Oklahoma City Oklahoma Notice of Assignment to Living Trust

Description

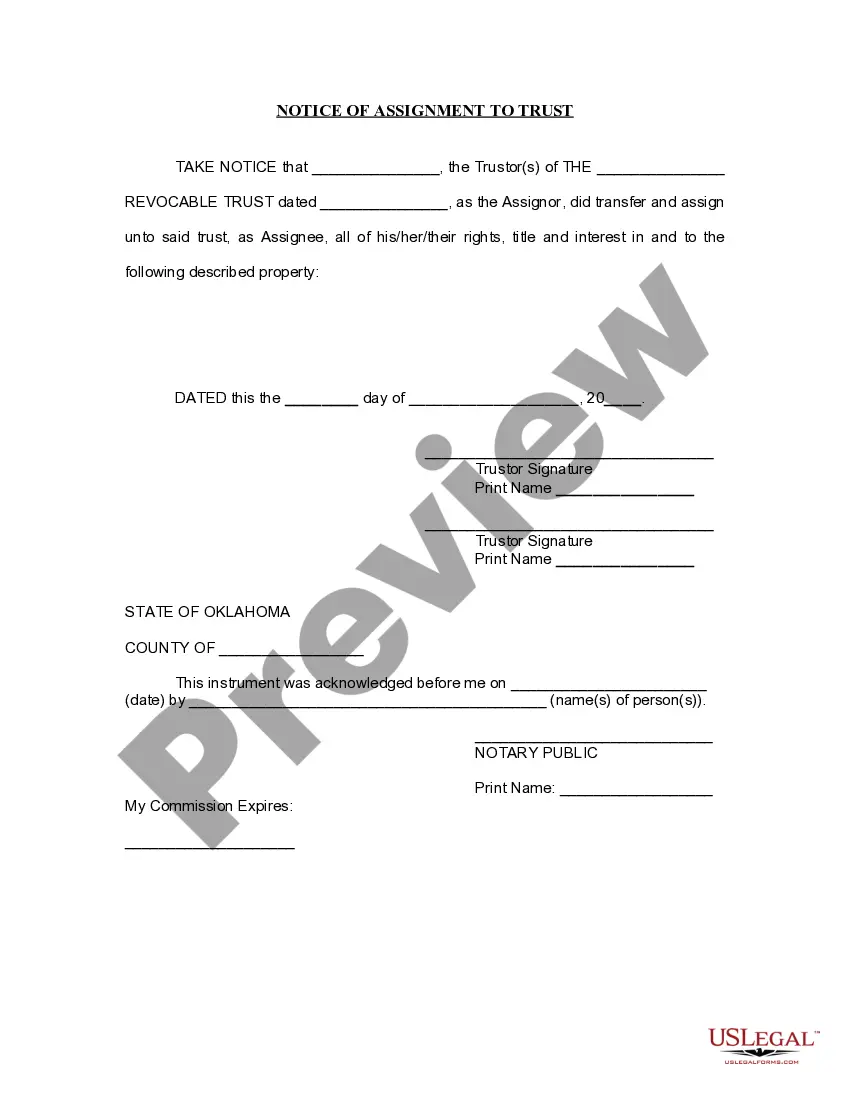

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

How to fill out Oklahoma Notice Of Assignment To Living Trust?

Finding authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms database.

It’s an online collection of over 85,000 legal documents for both personal and business purposes, catering to various real-life situations.

All the paperwork is systematically organized by field of application and jurisdictional regions, making the search for the Oklahoma City Oklahoma Notice of Assignment to Living Trust as simple as pie.

Maintaining documentation orderly and compliant with legal stipulations is crucial. Take advantage of the US Legal Forms collection to always have vital document templates readily available for any requirement!

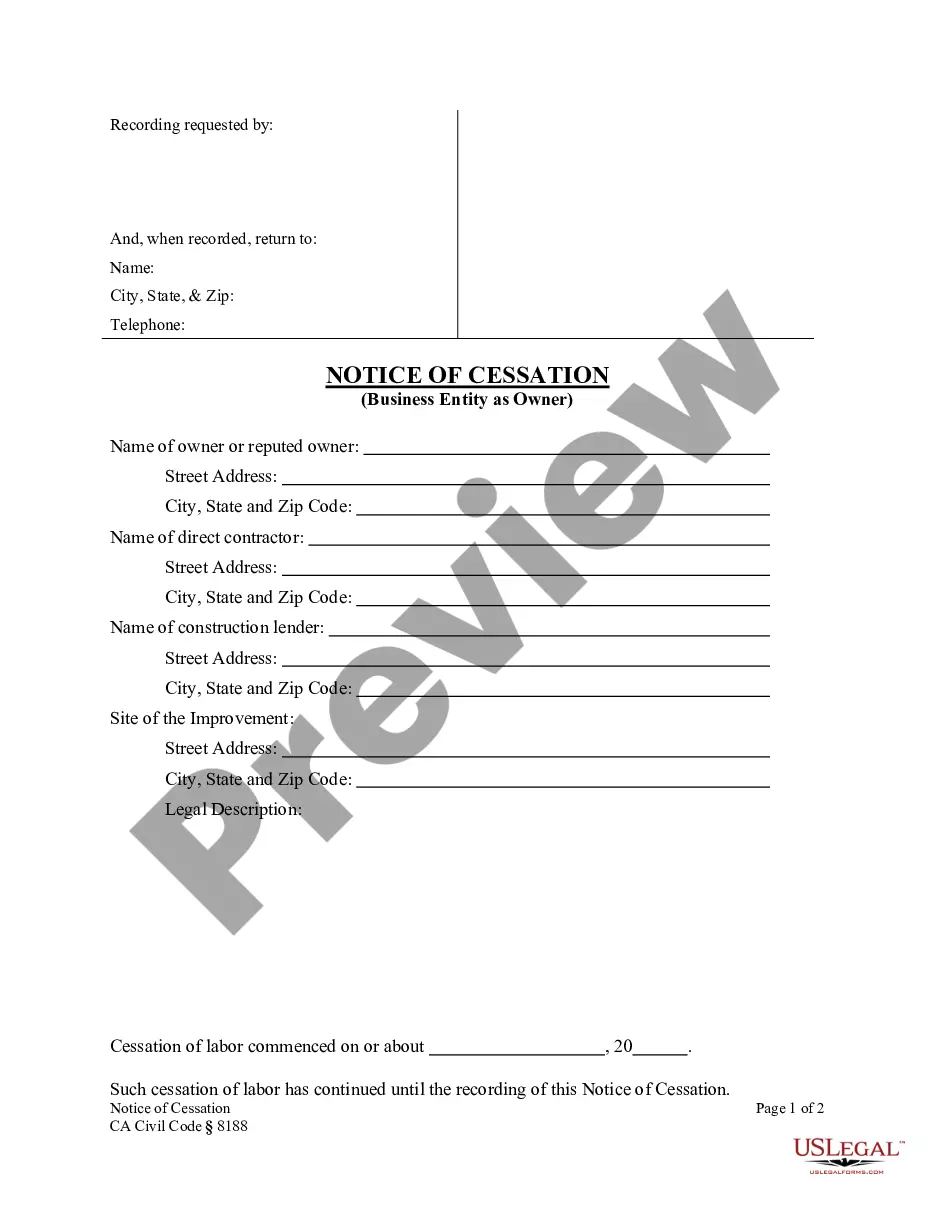

- Examine the Preview mode and form description.

- Ensure you’ve chosen the right one that fulfills your requirements and aligns perfectly with your local jurisdiction standards.

- Look for an alternative template, if necessary.

- If you find any discrepancy, use the Search tab above to acquire the appropriate one. If it fits your criteria, proceed to the next stage.

- Purchase the document.

Form popularity

FAQ

How Much Does It Cost to Create a Living Trust in Oklahoma? There is no set price tag on setting up a living trust. It can range from just under $100 to more than $1,000. It all depends on how you create it and how complex your estate is.

If you do have standing to contest a will, you must file the contest in a timely manner. In the state of Oklahoma that is 3 months from the time the will was admitted to probate. If it has been longer than 3 months, you are barred from filing a contest.

Once you die, your living trust becomes irrevocable, which means that your wishes are now set in stone. The person you named to be the successor trustee now steps up to take an inventory of the trust assets and eventually hand over property to the beneficiaries named in the trust.

The Oklahoma living trust is a legal entity into which the Grantor (the creator of the document) places their assets in order to protect them from litigation (probate) and, in certain circumstances, creditors.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

Choosing to create a living trust in Oklahoma is a matter of personal choice, but many people find its benefits to be very attractive. A trust creates privacy for your family because the trust is never public record.

The Oklahoma living trust is a legal entity into which the Grantor (the creator of the document) places their assets in order to protect them from litigation (probate) and, in certain circumstances, creditors.

Contact the county courthouse in the county where the trust grantor lived. Although revocable trusts are considered private documents and are not required to be filed with the court, some people file the trusts anyway. It is possible that the trust is on file and you can get a copy from the county clerk.

Anyone listed as a trust beneficiary will be entitled to receive a copy of the Trust. Additionally, an heir of the settlor is entitled to a copy of the Trust.

Therefore, if you want to contest a trust, you must initiate a legal action on your own. To do this, you must retain legal counsel. Litigation involving a trust challenge can be a lot more complex and costly. You may have heard that it is possible to include a no-contest clause in your trust.