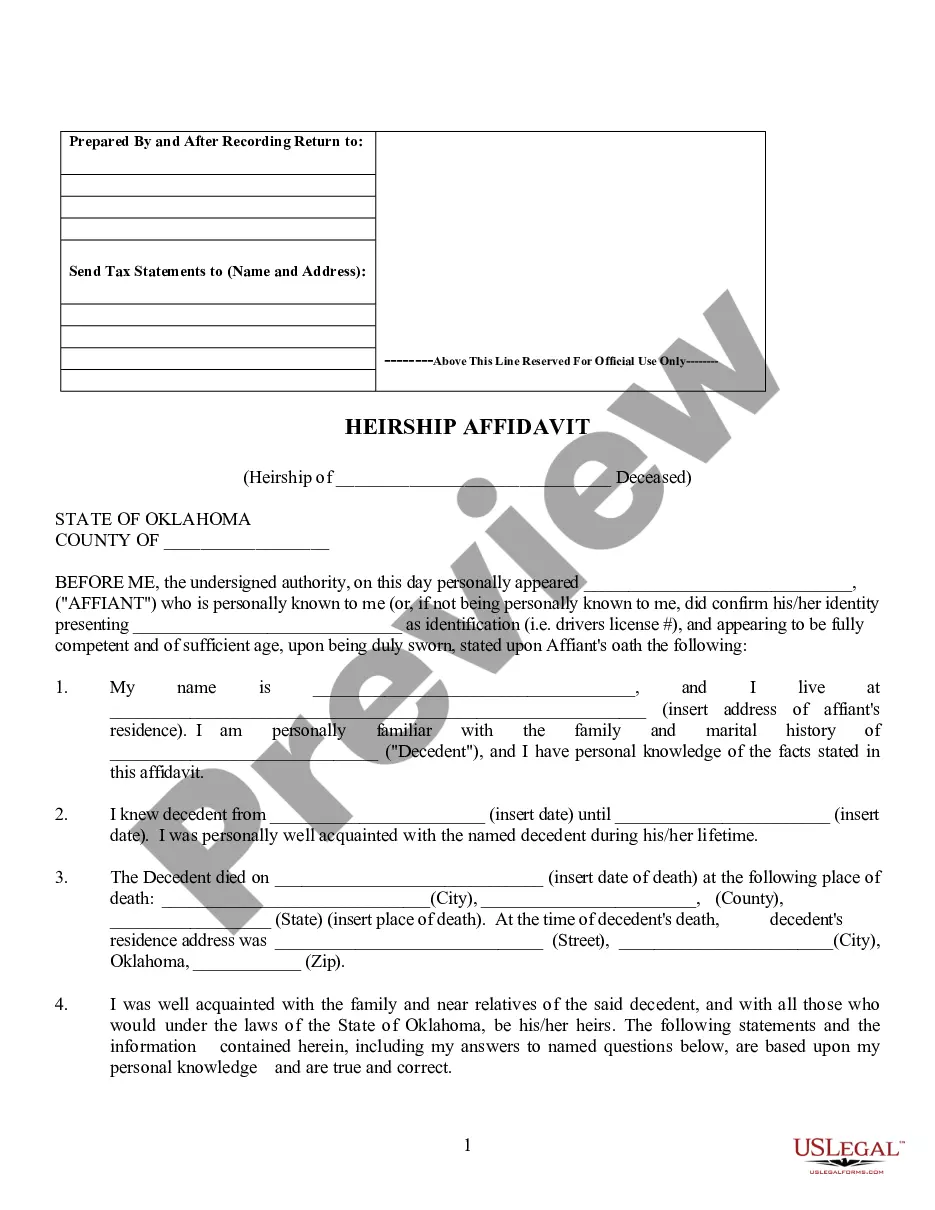

Oklahoma City Oklahoma Heirship Affidavit - Descent

Description

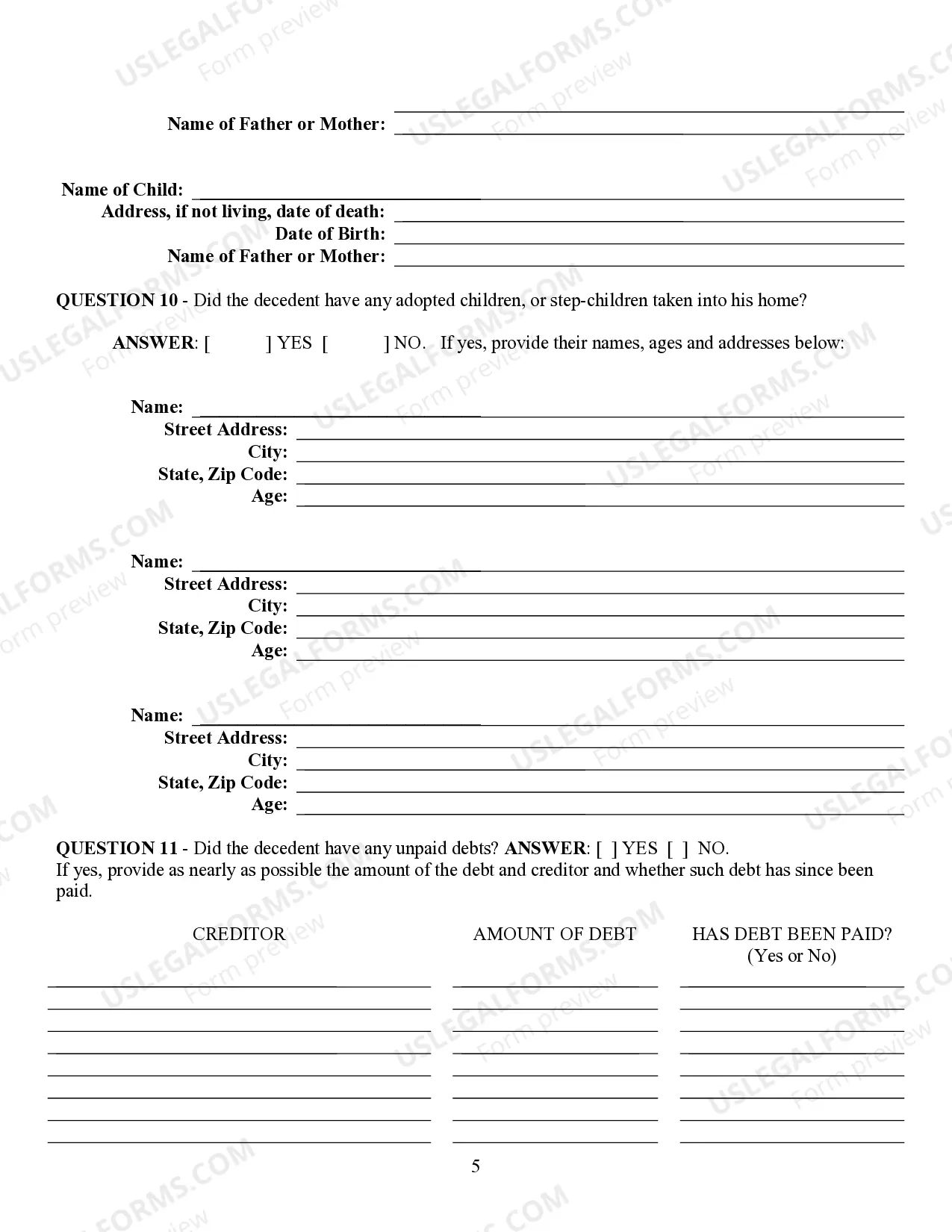

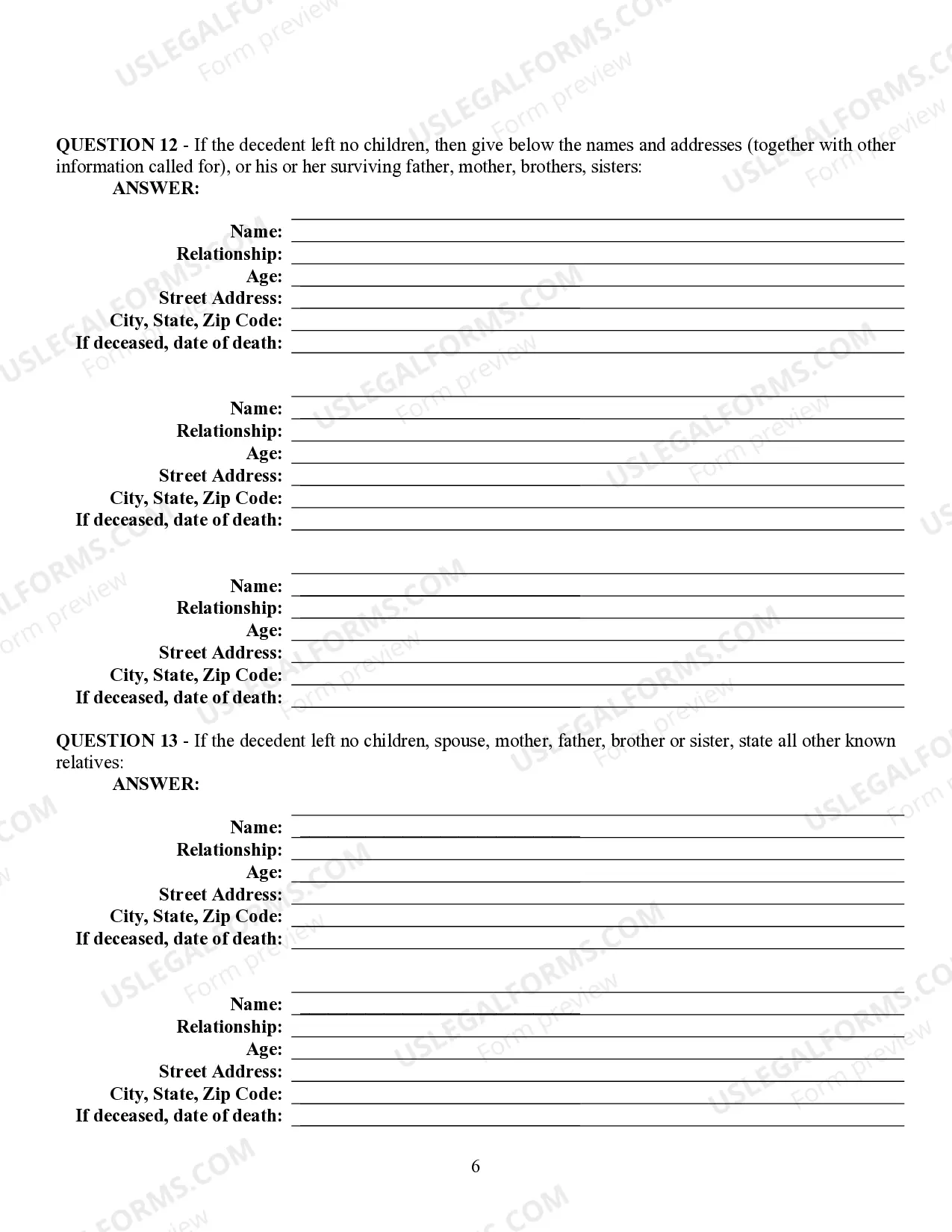

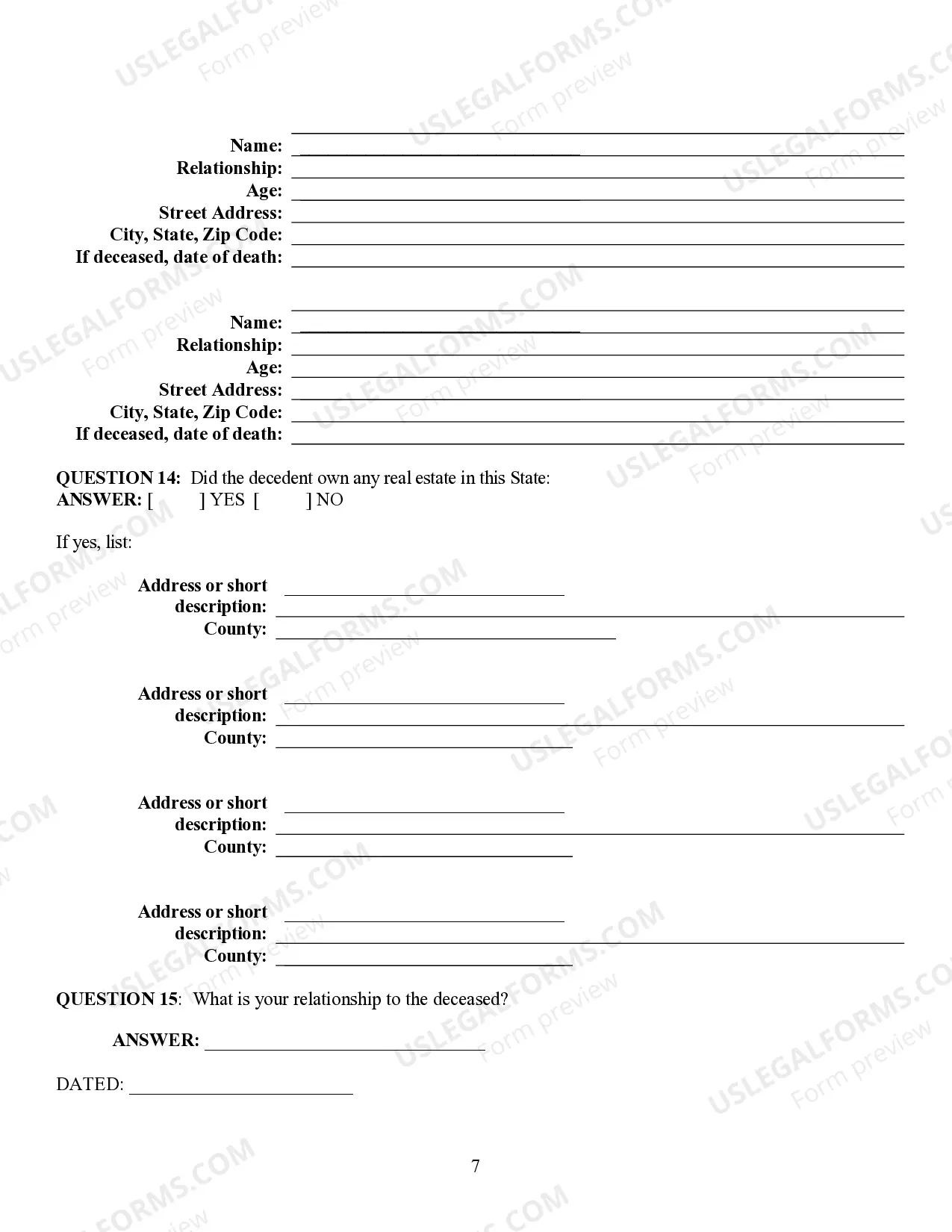

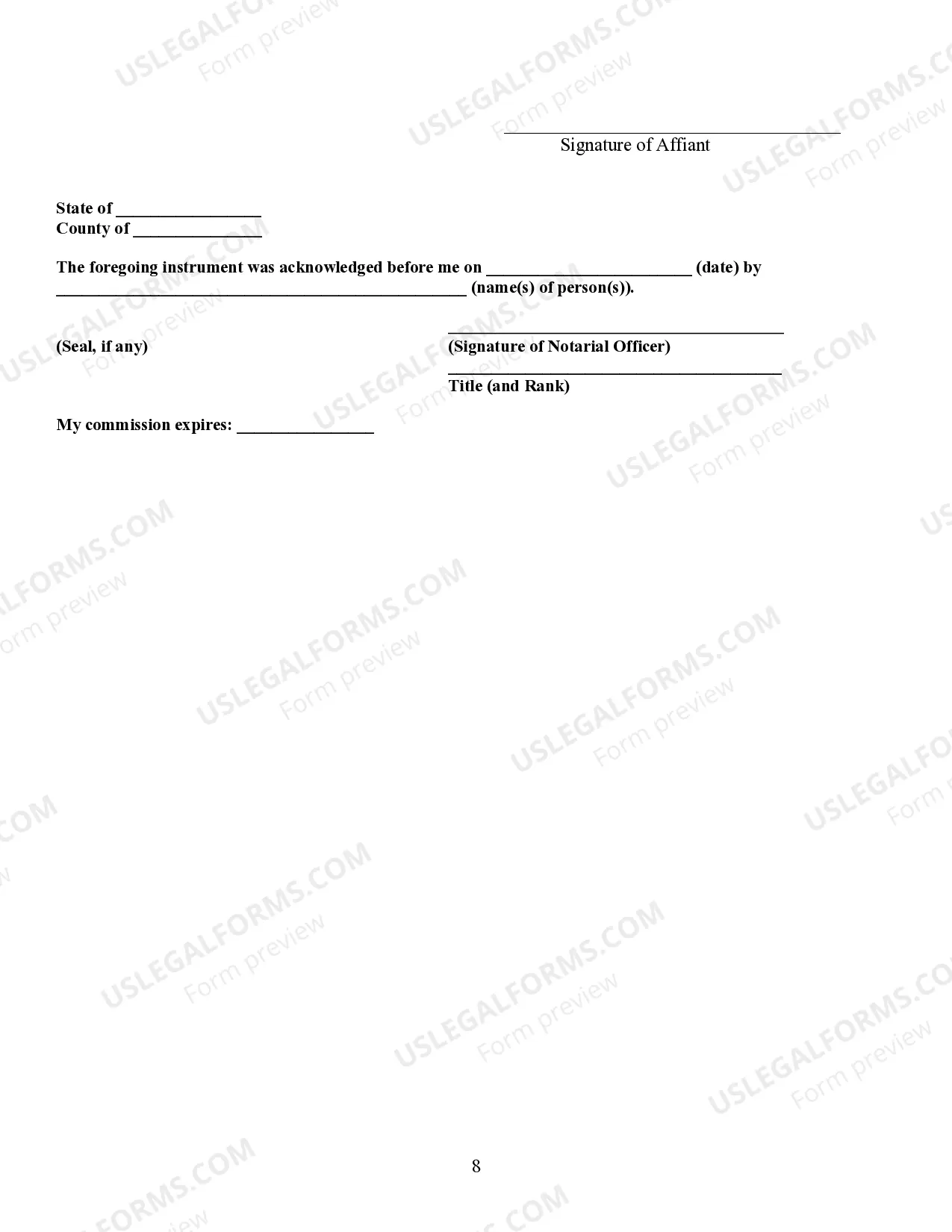

How to fill out Oklahoma Heirship Affidavit - Descent?

Utilize the US Legal Forms and gain immediate access to any document you need. Our user-friendly site with a vast array of templates streamlines the process of locating and acquiring nearly any document example you require.

You can conveniently download, complete, and validate the Oklahoma City Oklahoma Heirship Affidavit - Descent in merely a few minutes instead of spending hours online looking for a suitable template.

Using our library is an excellent way to enhance the security of your document submissions. Our experienced attorneys routinely review all documents to ensure that the forms are suitable for a specific state and comply with the latest laws and regulations.

How can you acquire the Oklahoma City Oklahoma Heirship Affidavit - Descent? If you already possess an account, simply Log In to your profile. The Download button will be visible on all the documents you view. Moreover, you can access all your previously saved files in the My documents section.

US Legal Forms is one of the most comprehensive and reliable document repositories available online. Our team is always delighted to assist you with any legal procedures, even if it’s simply downloading the Oklahoma City Oklahoma Heirship Affidavit - Descent.

Feel free to fully leverage our form collection and make your document experience as easy as possible!

- Access the page containing the template you need. Ensure that it is the template you are looking for: verify its title and description, and use the Preview option when available. Alternatively, utilize the Search field to find the correct one.

- Initiate the download process. Click Buy Now and choose your desired pricing plan. Then, create an account and complete your order using a credit card or PayPal.

- Download the file. Select the format to receive the Oklahoma City Oklahoma Heirship Affidavit - Descent and customize and fill it out, or sign it as required.

Form popularity

FAQ

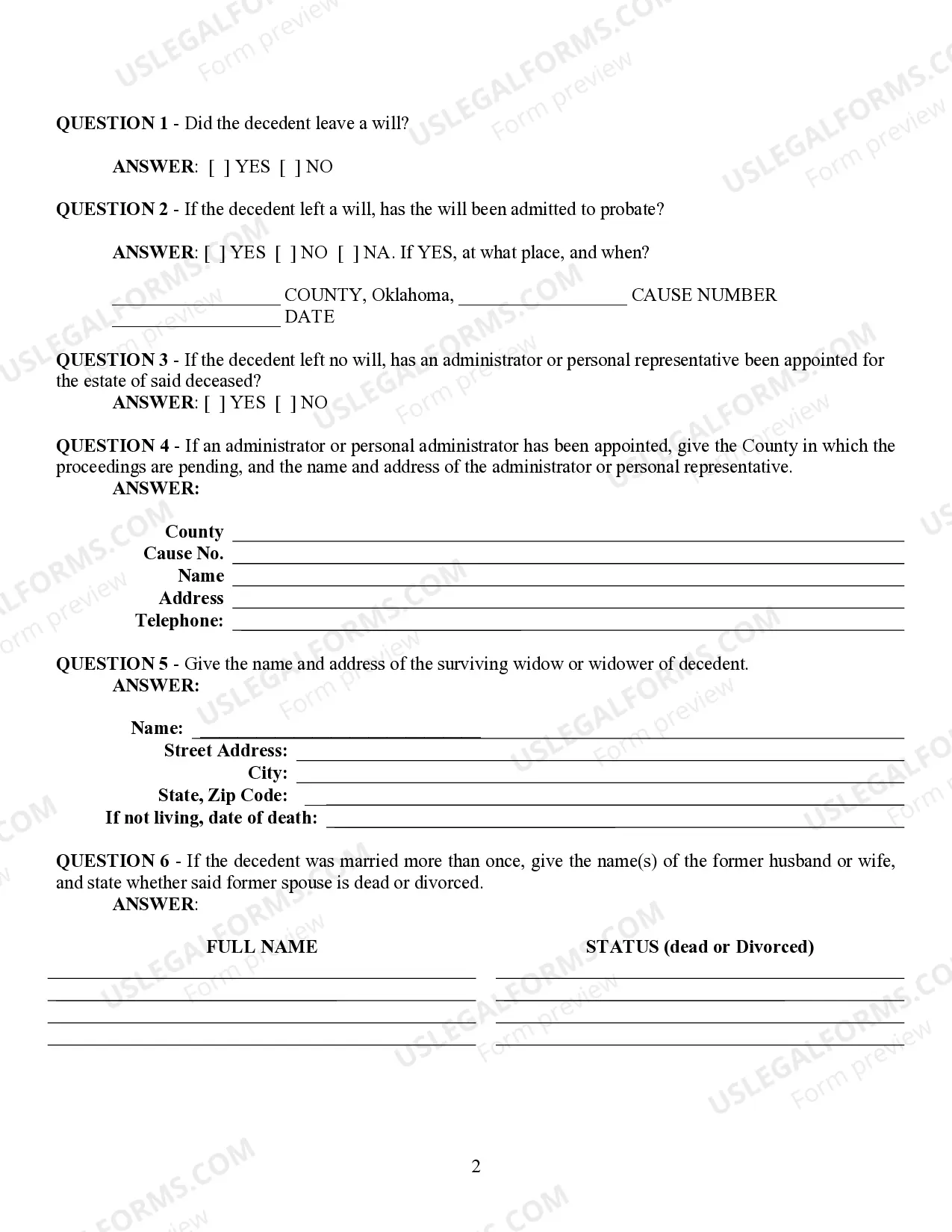

How Long Do You Have to Probate a Will in Oklahoma? According to OSCN 58 § 21, you have 30 days after learning of the death to begin the probate process. The probate matter should be filed in the county where the decedent lived at the time of their death.

The statute allowing for an affidavit of tangible personal property to transfer an estate's personal assets also allows for an affidavit of death and heirship to transfer severed mineral interests to an heir. The affidavit must be filed with the county clerk in the county where the property is located.

Under Oklahoma law, a will must be filed with the court within 30 days after the death of the testator. 58 Okla. Stat. § 21.

The statutes of Oklahoma require anyone in possession of a will to present it within 30 days of the person's death. If they fail to do so, the court may compel them to present it by retaining them in jail.

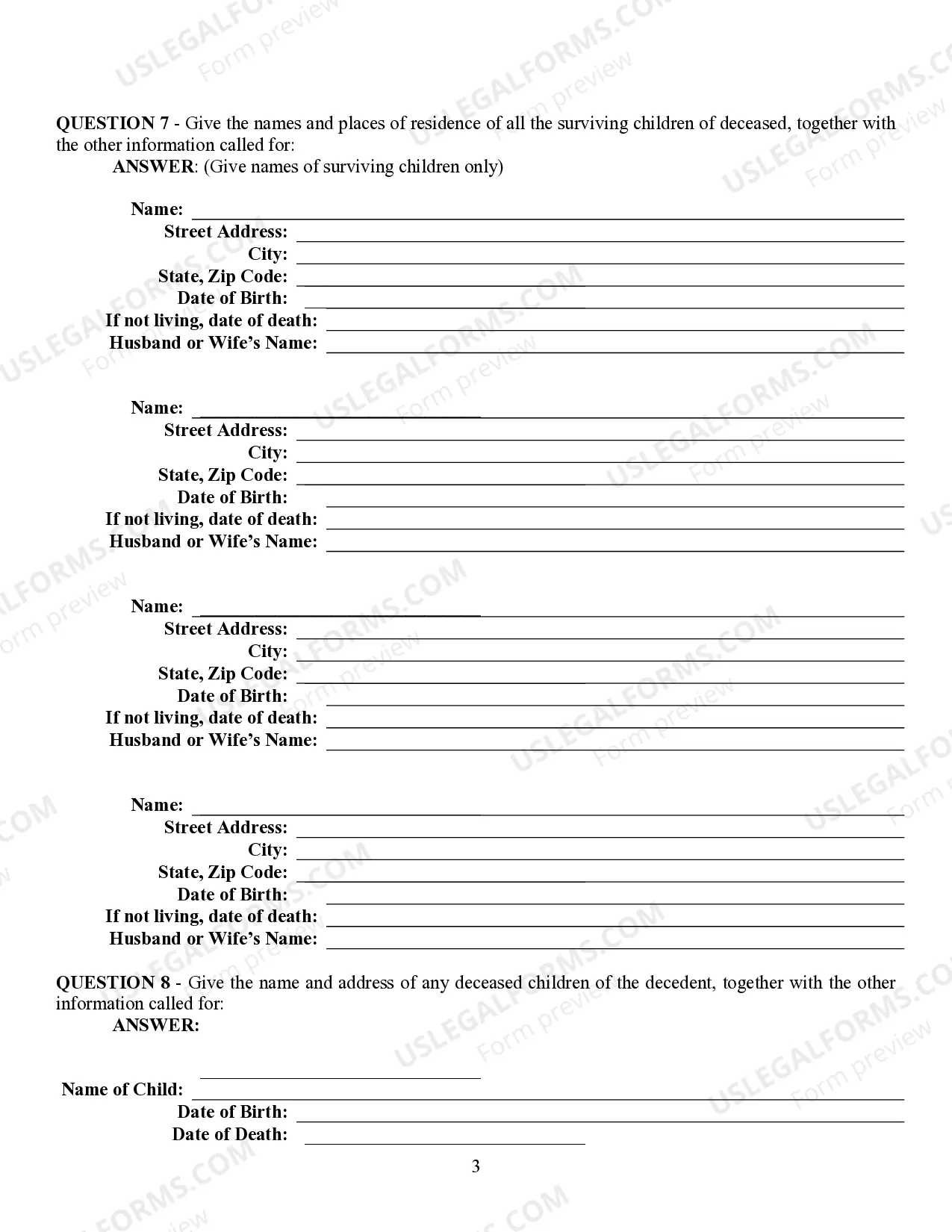

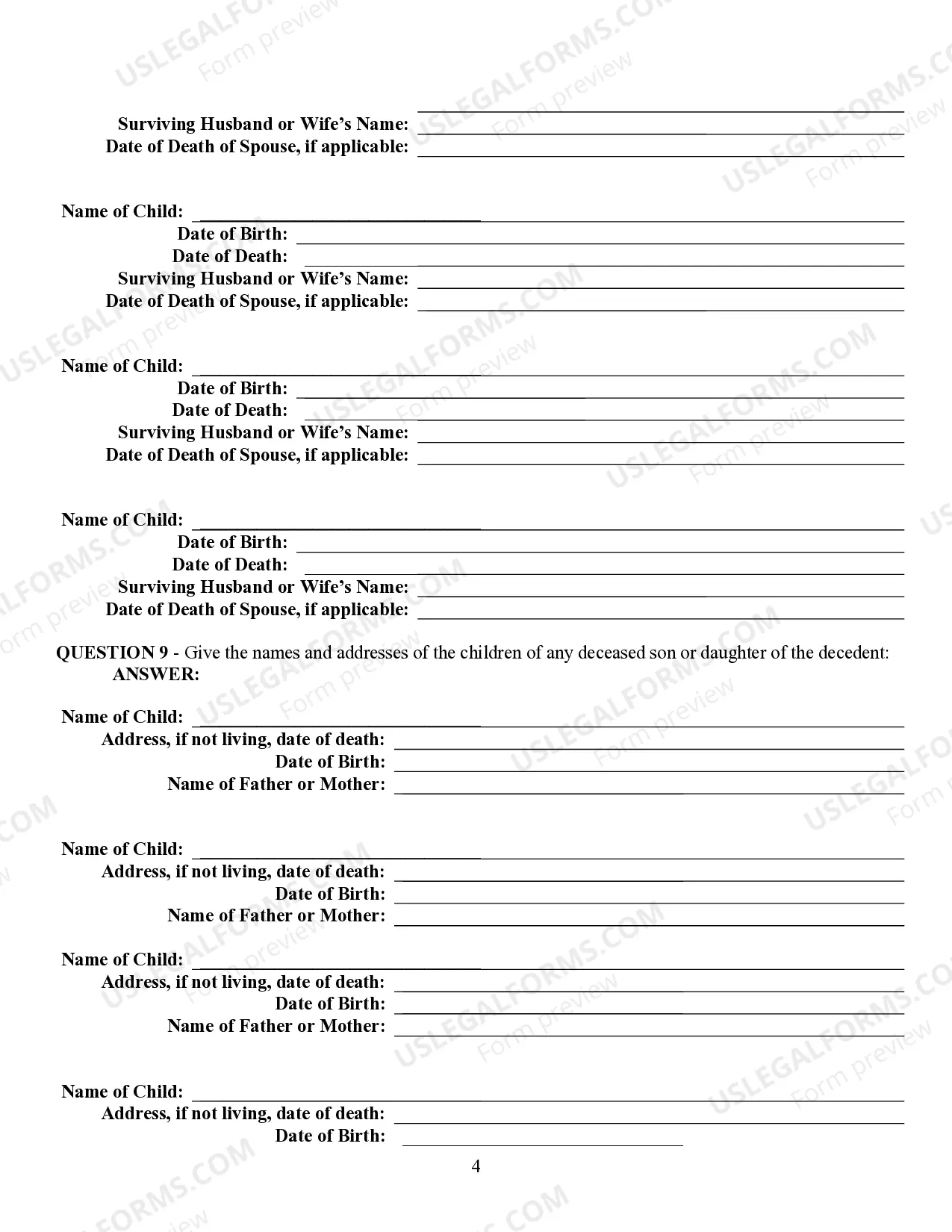

Generally, the heirs of the decedent are their surviving spouse and children, including all of decedent's biological children and adopted children.

An heir is a person who is legally entitled to collect an inheritance when a deceased person did not formalize a last will and testament. Generally speaking, heirs who inherit the property are children, descendants, or other close relatives of the decedent.

If you are named as an heir, you may have to prove to the estate trustee that you are the person named. This can be done by showing the estate trustee identification or providing an affidavit.

The minimum time required to administer a simple estate is normally six to 12 months. Complex estates with property to be sold usually take longer....Is Probate Needed? 2015$5,430,0002016$5,450,0002017$5,490,0002018$11,200,000

A Massachusetts small estate affidavit is a legal document used to present a claim on the estate or part of the estate of a deceased loved one. The petitioner, or affiant, must provide detailed information about the estate, the property in question, the decedent, and any other potential heirs.

If there are descendants, usually the surviving spouse and surviving children share in the assets of a deceased person's estate. When there is no surviving spouse, or any surviving children, the estate's assets pass to the parents.