Oklahoma City Oklahoma Living Trust for Individual as Single, Divorced or Widow (or Widower) with Children

Description

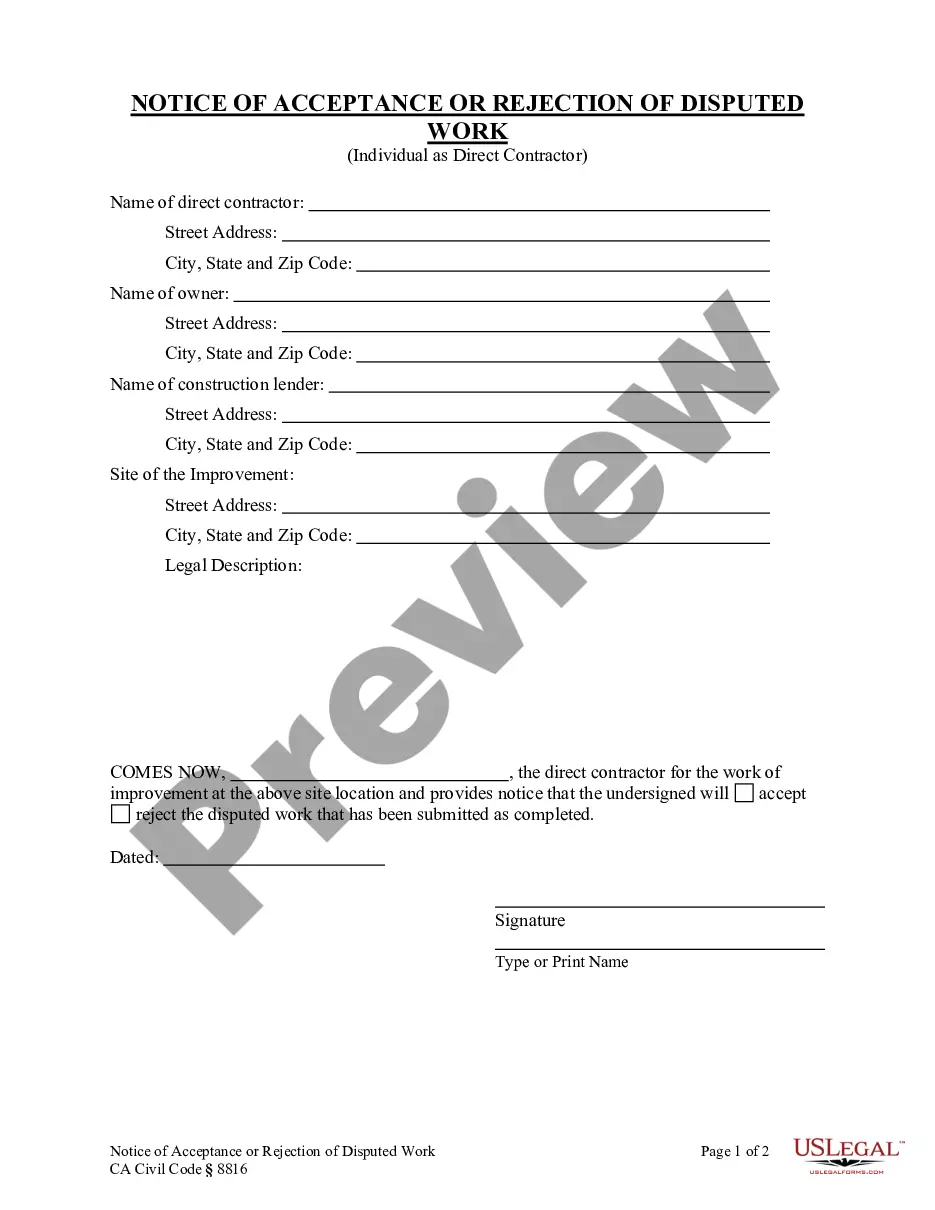

How to fill out Oklahoma Living Trust For Individual As Single, Divorced Or Widow (or Widower) With Children?

Locating authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms repository.

This is an online database featuring over 85,000 legal documents catering to both personal and professional requirements in various real-life circumstances.

All the files are appropriately categorized by purpose and jurisdiction, making it as straightforward as ABC to search for the Oklahoma City Oklahoma Living Trust for Individual as Single, Divorced or Widow (or Widower) with Children.

Maintaining documentation organized and compliant with legal standards is crucial. Utilize the US Legal Forms library to always have vital document templates readily available for any needs!

- For individuals already familiar with our service and have utilized it previously, acquiring the Oklahoma City Oklahoma Living Trust for Individual as Single, Divorced or Widow (or Widower) with Children only requires a few clicks.

- Simply Log In to your account, select the necessary document, and hit Download to save it on your device.

- The procedure for new users will involve just a few additional steps to complete.

- Follow the instructions below to begin using the most comprehensive online form collection.

- Review the Preview mode and document description. Ensure you’ve selected the appropriate one that matches your requirements and fully aligns with your local jurisdiction standards.

Form popularity

FAQ

Married partners or civil partners inherit under the rules of intestacy only if they are actually married or in a civil partnership at the time of death. So if you are divorced or if your civil partnership has been legally ended, you can't inherit under the rules of intestacy.

To make a living trust in Oklahoma, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

The Spouse's Share in Oklahoma. In Oklahoma, if you are married and you die without a will, what your spouse gets depends on whether or not you have living parents, siblings, or descendants -- children, grandchildren, or great-grandchildren. If you don't, then your spouse inherits all of your intestate property.

Here's a good rule of thumb: If you have a net worth of at least $100,000 and have a substantial amount of assets in real estate, or have very specific instructions on how and when you want your estate to be distributed among your heirs after you die, then a trust could be for you.

You are married with children at the time of your death ? Your spouse will inherit one-half of your estate and the remaining one-half will be divided equally among your children.

Choosing to create a living trust in Oklahoma is a matter of personal choice, but many people find its benefits to be very attractive. A trust creates privacy for your family because the trust is never public record.

The Oklahoma living trust is a legal entity into which the Grantor (the creator of the document) places their assets in order to protect them from litigation (probate) and, in certain circumstances, creditors.

In Oklahoma, these forms of joint ownership are available: Joint tenancy. Property owned in joint tenancy automatically passes to the surviving owners when one owner dies. No probate is necessary.

A: Under Oklahoma law, a married person may not completely exclude the surviving spouse. Oklahoma law allows the spouse to elect to take a certain portion of the estate despite the will.

How Much Does It Cost to Create a Living Trust in Oklahoma? There is no set price tag on setting up a living trust. It can range from just under $100 to more than $1,000. It all depends on how you create it and how complex your estate is.