon Claim Of Lien By Individual?

If you are looking for a suitable form template, it’s hard to find a more accessible site than the US Legal Forms webpage – one of the most extensive collections online.

With this collection, you can access a wide array of templates for business and personal purposes categorized by types and regions, or keywords.

With the efficient search feature, obtaining the most current Bend Oregon Claim of Lien by Individual is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finish the registration process.

Acquire the form. Select the file type and download it to your device.

- Moreover, the relevance of each document is confirmed by a team of professional attorneys who routinely assess the templates on our platform and refresh them based on the latest requirements from state and county authorities.

- If you are already familiar with our system and hold a registered account, all you need to do to acquire the Bend Oregon Claim of Lien by Individual is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, just follow the guidelines below.

- Ensure you have selected the form you require. Review its description and use the Preview option to investigate its contents. If it does not fulfill your requirements, utilize the Search option at the top of the page to find the suitable document.

- Confirm your selection. Click the Buy now button. Then, choose your desired subscription plan and enter details to register for an account.

Form popularity

FAQ

To find liens on property in Oregon, you can start by accessing public records maintained by the county clerk's office. These records often include information on various liens, including a Bend Oregon Claim of Lien by Individual. Additionally, online services and databases may provide searchable access to property liens, making it easier for you to gather information. Utilizing these resources can help you make informed decisions regarding property investments.

To file a Bend Oregon Claim of Lien by Individual, you typically need to prepare several key documents. These include a completed lien form, documentation of the work performed or the debt owed, and proof of service to the property owner. Ensuring you have all necessary documents can streamline the filing process and enhance your chances of a successful claim.

In Oregon, a lien is a legal claim against property, usually to secure payment for services or debts. To file a Bend Oregon Claim of Lien by Individual, you must provide notice to the property owner. Additionally, you must file the lien within a specific timeframe after the work is done or the debt is incurred. Following these rules helps protect your rights as a claimant.

Yes, you can place a lien against your own property in Bend, Oregon. By filing a Bend Oregon Claim of Lien by Individual, you can secure an obligation that another party owes you. This can be useful in certain situations, such as protecting your investment or ensuring payment for services rendered. However, it is important to follow the correct processes to ensure your claim is valid and enforceable.

Whether waivers need to be notarized can vary depending on the context in Bend, Oregon. Notarization can lend credibility and enforceability to the document, although it is not universally required. Check the particulars of your situation or consult a legal professional to determine if notarization will enhance the safety and reliability of your waiver.

To file a claim of lien by an individual in Oregon, begin by preparing the necessary documents that outline the debt. Then, file these documents with the county clerk in the county where the property is located. Make sure to comply with any specific state deadlines to ensure your claim is valid. For assistance with forms and filing, consider using platforms like uslegalforms to simplify the process.

In Bend, Oregon, a lien waiver does not always need to be notarized. However, having it notarized can provide an extra layer of validity and reassurance for both parties involved. It's good practice to check specific state regulations or requirements based on the type of waiver being issued. This small step can help secure your interests or those of your clients.

The most common lien on property typically comes from mortgage loans, allowing lenders to claim against the property in case of non-payment. However, among individuals in Bend, Oregon, mechanics' liens are also prevalent, filed by contractors or suppliers for unpaid work. Being informed about these common liens can help you protect your property and navigate potential claims.

A lien waiver and a lien release serve different purposes in Bend, Oregon. A lien waiver is a document that relinquishes a potential future lien, protecting the property owner from claims of unpaid work. On the other hand, a lien release formally cancels an existing lien, reflecting that the debt has been settled. Understanding these differences helps ensure proper handling of claims of lien by individuals.

Filling out a lien affidavit in Bend, Oregon, involves several key steps. Begin by entering the property owner's information, including their name and address. Then, provide details about the work performed or materials supplied, along with the amount owed. Finally, ensure you sign the affidavit and keep a copy for your records before filing it with the appropriate county office.